Blog > Optimizing Payment Methods and Customer Experience in NetSuite

Optimizing Payment Methods and Customer Experience in NetSuite

In today’s digital landscape, customers expect payment to be quick, seamless, and easy. Whether you’re running a SaaS company, a wholesale distribution business, or a growing eCommerce brand, a clunky payment experience can create friction and lost revenue.

NetSuite offers a strong ERP foundation, but optimizing how payments flow through your system can make a big difference. This article is for teams looking to streamline operations and improve customer satisfaction by rethinking how NetSuite billing methods are managed. We’ll break down practical strategies, tools, and real-world tips to help you get the most out of your NetSuite billing module.

Understanding the Payment Experience in NetSuite

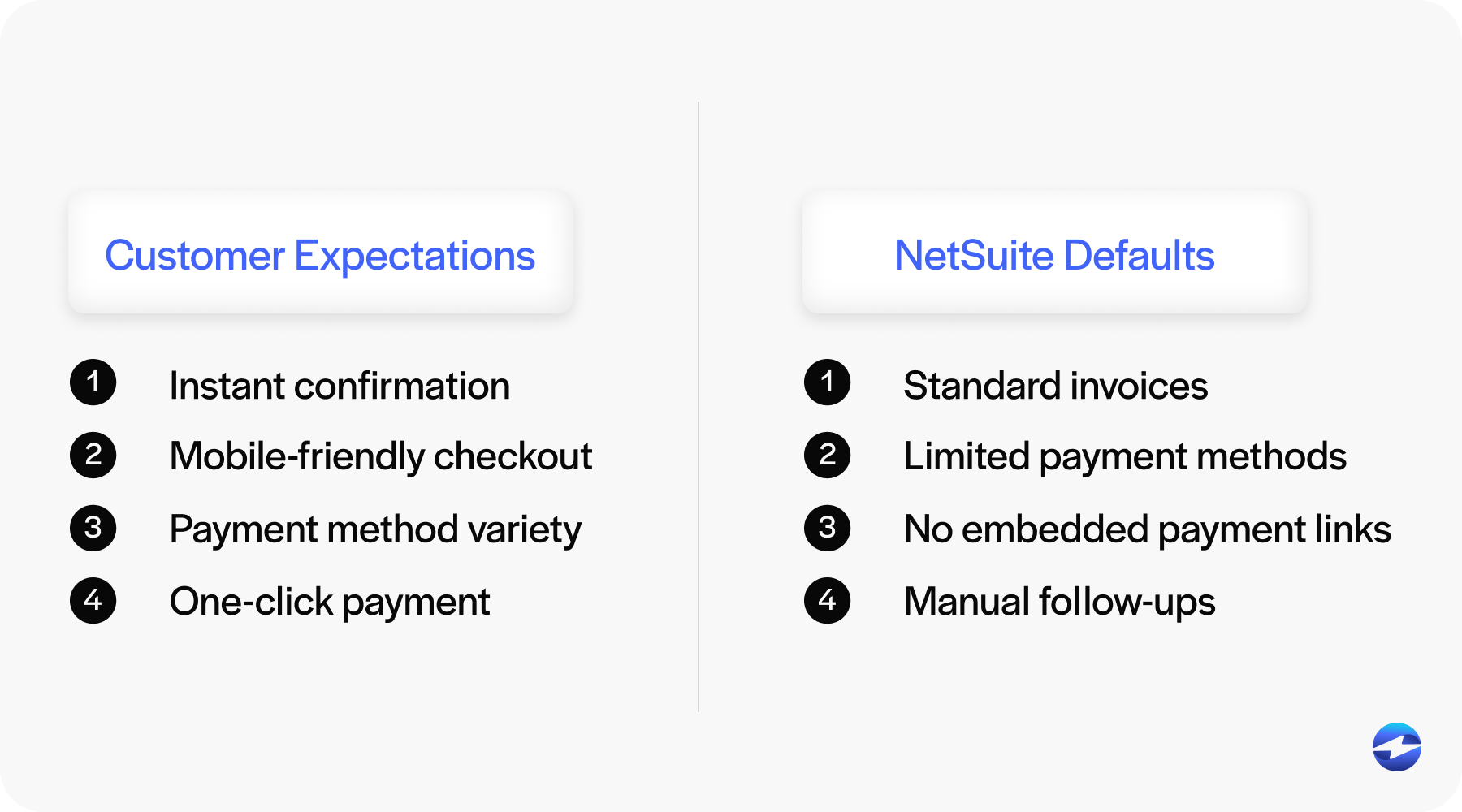

Out of the box, NetSuite provides standard tools for handling invoicing, collecting payments, and logging transactions. You can configure basic payment types, send invoices, and track payments in your financials. But many companies run into challenges as they scale.

Common pain points include limited support for modern payment processing preferences, fragmented checkout or invoice experiences, and manual reconciliation that consumes your team’s time. For example, if you’re not offering ACH, NetSuite eCheck, or credit card processing options in a clean, branded NetSuite payment portal, you’re likely creating barriers for your customers.

That’s why understanding both the limitations and potential of NetSuite payment processing is a smart first step. Once you see where things slow down, you can start to streamline.

Strategies for Optimizing Payment Methods in NetSuite

There’s no single solution for perfecting the payment process in NetSuite, but there are proven strategies that can dramatically improve how payments are handled. If your team is juggling manual steps or dealing with inconsistent customer experiences, adjusting your payment processor setup could ease the load and boost results.

- Offer Multiple Payment Options: Customers expect choice. Offering a variety of NetSuite payment methods—like credit cards, ACH transfers, NetSuite eCheck, or even digital wallets—can reduce friction and help you get paid faster. People want to pay in the way that works best for them. The more flexibility you provide, the better your user experience becomes.

- Enable Real-Time Payment Processing: Waiting for batch settlements or manually confirming payments isn’t just inefficient—it can delay service, shipments, or access to products. By connecting a real-time payment processor through a strong payment gateway integration, you ensure payments are authorized, posted, and reflected in NetSuite immediately. That means fewer delays and fewer support tickets.

- Simplify Invoice Payment Workflows: Make it easy for customers to pay directly from their invoice. Embedding secure payment links into emails or PDFs gives your customers a direct path to the NetSuite payment portal. Self-service payment tools, where users can view and settle multiple invoices at once, can make a major impact.

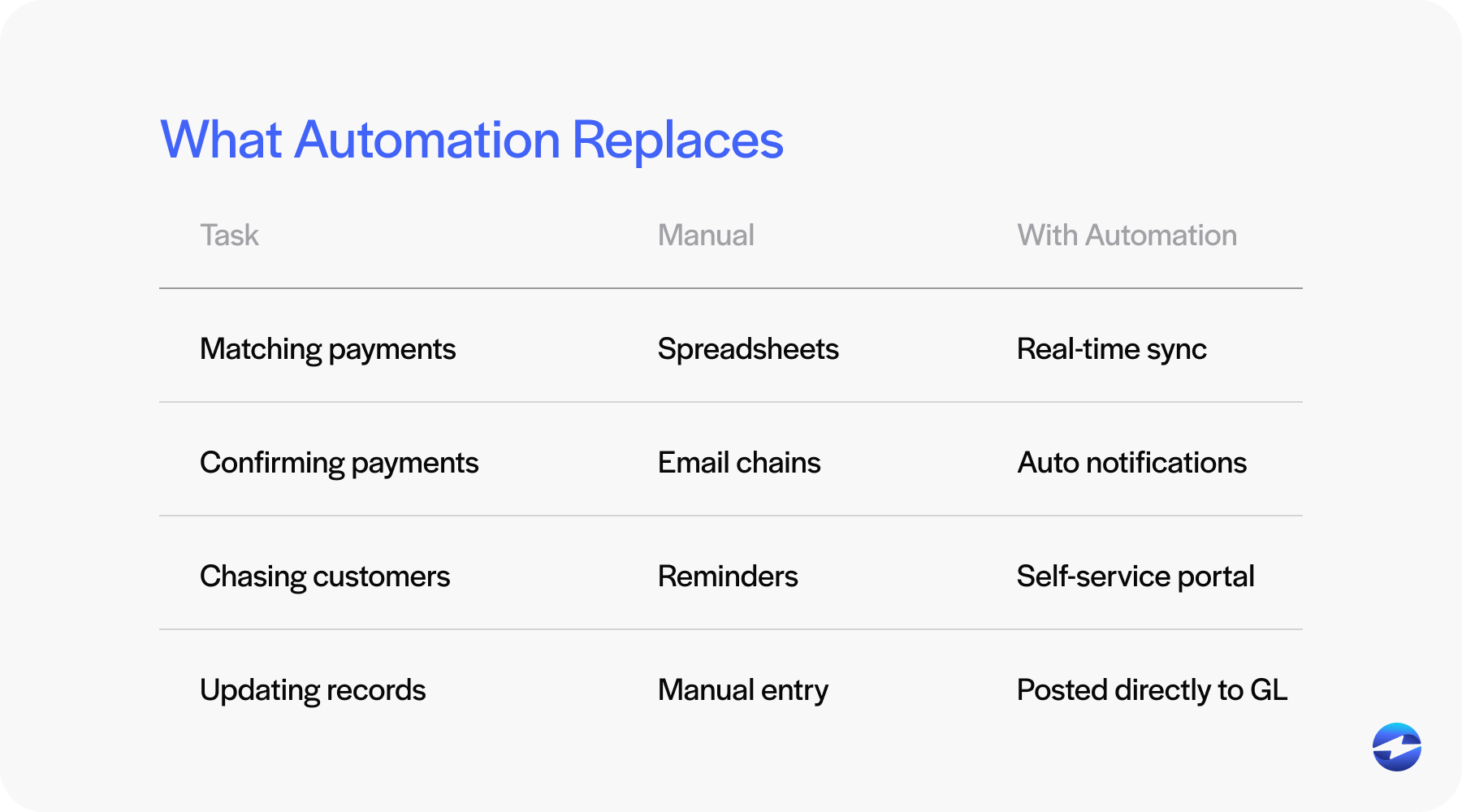

- Automate Reconciliation: Manual payment matching is time-consuming and error-prone. Using a payment processing solution that posts directly into NetSuite helps eliminate hours of reconciliation work. Look for a third-party integration that automatically matches payments to open invoices, updates records in real time, and provides detailed reports.

These strategies aren’t just about convenience—they’re about creating a scalable, accurate, and user-friendly system that supports the way modern businesses operate. Whether implementing one or all of them, each adjustment brings you closer to a more efficient NetSuite payment processing environment.

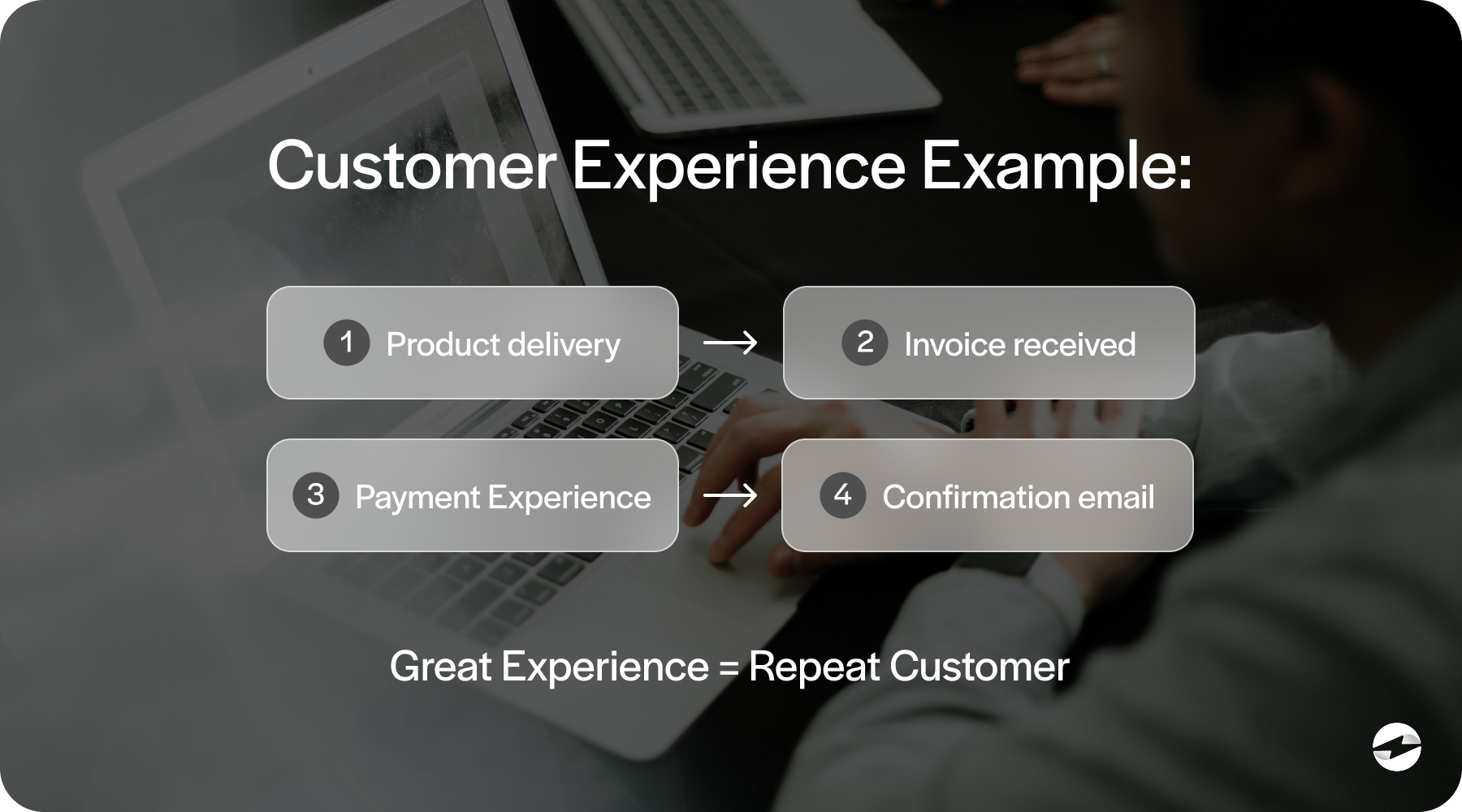

Enhancing Customer Experience Through Payment Integration

A great customer experience doesn’t stop at product delivery or service fulfillment—it extends all the way through to payment. How smooth and intuitive your payment processing is can influence whether customers return, how fast they pay, and how they perceive your company’s professionalism. That’s why it’s crucial to view payment integration not just as an operational concern, but as a customer experience priority.

The payment process isn’t just about collecting funds. It’s part of your brand experience. Customers notice when it’s easy—and they notice even more when it’s not.

Improving your payment integration within NetSuite means fewer roadblocks and better service. For example, clean branding on your NetSuite payment portal reinforces trust. Supporting recurring billing models or subscriptions shows that your business understands convenience. And real-time confirmation emails reduce support calls and payment processing confusion.

When payments work well, they tend to go unnoticed. That’s exactly what you want.

Ultimately, optimizing payment integration helps foster loyalty. It shortens the path from invoice to payment, removes stress for your customers, and strengthens the connection between your back-end systems and front-end experience. The smoother the payment processing, the more likely customers are to pay on time and come back again.

Key Considerations Before Optimizing Payments

Before rolling out any changes to your payment setup, take a step back and evaluate:

- Do you know your customers’ preferred NetSuite payment methods?

- How much time does your team spend manually updating or chasing payments?

- Are there gaps in your current payment processing solution?

- Do you need a single payment processor or a full payment processing solution with deep ERP integration?

- How are you handling security and PCI compliance?

Understanding your own bottlenecks—and how they affect both your internal workflows and your customers—is key to finding the right path forward.

How EBizCharge Transforms NetSuite Billing

Billing is more than just a back-office task—it impacts the entire customer journey, from sales to retention. And as your business grows, the need for a billing system that’s both flexible and deeply integrated becomes more urgent. That’s where EBizCharge comes in.

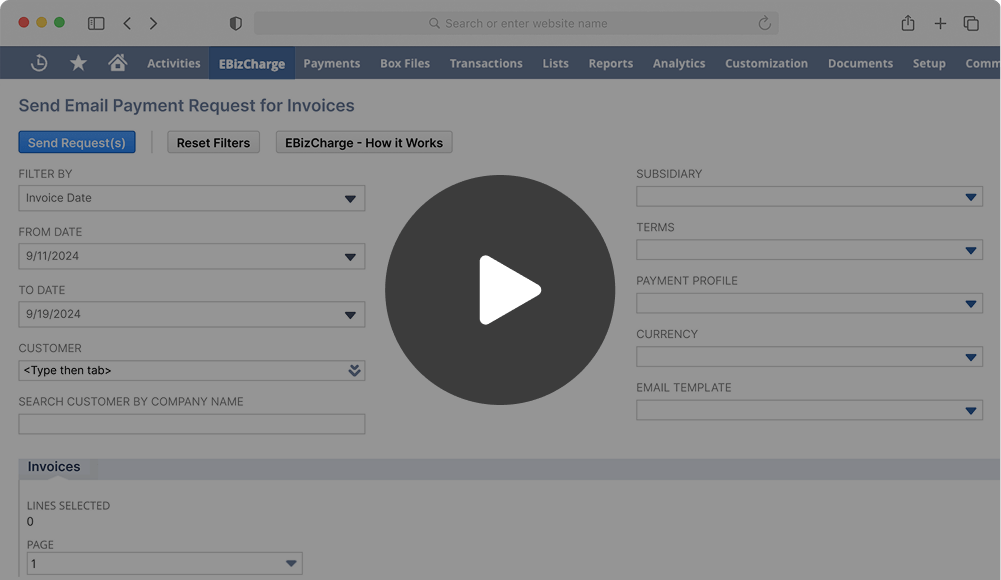

EBizCharge provides a seamless third-party integration designed specifically to streamline payment processing operations. By embedding directly into your NetSuite billing module, EBizCharge allows you to handle credit card processing and ACH payments within the same system you use to manage invoicing, accounting, and customer data. This eliminates the need to jump between systems, reduces errors, and accelerates cash flow.

Beyond simplifying credit card processing, EBizCharge enhances the entire billing workflow with real-time payment posting, automated reconciliation, and customizable reporting. The result is a more efficient, secure, and transparent payment experience for both your internal teams and your customers.

So, if you’re feeling constrained by your current billing setup, take a look at how integrated tools like EBizCharge can fill the gap. With the right solution, you can turn billing from a source of frustration into a driver of efficiency and growth.

Simplifying NetSuite billing with EBizCharge

Improving NetSuite billing isn’t just about technology—it’s about removing friction for your team and customers. By offering modern options, enabling real-time payments, and choosing the right payment integration, you can reduce delays, lower error rates, and improve satisfaction across the board.

A solution like EBizCharge doesn’t just plug a gap—it reshapes how NetSuite custom billing solutions and NetSuite billing solutions work behind the scenes. With tools like automated reconciliation, a branded NetSuite payment portal, and deep support for NetSuite credit card processing and ACH, it becomes easier to get paid on time and without hassle.

In the end, the best payment solution is the one that makes it easy to do business with you. And that starts with a thoughtful, optimized approach to NetSuite billing.