Blog > NetSuite Credit Card Processing and Automated Reconciliation Best Practices

NetSuite Credit Card Processing and Automated Reconciliation Best Practices

If you’ve ever spent an entire afternoon buried in spreadsheets trying to match credit card transactions at the end of the month, you’re not alone. For many finance teams, reconciliation is a dreaded task. It’s tedious, error-prone, and frustrating.

Manual reconciliation in NetSuite, especially when it involves credit card transactions, can lead to serious delays. Payments get posted late, reports don’t line up, and small mistakes evolve into hours of cleanup. For growing businesses, this is more than just a nuisance—it’s a roadblock to scale.

But with the right setup, NetSuite credit card processing doesn’t have to be painful. When automated correctly, reconciliation becomes a background task, not a month-end crisis. This article will walk through challenges, best practices, and automation strategies to make your NetSuite billing smoother, faster, and more reliable.

Understanding NetSuite Credit Card Processing Challenges

Before diving into solutions, it’s helpful to understand the specific pain points many teams deal with when managing credit card transactions in NetSuite. Whether you’re in accounting, finance operations, or IT, chances are you’ve seen how even a small inefficiency in payment processing can ripple across your organization.

Here are a few examples:

- Credit card transactions need to be manually entered or matched to invoices.

- Posting delays make it hard to know what’s been paid and what hasn’t.

- Payment processors often use batch settlements, which don’t always align with how NetSuite tracks payments.

- Some companies use multiple processors, increasing the complexity of reconciliation.

These challenges don’t just eat up time. They make it harder to close the books on time, introduce errors into financial statements, and cloud visibility into your real-time cash position.

And as your business grows, these problems multiply. More sales, more payments, and more exceptions—all layered on top of a manual system that wasn’t built to scale. If your team is spending hours every week on NetSuite credit card reconciliation, it’s time to rethink your process.

Core Components of Effective NetSuite Credit Card Processing

Improving your NetSuite credit card processing starts with a few foundational elements, but these aren’t just technical checkboxes. They’re the building blocks of a scalable, reliable, and efficient process. Whether your finance team is handling hundreds or thousands of credit card transactions a month, these components will ensure you’re equipped to manage complexity without sacrificing accuracy or speed.

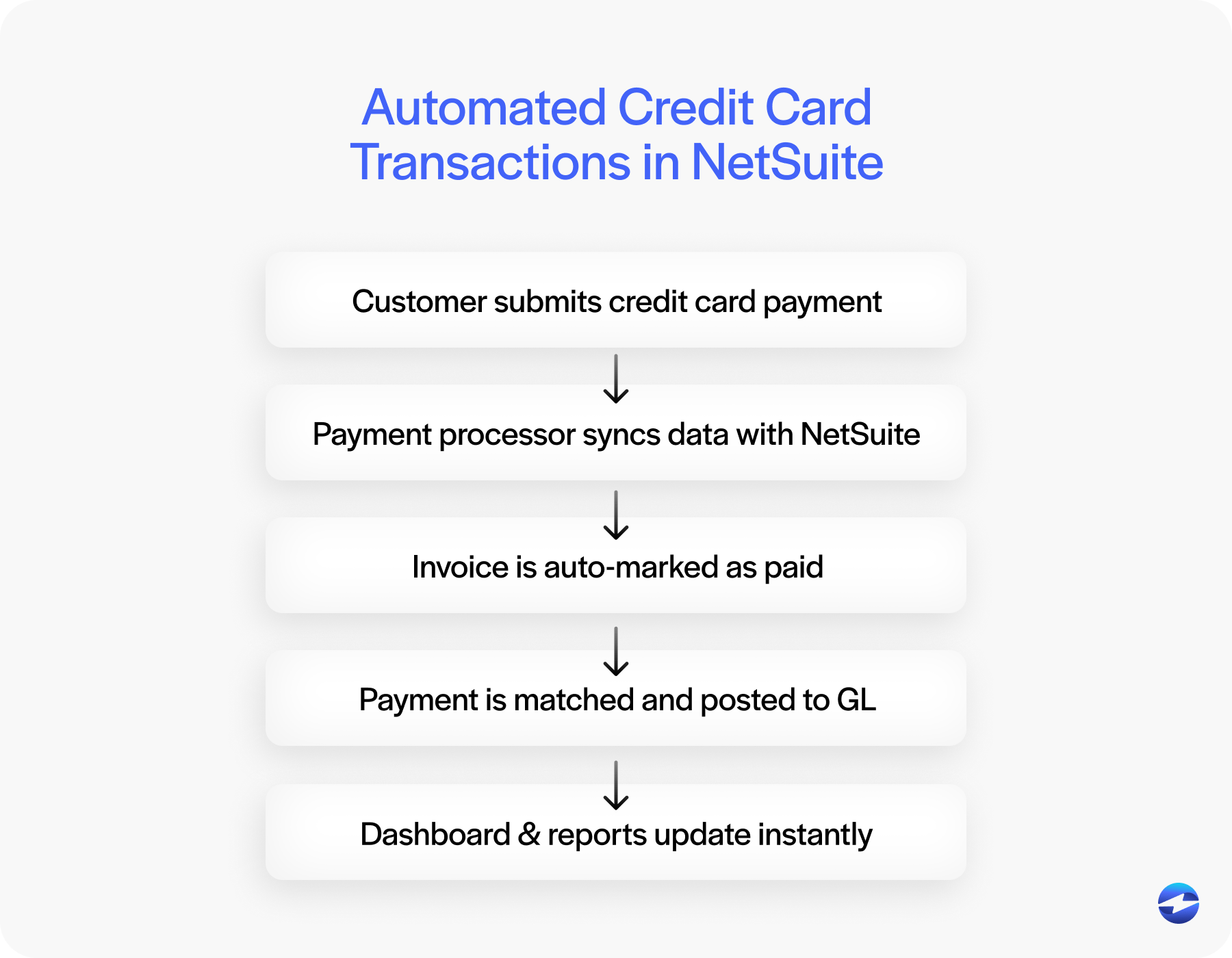

1. Real-time payment posting

When credit card payments are posted in real time, you get a clear picture of your cash flow as it happens. No more waiting for batch files or worrying about delays between the customer paying and the system reflecting it. Real-time NetSuite payment processing helps you stay on top of receivables, manage cash more effectively, and catch issues earlier.

2. Automated transaction matching

One of the biggest consumers of time in reconciliation is matching credit card payments to the correct invoices. Doing this manually is slow and error-prone. With automated matching rules, NetSuite can do the heavy lifting for you—linking payments to open invoices based on transaction amount, date, and customer.

3. Integrated payment gateways

A solid NetSuite credit card integration is key to eliminating data silos. Whether you’re using a native solution or a trusted partner, the integration should sync transaction data directly into NetSuite. This ensures that every payment shows up in your system with the correct metadata—no more toggling between platforms.

4. Comprehensive reporting and audit trails

Reconciliation doesn’t end when the books close. You need clear audit trails and reports for compliance, internal reviews, and peace of mind. Look for tools and workflows that automatically generate reconciliation reports and flag anomalies.

These components aren’t optional; they’re essential if you want to eliminate friction from your NetSuite credit card reconciliation process. By prioritizing real-time data, smart automation, seamless integrations, and transparent reporting, you’re laying the foundation for a financial system that can grow with your business.

Best Practices for NetSuite Credit Card Reconciliation

Even with the right tools in place, credit card reconciliation can still be one of the most detail-heavy aspects of NetSuite billing.

If you’re wondering how to reconcile credit cards in NetSuite more efficiently, these best practices will help:

Establish standardized workflows

- Define posting rules that automate how and when payments get applied.

- Create consistent account mapping across all credit card processors.

- Set up approval processes for handling exceptions or edge cases.

Leverage NetSuite’s native tools

- Use saved searches to monitor unreconciled transactions.

- Set up key performance indicator (KPI) dashboards to track reconciliation metrics.

- Create alerts for failed or declined transactions so they don’t fall through the cracks.

Implement exception handling procedures

- Build processes for managing declined cards, chargebacks, and partial payments.

- If you work with international customers, make sure your system handles multi-currency transactions correctly.

- Define steps for resolving mismatches and posting corrections.

Stick to a regular reconciliation schedule

- Daily or weekly reconciliation reduces surprises at month-end.

- Optimize your month-end close by reconciling smaller batches more often.

- Prepare ahead for year-end audits with clean, reconciled data.

This all ties back to one goal: turning reconciliation from a reactive scramble into a proactive, repeatable process.

Automating Reconciliation with Payment Processor Integration

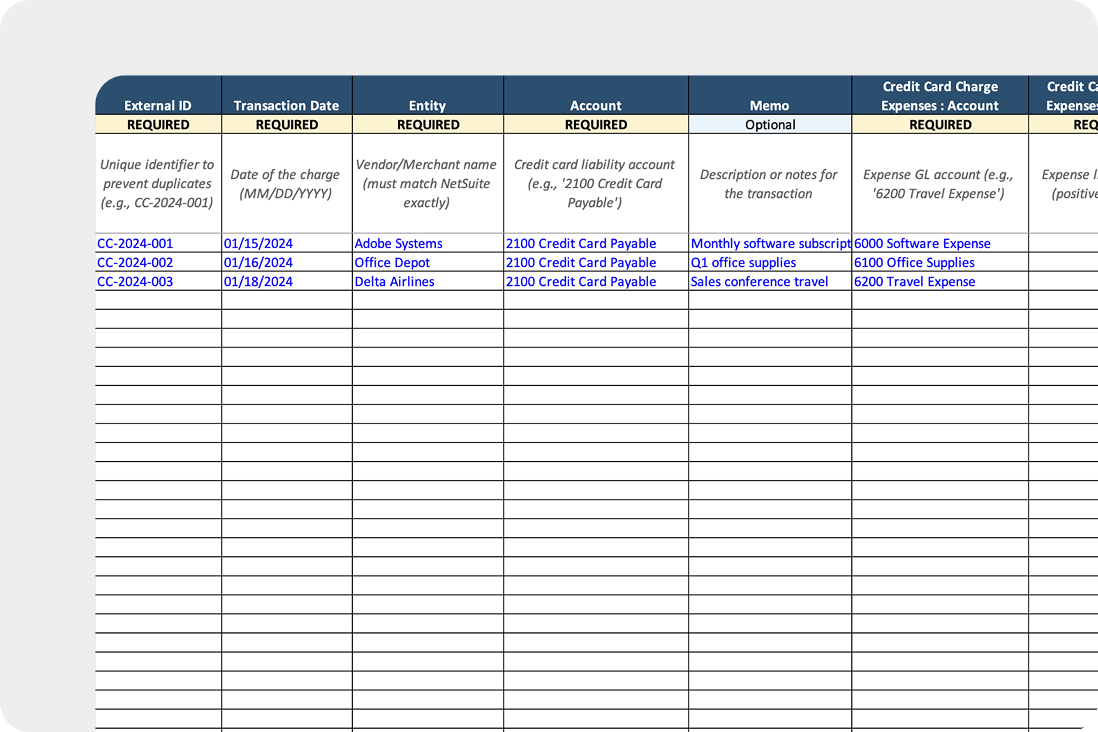

If you’re exploring how to import credit card transactions into NetSuite seamlessly, integration is the answer.

When your payment processor connects directly to NetSuite, you eliminate manual entry. Credit card payments flow automatically from the processor into your ERP, complete with transaction details and general ledger accounts.

This level of automation supports real-time synchronization, automated general ledger posting, and reduced reconciliation work. Look for NetSuite credit card processing partners that offer native integration and reconciliation tools tailored for the platform.

The return on investment (ROI) is clear: fewer errors, faster closes, and better visibility into your cash flow. You get time back, and your team can focus on strategic work instead of transaction matching.

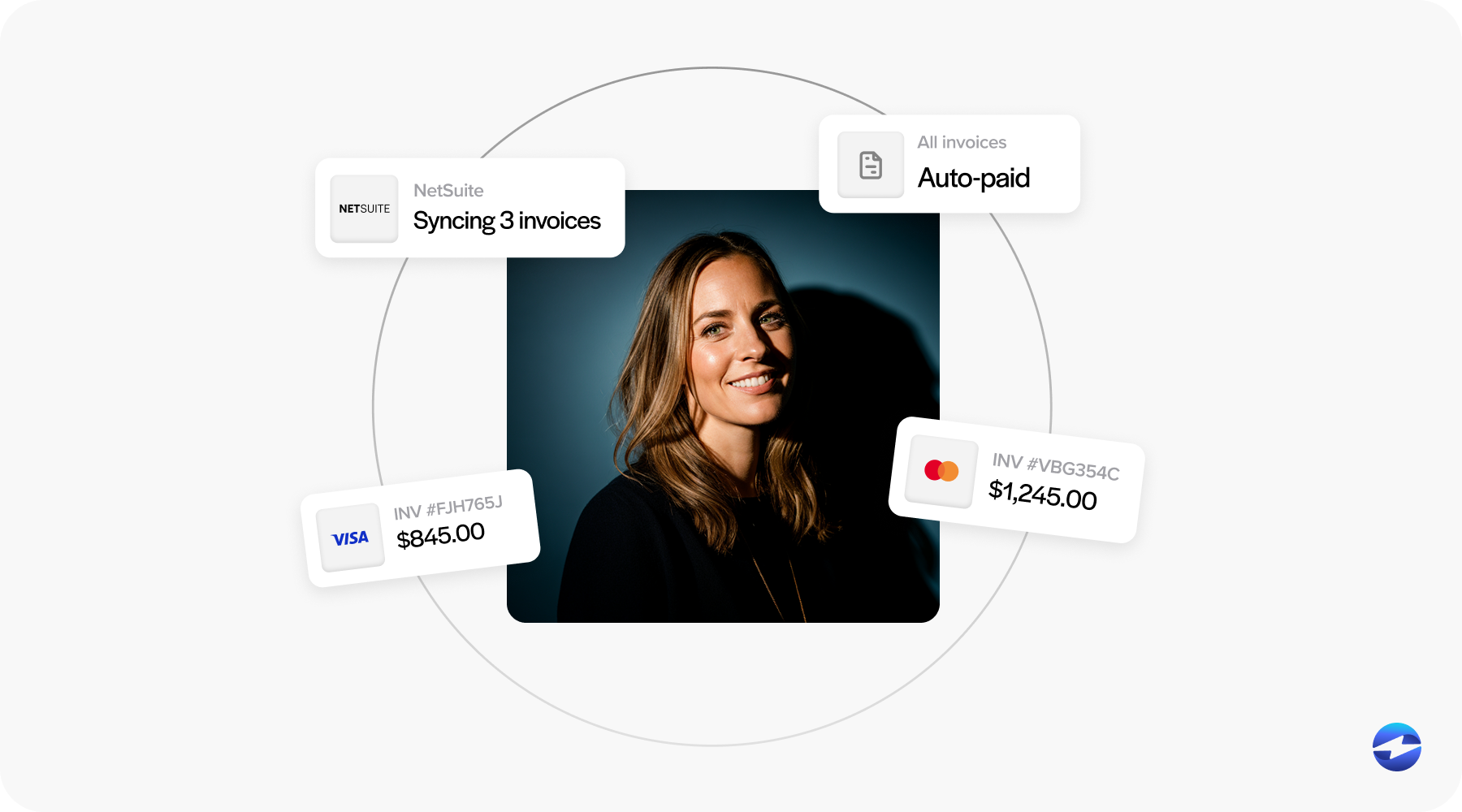

EBizCharge: Streamlining NetSuite Credit Card Processing

If you’re evaluating NetSuite credit card processing partners, EBizCharge is worth considering. Built to work natively within NetSuite, it supports real-time NetSuite automated credit card payments, deep integration, and streamlined reconciliation.

Users report measurable improvements in how quickly they close their books, reduce manual effort, and gain clarity into their financials. From real-time NetSuite credit card transactions to automated reconciliation reports, EBizCharge simplifies the process.

Whether you’re just starting to automate or looking to improve your current setup, a tool like EBizCharge can be a major step forward in modernizing your NetSuite billing workflows.

Implementing Better Credit Card Processing Practices

If your team is still wrestling with spreadsheets at month-end, it’s time to audit your current process.

Start small—automate a subset of your NetSuite credit card transactions and refine the workflow. As confidence builds, expand to full automation. The goal is to create a scalable system that supports your growth.

NetSuite credit card processing doesn’t have to be a burden. With the right tools and a thoughtful strategy, it becomes a fast, reliable, and accurate part of your finance operation.

By embracing automated NetSuite credit card reconciliation and leveraging smart integrations, your team can leave manual work behind—and focus on what really matters.

Summary

- Understanding NetSuite Credit Card Processing Challenges

- Core Components of Effective NetSuite Credit Card Processing

- Best Practices for NetSuite Credit Card Reconciliation

- Automating Reconciliation with Payment Processor Integration

- EBizCharge: Streamlining NetSuite Credit Card Processing

- Implementing Better Credit Card Processing Practices