Blog > Salesforce Payment Methods: Accepting All Payment Types Natively

Salesforce Payment Methods: Accepting All Payment Types Natively

Getting paid is one of the most important parts of running a business, yet it’s also one of the most complex. Customers expect to pay in the way that’s most convenient for them, whether that’s a credit card, ACH transfer, or a digital wallet on their phone. For businesses running on Salesforce, accepting all these methods natively can make the difference between a smooth revenue process and a tangle of manual work.

This guide explores Salesforce payment methods and how companies can put them to work. It explains the most common Salesforce payment options, what makes B2B commerce different, and how to consider international payments. It also explores the role of Salesforce payment gateways, how the Salesforce billing platform fits into the picture, and why choosing the right payment processing solution matters. If you’re in IT, finance, or an eCommerce team, the goal here is to give you practical, down-to-earth guidance you can actually use.

Overview of Salesforce Payment Methods

Salesforce provides native tools to help businesses accept a variety of payments without leaving the platform. These Salesforce payment methods can be tied directly to quotes, invoices, and contracts, so when a customer pays, the records are updated in real time. That reduces reconciliation work and helps finance teams trust the numbers they see.

The Salesforce billing platform and Salesforce B2B Commerce both benefit from integrating payments directly. Instead of exporting data to a separate system or relying on spreadsheets, businesses can use Salesforce billing to generate invoices, match payments, and keep customer accounts up to date. Having everything in one place brings more than convenience—it provides a consistent source of truth for revenue.

Core Payment Types and Their Use Cases

Every business must think carefully about which payment types to accept. In Salesforce, that choice can shape how smooth the billing process feels for both customers and finance teams.

Credit Cards

Credit cards are still the backbone of many industries. They’re widely accepted and easy for customers to use. In Salesforce billing, they’re often used for subscriptions and recurring charges because settlement is fast and predictable. PCI-compliant features like tokenization and fraud detection are built into modern Salesforce payment gateways, so sensitive card data is stored securely.

ACH Transfers

For B2B commerce, Automated Clearing House (ACH) is just as important as other payment methods. When invoices are large, paying by card can be costly in fees. ACH transfers offer a lower-cost alternative, though settlement may take longer. Salesforce payment options include ACH support, and when integrated correctly through a payment processor, reconciliation is handled inside the Salesforce billing platform. That way, finance teams aren’t chasing down deposits and matching them manually.

Digital Wallets

Digital wallets like Apple Pay, Google Pay, and PayPal are growing fast. They’re especially useful for mobile checkouts and international customers who prefer alternatives to cards. Salesforce payment gateways can connect to these wallets so customers have the choice at checkout or when paying invoices through a portal. Supporting wallets is not just about convenience; it shows buyers you’re keeping up with modern expectations.

Together, these payment types give organizations a strong foundation. Credit cards handle everyday transactions, ACH reduces costs on large B2B invoices, and wallets help capture modern, mobile-first customers. With the right mix, businesses can balance customer convenience with operational efficiency.

International Payment Considerations

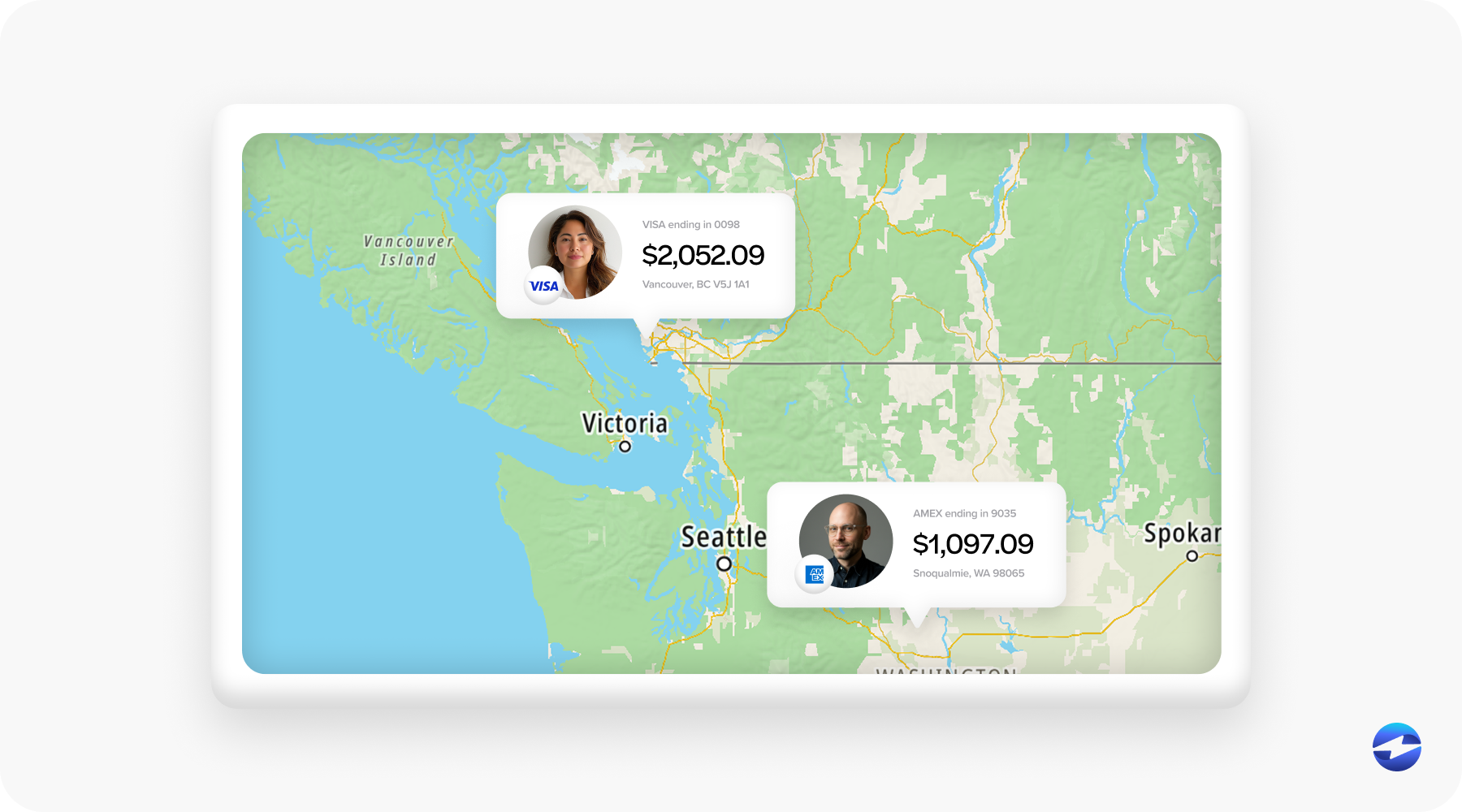

Going international adds layers of complexity. Multi-currency support is a must, and the Salesforce billing platform makes it possible to charge in one currency while reporting in another. If you’re selling to customers overseas, your Salesforce payment gateway should support the methods they trust.

Tax rules also vary by country. A payment processing solution tied into Salesforce helps you apply the correct tax rates and keep a clean audit trail. Security is another concern. Fraud prevention at a global scale requires monitoring, tokenization, and compliance with regional privacy laws. Businesses that take international expansion seriously should plan for these factors early.

Payment Processes and Integration

The way payments move through Salesforce is as important as the methods themselves. A Salesforce payment gateway handles the secure transmission of payment details, while the payment processor actually moves the money into your account. A strong payment processing solution ensures that once a payment is authorized, it posts to the invoice in Salesforce billing.

Integration matters because payments don’t happen in isolation. Refunds, disputes, and dunning sequences all need to be triggered automatically. Event-driven workflows are especially powerful here. If a payment fails, Salesforce can launch a retry sequence or notify the right team. Connecting Salesforce to ERP and accounting systems closes the loop, giving full visibility from order to cash.

B2B Commerce Use Cases

Salesforce B2B Commerce comes with its own challenges. Buyers often place bulk orders, operate under negotiated contracts, and expect extended payment terms. They may prefer purchase orders or ACH instead of credit cards. Supporting all of these Salesforce payment options natively is critical.

For example, corporate cards that require Level 2/3 data can be handled through Salesforce payment gateways that pass detailed transaction data to reduce interchange fees. Customer portals let buyers log in and pay invoices directly, choosing whether to use ACH, card, or a wallet. With Salesforce billing tied to Salesforce B2B Commerce, these payments are reflected in real time, keeping accounts accurate and reducing disputes.

Benefits of Native Salesforce Payment Gateway Integration

Native integration reduces headaches. When a Salesforce payment gateway posts transactions directly to invoices, there’s less manual reconciliation and fewer errors. Data stays unified across sales, billing, and finance, which means fewer meetings just to resolve discrepancies. A good payment processor will also build compliance and security features into the integration so businesses don’t have to manage them separately.

Flexibility is another advantage. With Salesforce payment methods built in, businesses can quickly add new Salesforce payment options as customer preferences evolve. That might mean rolling out support for new digital wallets or enabling ACH for a new market segment. Native tools make those shifts faster and less disruptive than relying on a third-party payment processor that requires custom sync jobs.

Best Practices for Implementing Multiple Payment Methods

Rolling out multiple Salesforce payment methods takes planning. Start by mapping customer preferences by region and industry. In some markets, cards dominate. In others, ACH or local transfers may be more common. Understanding these patterns helps you decide which Salesforce payment gateways to prioritize.

Testing is also critical. Don’t just test credit cards—test ACH transfers, digital wallets, purchase orders, and bulk orders. See how Salesforce billing responds and confirm that records flow correctly to finance. Plan for exceptions too. Refunds, failed payments, and chargebacks are inevitable. Make sure your payment processing solution has clear rules for handling them.

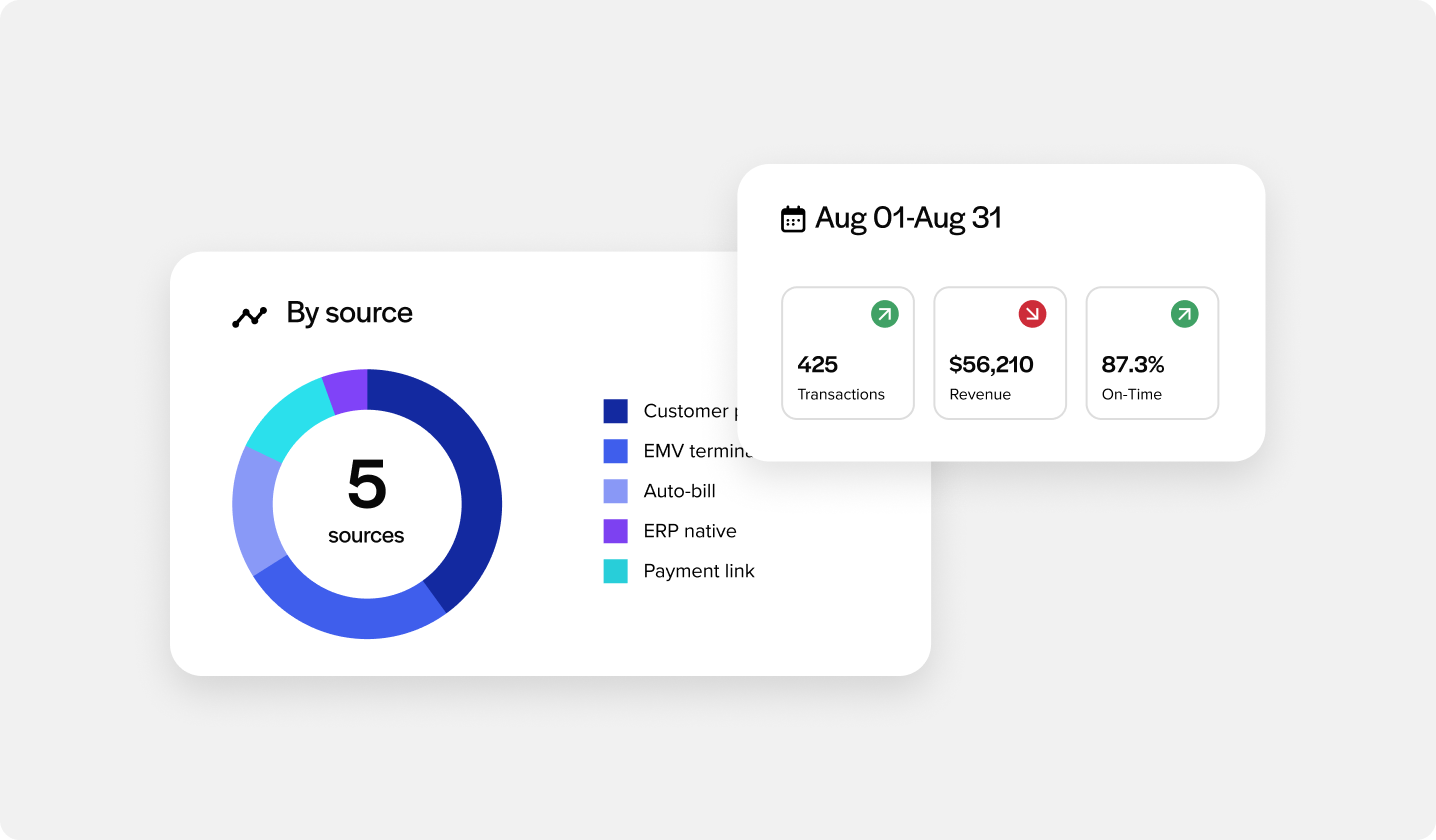

Finally, keep an eye on analytics. Monitor transaction success rates, retry performance, and payment costs. The Salesforce billing platform makes it possible to track these metrics in one place. Over time, the data helps refine your setup for better performance and lower costs.

Building Confidence in Salesforce Payments with EBizCharge

Accepting payments is never just about moving money. It’s about giving customers choices, keeping records accurate, and making life easier for the teams who depend on Salesforce billing. Offering a range of Salesforce payment options—from cards and ACH to wallets and international methods—builds trust and improves cash flow.

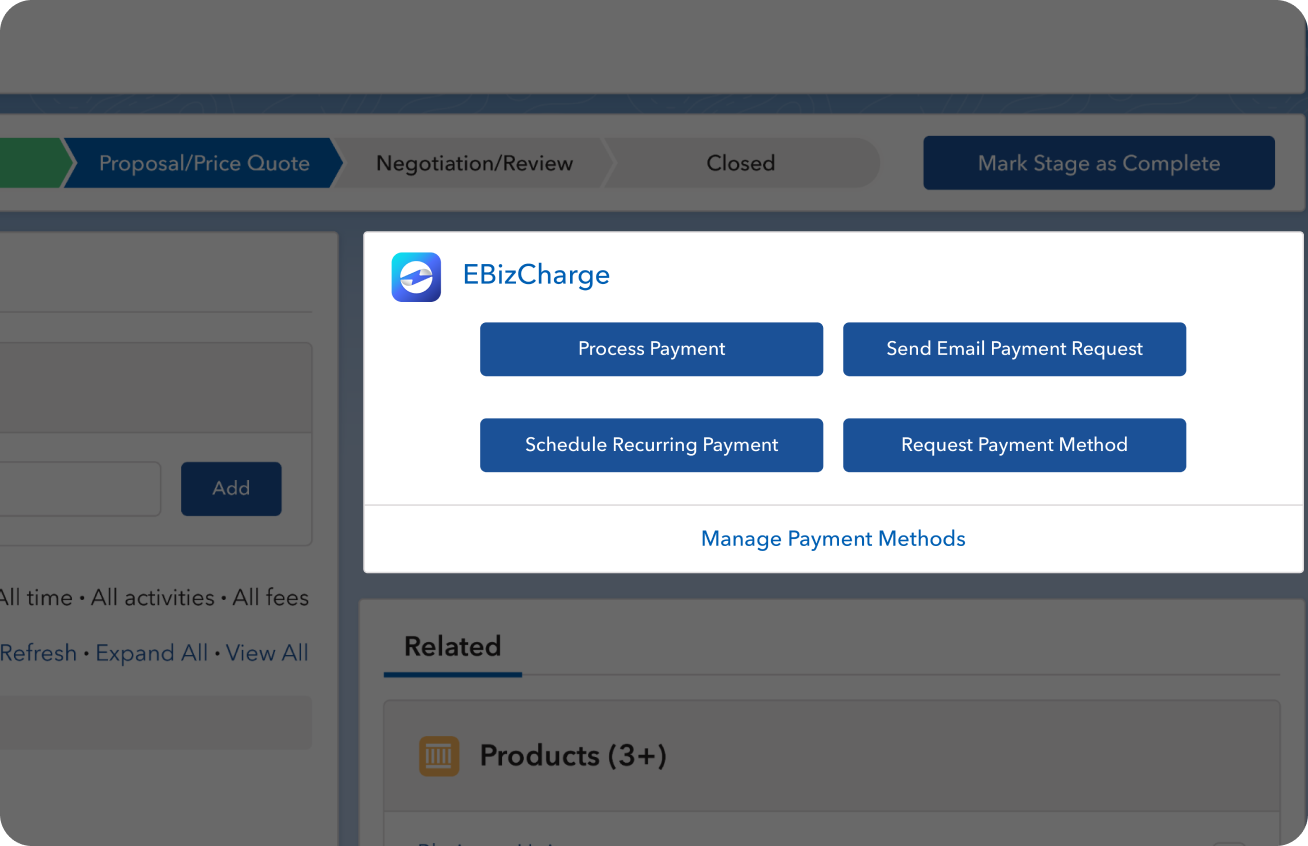

Among the available tools, EBizCharge stands out as a strong fit. It’s a native Salesforce payment gateway that posts payments directly to invoices and accounts in real time. That means fewer manual steps for finance and fewer errors across the board. With support for ACH, credit cards, digital wallets, and multi-currency transactions, EBizCharge covers the Salesforce payment methods businesses need. Tokenization, PCI compliance, and fraud monitoring are built in, making it more than just a payment processor—it’s a complete payment processing solution.

For Salesforce B2B Commerce users, that combination of native integration and enterprise features is particularly valuable. EBizCharge helps businesses scale internationally, adapt to customer preferences, and simplify payment operations without relying too heavily on a third-party payment processor. For IT managers, finance leaders, and eCommerce teams, the result is a Salesforce billing platform that feels reliable and sustainable.