Blog > Credit Card Surcharges in Canada: A Legal Guide

Credit Card Surcharges in Canada: A Legal Guide

For Canadian businesses, credit card fees have always been a pain. Whether you’re a local shop, a service-based business, or an eCommerce brand, the fees you pay to accept credit card payments can eat into your profits. That’s where surcharging comes in.

This guide will walk you through the basics of credit card surcharging in Canada, from legal background and card network rules to disclosure requirements and best practices. If you’re a business owner dealing with rising credit card processing costs, this is for you.

Can I surcharge in Canada?

A credit card surcharge is a fee added to a customer’s bill when they choose to pay with a credit card. It’s a way for businesses to recover part or all of the processing fees they would otherwise absorb.

But the question on many merchants’ minds is, “Is it legal to add a surcharge for credit card payments?” In Canada, the answer is yes—but with some rules and responsibilities attached.

Legal Background in Canada

Let’s start with how we got here. For a long time, Canadian merchants were not allowed to pass on credit card fees to their customers. This was mainly due to card brand rules from Visa and Mastercard, which contractually prohibited surcharging.

That changed in 2022.

A class-action settlement between Canadian merchants and Visa and Mastercard gave businesses the ability to start surcharging customers for credit card payments. As part of the agreement, the card brands agreed to allow surcharging under certain conditions, effectively rewriting the rules for credit card processing in Canada.

For businesses, that means a new opportunity to offset rising costs—but also a new set of responsibilities to stay compliant.

Federal and Provincial Regulations

There’s no federal law in Canada that prohibits credit card surcharging, but that doesn’t mean businesses can surcharge without any oversight. Canada’s legal framework leaves much of the regulatory nuance to the provinces, each of which has its own set of consumer protection laws. These laws may impact how and when a business can add a surcharge, especially around how fees are disclosed to the customer and whether the practice could be considered misleading or unfair.

For example, in Quebec, the pricing transparency laws require all mandatory charges to be included in the advertised price. While this doesn’t explicitly ban credit card surcharging, it makes it very difficult to add a surcharge without violating consumer protection laws. In other provinces like Ontario, Alberta, or British Columbia, there’s no specific ban, but that doesn’t mean you can surcharge without following disclosure rules, especially if customer complaints arise.

In short, you can surcharge nationwide, but how you implement that and how you communicate it can vary greatly depending on where you operate. It’s essential to review the specific requirements in your province and consult up-to-date legal guidance. A knowledgeable payment processor or legal advisor can help you understand these rules and ensure your approach aligns with federal expectations and local enforcement practices.

Card Network Rules for Canadian Merchants

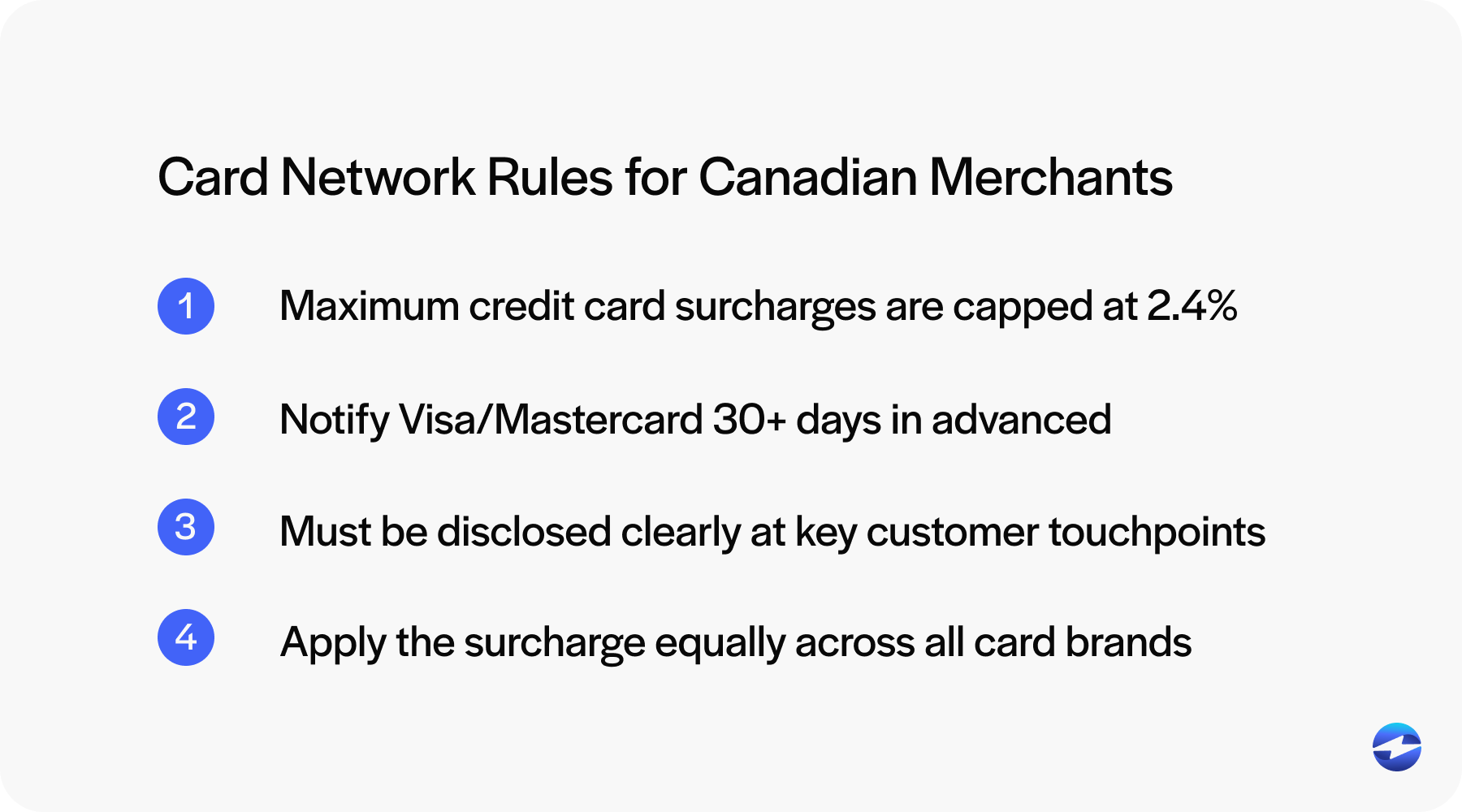

Understanding and complying with card network rules is a critical part of any Canada credit card surcharge program. These aren’t suggestions—they’re contractual obligations that come with penalties if ignored. Visa and Mastercard have established a framework to govern surcharging in Canada to ensure it’s done fairly and transparently.

Here are the key rules:

- Maximum credit card surcharges are capped at 2.4% of the transaction amount. This is strict—you can’t exceed it even if your credit card processing fees are higher than that.

- You must notify Visa and/or Mastercard at least 30 days before you start adding surcharges.

- Surcharges must be disclosed clearly at key customer touchpoints—like your storefront entrance, your website’s payment page, and on the final receipt.

- You must apply the surcharge equally across all credit card brands you accept.

Following these card network rules is just as important as following the law. Violating them can result in penalties, chargebacks, or even the suspension of your merchant account. If you’re unsure how to meet these requirements, a qualified payment processor or payment solution provider can guide you through each step and ensure your systems and disclosures are fully compliant.

Disclosure and Communication

Customers don’t like surprises—especially at checkout. So, if you’re going to surcharge credit cards, be transparent. Here’s what disclosure should look like:

- Signage at your physical location, near the entrance and payment terminal, stating that a surcharge applies to credit card payments.

- Online notifications for digital stores or service-based businesses before the customer reaches the payment screen.

- Itemized receipts that show the surcharge as a separate line item.

In Canada, especially in provinces with strong consumer rights legislation, this is not optional. Being upfront protects both your customers and your business.

Implementation

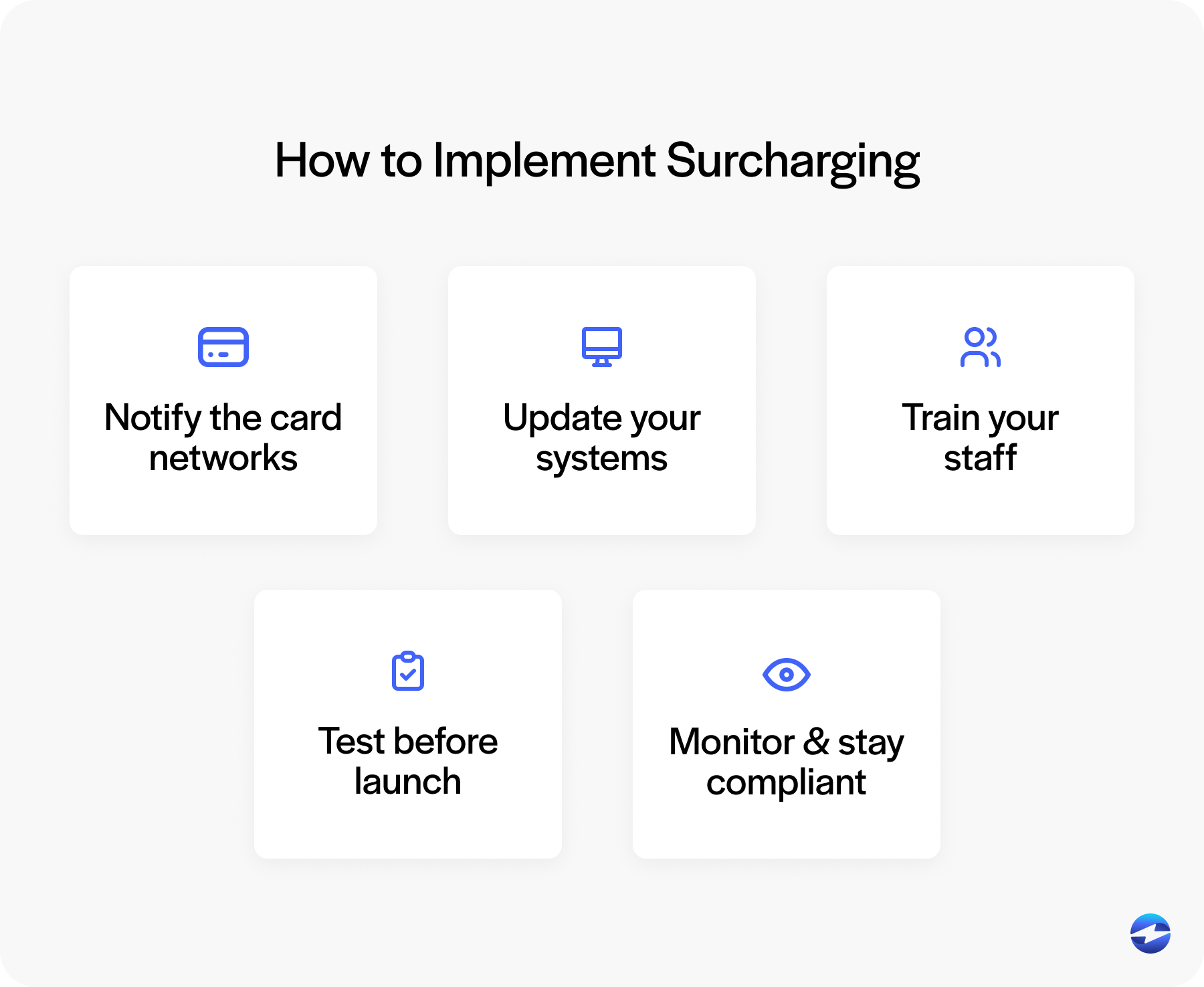

Thinking of surcharging? It can be a good way to recover rising credit card fees, but it needs to be done right. There are technical steps, compliance issues, and customer experience factors to consider. A rushed implementation can lead to errors, disputes or, worse—violations of card network rules or provincial regulations.

Here’s how to do it:

- Notify the card networks. Give at least 30 days’ notice to Visa and Mastercard before you start credit card surcharging.

- Update your systems. Ensure your platform supports line-item surcharges, distinguishes credit from debit, and complies with all rules. If it doesn’t, consult your payment processor.

- Train your staff. Employees should understand how credit card surcharging works and how to effectively explain it.

- Test before launch. Ensure your payment solution accurately calculates and displays the surcharge.

- Monitor and stay compliant. Keep up with updates from card brands and provincial law.

The right payment processor simplifies all of this, helping you reduce risk and improve your bottom line.

How EBizCharge takes the stress out of surcharging

Canada credit card surcharge rules have changed, and merchants can recover credit card fees—but only if done right. From provincial regulations to card network rules, there’s a lot to manage.

EBizCharge makes this easy with a platform designed for compliant surcharging. It includes tools to calculate fees within the 2.4% cap, apply surcharges only to eligible credit card payments, and generate clear and accurate receipts. It also guides merchants through card network registration and integrates with various accounting systems to ensure everything runs smoothly.

If you’re asking, “Is it legal to add a surcharge for credit card payments”, EBizCharge helps you say yes—with confidence and clarity. It’s a practical way to manage processing fees while staying compliant and transparent.