Blog > The Complete NetSuite Payment Gateway Integration Guide

The Complete NetSuite Payment Gateway Integration Guide

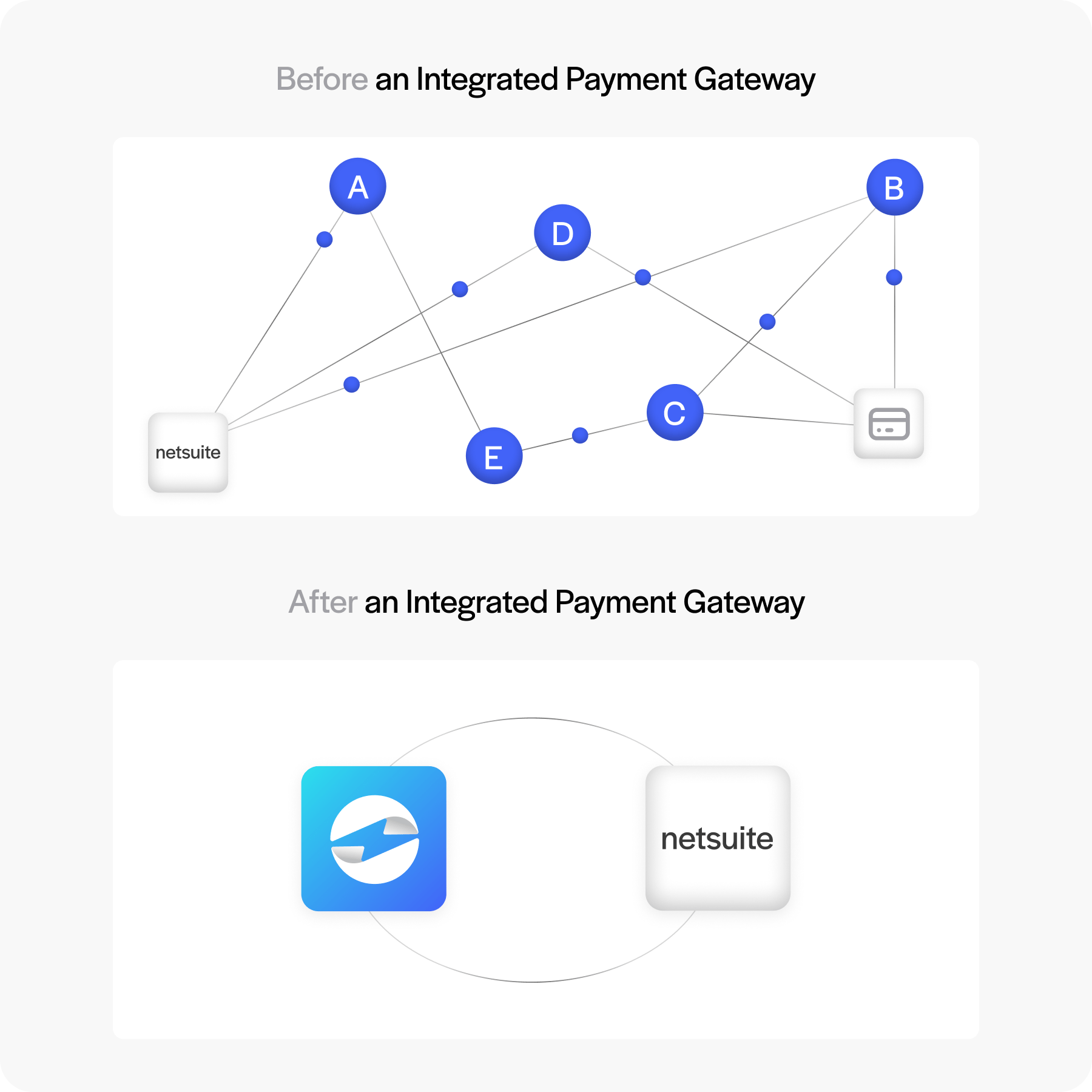

If you’re using NetSuite to manage your business operations, you’ve probably noticed one area that can still feel disconnected: payments. While Oracle NetSuite offers a solid foundation, it doesn’t always deliver the seamless experience modern finance and operations teams need when it comes to accepting, tracking, and reconciling payments.

That’s where a well-executed NetSuite payment gateway integration can make a serious impact. This guide is designed for the folks in finance, IT, and operations who want to stop jumping between platforms and start managing payments directly inside NetSuite—with confidence, speed, and accuracy.

Why NetSuite Users Need Integrated Payment Gateways

For many businesses, manual payment processing remains a tedious task. You might be logging into an external payment processor portal, downloading reports, and then manually updating records in NetSuite. It’s slow, error-prone, and a headache when trying to reconcile at the end of the month.

When you integrate NetSuite with a payment gateway, you eliminate most of that busy work. Embedded payments enable customers to pay directly from an invoice. Your system records it in real time and everything ties back to the original transaction. Fewer errors and faster cash flow.

Additionally, the integration provides your team with greater visibility. With a proper NetSuite & payment gateway connector, AR teams can track who paid what, when, and how—without switching systems. Finance can run reports in a few clicks. And operations can make better calls with access to up-to-date payment data.

How NetSuite Handles Payment Processing by Default

Out of the box, NetSuite has basic payment functionality. You can create invoices and apply payments, but it lacks modern tools for real-time card processing, ACH handling, and PCI-compliant tokenization.

It also doesn’t support embedded customer-facing payment options natively, which means you need a workaround or additional setup to collect payments online. That’s especially limiting for B2B companies who bill clients on net terms or recurring schedules.

That’s where third-party NetSuite payment gateways come in. They plug into NetSuite and fill in those critical gaps. A good NetSuite integration lets you accept credit cards, ACH, or other methods directly from invoices, automates reconciliation, and keeps everything within your ERP.

Key Features to Look for in a NetSuite Payment Gateway Integration

Not all NetSuite payment gateway integrations are created equal. If you’re evaluating options, here are the key capabilities to prioritize:

- Real-time payment posting and automatic reconciliation: Payments should be applied instantly and directly tied to customer records and general ledger accounts.

- Multiple payment types: The system should support credit cards, ACH, and ideally allow customers to store payment methods for future use.

- PCI compliance and tokenization: You shouldn’t have to touch or store sensitive data. Your payment processor should handle that securely.

- Customer payment portals: Make it easy for clients to pay open invoices from a branded, secure interface.

- Saved searches and automation support: The best integrations work natively with NetSuite’s workflow tools so you can build automations, alerts, and reports.

A strong NetSuite and payment gateway integration should feel like a natural extension of your ERP—not an awkward bolt-on.

Choosing the Right Payment Gateway for Your Business

Not all payment processors offer a smooth NetSuite and payment gateway integration.

Start by identifying your payment priorities: lower fees, better reporting, multi-currency support, or embedded capabilities. Also consider how your business model affects your needs. For example, subscription-based billing, large invoice volumes, or international clients will demand more from your NetSuite payment gateway.

Ask tough questions:

- How seamlessly does this solution integrate with NetSuite?

- Will it support our business model (e.g., subscriptions, project-based billing, net terms)?

- What does onboarding and support look like?

- Can it scale with our growth and adapt to future changes in our workflows?

Some Oracle NetSuite payment gateways are “certified,” which often means tighter integration, better performance, and faster resolution when issues arise. Others may be functional but require more custom development, which can increase costs and complexity down the road.

Ultimately, the goal is to find a NetSuite & payment gateway connector that aligns with your current system, supports your goals, and won’t cause friction as your business evolves. Remember, you’re not just picking a payment processor—you’re choosing a long-term piece of your finance infrastructure.

Implementation Steps: How to Integrate a Payment Gateway with NetSuite

Once you’ve chosen your payment gateway provider, it’s important to bring together your IT and finance teams to coordinate a smooth rollout. Here’s a quick breakdown of how the integration process works:

Step 1: Planning

Start by clearly defining your goals. Are you looking to accelerate cash flow, reduce DSO, or eliminate manual reconciliation? Having specific outcomes in mind will shape the implementation process.

- Identify payment processing pain points and how integration will address them.

- Bring stakeholders from accounts receivable, IT, and operations together to align expectations and assign responsibilities.

Step 2: Setup and Configuration

Next, install the appropriate NetSuite & payment gateway connector or integration bundle provided by your vendor. This step will involve some technical setup.

- Configure the system to recognize various payment methods, including credit cards and ACH.

- Assign user permissions based on roles to ensure secure access.

- Set up automated workflows for payment collection, such as sending invoice payment links or triggering reminders.

Step 3: Testing and Validation

Before going live, thoroughly test the system to ensure everything works as intended.

- Run sample payments through various scenarios, including different payment types and invoice statuses.

- Confirm that payments are correctly recorded and applied in your general ledger.

- Review workflows to verify that emails, receipts, and internal notifications are functioning properly.

Step 4: Go Live

Once you’re confident in the setup, proceed with a measured rollout.

- Launch the integration in phases if necessary, starting with a small group or specific invoice types.

- Train staff so they know how to use the new tools and can troubleshoot minor issues.

- Closely monitor payment activity during the initial weeks and adjust workflows or settings as needed.

When executed thoughtfully, your NetSuite payment gateway integration should operate reliably in the background, making your collections process smoother and more transparent.

Common Pitfalls and How to Avoid Them

Even good integrations can go wrong if not handled carefully. Here are a few things to watch out for:

- Over-customization: If your NetSuite instance is highly customized, make sure your payment gateway NetSuite integration won’t break anything—or require extensive developer support.

- Compliance oversights: If your payment processor doesn’t handle PCI or fails to tokenize data correctly, that’s a major liability.

- Lack of communication: Keep finance and IT in sync throughout. This isn’t just a technical project—it impacts collections, reporting, and customer experience.

Avoiding these issues keeps your NetSuite and payment gateway integration clean, stable, and scalable.

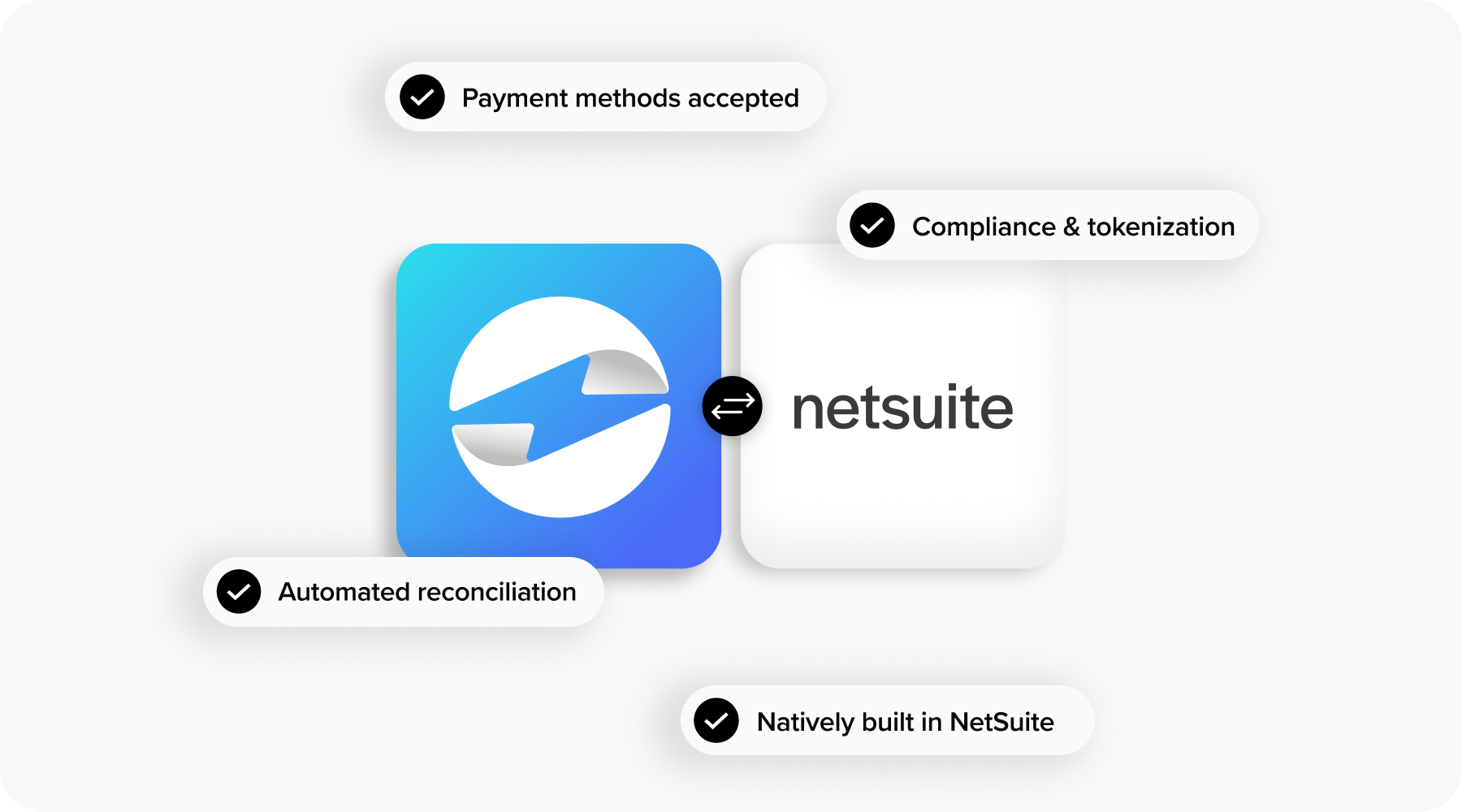

EBizCharge’s comprehensive NetSuite payment gateway

EBizCharge offers one of the most comprehensive Oracle NetSuite payment gateways available. Its integration embeds directly into your NetSuite environment, allowing payments to be accepted, processed, and reconciled—all without leaving the ERP.

It supports credit cards, ACH, email pay links, and secure customer portals. More importantly, it’s designed with finance teams in mind, automating payment application and syncing data directly to the GL.

What makes EBizCharge stand out isn’t just the tech—it’s the onboarding, support, and understanding of how NetSuite actually works in the real world. The integration supports saved searches, SuiteFlow automations, and role-based access, which makes it ideal for teams that want deep functionality without the bloat.

If you’re looking to integrate NetSuite with a payment gateway that’s actually built for ERP workflows, EBizCharge is worth a look.

When done right, a NetSuite payment gateway integration eliminates the noise around payments. No more rekeying data. No more chasing spreadsheets. Just clean, real-time visibility and faster processing across the board.

The key is finding a payment gateway NetSuite integration that fits your business—not just technically, but operationally. Look for a partner, not just a vendor. And make sure your teams are aligned from the start.

With the right tools and approach, NetSuite becomes more than an ERP. It becomes your complete hub for managing finance and payments—end to end.

Summary

- Why NetSuite Users Need Integrated Payment Gateways

- How NetSuite Handles Payment Processing by Default

- Key Features to Look for in a NetSuite Payment Gateway Integration

- Choosing the Right Payment Gateway for Your Business

- Implementation Steps: How to Integrate a Payment Gateway with NetSuite

- Common Pitfalls and How to Avoid Them

- EBizCharge’s comprehensive NetSuite payment gateway