Blog > Oracle Fusion Credit Card Processing: Secure, Compliant Payment Solutions

Oracle Fusion Credit Card Processing: Secure, Compliant Payment Solutions

For most businesses today, credit card payments aren’t just a convenience—they’re a necessity. Customers expect to be able to pay quickly, securely, and without hassle. On the business side, finance teams need those payments to flow directly into their systems without creating extra work. When those pieces don’t connect, you end up with errors, compliance risks, and frustrated staff.

That’s where Oracle Fusion credit card processing comes in. By embedding payments into the core of Oracle Fusion Cloud ERP, businesses can streamline their workflows, strengthen compliance, and create a smoother experience for everyone involved. This article walks through what credit card processing looks like in Oracle Fusion, why security and compliance matter, and how to get the most out of this functionality with the right tools.

Understanding Oracle Fusion Credit Card Processing

Oracle Fusion ERP is a modern enterprise resource planning platform that brings critical business functions into a single, unified environment. Whether it’s finance, HR, or supply chain, every team works off the same system, which means less duplication and more accurate data.

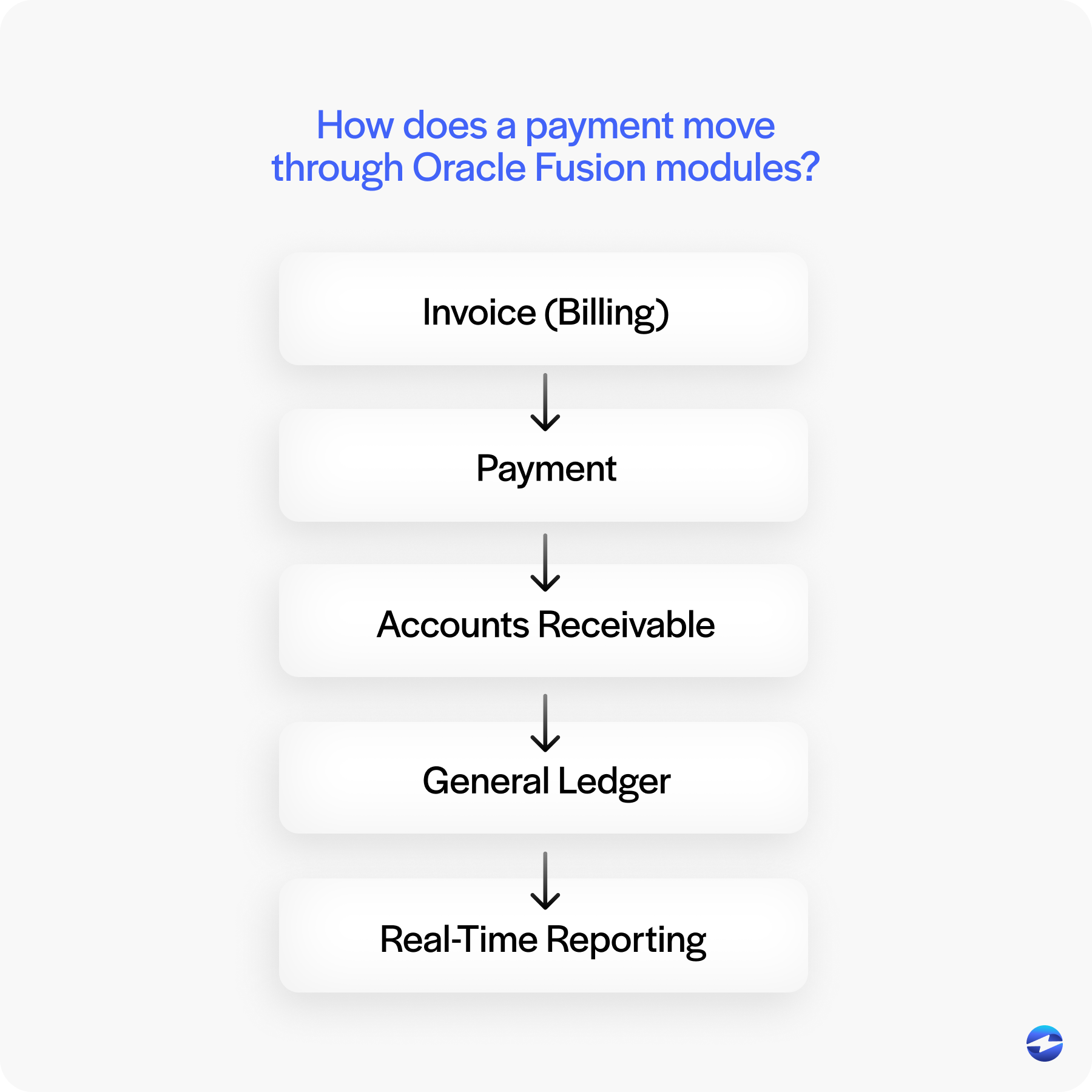

When it comes to payments, Oracle Fusion credit card processing connects directly with key Oracle Fusion modules like Accounts Receivable, Billing, and the General Ledger. Instead of relying on external platforms or manual uploads, payments are posted directly into the Oracle Fusion software environment. This creates a smoother cycle: invoices generated in Oracle Fusion billing are paid securely by customers, those payments post immediately to AR, and the GL reflects the updates in real time.

For finance teams, that means fewer headaches with reconciliation. For leadership, it means real-time visibility into revenue and cash flow.

Why Security and Compliance Matter

Processing credit card data comes with big responsibilities. Regulations like Payment Card Industry Data Security Standards (PCI-DSS) require companies to keep sensitive cardholder information safe, and failing to do so can mean hefty fines and reputational damage. Beyond compliance, customers simply expect their information to be protected.

Oracle Fusion provides strong safeguards within its ERP software. Features like encryption and tokenization ensure that sensitive data is never exposed in raw form. Fraud detection and monitoring add another layer of protection, helping businesses identify suspicious activity before it becomes a bigger problem.

With integrated Oracle Fusion credit card processing, companies can meet compliance requirements while also reassuring customers that their transactions are secure. It’s not just about checking boxes—it’s about building trust.

Core Benefits of Oracle Fusion Credit Card Processing

Integrating credit card processing into Oracle Fusion brings an array of advantages:

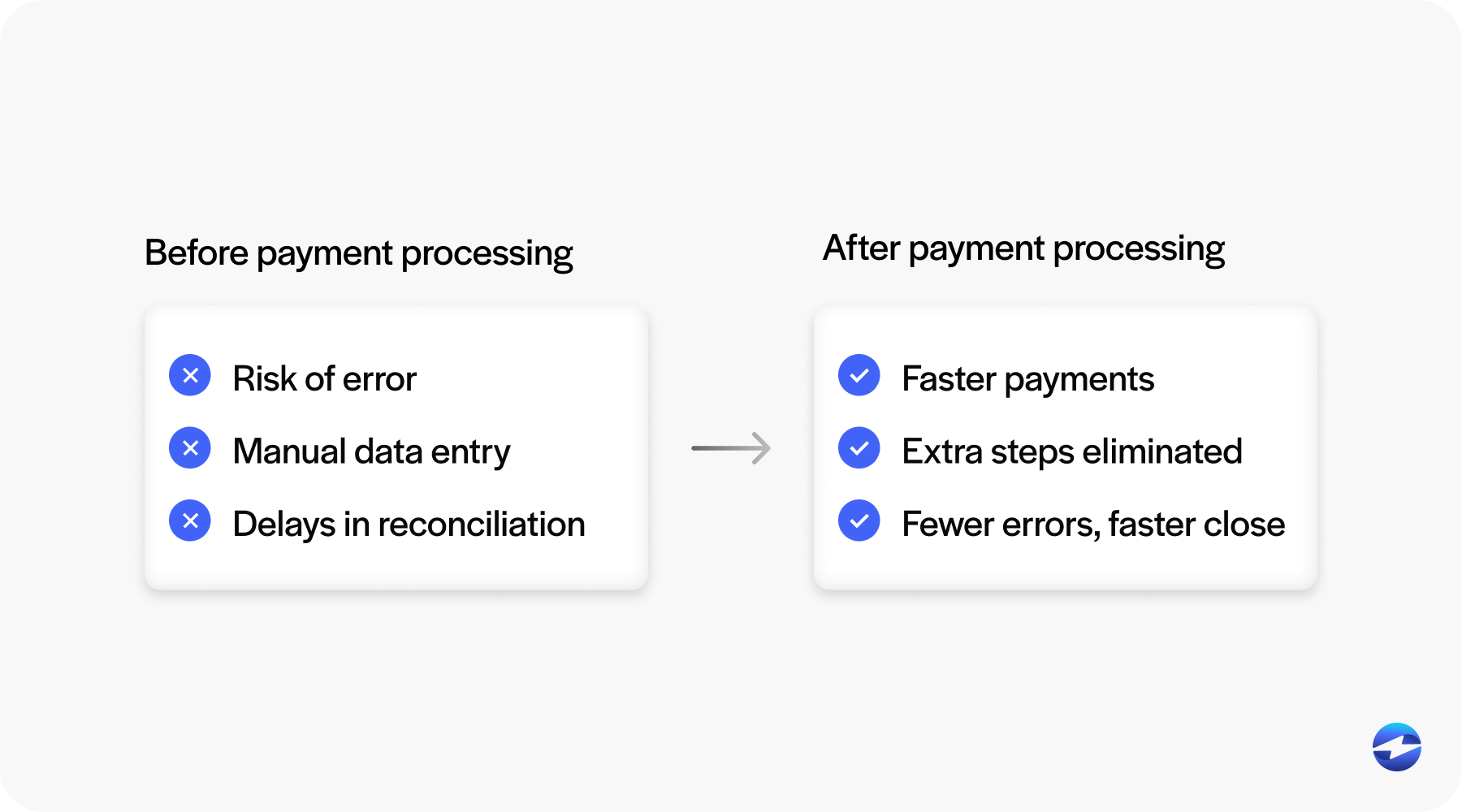

- Faster posting of payments into Accounts Receivable and the General Ledger.

- Improved accuracy by cutting out manual data entry.

- Stronger cash flow through quicker settlements.

- More reliable compliance with industry standards.

- A smoother experience for customers paying invoices.

These improvements ripple across the organization. Finance teams save time, leadership gains better insight, and customers enjoy a more seamless payment process.

Challenges Businesses Face Without Integrated Credit Card Processing

Without integrated credit card processing, businesses often rely on patchwork solutions. Payments might be processed outside the ERP and then entered manually into Accounts Receivable or the General Ledger. This creates opportunities for errors and slows down the reconciliation process.

There are also compliance risks. When systems aren’t connected, sensitive data may be handled in ways that don’t meet PCI requirements. Limited visibility into payment data means leaders can’t see the full financial picture until reports are manually compiled. On top of that, collections take longer, leaving AR teams overwhelmed and cash flow lagging.

Leveraging Third-Party Payment Processors

While Oracle Fusion offers strong native tools, many businesses look to expand their capabilities with a third-party payment processor. These providers extend the system’s functionality, offering features like online customer portals, advanced reporting, and multi-currency support.

The most important factor is integration. A good payment processing solution connects directly with Oracle Fusion modules, ensuring payments flow naturally into AR and the GL without requiring extra work. This way, businesses can keep using Oracle Fusion software as their central hub while gaining flexibility and scalability from outside providers.

Why EBizCharge is a Strong Fit

Among third-party payment processing solutions, EBizCharge is often a top choice for companies using Oracle Fusion. It integrates seamlessly with Oracle Fusion ERP, automating the posting of payments into Accounts Receivable and the General Ledger. That means no duplicate entry, fewer errors, and faster financial reporting.

EBizCharge also brings more to the table. It includes PCI-compliant security tools like encryption and tokenization, as well as fraud monitoring features that protect both businesses and customers. Customer-facing portals make it easy for clients to pay invoices online, and advanced reporting features give finance teams deeper insight into payment trends and cash flow.

As businesses grow, scalability becomes critical. EBizCharge adapts easily to higher transaction volumes, ensuring the system continues to run smoothly without bottlenecks. For many organizations, this combination of compliance, usability, and flexibility makes EBizCharge a standout option.

Best Practices for Implementing Credit Card Processing in Oracle Fusion

Rolling out Oracle Fusion credit card processing requires thoughtful preparation. A few best practices can make all the difference:

- Start by reviewing and cleaning your data. Inconsistent records can cause problems once payments start posting automatically.

- Test thoroughly before going live. Running sample transactions ensures everything flows into AR and the GL as expected.

- Train your finance teams on both the mechanics and the purpose of automation. When staff understand why it matters, adoption is smoother.

- Monitor performance regularly. Reporting tools provide valuable feedback, and adjustments can be made as business needs evolve.

- By following these steps, businesses can ensure their credit card processing setup is reliable, compliant, and efficient.

Building Reliable, Compliant Payments with Oracle Fusion

Credit card processing is no longer just a back-office function—it’s a critical part of customer experience and financial health. With Oracle Fusion ERP, companies have a strong foundation to embed secure, automated payments directly into their workflows. By leveraging tools like Oracle Fusion billing and partnering with a trusted third-party payment processor such as EBizCharge, businesses can streamline collections, improve compliance, and gain real-time visibility into their financial data.

The result is a payment system that’s not only faster and more accurate but also secure and customer-friendly. For businesses ready to modernize, Oracle Fusion credit card processing offers the tools and integrations needed to build a payment workflow that truly supports long-term growth.