Blog > Professional Services: Automating Client Invoicing in Sage Intacct

Professional Services: Automating Client Invoicing in Sage Intacct

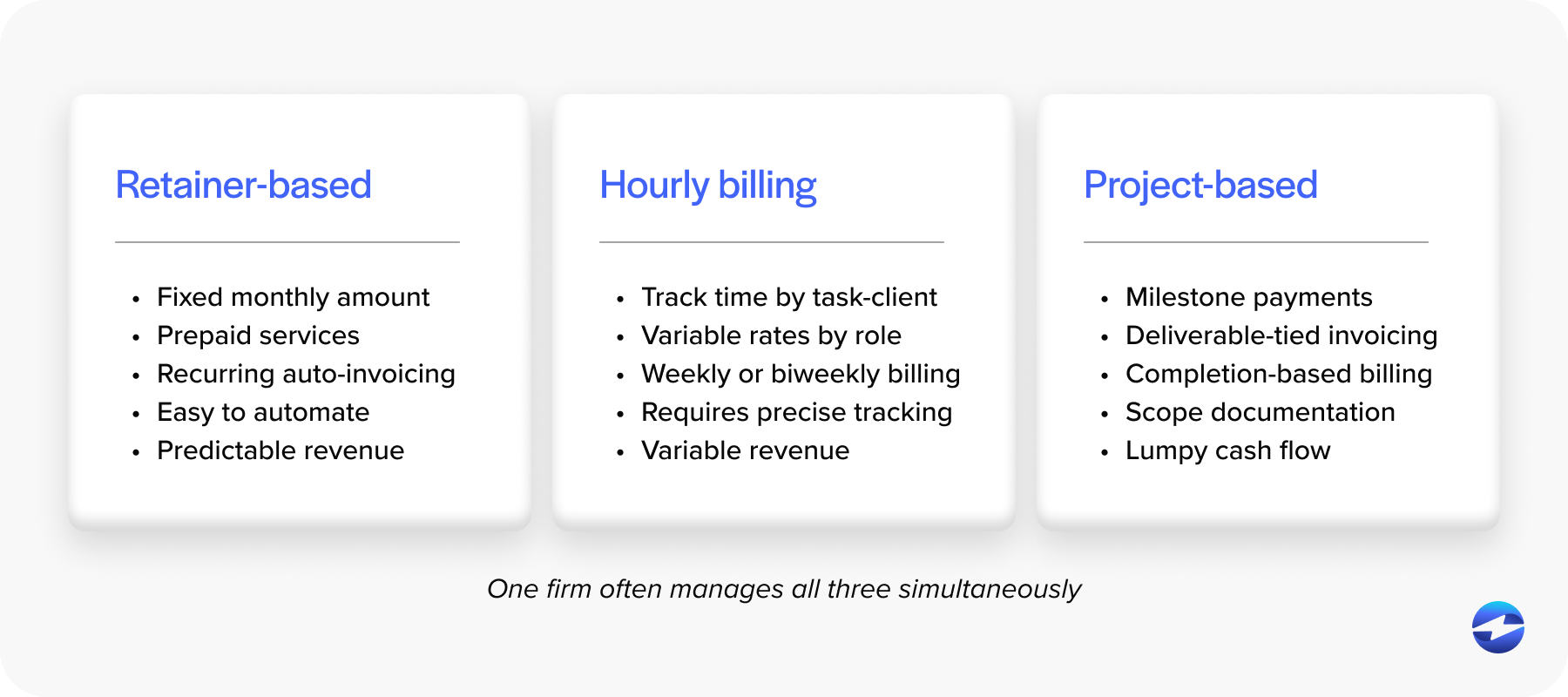

In professional services, accurate invoicing can make or break a client relationship. Whether you’re managing retainers, hourly billing, or project-based work, the challenge isn’t just about sending invoices—it’s about doing it consistently, correctly, and on time. Many firms still rely on spreadsheets or disconnected tools, which often leads to billing delays, manual errors, and frustration for both clients and finance teams. Over time, those small inefficiencies can pile up, impacting cash flow and eroding client trust.

That’s where Sage Intacct comes in. As one of the leading cloud-based accounting platforms for service-based organizations, it’s designed to simplify complex financial workflows. Sage Intacct professional services firms use it to unify time tracking, expense management, and billing into one connected system—so invoices practically write themselves. Automation in Sage Intacct invoicing turns what used to be a weekly accounting headache into a transparent, repeatable process that keeps cash flow predictable and relationships strong.

The Complexities of Client Invoicing in Professional Services

No two clients are the same, and neither are their invoices. In consulting, legal, or creative industries, one client might be on a retainer, another billed by the hour, and a third charged by deliverables or milestones. Manually juggling those billing structures across multiple projects and departments creates opportunities for mistakes—especially when time entries, expenses, and approvals live in different systems.

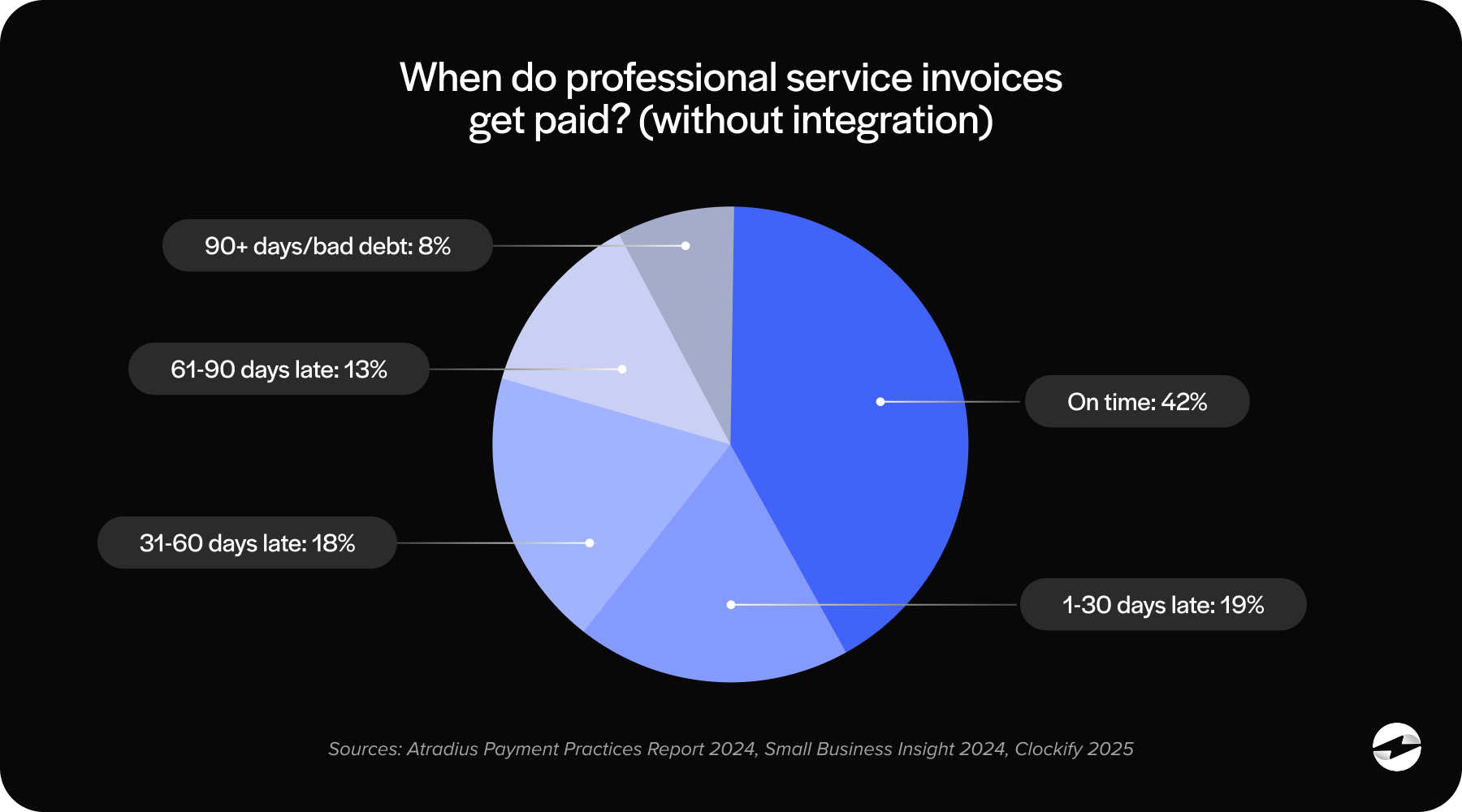

Without automation, finance teams spend hours reconciling spreadsheets and adjusting invoice line items. One missed expense or outdated rate can delay an entire billing cycle. Even worse, these errors can strain client relationships, particularly when billing disputes arise. For firms that depend on recurring business, accuracy isn’t just a financial metric—it’s a matter of trust.

Sage Intacct accounting software solves much of this by providing a single source of truth for all billing data. When project management, time tracking, and expense tools feed directly into Sage Intacct ERP, invoices reflect real-time data with little manual oversight. Instead of chasing updates, teams can focus on reviewing and approving what’s already been calculated automatically.

Automating Client Invoicing in Sage Intacct

Automation in Sage Intacct professional services is more than just efficiency—it’s consistency. Once projects and billing structures are defined, Sage Intacct automatically generates invoices based on logged hours, milestones, or contracts. Its built-in workflows route invoices for approval, apply the right payment terms, and even send reminders to clients when payments are due.

This is where Sage Intacct payment processing becomes a powerful extension of the invoicing process. Instead of waiting days or weeks for clients to manually submit payments, invoices can include direct payment links that connect to your payment processor. When a client pays, the transaction is automatically applied to the correct account, and the system updates instantly. There’s no need for data re-entry or cross-checking—everything is synced.

Many firms also use the Sage Intacct API to connect other tools, such as CRMs or project management platforms. This means that billing data flows freely between systems without spreadsheets acting as the middleman. The result is an end-to-end invoicing and collections process that practically runs itself.

Streamlining Payments Through Sage Intacct Integration

One of the biggest benefits of Sage Intacct integration is how it brings payments, accounting, and project management into a single ecosystem. When a payment processor is connected, data moves in real-time between invoices, bank accounts, and ledgers. This eliminates one of the most common sources of financial bottlenecks—manual reconciliation.

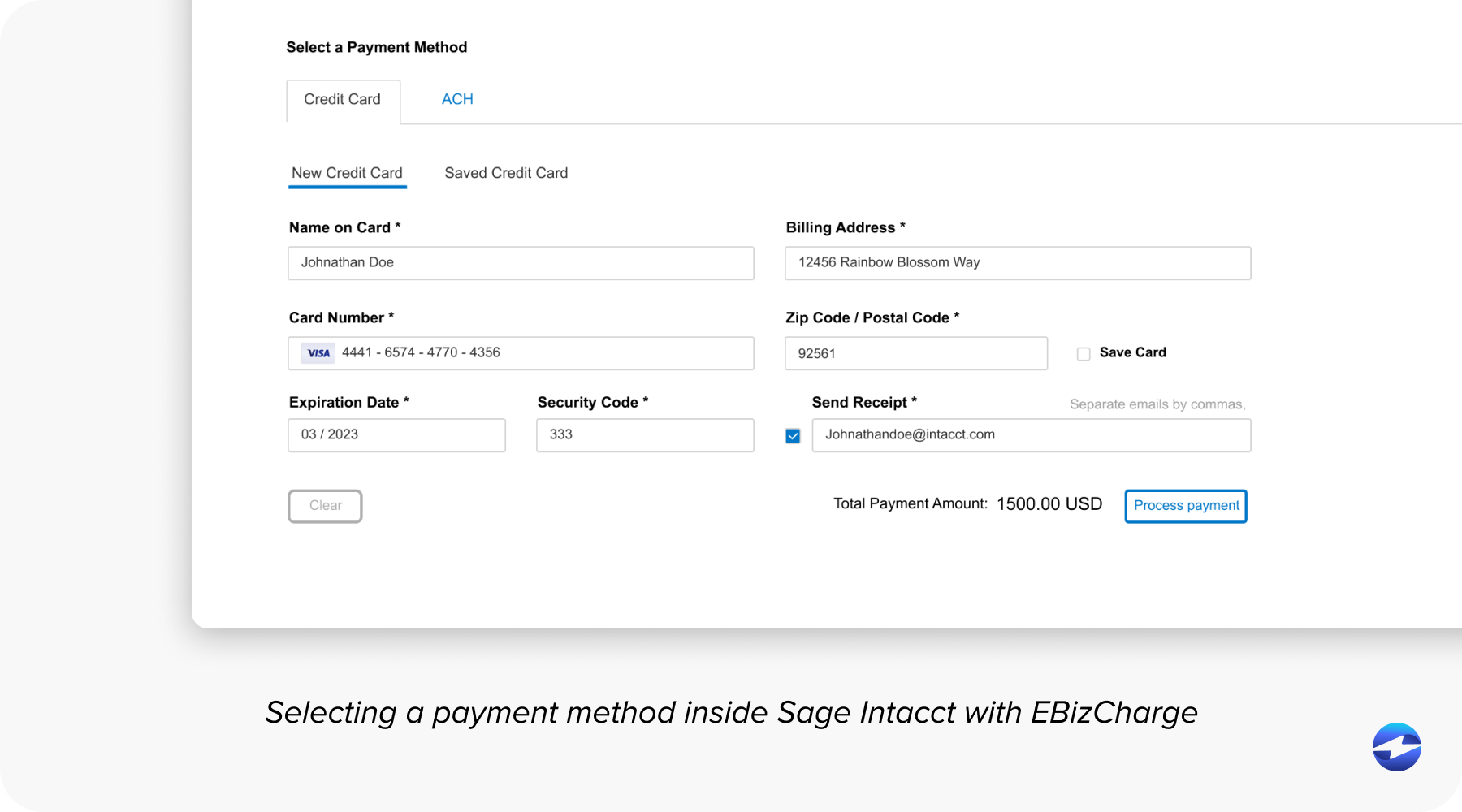

Integrating Sage Intacct ERP with a payment processing solution like EBizCharge allows firms to manage billing and payment in the same interface. You can process credit cards, ACH transfers, or eChecks directly from an invoice, and every transaction posts automatically. The moment a client pays, the balance updates, reports refresh, and everyone from finance to operations sees the same data.

This kind of automation doesn’t just save time—it transforms how firms operate. Instead of reacting to late payments, teams gain visibility into client payment trends and can forecast cash flow with accuracy. And because automation handles the repetitive work, your finance team can focus on higher-value analysis and client strategy instead of chasing down invoices.

Beyond Billing: Payment Solutions Across Industries

The benefits of automation in Sage Intacct accounting software aren’t limited to professional services. The same framework supports industries like SaaS and nonprofits, where recurring billing or donation management adds another layer of complexity.

For example, Sage Intacct payment processing enables SaaS companies to manage subscription renewals automatically while keeping financial data tied to revenue recognition rules. Nonprofits use similar tools to manage donor payments, automate grant disbursements, and maintain transparency across funding sources. In both cases, automation ensures the right data reaches the right ledger—accurately and securely.

For professional service firms, this cross-industry adaptability means that Sage Intacct is built to scale. Whether you’re billing ten clients or a hundred, the system adapts without requiring a complete overhaul. It’s flexible enough to handle unique billing structures yet structured enough to enforce consistency.

Advantages of Using Sage Intacct for Professional Services

At its core, Sage Intacct professional services software brings structure to what’s often a chaotic process. Everything from time entries to client payments is linked within one platform, ensuring that your books stay balanced automatically. Reports update in real time, giving partners and finance leaders clear visibility into revenue streams, outstanding invoices, and profitability by project or client.

But beyond the numbers, automation improves client experience. Invoices are clear, consistent, and easy to pay. Clients can choose how they want to pay—credit card, ACH, or eCheck—through a secure link embedded in each invoice. This convenience shortens payment cycles and builds confidence in your firm’s professionalism.

With Sage Intacct ERP, scaling becomes easier. Adding new clients or adjusting billing models doesn’t mean reworking your entire financial system. The platform grows with you, allowing for deeper integration with your payment processing solution, CRM, and reporting tools.

Why EBizCharge is a Perfect Fit for Sage Intacct Integration

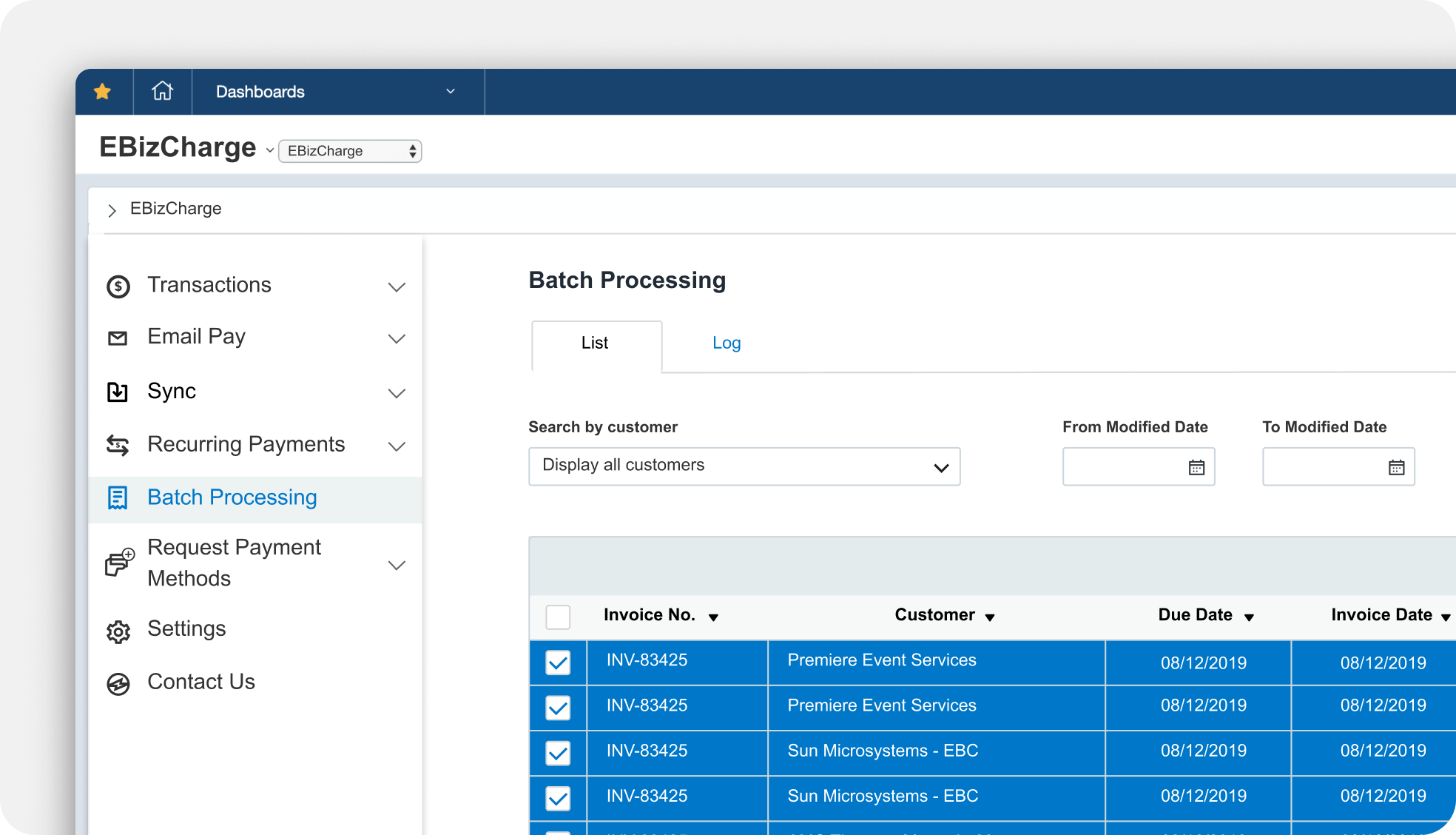

If automation is the goal, integration is the key—and this is where EBizCharge shines. The EBizCharge payment processor works hand-in-hand with Sage Intacct integration, embedding payment acceptance directly into the accounting environment. For firms that bill clients frequently, this reduces manual effort and speeds up cash flow without forcing teams to switch between platforms.

When a client pays an invoice through EBizCharge, the payment is posted instantly to Sage Intacct ERP, applying it to the correct account and marking the invoice as paid. Every transaction is logged, reconciled, and available for reporting in real time. Because EBizCharge is PCI-compliant, sensitive payment data never touches your servers—protecting both your clients and your business.

What makes this pairing so effective is the visibility it provides. With full payment histories linked to client records, you can identify slow payers, spot recurring issues, and plan accordingly. The integration even supports recurring billing and automated payment retries, features that are particularly useful for long-term client engagements.

In short, pairing Sage Intacct accounting software with EBizCharge creates a self-sustaining workflow: invoices go out automatically, payments come in securely, and your books stay in sync—all without manual input. It’s a clean, efficient system designed for firms that want to grow without adding administrative burden.

Building a Smarter Invoicing System for the Future

In the world of professional services, reputation rests not only on the quality of your work but also on how smoothly you handle business operations. Clients notice when invoicing feels effortless, and they appreciate firms that make payment easy. That’s why adopting tools like Sage Intacct ERP and the Sage Intacct API isn’t just about saving time—it’s about creating a foundation for reliability and trust.

The combination of Sage Intacct invoicing, automation, and a modern payment processor like EBizCharge enables firms to focus less on back-office tasks and more on delivering exceptional client service. You get real-time insight, faster payments, and predictable cash flow—all essential elements for growth.

Professional service leaders know the value of time. By investing in automation through Sage Intacct and its integrations, you’re not just improving efficiency—you’re future-proofing your firm’s financial operations. That’s what true scalability looks like.