Blog > Surcharge for Acumatica: A Step-by-Step Guide for B2B Merchants

Surcharge for Acumatica: A Step-by-Step Guide for B2B Merchants

Credit card processing fees are one of those line items that quietly eat away at margins. For many B2B businesses running on Acumatica, they’re not just annoying—they’re significant. As these payment processing costs continue to rise, companies are looking for practical ways to offset them without overhauling their pricing models. One increasingly popular tactic is surcharging.

However, while surcharges can be effective, they need to be handled carefully. The rules are strict, the customer experience matters, and it must integrate seamlessly with your enterprise resource planning (ERP). That’s where Acumatica can help—if you set it up the right way.

This guide will walk you through exactly how to do that without the fluff. Whether you’re a CFO, controller, or IT lead supporting finance, you’ll find clear, usable steps to implement surcharging inside Acumatica.

What is a surcharge and when is it allowed?

A surcharge is a fee added to a transaction when a customer chooses to pay with a credit card. It’s a way for businesses to recover some or all of the credit card processing fees they’d otherwise eat. This approach is becoming more common, especially as merchants look for ways to reduce the growing burden of payment processing costs without impacting their overall pricing structure.

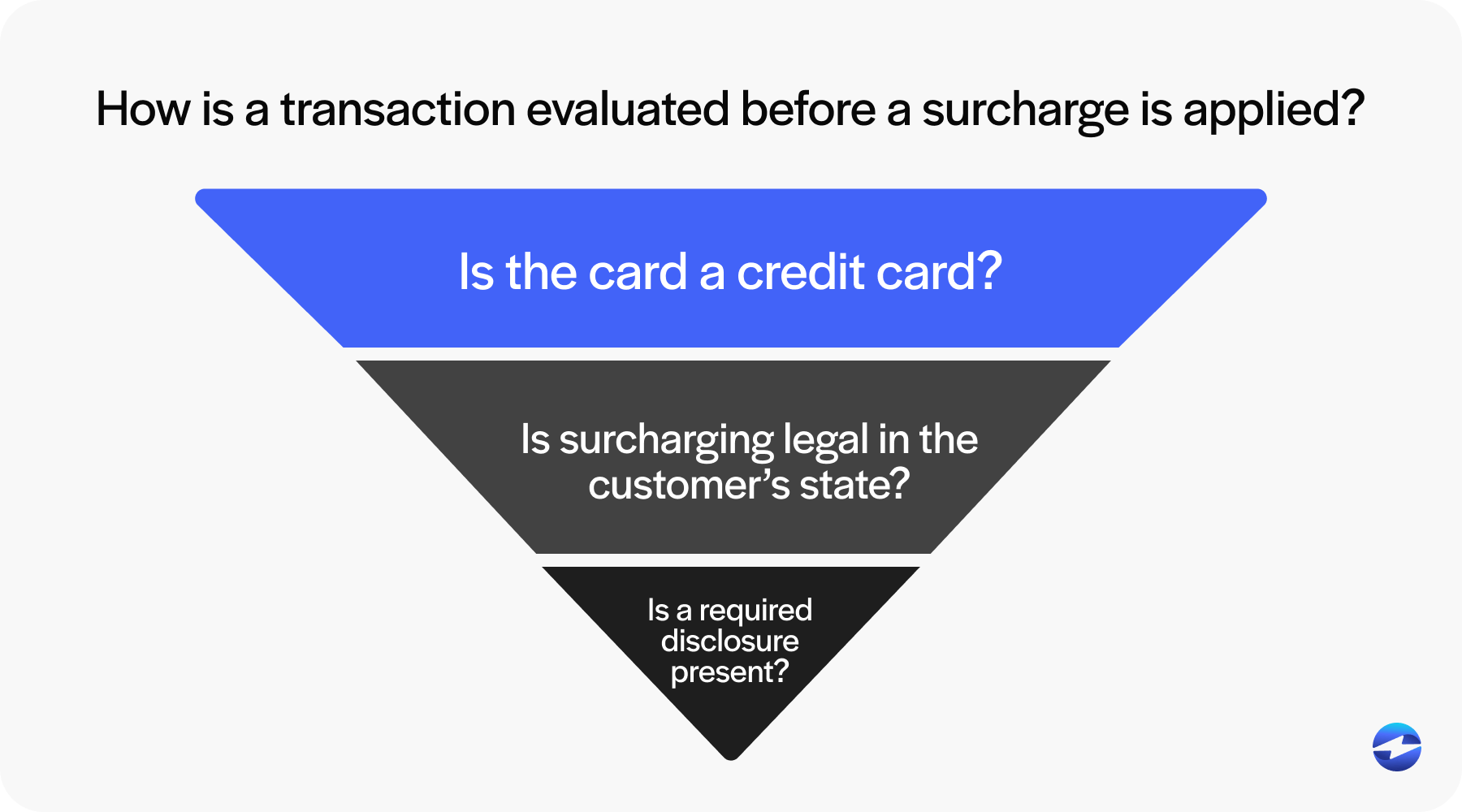

How is a transaction evaluated before a surcharge is applied?

How is a transaction evaluated before a surcharge is applied?

But it’s not a free-for-all. There are strict guidelines on where and how surcharging is allowed. Some U.S. states prohibit surcharges altogether, and the card brands (like Visa and Mastercard) have rules around how they must be disclosed and applied. For example, you typically can’t apply a surcharge to debit card transactions—only credit. Additionally, you must clearly notify customers of the surcharge both before the transaction and on their receipt.

It’s also worth distinguishing between surcharges, convenience fees, and cash discounting. While they all aim to recoup payment processing costs, they work differently, and the compliance requirements aren’t interchangeable. Choosing the wrong approach—or applying it incorrectly—can lead to unhappy customers or even non-compliance penalties.

Why surcharging matters in Acumatica

If you’re using Acumatica to manage your sales, accounting, and AR, it makes sense to manage surcharges there, too. Why bolt on a workaround when you can build the logic directly into your ERP?

Surcharging in Acumatica offers several advantages:

- You can automate the math.

- You can control when and where fees apply.

- You can link everything to your general ledger for clean reporting.

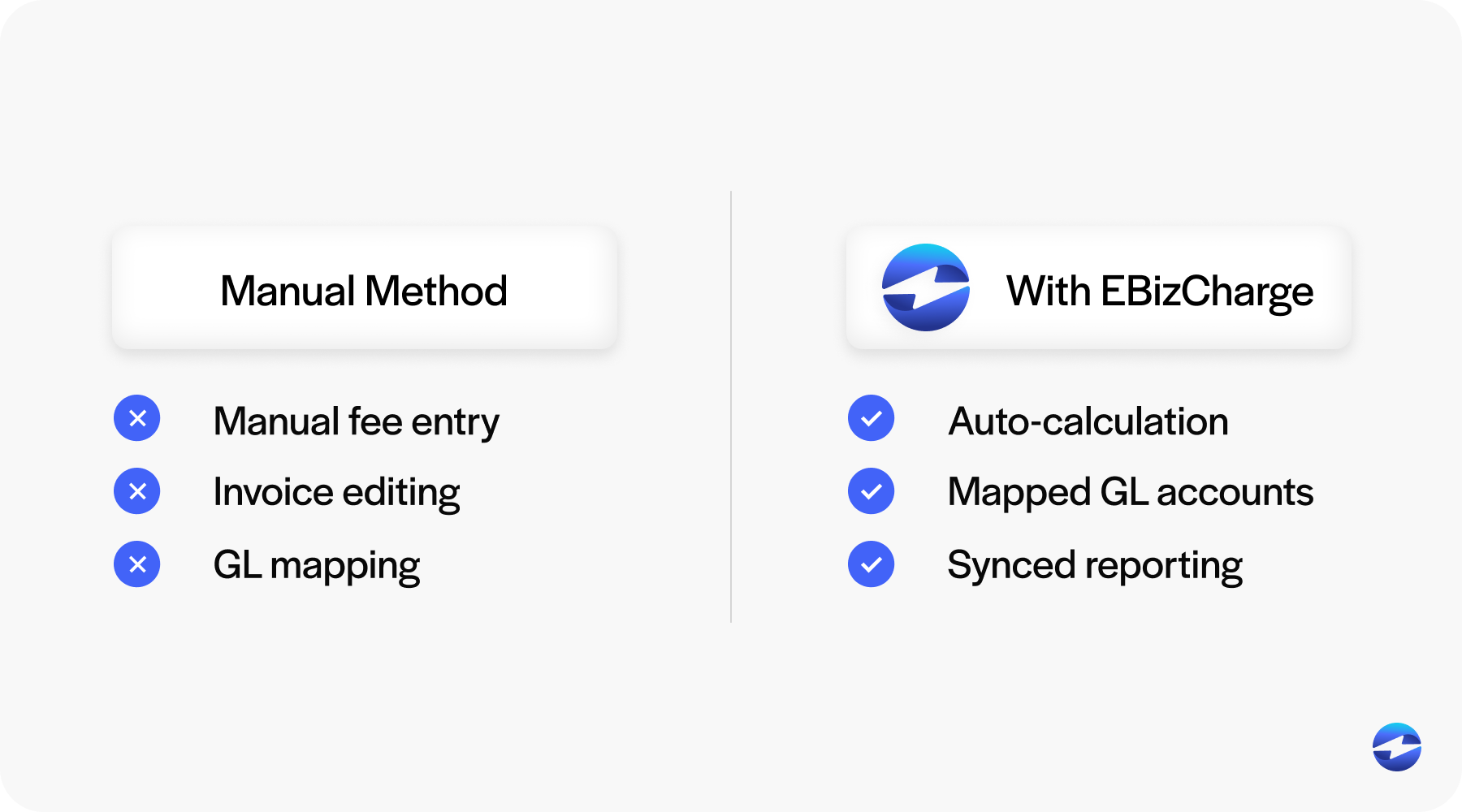

Attempting to handle payment processing fees manually is a risky endeavor. People forget, customers complain, and reconciling your books becomes a nightmare. A native or integrated setup in Acumatica simplifies all of this.

Plus, it’s not just about offsetting credit card processing fees. Done right, surcharging frees up margin without needing to raise prices across the board. That can be a real win for your business and your customers.

Key features to look for in a surcharge integration

Before diving into setup, it’s worth understanding what a good payment processing solution should support. Acumatica users, in particular, should be looking for capabilities that tie seamlessly into the ERP’s workflows and provide controls for finance teams to manage surcharges without added complexity.

Whether you’re using Acumatica’s built-in tools or a third-party payment processor, the right features make a huge difference. This isn’t just about automating a fee—it’s about doing it in a way that meets compliance standards, reduces manual intervention, and keeps the customer experience intact.

Look for:

- Automatic surcharge calculation based on card type.

- Clear, visible disclosure of surcharges on invoices and payment screens.

- Compliance with Visa/Mastercard and state-level rules.

- Flexibility to exclude certain states or card types.

- Real-time validation of card type to prevent accidental surcharging of debit or exempt cards.

- Support for multi-entity environments and varying regional rules.

- Transparent audit trails and reporting for all surcharged transactions.

- Seamless integration with Acumatica’s AR and general ledger modules to track surcharge revenue accurately.

These features ensure that your surcharging approach is clean, legal, and easy for both your team and your customers. They also prevent the need for workarounds or constant data maintenance, which can lead to errors and friction as your payment volume scales.

Setting up surcharging in Acumatica

Now, let’s get into the actual setup. Here’s a brief roadmap to enabling surcharges in Acumatica:

- Get your payment setup in order: Make sure you’re working with a payment processor that supports surcharging. Not all do, and not all support it natively in Acumatica. Confirm you’re using an Acumatica-integrated payment processing solution that can pass surcharge data properly.

- Create a surcharge item in Acumatica: Set up a non-stock item called something like “Credit Card Surcharge.” This lets you track the fee as a separate line item.

- Assign surcharge logic by payment type: Configure your payment methods so the surcharge item is automatically added when the customer selects a credit card. This typically involves custom rules or leveraging an integrated payment plugin.

- Map general ledger accounts: Route surcharge revenue and related payment processing costs to dedicated general ledger accounts. That way, you can see how much you’re recovering versus spending.

- Test before you go live: Run test invoices, check that the surcharge appears correctly, and verify your journal entries. Make sure nothing breaks downstream in AR or reporting.

Best practices for surcharge communication

Surcharging may be allowed, but that doesn’t mean it’s always welcomed. How you present it matters. Even when implemented correctly, customers may still have questions or concerns, especially if they’re unfamiliar with surcharges in a B2B context.

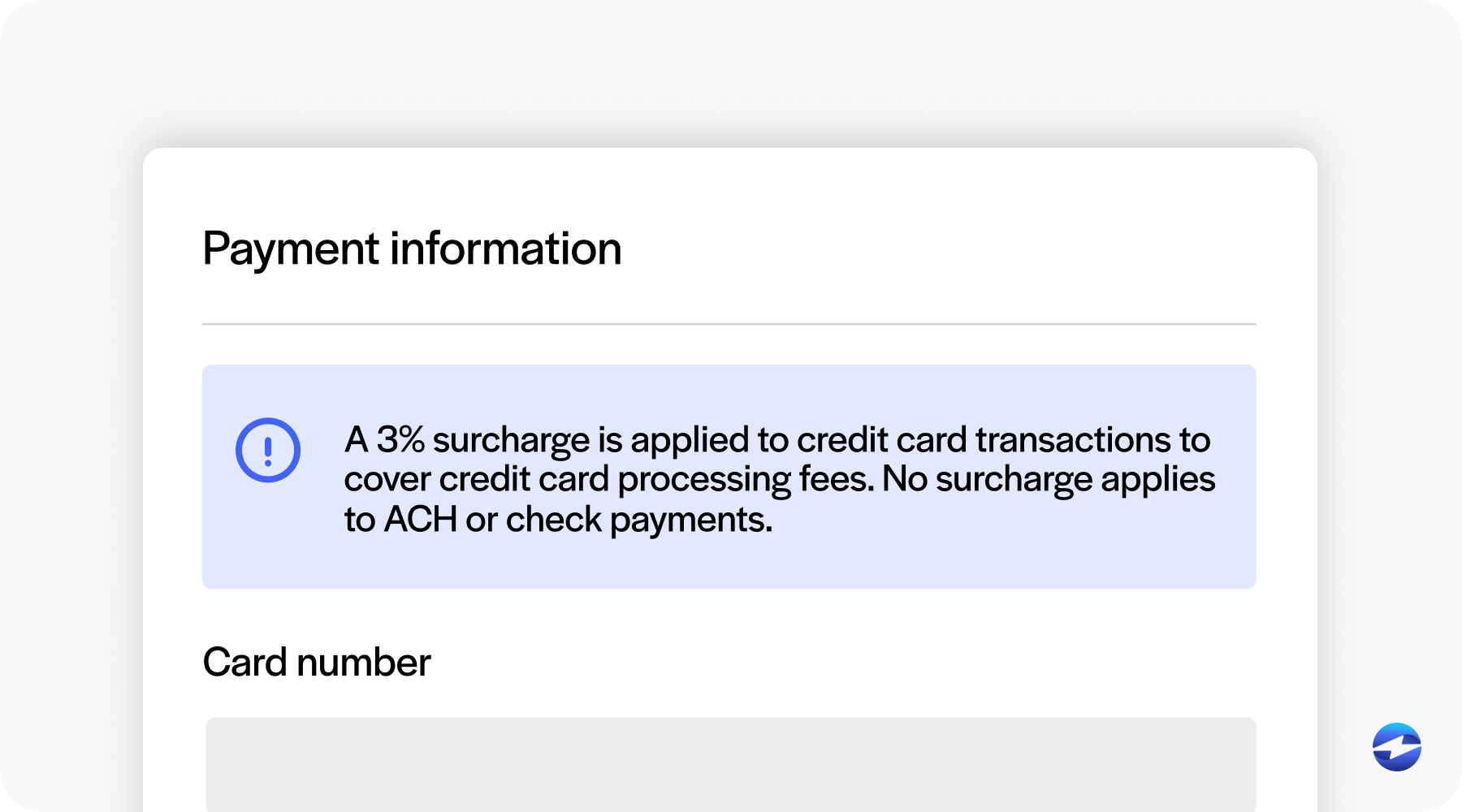

Be upfront. Include a clear and concise message on invoices or checkout screens that explains the fee clearly. Something like:

“A 3% surcharge is applied to credit card transactions to cover credit card processing fees. No surcharge applies to ACH or check payments.”

Ensure the message appears early in the payment process—ideally before the customer submits their payment—to avoid any surprises that could lead to disputes.

Train your AR team and customer service reps so they can explain it confidently. They should understand the purpose of the surcharge, the options available to customers, and how it aligns with industry norms.

The goal isn’t to hide the fee—it’s to be transparent and give customers options. Offering alternative, no-fee methods like ACH or checks can soften the impact of surcharging and give customers a sense of control.

Remember, surcharges aren’t about punishing customers. They’re about giving the choice to avoid extra fees by choosing lower-cost payment methods.

Using payment integrations to simplify surcharging

Managing surcharging gets a lot easier when your payment processor is built into Acumatica. With embedded payment tools, surcharge logic, tax handling, and reporting all flow in the same system.

Integrated solutions can detect when a customer chooses a credit card, calculate the fee, apply it to the invoice, and track it all in your financials. No re-keying, no duplicate data, and far fewer errors.

Some payment processing solutions even let you adjust surcharge rates by card type or block fees in states where they’re not allowed. That kind of flexibility is hard to manage manually.

The result? Cleaner compliance, faster reconciliation, and fewer calls from confused customers.

Compliance and reporting considerations

Surcharging isn’t a “set it and forget it” strategy. You’ll need to audit your usage periodically, especially if rules change or you add new states or card types to your customer base.

Use Acumatica’s reporting tools (or your payment processor’s dashboard) to track:

- How much surcharge revenue you’re collecting.

- Which transactions are surcharged.

- Which fees you’re still absorbing as part of your broader payment processing costs.

Keep an eye on state regulations, too. A few states have recently changed their rules, and others may follow. Good compliance is a moving target.

How EBizCharge makes surcharging in Acumatica effortless

Surcharging in Acumatica isn’t just about trimming costs—it’s about building a more sustainable model for accepting payments. With the right setup, you can recover credit card processing fees in a way that’s clean, compliant, and easy for customers to understand.

That’s exactly what EBizCharge delivers through its Acumatica integration. It offers seamless surcharging capabilities built directly into the Acumatica platform. From automatically calculating surcharge amounts based on card type to applying those fees with full compliance and reporting, EBizCharge handles the heavy lifting behind the scenes. It also ensures that customers see clear surcharge disclosures and gives your finance team full visibility through synced transaction data and general ledger tracking.

With EBizCharge, businesses don’t need to rely on workarounds or custom logic. Its embedded payment processing solution is purpose-built to reduce manual work, improve accuracy, and simplify surcharge management from end to end.

If you’re ready to stop absorbing unnecessary payment processing costs, EBizCharge’s Acumatica integration is a proven path forward. Just remember: clear rules, clear communication, and the right tools make all the difference.

- What is a surcharge and when is it allowed?

- Why surcharging matters in Acumatica

- Key features to look for in a surcharge integration

- Setting up surcharging in Acumatica

- Best practices for surcharge communication

- Using payment integrations to simplify surcharging

- Compliance and reporting considerations

- How EBizCharge makes surcharging in Acumatica effortless