Blog > Oracle Fusion Billing Integration: Automated Payment Collection and Processing

Oracle Fusion Billing Integration: Automated Payment Collection and Processing

For finance and operations teams, managing billing and payments is one of the most critical parts of the job. Yet too often, it’s also one of the most time-consuming. Manual billing workflows stretch out the payment cycle, create opportunities for errors, and limit visibility into cash flow. When the process breaks down, revenue collection slows, and the entire business feels the effects.

That’s where Oracle Fusion billing integration steps in. By automating the movement from invoice creation to payment collection, businesses can shorten their revenue cycle and gain real-time insight into financial performance. This isn’t just about efficiency. It’s about making life easier for finance teams, freeing leaders to plan with confidence, and giving customers a smoother payment experience. Revenue cycle optimization becomes not just a goal, but a practical reality.

The Challenges of Manual Billing and Payment Collection

Manual billing and payment collection may work for smaller companies, but as soon as transaction volumes grow, the cracks start to show. Invoices often take too long to generate. Payments arrive late or aren’t matched properly to the right accounts. Finance staff spend hours reconciling spreadsheets or chasing down discrepancies. These issues don’t just frustrate teams—they directly impact cash flow.

The result is a revenue cycle that drags on longer than necessary. Instead of collecting payments quickly, businesses wait weeks or months. Leaders can’t see accurate, up-to-date numbers in real time, which makes it harder to plan budgets or forecast revenue. Worse, errors in billing or reconciliation introduce compliance risks that no organization wants to face.

What is Oracle Fusion Billing Integration?

At its core, Oracle Fusion ERP is a comprehensive enterprise resource planning platform. It unites critical business functions—finance, supply chain, HR—under one roof. Within that system, Oracle Fusion billing is designed to handle the invoice-to-cash process with automation at the center.

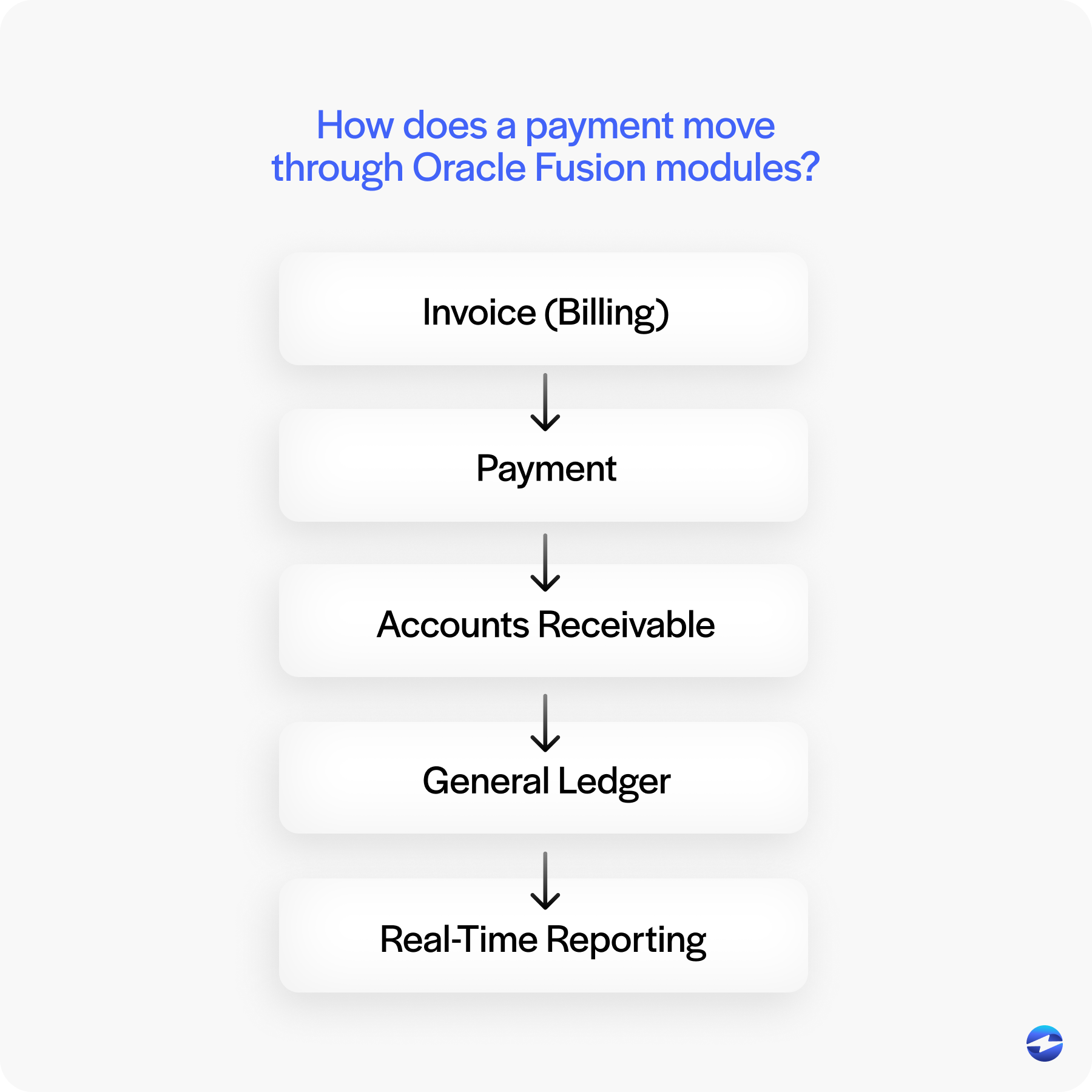

Billing integration connects invoices generated in Oracle Fusion Billing directly with Accounts Receivable. From there, payments flow into the system, automatically matched to the right accounts. The General Ledger updates in real time, ensuring financial data is always accurate and current. By linking Oracle Fusion modules like Billing, AR, and the GL, businesses get a single, unified workflow instead of a patchwork of disconnected processes.

Put simply, Oracle Fusion software eliminates the silos that slow down billing and payment collection. Every department works from the same data, and that consistency is what drives revenue cycle optimization.

Revenue Cycle Optimization with Automation

The idea of “revenue cycle optimization” can sound abstract, but in practice, it comes down to shortening the time between sending an invoice and receiving payment. Automation makes this possible. With Oracle Fusion ERP, invoices are created faster, payments are matched automatically, and leaders get real-time visibility into cash flow.

This tighter cycle benefits everyone involved. Customers experience fewer billing errors and more convenient ways to pay. Finance teams spend less time on manual reconciliation and more time analyzing performance. And leadership gets accurate insights without waiting for monthly reports.

Automation also improves compliance. By removing manual steps, companies reduce the chance of mishandled data or inconsistent record-keeping. That’s especially important for organizations managing high transaction volumes across multiple regions.

Benefits of Oracle Fusion Billing Integration

When businesses embrace billing integration, the benefits go far beyond saving time. They include:

- Efficiency: Automating the invoice-to-cash process eliminates wasted hours on repetitive tasks.

- Accuracy: With payments matched automatically, the risk of errors drops significantly.

- Visibility: Real-time insights allow leaders to track revenue and cash flow at any point in the cycle.

- Compliance: Built-in adherence to payment and accounting standards makes audits less stressful.

- Customer Experience: Giving customers easier payment methods—like portals or credit card options—builds trust and loyalty.

Together, these improvements create a healthier, faster-moving revenue cycle that supports the entire organization.

Extending Capabilities with Third-Party Payment Processors

While Oracle Fusion billing covers the essentials, some businesses need added flexibility. That’s where a third-party payment processor can make a big difference. These providers bring extra tools and customization that enhance the base features of Oracle Fusion.

For example, a modern payment processor might offer:

- Self-service customer portals for online payments.

- Integration with Oracle Fusion credit card processing to support more payment methods.

- Advanced fraud detection and monitoring.

- Multi-currency support for international operations.

- More detailed reporting and analytics tools.

A strong payment processing solution should integrate seamlessly with Oracle Fusion modules, so that data flows naturally into AR, Billing, and the GL without manual uploads. When the integration is smooth, finance teams don’t have to choose between Oracle Fusion software and outside tools—they can use both together for the best results.

Best Practices for Implementing Oracle Fusion Billing Integration

Rolling out billing integration is a process, and careful preparation makes all the difference. Here are some practical steps:

- Clean your data: Ensure customer records, invoices, and accounts are accurate before automation begins. Bad data leads to bad results.

- Test your workflows: Run sample transactions to confirm that invoices, payments, and ledger entries flow correctly.

- Train your team: Staff adoption is easier when people understand how automation works and why it matters.

- Monitor performance: Use built-in reporting to track progress and identify areas for improvement.

These best practices ensure automation doesn’t just run—it runs smoothly, delivering the benefits you expect.

EBizCharge as a Revenue Cycle Optimization Partner

For companies looking to extend Oracle Fusion billing even further, EBizCharge is a popular choice. As a third-party payment processor, it integrates directly with Oracle Fusion ERP, posting payments into Accounts Receivable and the General Ledger without duplicate entry. That means faster reporting and fewer errors for finance teams.

EBizCharge adds practical features that support revenue cycle optimization:

- PCI-compliant security and fraud monitoring.

- Customer-facing portals for easy online payments.

- Multi-currency support to handle international transactions.

- Scalable performance that adapts as transaction volumes grow.

By pairing Oracle Fusion software with a payment processing solution like EBizCharge, businesses create a system that’s not just efficient, but also secure, compliant, and ready to grow.

Simplifying the Revenue Cycle with Oracle Fusion Billing

Manual billing and payment collection slow down the revenue cycle and limit visibility into cash flow. With Oracle Fusion billing integration, companies can automate the invoice-to-cash process, reduce errors, and improve compliance. The result is a revenue cycle that runs faster and more reliably, giving leaders the information they need when they need it.

Adding a trusted third-party payment processor like EBizCharge further enhances the experience. Businesses gain customer-friendly tools, advanced security, and scalability without sacrificing the stability of their ERP software. For finance teams and leaders alike, this combination makes revenue cycle optimization not just a buzzword, but a day-to-day reality.