Blog > Surcharge Signage & Notices: What You Must Display

Surcharge Signage & Notices: What You Must Display

If you’re planning to pass along credit card processing fees to your customers, there’s more to it than just flipping a switch. You need to be clear, transparent, and most importantly, compliant. That’s where proper surcharge signage and notices come in. Whether you run a storefront or an online business, understanding what to display (and where) is critical. This guide walks you through what’s required to stay on the right side of both the law and card brand rules.

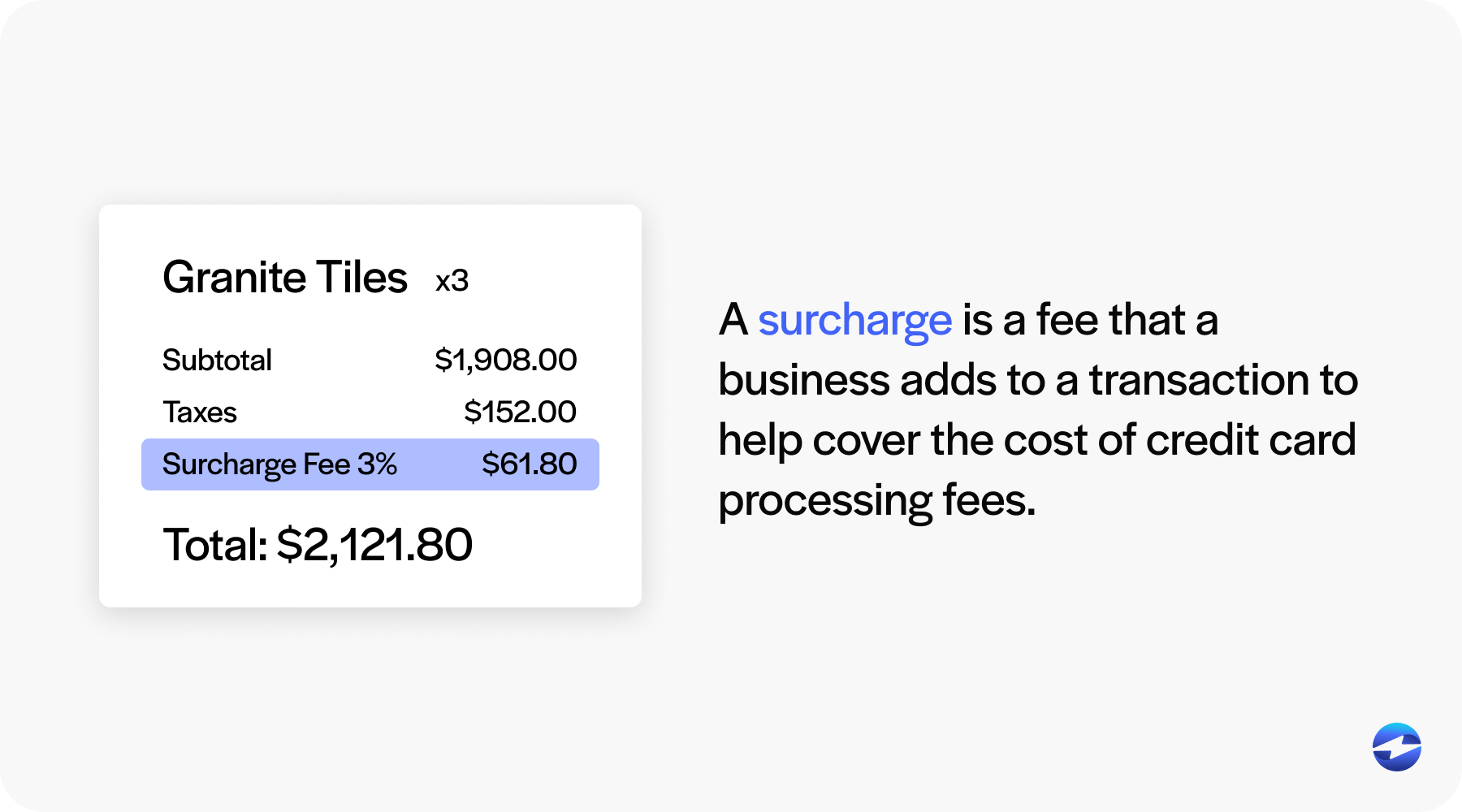

What is a surcharge?

A surcharge is a fee that a business adds to a transaction to help cover the cost of credit card processing fees. This is part of what’s often called credit card surcharging. Instead of eating those fees, the business passes them along to the customer. These surcharges are credit cards only, which means they generally can’t be applied to debit or prepaid cards.

The purpose behind surcharging is simple: offset the fees businesses pay to process credit cards. But it’s not something you can do casually—debit card surcharging is prohibited in many places, and there are firm rules around when and how you notify customers. Done right, it’s a straightforward way to manage costs. Done wrong, it can lead to fines or even legal issues.

Legal and card brand requirements for surcharge notices

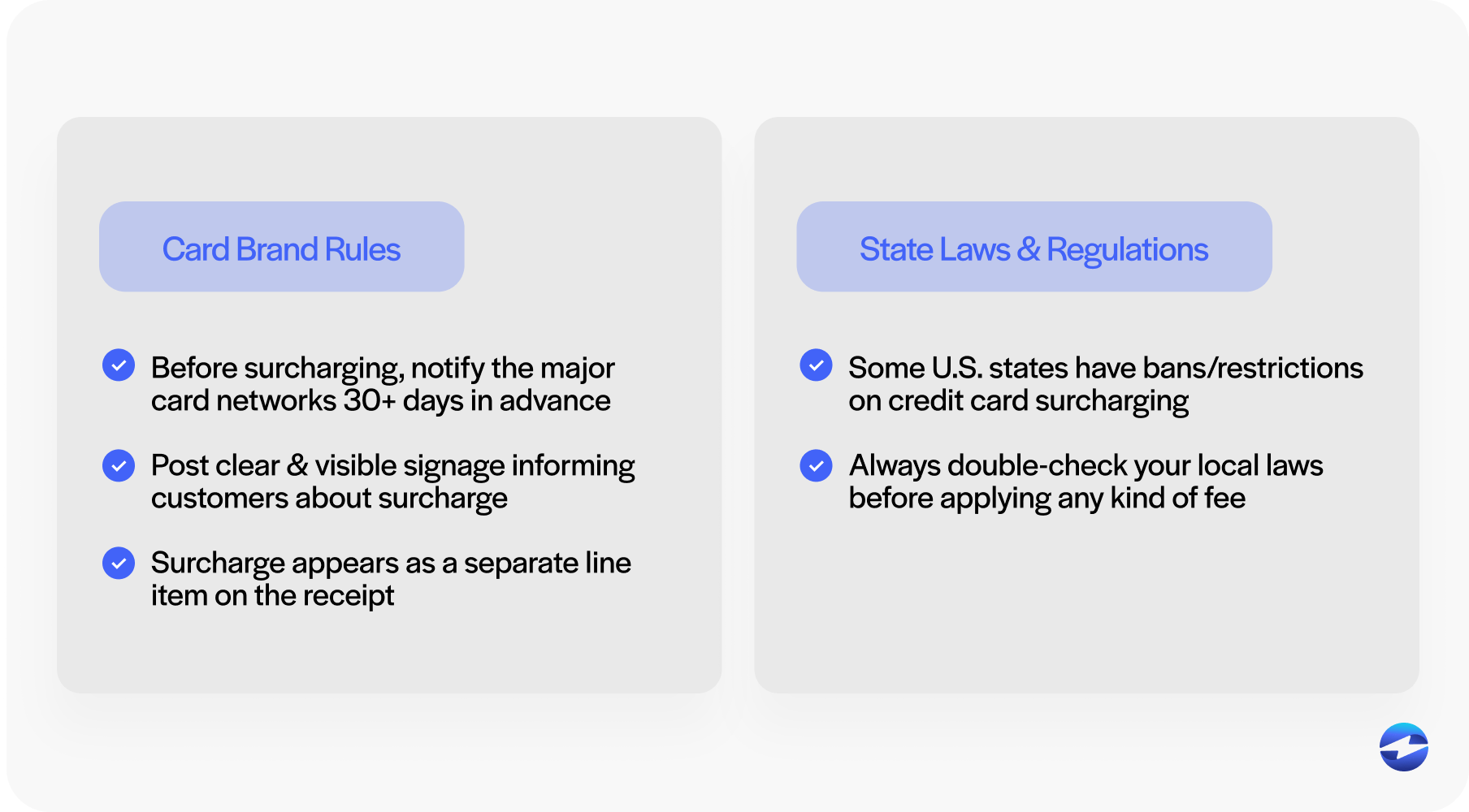

Before you add a surcharge to credit card transactions, there are some boxes you have to check. Both card brands and state governments have specific requirements, and understanding them upfront can save you a lot of trouble later. Navigating this landscape might seem intimidating at first, especially if you’re new to credit card surcharging, but getting familiar with the basics goes a long way toward staying compliant and building customer trust.

Card brand rules

- Notification requirements: Before implementing credit card surcharging, businesses are required to notify the major card networks—typically at least 30 days in advance. Visa, Mastercard, and others all have specific processes for this.

- Signage requirements: Businesses must post clear and visible signage informing customers about the surcharge. This applies to both physical entry points and the checkout area.

- Disclosure on receipts: The surcharge must appear as a separate line item on the receipt. This level of transparency helps ensure customers understand what they’re being charged for and why.

State laws and regulations

- Where surcharging is banned or restricted: Some U.S. states have outright bans or restrictions on credit card surcharging. Others may limit how much you can charge or have specific notice requirements.

- Varying compliance standards: Even in states where surcharging is allowed, rules can differ. Always double-check your local laws before applying any kind of fee, especially if you operate across state lines.

Taking the time to follow these requirements not only helps you avoid penalties—it also builds trust with your customers. Knowing that you’ve taken care to be transparent and fair makes a difference. When people know exactly what they’re being charged and why, they’re more likely to feel confident in doing business with you—and that trust is worth protecting.

Required signage for physical locations

Making customers aware of a surcharge before they pay isn’t just good practice—it’s a requirement. If you’re running a physical location, there are specific places and ways you need to display that information so no one’s caught off guard. Surcharge signage isn’t just about checking a compliance box—they’re about being upfront, clear, and respectful to the people who support your business.

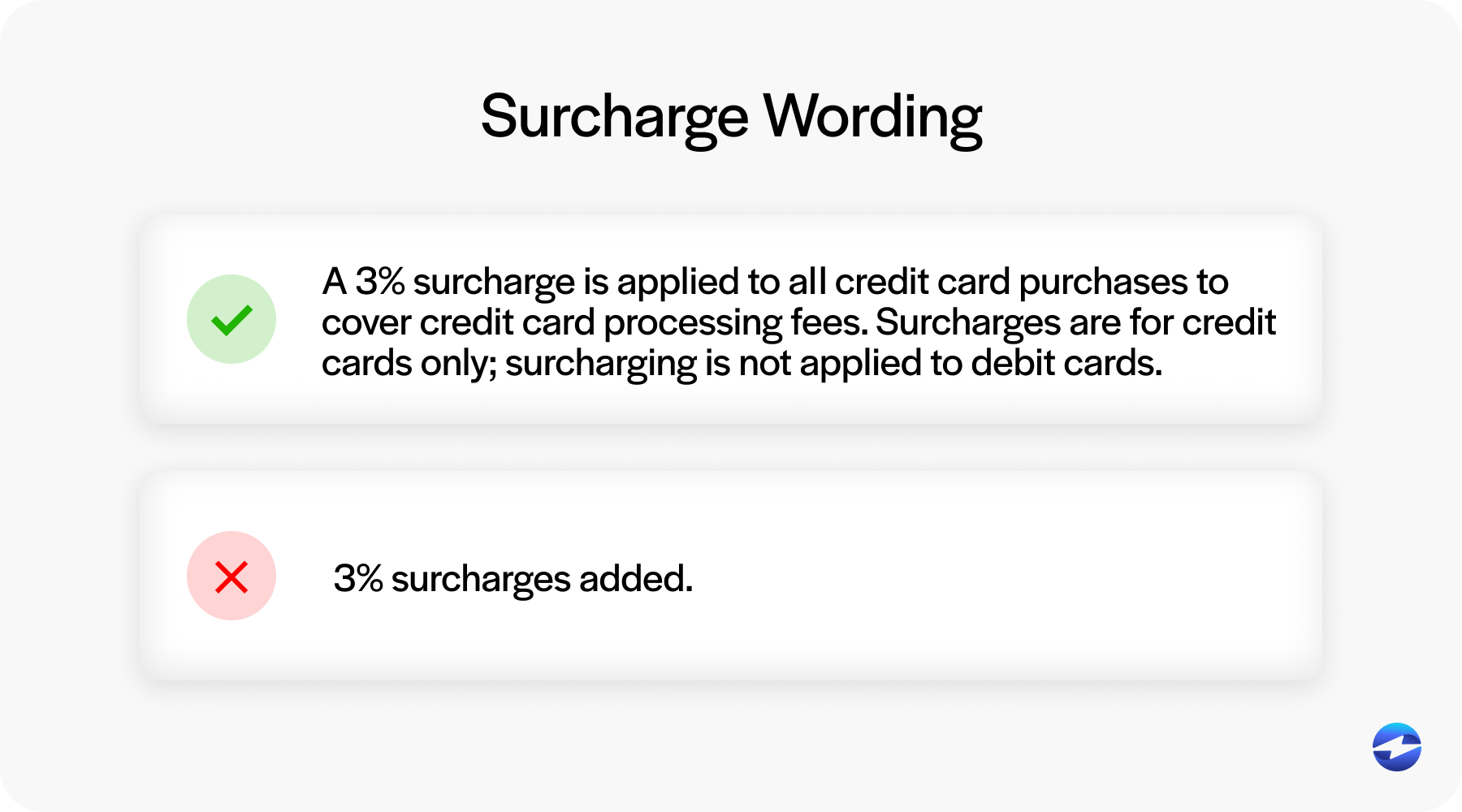

Entry signage

Entry signage refers to the sign displayed at the entrance of your business. Its purpose is to inform customers about any surcharge fees before they step inside and make a purchase. This upfront notice helps ensure transparency and keeps your business in compliance with card network rules and state regulations. It also sets expectations early, which reduces surprises and helps customers make informed choices about how they pay.

- Placement: Signage must be clearly displayed at all customer entry points. The idea is that customers should know about the surcharge before they step inside.

- Content: The sign should state that a surcharge is added to credit card purchases. Be concise but clear.

- Example language: “A 3% surcharge is applied to all credit card purchases to cover credit card processing fees. Surcharges are applied to credit cards only; surcharging is not applied to debit cards.”

Point-of-sale (POS) signage

- Location: Place signage close to the register or payment terminal so it’s visible before payment is processed.

- Content: Reinforce the message that the surcharge only applies to credit cards, not debit. Clearly state the fee amount.

- Design tips: Avoid tiny fonts or hard-to-read language. Keep it straightforward. Use bold headers and plain, friendly wording.

When signs are placed thoughtfully and written clearly, you give customers the transparency they expect and protect your business from compliance risks. It’s a small but essential part of implementing a surcharge responsibly.

Required notices for eCommerce and digital payments

If your business operates online, surcharge transparency is just as important as it is in person. The absence of a physical storefront doesn’t exempt you from making your policies known. Customers still deserve to know about any additional charges that may affect the total cost of their purchase—before they commit to payment. This section outlines the key digital touchpoints where surcharge notices should appear.

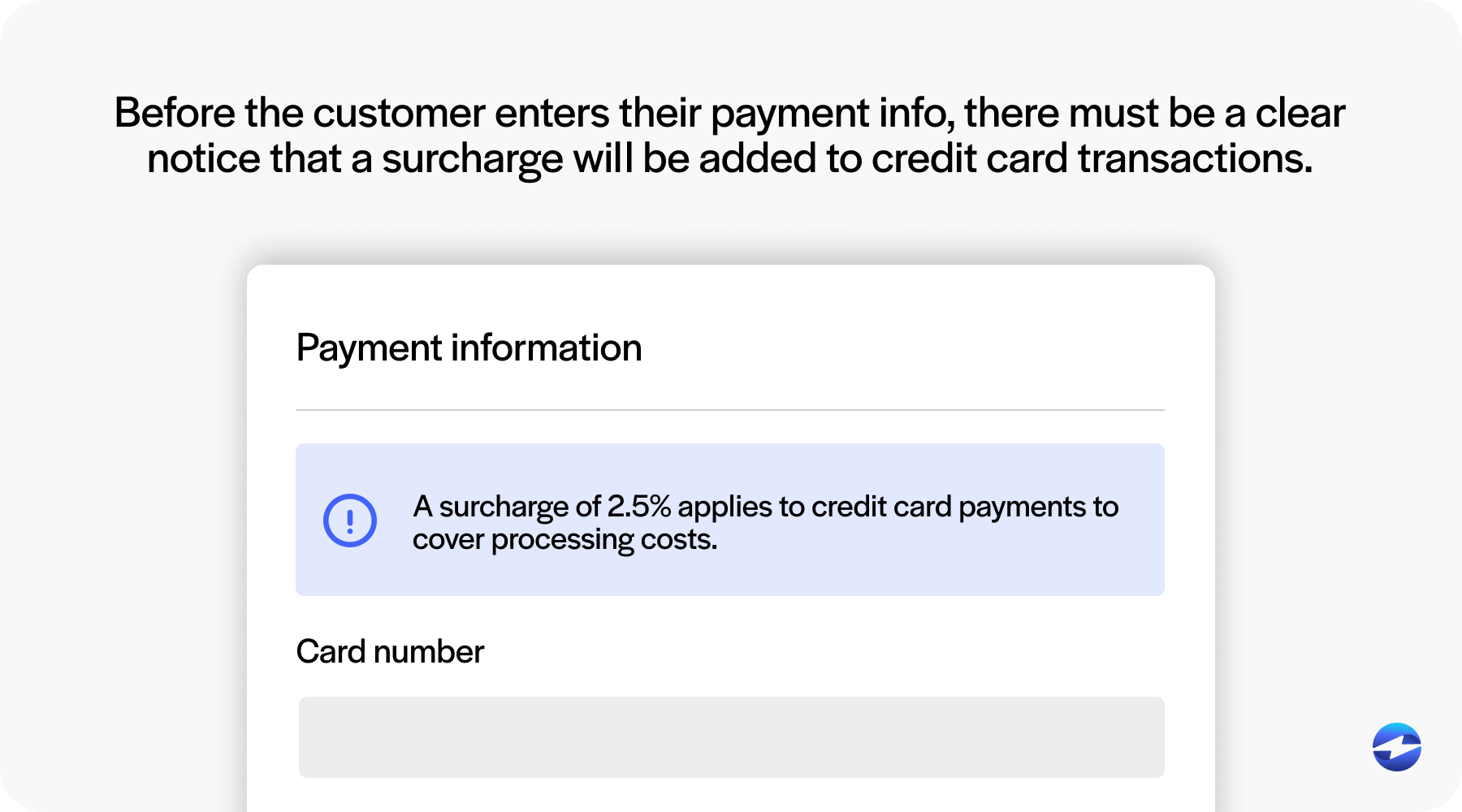

Online checkout notices

- Pre-transaction disclosure: Before the customer enters their payment info, there must be a clear notice that a surcharge will be added to credit card transactions.

- Clear language: Use simple, direct messaging: “A surcharge of 2.5% applies to credit card payments to cover processing costs.”

- Best practices: Add tooltips, banners, or brief notes next to the credit card payment option. Make sure customers understand that surcharges are credit cards only. Consider mobile responsiveness and ensure that notices are easy to read across devices.

Confirmation page and receipt disclosure

- Receipt language: Break out the surcharge as a distinct line on the receipt. Avoid bundling it with the item total.

- Customer acknowledgement: Ideally, you want the customer to see and accept the surcharge before finalizing the transaction. This could be a checkbox or clearly labeled line item. Some businesses include a brief statement on the confirmation screen as an extra step for clarity.

These steps help set the right expectations and reduce confusion or disputes. Online customers appreciate clarity—and good signage in a digital setting is all about clear, timely messaging. Transparent communication helps minimize abandoned carts and builds trust in your brand, even before the transaction is complete.

Keeping Surcharge Practices Transparent and Trustworthy

If you’re charging customers a fee to help cover your credit card processing fees, you need to do it the right way. That means understanding the rules around surcharging, following card brand guidelines, and complying with state laws. Most importantly, it means being transparent and consistent across every point of interaction.

This is where EBizCharge can help. The platform is designed to simplify surcharge compliance by automating the process of applying fees only where allowed and in line with all relevant regulations. Whether you’re managing payments through a storefront, website, or invoicing system, EBizCharge ensures that surcharge notices are clearly displayed, fees are calculated correctly, and receipts reflect the right breakdown—every time.

It also provides templates and resources for proper signage, along with expert support to help businesses navigate state-specific laws and card brand requirements. With EBizCharge, you’re not just meeting compliance standards—you’re reinforcing trust with your customers through honest, up-front communication. Taking these steps helps your business stay protected while maintaining a positive payment experience for everyone involved.