Blog > Oracle Fusion Accounting Automation: Eliminate Manual Payment Processing

Oracle Fusion Accounting Automation: Eliminate Manual Payment Processing

For many finance professionals, manual payment processing isn’t just a minor inconvenience—it eats away at valuable time, accuracy, and focus. Hours go into keying in data, reconciling payments, and fixing errors that should never have happened in the first place. Those hours could be better spent on planning, strategy, and meaningful analysis. This is where accounting automation in Oracle Fusion makes a real difference. By weaving accounting automation directly into everyday tasks, companies can cut down on repetitive work, avoid costly mistakes, and keep tighter control of their financial operations. It’s not about chasing the latest tech trend—it’s about giving finance teams breathing room and equipping leaders with clearer, faster insights.

The Problem with Manual Payment Processing

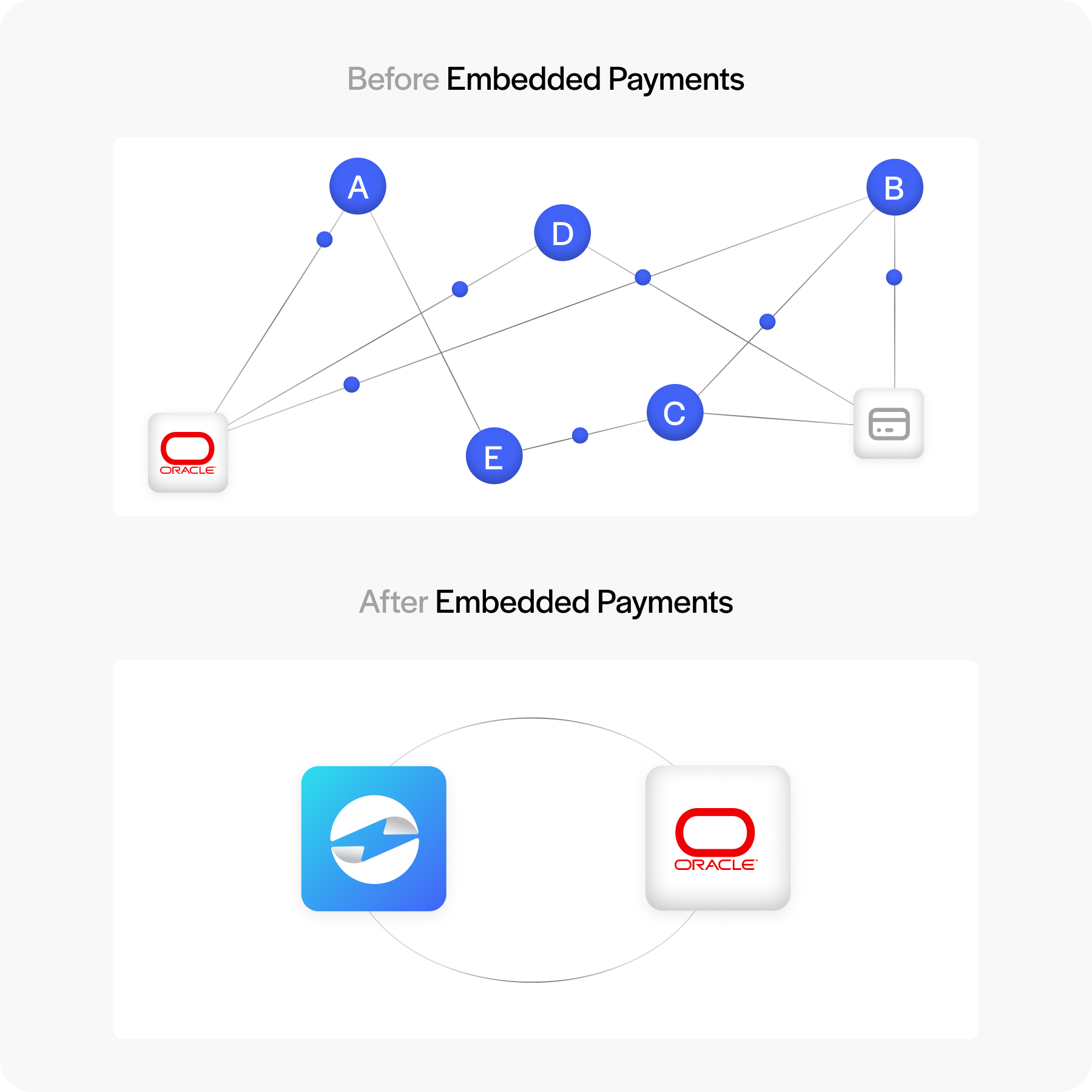

Anyone who has worked in accounting knows the frustrations of manual processes. A single misplaced digit in data entry can cause headaches that ripple across accounts payable and receivable. Reconciling invoices against payments takes longer than it should, often pushing closing dates out further than expected. And when payment data sits in spreadsheets or disconnected systems, leaders can’t see an accurate picture of cash flow until everything is manually compiled.

Beyond inefficiency, there are compliance risks. Manual processes leave more room for error and inconsistency, which can make meeting accounting and payment regulations difficult. The result? Slower business cycles, frustrated teams, and unnecessary operational costs. These challenges are precisely what Oracle Fusion accounting automation is designed to solve.

What is Oracle Fusion Accounting Automation?

At its core, Oracle Fusion ERP is a platform that unites critical business functions—from finance to HR to supply chain—into a single environment. Within that environment, accounting automation uses built-in intelligence to streamline payment processing. Instead of manually entering invoices and matching payments, Oracle Fusion modules like Accounts Payable, Accounts Receivable, and the General Ledger work together to handle these tasks automatically.

Here’s what that looks like in practice:

- Invoices are matched automatically to payments.

- Payments flow directly into AR and AP.

- The General Ledger updates in real time, without manual uploads or duplicate entries.

This process is supported by machine learning features that improve accuracy over time, helping to spot anomalies and reduce reconciliation errors. By using Oracle Fusion software as the foundation, businesses can embed automation where it matters most.

Key Benefits of Automating Payments with Oracle Fusion

The shift from manual processes to Oracle Fusion accounting automation brings measurable improvements:

- Efficiency: By cutting out repetitive tasks, teams save hours every week.

- Accuracy: Automated workflows reduce errors that come from human oversight.

- Speed: Payments are processed and reconciled faster, shortening cash cycles.

- Visibility: With real-time reporting across Oracle Fusion billing and finance modules, leadership always has a clear view of performance.

- Compliance: Automated systems help ensure accounting and payment regulations are consistently met.

These benefits free up finance teams to focus on higher-value work, like forecasting and strategy, instead of chasing down errors in spreadsheets.

How Automation Improves Cash Flow and Business Performance

Cash flow is the lifeblood of any organization, and it’s hard to manage well when processes are slow and manual. Delays in reconciliation and reporting often leave leadership unsure of how much cash is actually available at a given moment. With automation built into Oracle Fusion ERP, that guessing game disappears. Payments are processed quickly, invoices clear faster, and accounts update in real time—so leaders always have reliable numbers in front of them.

This kind of visibility goes beyond efficiency. It gives decision-makers the confidence to plan with accurate, current data. And for finance teams, it means spending less time chasing down discrepancies and more time on meaningful work that helps guide the business forward.

Integration with Third-Party Payment Processors

While Oracle Fusion credit card processing and native automation tools cover much of the accounting cycle, many businesses choose to expand their capabilities with a third-party payment processor. These providers can add layers of flexibility and customer-facing features that go beyond what’s available out of the box.

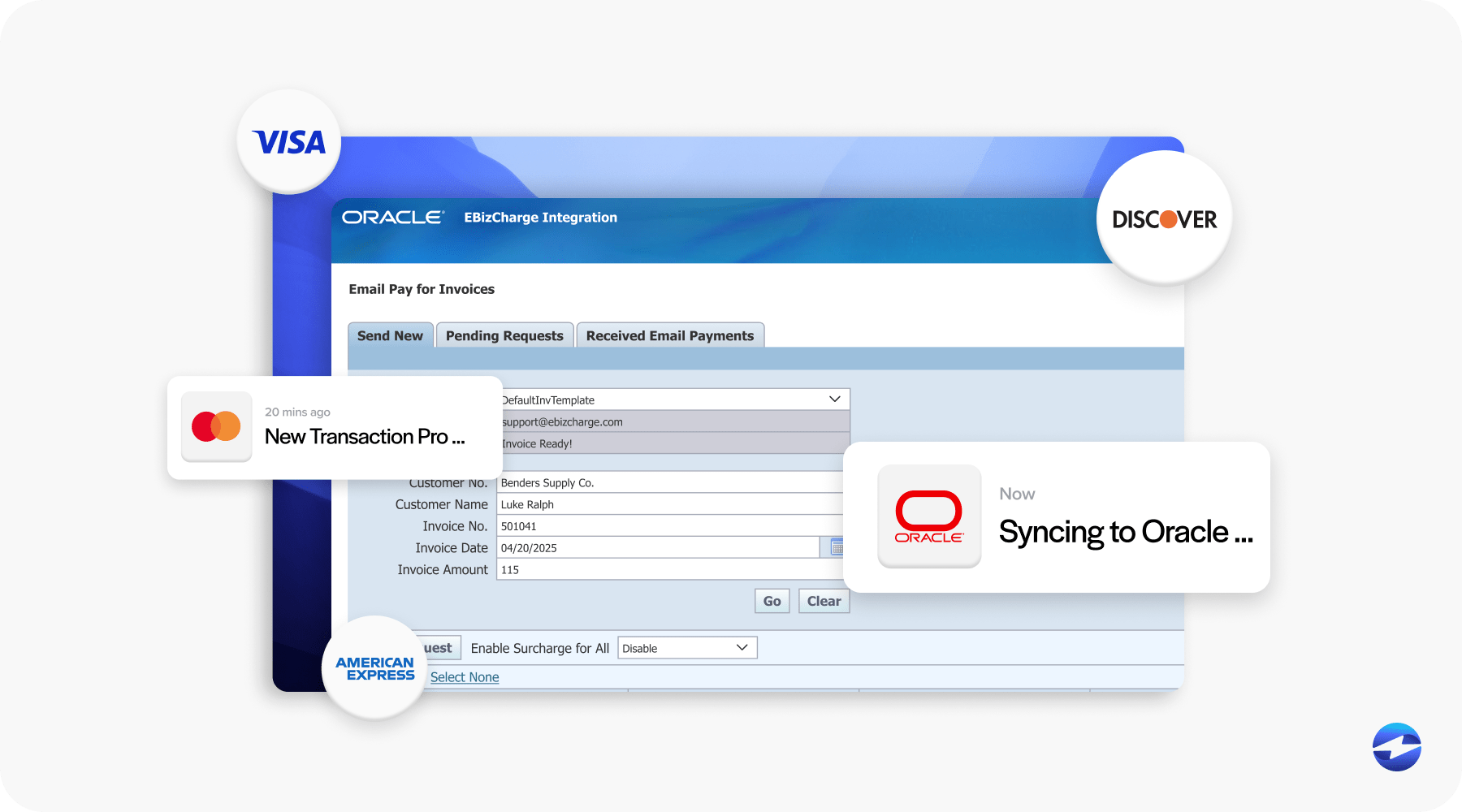

A strong payment processing solution should integrate directly with Oracle Fusion modules, so data flows seamlessly into AP, AR, and the GL. Third-party payment processors like EBizCharge enhance Oracle Fusion automation by providing:

- Customer portals for online payments.

- Advanced fraud detection and security tools.

- Multi-currency processing for global transactions.

- Detailed reporting for greater financial visibility.

When the integration is seamless, businesses gain the best of both worlds: the stability of Oracle Fusion software and the adaptability of a specialized provider.

Best Practices for Implementing Accounting Automation in Oracle Fusion

Adopting Oracle Fusion accounting automation isn’t just about flipping a switch—it requires thoughtful preparation. Here are some steps to make the rollout smoother:

- Clean your data: Inconsistent or outdated records can cause major issues once payments start posting automatically.

- Test thoroughly: Run sample transactions to ensure postings flow correctly into AR, AP, and the General Ledger.

- Train your teams: When finance staff understand both the mechanics and the purpose of automation, adoption is faster and smoother.

- Monitor and adjust: Use reporting tools to track performance and refine processes as your business evolves.

Taking these steps ensures automation doesn’t just run—it runs effectively.

EBizCharge as a Complement to Oracle Fusion

If your organization wants to take automation even further, EBizCharge is a natural fit alongside Oracle Fusion ERP. It connects directly with Oracle Fusion billing and finance modules, automatically posting payments into Accounts Receivable and the General Ledger. That means faster reporting, no duplicate entry, and less back-and-forth for your finance team.

But the value doesn’t stop with integration. EBizCharge brings practical tools that matter day-to-day: PCI-compliant security, fraud monitoring, and the ability to handle increasing transaction volumes without slowing down. For companies with a wide range of customers, features like online payment portals and multi-currency support make collecting payments easier and more flexible.

Together, Oracle Fusion software and a payment processing solution like EBizCharge give businesses a system that’s secure, compliant, and ready to grow right alongside them.

Turning Automation into Everyday Confidence

Manual payment processing is no longer sustainable for businesses that want to stay competitive. With accounting automation in Oracle Fusion, finance teams can move past repetitive tasks and focus on what really drives performance. Automated workflows bring efficiency, accuracy, and compliance, while integrated solutions like EBizCharge extend those benefits with customer-facing features and advanced reporting.

For finance leaders and accounting professionals, this isn’t about adopting the latest trend—it’s about building a payment processing solution that eliminates unnecessary work and supports long-term growth. By leveraging Oracle Fusion ERP and trusted third-party payment processors, businesses can create a reliable, scalable system that keeps cash flowing and teams focused on strategy.