Blog > Should You Use QuickBooks Credit Card Surcharge? Pros and Cons Explained

Should You Use QuickBooks Credit Card Surcharge? Pros and Cons Explained

Running a business means juggling a lot of expenses, and credit card processing fees are one of those costs that can quietly add up month after month. That’s where credit card surcharging comes in—passing the fee along to customers who choose to pay with credit cards. It’s not a perfect solution, but for some, it can ease the pressure on tight margins.

If you’re a QuickBooks user, you might be wondering about your options for applying a QuickBooks credit card surcharge to help offset those fees.

This article breaks down what surcharging looks like in practice, how it works in QuickBooks, and the key pros and cons you should consider.

What Is Credit Card Surcharging?

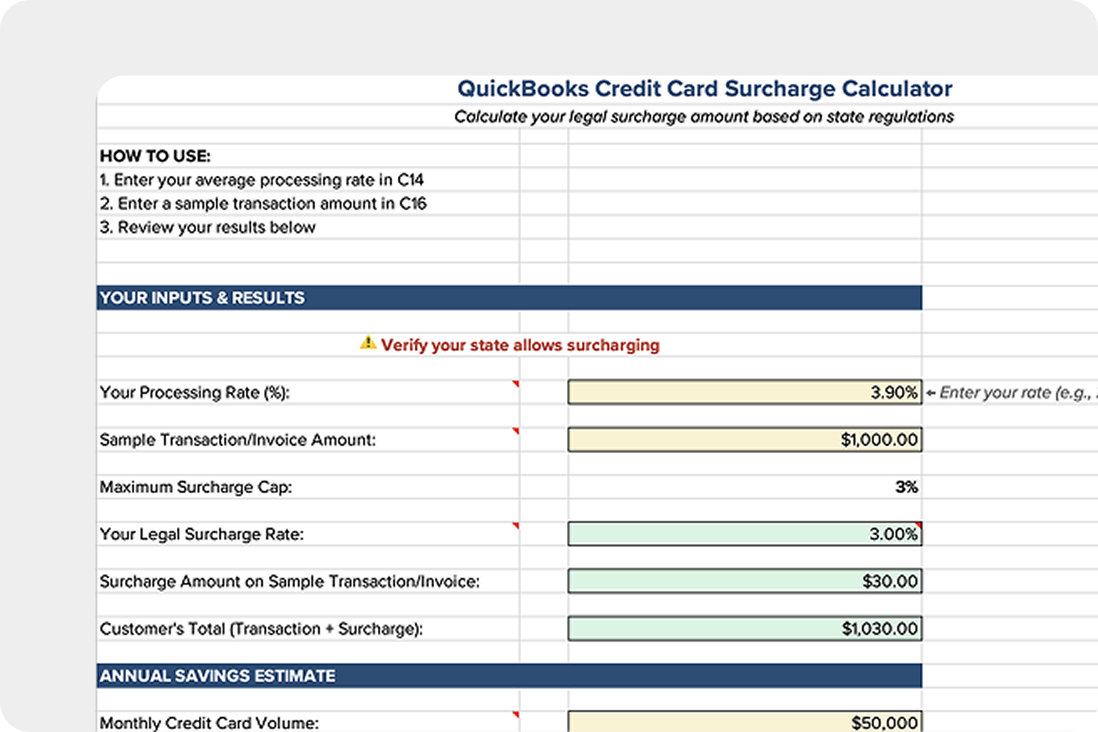

Surcharging is the practice of adding a small percentage fee to a customer’s bill when they pay with a credit card. It’s a way for businesses to offset the processing fees that come with accepting credit card payments. Instead of absorbing those costs, the business passes them on to the customer who chooses to use a credit card. There are rules to follow. Credit card surcharging is legal in most U.S. states, but not all. A few states restrict or prohibit the practice entirely. The major card networks—like Visa and Mastercard—have their own guidelines, such as requiring upfront customer notifications and limiting the surcharge amount (usually capped at 3%).

To stay compliant, businesses typically need to register their intent to surcharge with the card networks and include the disclosure on receipts or invoices. These steps help ensure the process is both transparent and legal.

Businesses often use surcharging to recover costs on high-ticket transactions where the processing fees would otherwise eat into profits. It’s common in professional services, business-to-business (B2B) sales, and industries with narrow margins—places where customers are used to card-based billing and less likely to object to an added fee.

How QuickBooks Handles Credit Card Surcharges

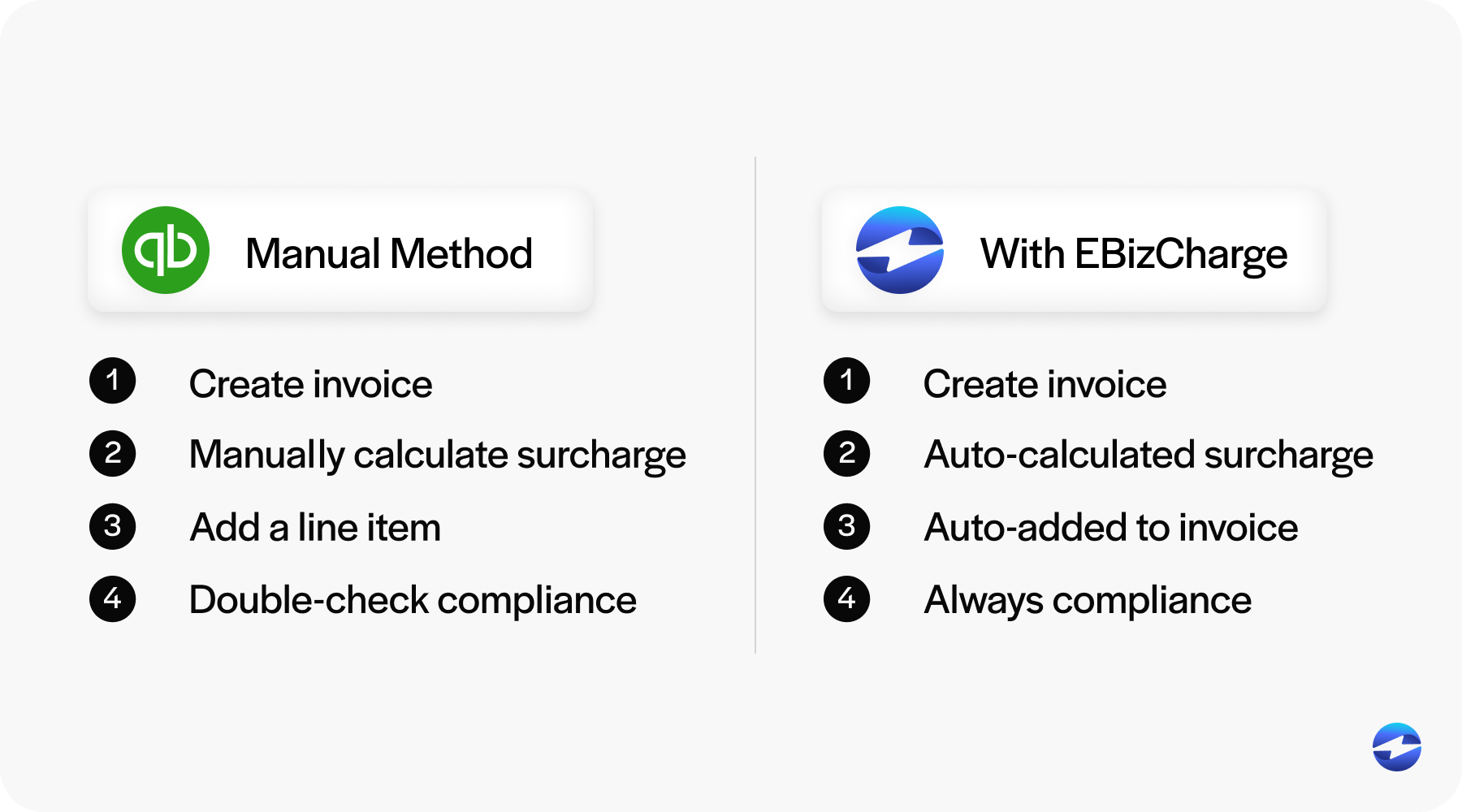

If you’re wondering how to add a credit card surcharge in QuickBooks, the most common method is to manually calculate the fee based on a fixed percentage (usually up to 3%), then enter it as a custom charge on the invoice. It’s a good idea to label this clearly so customers know why there’s an extra charge. Before surcharging, ensure your approach complies with local laws and the rules of the card networks like Visa and Mastercard. This includes customer notifications and fee caps.

If you’re looking for a more streamlined solution, third-party tools, and payment processing solutions are available that integrate with QuickBooks and support compliant surcharging with less manual effort. These integrations can automate fee calculations, improve consistency, and reduce errors in the invoicing process.

Pros of QuickBooks Surcharging

Here are the advantages of surcharging through QuickBooks, whether manually or with third-party tools:

- Centralized workflow: QuickBooks is already the financial hub for many businesses, so keeping surcharging in the same system reduces complexity.

- Convenience: You don’t have to leave the platform or juggle separate tools to apply a credit card surcharge when invoicing customers.

- Transparency: Adding a clearly labeled surcharge to your invoices helps set clear expectations with customers, minimizing confusion and trust.

- Compatibility: QuickBooks integrates with various payment processing solutions, so you can add more functionality to QuickBooks with tools that make surcharging more efficient and compliant.

QuickBooks is a practical option for businesses that want to recover payment processing fees without changing their whole system.

Cons of QuickBooks Surcharging

While QuickBooks can support your surcharging workflow, here are the downsides:

- Manual effort: Unless you’re using an integration, you’ll need to calculate the surcharge yourself and add it to invoices manually. This slows down your workflow and increases the likelihood of errors.

- Compliance responsibility: You’re responsible for understanding and complying with state laws and card brand rules on surcharging. This means doing your homework and staying up to date.

- Customer perception: Some customers may not like paying a credit card surcharge, even if it’s small. If not communicated clearly, it can affect customer relationships or lead to awkward conversations.

- Partial cost recovery: Surcharging helps offset costs but doesn’t eliminate your payment processing costs entirely. You’re still paying fees—just passing some of them along to your customer.

These aren’t deal breakers, but they do require planning and attention to detail.

Is QuickBooks surcharging right for your business?

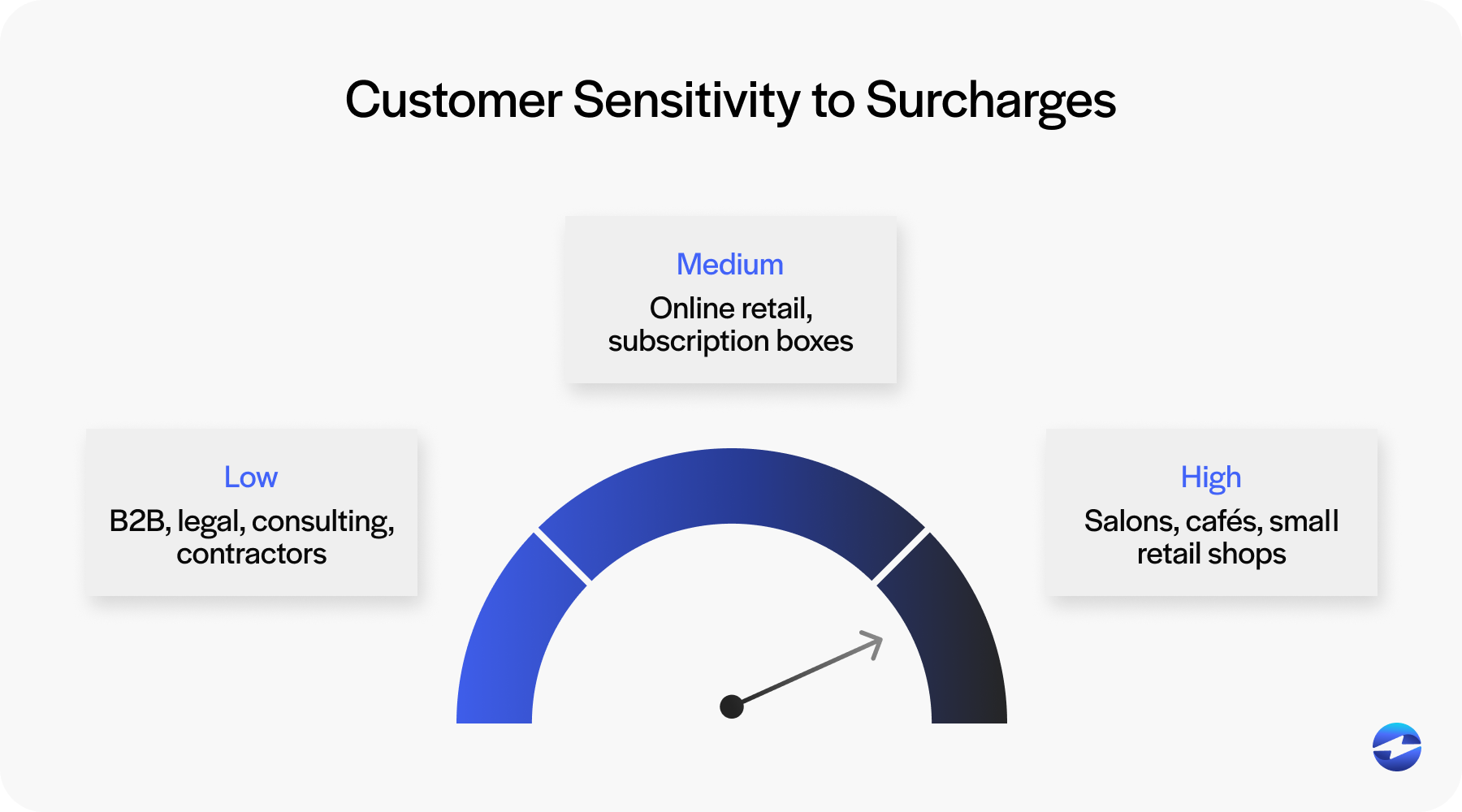

For service-based businesses or B2B companies already using QuickBooks for invoicing, manually applying a credit card surcharge in QuickBooks can be a viable approach, especially when handling high-value invoices where clients are less likely to be surprised by the additional fee.

However, if your business operates in a customer-facing industry such as retail, food service, or personal care, it may be worth reconsidering. In these environments, where credit card usage is frequent and transaction values tend to be lower, surcharges can become more noticeable and may negatively impact the customer experience.

It all comes down to your customers, your pricing model, and how much credit card use affects your margins. Think carefully about whether the financial upside outweighs any potential friction it might cause.

Simplifying QuickBooks surcharging with EBizCharge

Credit card surcharging is a great way to manage rising payment processing costs when done efficiently and in compliance with industry regulations.

While QuickBooks has enough flexibility to support manual surcharging or basic integrations, businesses looking for a more streamlined and scalable solution may benefit from partnering with a dedicated provider like EBizCharge.

EBizCharge makes credit card surcharging simple and compliant. Their solution integrates directly with QuickBooks, so merchants can automate surcharge calculations, maintain proper disclosures, and stay within card brand and legal requirements—all without the hassle of manual invoicing updates. This reduces errors, saves time, and creates a smoother experience for both merchants and their customers.

If you’re wondering how to add a credit card surcharge in QuickBooks painlessly, EBizCharge has you covered. With its built-in controls and full-service support, it lets businesses reclaim processing costs while keeping customer communication clear and professional.

In short, for merchants who want to surcharge with confidence and ease, EBizCharge is a comprehensive payment processing solution for modern businesses.