Blog > Writing the Perfect Credit Card Surcharge Notice

Writing the Perfect Credit Card Surcharge Notice

Adding a surcharge to credit card transactions can be a great way for businesses to offset processing costs but doing it right matters. That’s where a clear, legally sound surcharge notice comes in. This article will walk you through everything you need to know about creating one that’s not only compliant but also clear and fair to your customers.

We’ll look at who needs to post a notice, what it should say, what to avoid, and how to talk to customers about it. You’ll even get a free template to download and customize. Whether you’re new to surcharging or need to tighten up your process, you’re in the right place.

Do You Need a Credit Card Surcharge Notice?

Not every business adds a surcharge to credit card payments, but if you do, you may need to notify your customers, not just as best practice but by law.

A surcharge notice is needed if the business:

- Adds a percentage or flat fee to credit card transactions

- Operates in a state where surcharging is allowed

- Is subject to card network rules (like Visa, Mastercard, and American Express)

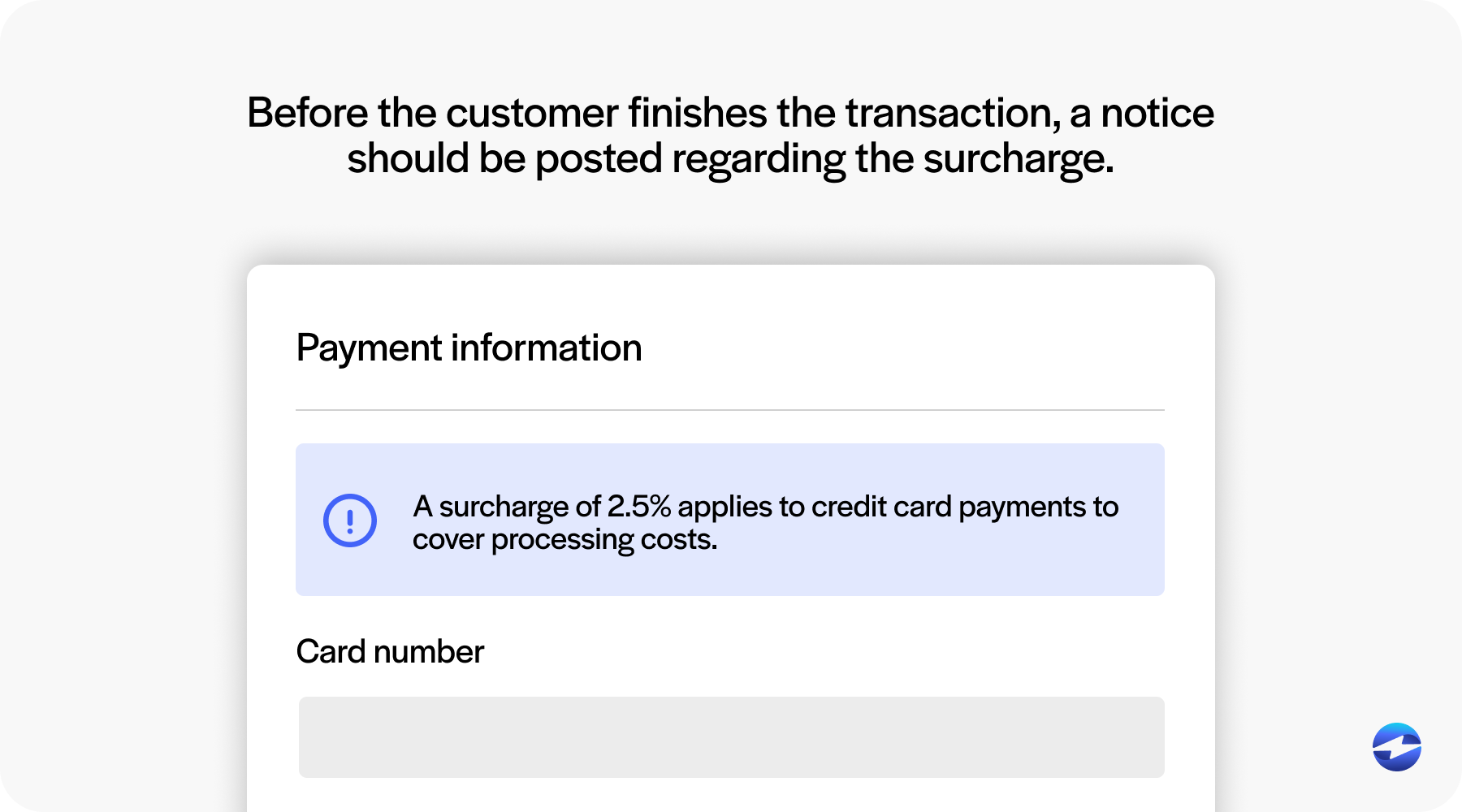

The notice should be posted before the customer finishes the transaction, which includes both in-person and online checkouts. Posting it prominently helps avoid confusion and gives people a chance to decide how they want to pay.

Transparency is key. Even if not required in your state, telling customers about surcharges builds trust. Nobody likes hidden fees. If you’re upfront, customers are much more likely to accept the charge.

What Happens If You Don’t Notify Customers of a Surcharge

If you’re adding a surcharge to credit card transactions, it’s not enough to add it and move on. Letting customers know about the fee clearly and in advance is a big deal. It’s about being transparent, yes, but it’s also about being compliant with the law and avoiding headaches down the road.

Here’s what’s at stake:

- Legal issues. Some states have surcharge laws. Ignore them, and you could face fines or penalties.

- Card network violations. Visa and Mastercard have surcharge rules. Break those, and you might face processing restrictions or extra fees.

- Chargebacks and disputes. Customers who feel blindsided will contest the charge with their card issuer.

- Loss of trust. Customers who feel deceived won’t come back, and the word spreads.

- Refund obligations. If you collected a surcharge improperly, you might have to pay it back.

- Lawsuits. In extreme cases, legal action from consumers or regulators isn’t out of the question.

Visa and other card networks have been tightening their enforcement around improper surcharge practices, with potential penalties for merchants and even ISOs that don’t follow the rules. Visa’s fines can be steep, with some reports noting that non-compliant merchants may face penalties ranging from $50,000 to $1 million, depending on the severity of the violation.

The good news? A simple notice can prevent all that from happening.

What to Include in a Credit Card Surcharge Notice

When it comes to credit card surcharges, how you communicate the fee matters just as much as the fee itself. A clear and honest notice can prevent confusion, avoid legal issues, and build customer trust while helping you stay compliant with card network rules and state laws. The notice doesn’t have to be complicated or formal, but it should be thorough and well-written.

Writing a surcharge notice isn’t hard, but you do need to cover a few key points:

- Be specific. Clearly state the fee, either as a percentage (like 3%) or a flat amount (like $2.00).

- Use plain English. You can be compliant without sounding like a lawyer. Use language people understand.

- Make it visible. Post it at the register, on the wall, on your receipts, or online just anywhere a customer will see it before paying.

Seeing a few examples can give you a sense of tone, clarity, and compliance to help you write your own with confidence.

Examples of Credit Card Surcharge Fee Wording

These examples aren’t one-size-fits-all, but they’ll give you a starting point for your own notice.

- “3% surcharge on all credit card payments.”

- “2.5% fee on credit card purchases.”

- “Credit card? $1.50 surcharge.”

The most important thing is that your wording is specific to your business, reflects your actual surcharge practice, and complies with any state and card network rules. Take a few minutes to review and tweak your language and you’ll save yourself a lot of trouble later.

Need help? We’ve got a simple, downloadable credit card surcharge notice template (PDF) for you. Just fill in the blanks and post it where customers will see it.

Common Mistakes to Watch Out For

- Being unclear. Don’t use phrases like “may include a fee.” Be direct.

- Charging debit cards. Many places don’t allow this. Know the difference between debit and credit.

- Forgetting to update. If your fee changes, your signage and wording should too.

How to Tell Customers About Surcharges

Posting a sign or adding a line to your receipt is just one part of the equation. Even when you’ve done everything right on paper, customers will still ask about the surcharge and how you respond can make all the difference. Communication, especially in person, shapes how customers feel about the fee and your business.

How you say it matters.

- Keep it simple: “We’re passing along the cost of credit card processing, and you can always pay with cash or debit to avoid the fee.”

- Be confident, not defensive. You’re not doing anything wrong; you’re just being transparent.

- Train your staff. Make sure they know what to say and how to say it. Role-playing helps.

You don’t need a long explanation or legalese, just a simple, honest answer. Most people will understand as long as you explain it clearly and respectfully. Don’t overthink it. A little preparation goes a long way.

Compliance and Trust Through Better Fee Disclosure

Surcharge notices might seem like just another box to check for compliance, but they’re more than that. They’re a simple way to be upfront with your customers and being upfront builds trust.

If you made it this far, chances are you care about doing things right. Maybe you’re a business owner trying to stay compliant, or maybe you’re part of a team that has to keep everything above board. Either way, taking the time to understand and implement a clear, honest surcharge notice is smart.

If you’re not sure where to start or just want an expert to walk you through it, EBizCharge can help. We’ve worked with thousands of businesses to make sure their surcharge practices are compliant, clear, and easy to manage.

Being transparent isn’t just good practice; it’s good business.