Blog > Free Merchant Services: How to Process Payments Without Monthly Fees

Free Merchant Services: How to Process Payments Without Monthly Fees

Merchant services are a must-have for any business that wants to accept credit cards, but they often come with a tangle of fees that chip away at your profits. From gateway access to statement fees and PCI compliance charges, the cost of doing business can quietly pile up. If you’re a small business or just getting started, those recurring charges can feel more like penalties than necessary operating expenses.

That’s why a lot of business owners are looking into free merchant services or options that come with no monthly costs. The idea is simple: find a payment processing solution that won’t hit you with a fee just for existing. This guide will unpack how to process payments without paying monthly fees, what the trade-offs might be, and how to pick the right path for your business.

Understanding Merchant Services

Merchant services refer to the tools and systems that let you accept credit card payments. That includes everything from your payment processor to your point-of-sale system, gateway software, and even fraud protection tools.

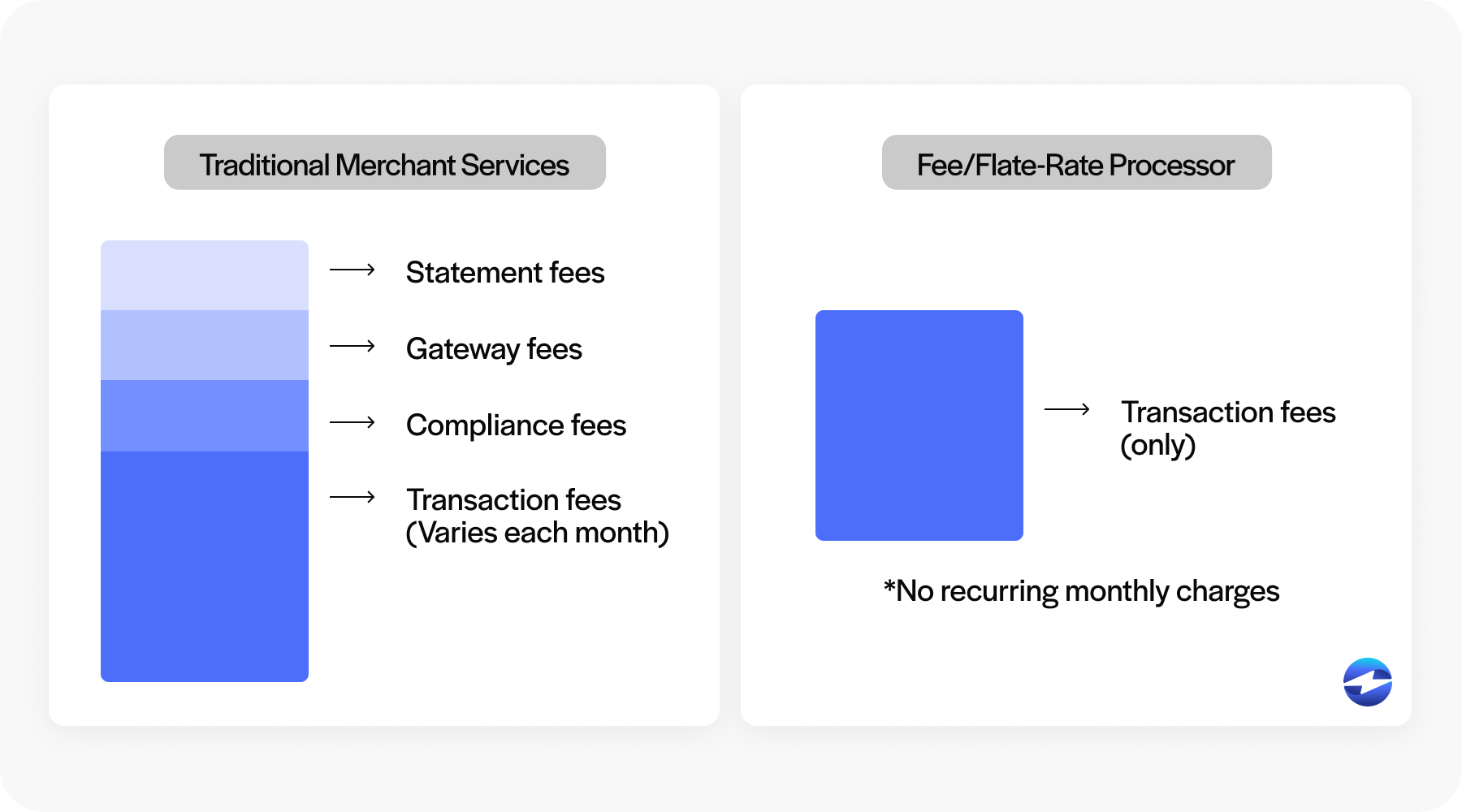

Most traditional merchant service setups involve a mix of fees—monthly charges for access, per-transaction costs, setup fees, and more. A typical arrangement might include a gateway fee, a statement fee, and a Payment Card Industry (PCI) compliance fee. These charges can add up fast, especially if you’re processing a low volume of transactions.

The Cost Burden of Monthly Fees

Monthly fees vary, but they usually fall into a few predictable buckets: statement fees, gateway access fees, and compliance costs. Some processors also tack on minimum processing fees if your volume doesn’t hit a certain threshold.

These fees often feel invisible until you add them up at the end of the month. For many small business owners, it’s not the per-transaction costs that hurt—it’s the recurring overhead, especially during slower months.

What Are “Free” Merchant Services?

“Free merchant services” doesn’t mean your business won’t pay anything to accept credit card payments. Rather, it typically refers to providers that don’t charge recurring monthly fees for maintaining your account. You’ll still pay something—usually a flat fee per transaction—but you won’t be charged just for having access to the service.

In the world of no-fee merchant services, one common approach is flat-rate pricing. These providers usually charge a fixed percentage of the transaction amount plus a small per-transaction fee—often around 2.6% + 10¢. While this may be slightly higher than traditional interchange-plus pricing, it eliminates the need for monthly gateway or statement fees, which makes it easier to predict your costs. This model is especially appealing for newer businesses, low-volume sellers, or seasonal operations that can’t justify monthly overhead.

Another option is the pay-as-you-go model. These services don’t require contracts or monthly minimums. You simply pay when a transaction is processed, making it easier to test the waters without being tied down. This structure gives small businesses the flexibility to scale their payment processing as they grow, and it keeps financial commitments minimal when cash flow is tight.

Some platforms even combine flat-rate and pay-as-you-go models, giving business owners more control and transparency. It’s a welcome alternative to the legacy systems that charge even when you’re not making sales.

Benefits of Using No-Monthly-Fee Payment Processing

If you’re running a seasonal business, a side hustle, or a shop with low transaction volume, no-cost credit card processing models can offer serious relief. Without monthly fees, you’re only paying when you actually make money.

The simplicity of these services is another bonus. Onboarding is usually quick, and there’s no red tape if you decide to stop using them. Plus, you know exactly what to expect cost-wise—no complicated rate sheets or fine print to decipher.

Free merchant services also reduce your risk. If a payment processor isn’t working out, you can move on without the pain of cancellation fees or long-term contracts.

Potential Drawbacks and Considerations

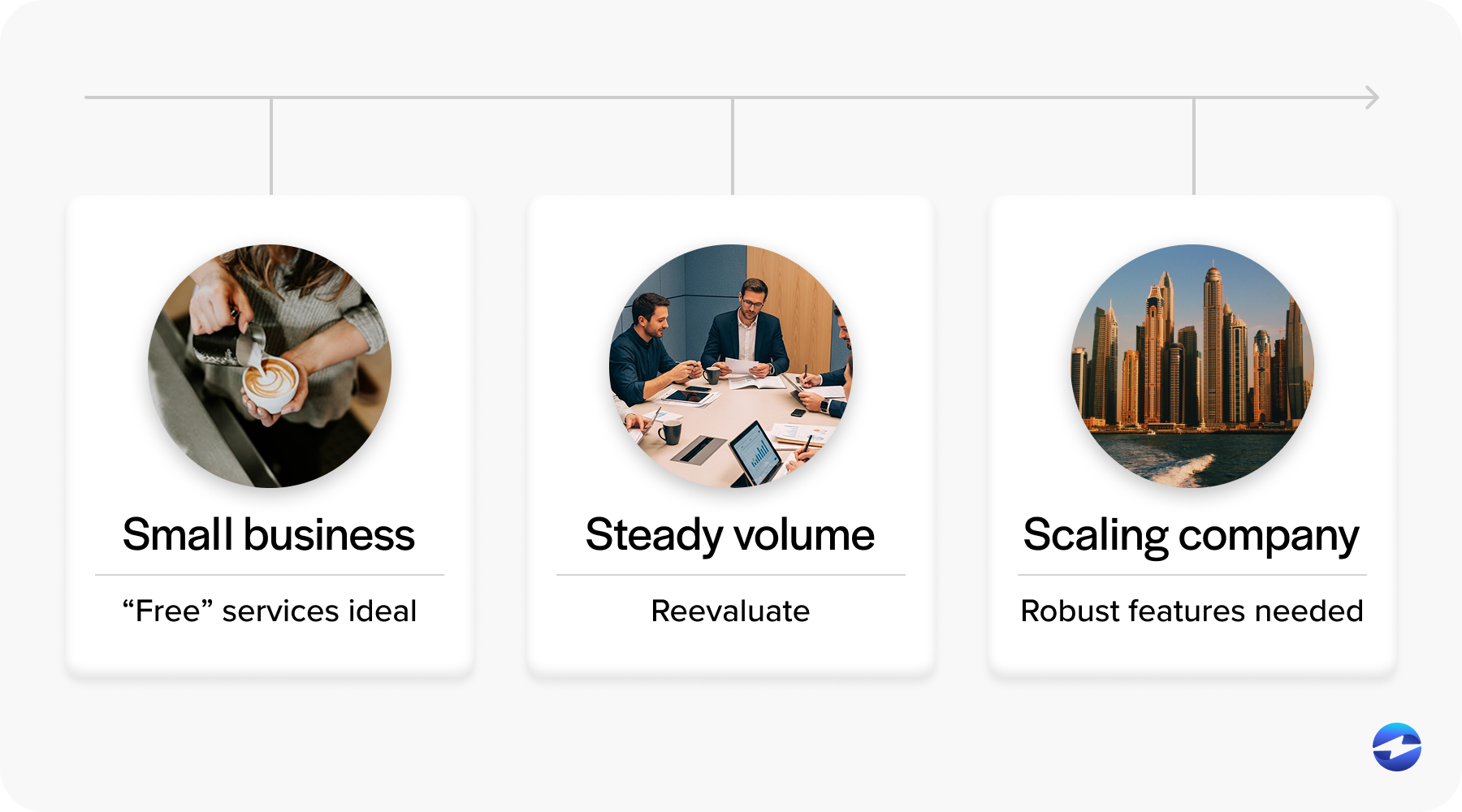

It’s not all sunshine and savings. No-fee merchant services often charge higher per-transaction rates compared to traditional processors. That can add up fast if your volume grows.

Some platforms also come with fewer features or less robust customer support. You may receive a basic dashboard but miss out on advanced reporting tools or API integrations. Security and PCI compliance can also be more of a do-it-yourself situation with budget platforms.

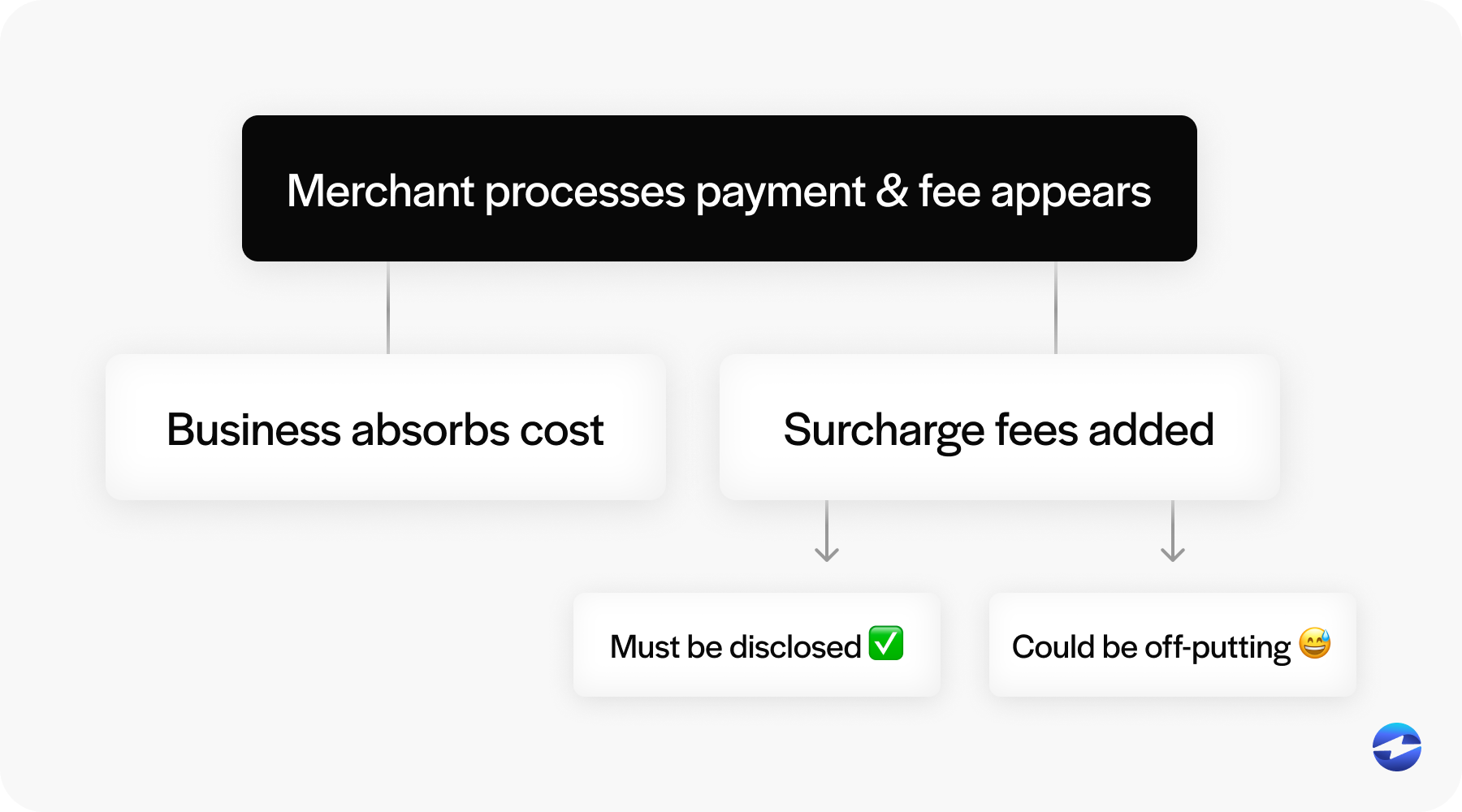

Additionally, watch out for situations where a credit card surcharge fee might be automatically passed to your customer—sometimes without you even realizing it, depending on your provider’s default settings. While credit card surcharging is legal in many states, it comes with a specific set of rules. These include disclosure requirements, signage obligations, and, in some cases, limits on how much you can charge. Make sure you’re familiar with the regulations in your state and check whether your payment processor has surcharging enabled by default. Beyond legality, think about how surcharges might influence customer behavior—some buyers may be put off by the added fee at checkout, especially if it’s unexpected.

Choosing the Right Solution for Your Business

When selecting a payment processing solution, think beyond just the upfront costs or advertised rates. Start by evaluating your business model: How many transactions are you handling each month? Are your sales in-person, online, or both? Do your customers expect seamless digital payments, or are you primarily operating in a more traditional, face-to-face environment?

You’ll also want to consider your current infrastructure. The best solution will integrate smoothly with the tools you’re already using—whether that’s a point-of-sale (POS) system, accounting software, or an eCommerce platform. Compatibility can save you hours of work and reduce the risk of errors. Additionally, ensure you know what kind of customer support is available. Issues with payment systems can grind operations to a halt, so it’s crucial to have a provider that’s responsive and available when things go wrong.

You should also think long-term. Free merchant services and no-cost credit card processing solutions are excellent for starting out, especially if you’re trying to minimize risk. But as your business scales, the flat per-transaction fees or feature limitations might become restrictive. At that point, a traditional processor with more robust options—even if it charges a monthly fee—might actually offer better value. Ensure your provider can grow with you so you’re not forced into a complete system overhaul down the road.

Tips for Minimizing Payment Processing Costs Overall

Whether you use no-cost credit card processing or a more traditional setup, there are always ways to save money—without sacrificing service quality or customer experience. Being proactive with your setup and regularly reviewing your costs can go a long way in keeping expenses manageable.

- Negotiate: If you have consistent or high transaction volume, some providers are open to negotiation. It’s worth asking if lower rates or custom pricing is available.

- Limit chargebacks: Set clear return and refund policies, provide excellent service, and maintain transparent communication with customers. These steps reduce the chances of disputes that can result in chargebacks and extra fees.

- Bundle wisely: Some providers offer discounted rates if you use multiple services from them—like combining your payment processing, invoicing tools, and POS system under one roof.

- Check your statements: Make a habit of reviewing your monthly statements. Look for new or hidden fees that may have been added without notice, and reassess whether your plan still fits your needs.

Additionally, consider whether surcharging is right for your business. Credit card surcharging lets you pass the processing fee to the customer, which can help preserve your margins—especially on tight-budget sales. But it must be disclosed clearly, comply with legal guidelines, and be implemented in a customer-friendly way. It’s an increasingly popular strategy for businesses looking to offset rising payment costs without having to raise base prices across the board.

How EBizCharge helps you cut costs and simplify payments

Choosing the right payment processor isn’t just about cutting costs—it’s about finding the right fit for how you do business. Free merchant services and no-fee merchant services offer real value, especially for those starting out or operating at lower volumes. But as with any tool, they come with trade-offs.

That’s where EBizCharge comes in. EBizCharge facilitates free merchant services by eliminating unnecessary monthly fees while still delivering a robust, full-featured payment processing solution. Their platform supports no-cost credit card processing options and gives businesses tools to enable compliant credit card surcharging, making it easier to offset processing costs when needed. Whether you’re trying to reduce overhead, pass along a credit card surcharge fee, or find a better way to handle your payment processing, EBizCharge can help tailor a solution that fits.

Beyond cost savings, EBizCharge offers seamless integrations with major accounting, ERP, and CRM platforms, along with real-time reporting, secure payment links, mobile capabilities, and top-tier customer support. It’s not just about lowering your bill—it’s about simplifying and improving how you get paid.

So, take your time to explore your options, understand your transaction patterns, and evaluate what kind of support and features will serve your business in the long run. Whether you’re exploring credit card surcharging, comparing credit card surcharge fees, or simply trying to streamline your processes, EBizCharge provides the kind of flexibility and transparency that can make all the difference.

In the end, the goal isn’t just to save money—it’s to make payments easier, more predictable, and less stressful for your business and your customers.

- Understanding Merchant Services

- The Cost Burden of Monthly Fees

- What Are “Free” Merchant Services?

- Benefits of Using No-Monthly-Fee Payment Processing

- Potential Drawbacks and Considerations

- Choosing the Right Solution for Your Business

- Tips for Minimizing Payment Processing Costs Overall

- How EBizCharge helps you cut costs and simplify payments