Blog > Small Business Guide to Credit Card Surcharges

Small Business Guide to Credit Card Surcharges

For small business owners, every dollar counts. Credit card acceptance helps bring in more customers, but it also comes with credit card processing fees that can eat into your profit margin. One way to offset those fees is by adding a credit card surcharge—a small percentage added to a sale when a customer chooses to pay with a credit card.

If you’re new to surcharging, you’re not alone. Many small business owners aren’t sure where to start, whether it’s even legal, or how customers will respond. This guide is here to help you understand the process, weigh the pros and cons, and make the best choice for your business.

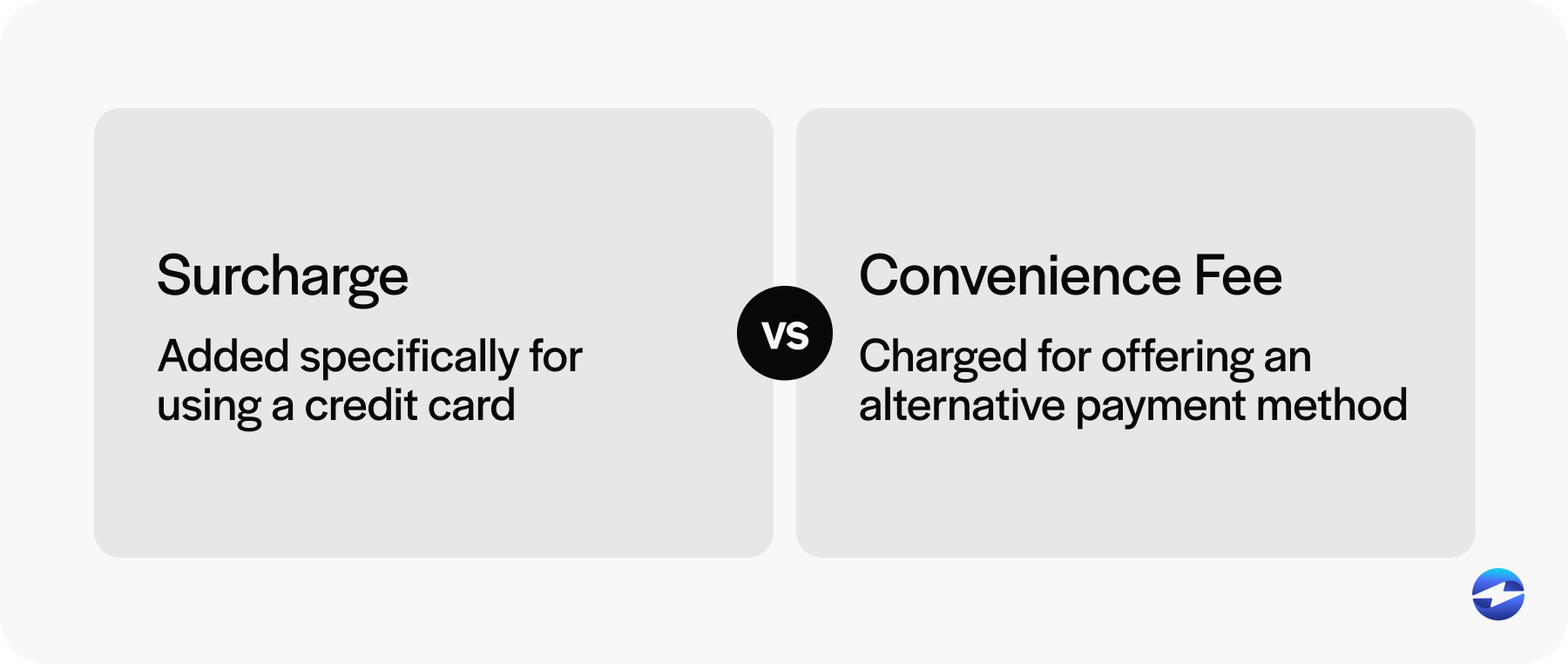

Understanding Surcharges vs. Convenience Fees

One of the first things to get clear on is what a surcharge actually is—and how it’s different from other types of fees.

A credit card surcharge is added specifically when a customer pays with a credit card. It’s not about how they pay (in person or online); it’s about what they use to pay. A convenience fee, on the other hand, is charged for using an alternative payment channel—like paying online instead of by check.

Mixing up the two could get you into trouble. They’re treated differently under both state laws and card network rules. Always be specific in your signage and receipts.

Is Surcharging Legal in Your State?

The legality of surcharging depends heavily on where your business operates. Some states, like Connecticut and Massachusetts, still ban the practice. Others allow it but require specific steps like formal notification, prescribed signage, or capped surcharge amounts. In a few states, laws are in flux or under legal challenge, making the rules a bit harder to pin down.

Before applying a small business credit card surcharge, it’s essential to do your homework. Start by reviewing your state’s current regulations—your attorney general’s website is a good resource. You should also check in with your payment processor, as many keep updated state-by-state compliance maps and can help you navigate the finer points of local laws.

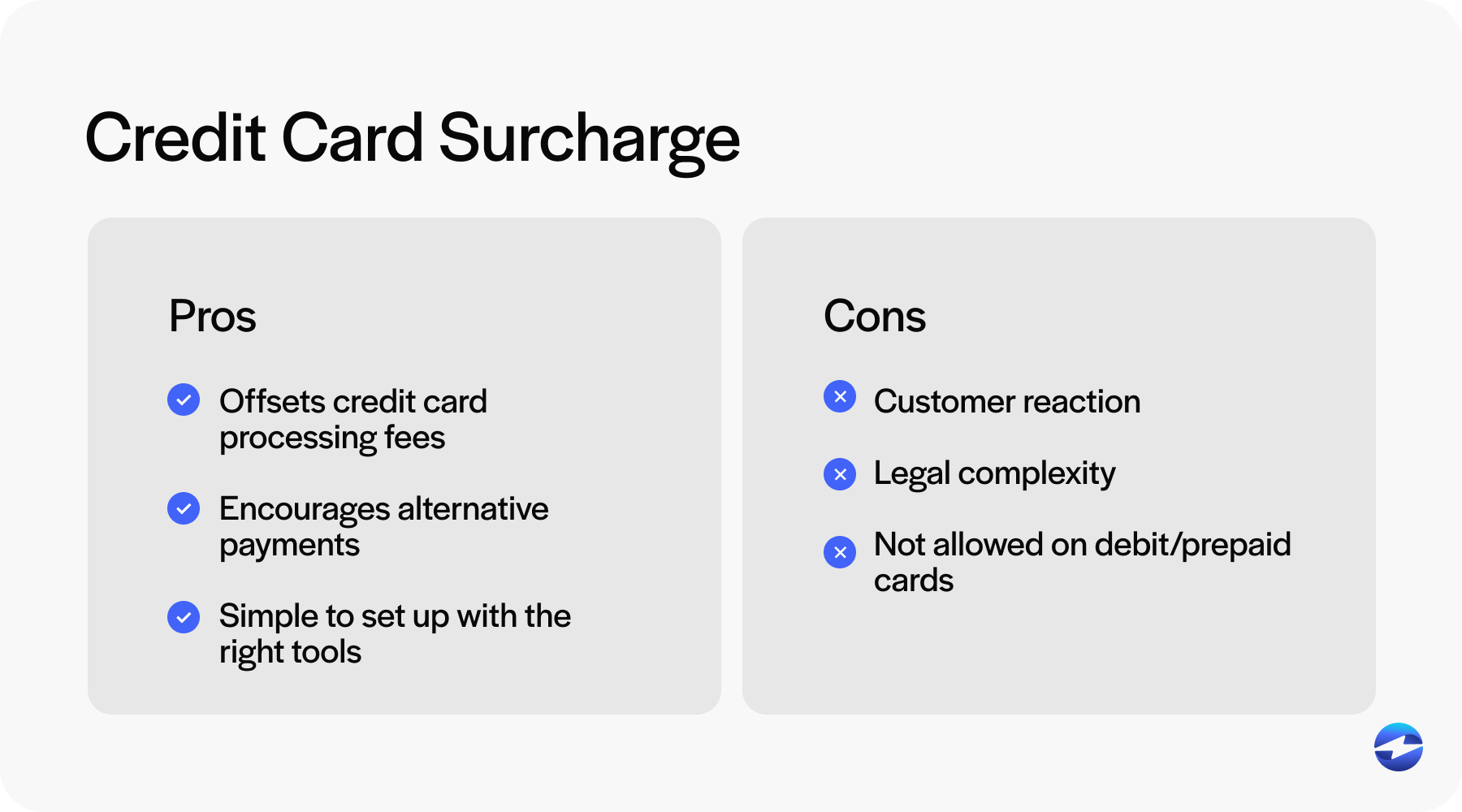

Pros and Cons of Credit Card Surcharging

Like most decisions in a small business, surcharging isn’t one-size-fits-all. Some business owners see real benefits, while others find the trade-offs too steep. Taking a few minutes to weigh the potential pros and cons can help you figure out whether it’s a smart move for your business, and for your particular setup.

Pros

- Offsets credit card processing fees: This is the biggest reason small businesses consider surcharging. It can help preserve your profit margin.

- Encourages alternative payments: Customers might switch to cash, debit, or ACH to avoid the surcharge.

- Simple to set up with the right tools: Most payment processing platforms now have built-in surcharge features.

Cons

- Customer reaction: Some customers dislike extra fees, no matter how well you explain them.

- Legal complexity: You have to follow state laws and card network rules to stay compliant.

- Not allowed on debit or prepaid cards: Even if they’re run as credit, surcharging them violates rules.

Also, many business owners ask: “Is a credit card surcharge taxable?” The answer depends on your state. Some states require sales tax on the surcharge, while others don’t. Check with a tax advisor or your local Department of Revenue to be sure.

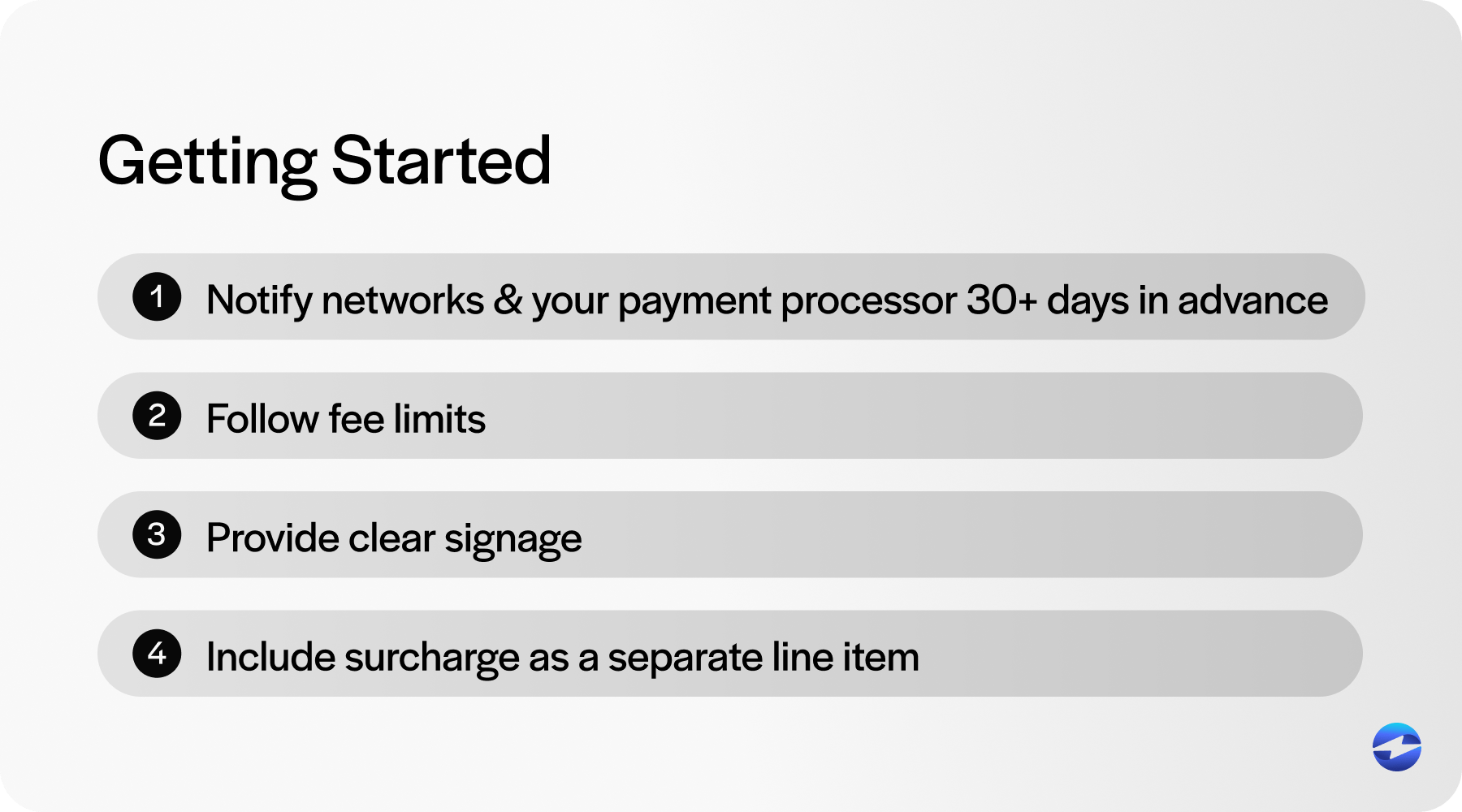

Getting Started: What Small Businesses Need to Know

Each card brand—Visa, Mastercard, American Express, and Discover—has slightly different rules for surcharging. In general, you must:

- Notify the network and your payment processor at least 30 days in advance

- Follow fee limits (typically capped at 3% or your actual cost of credit card processing)

- Provide clear signage at your business and during online checkout

- Include the surcharge as a separate line item on the receipt

Also, ensure your payment processing system can distinguish between credit and debit cards. This prevents accidental violations.

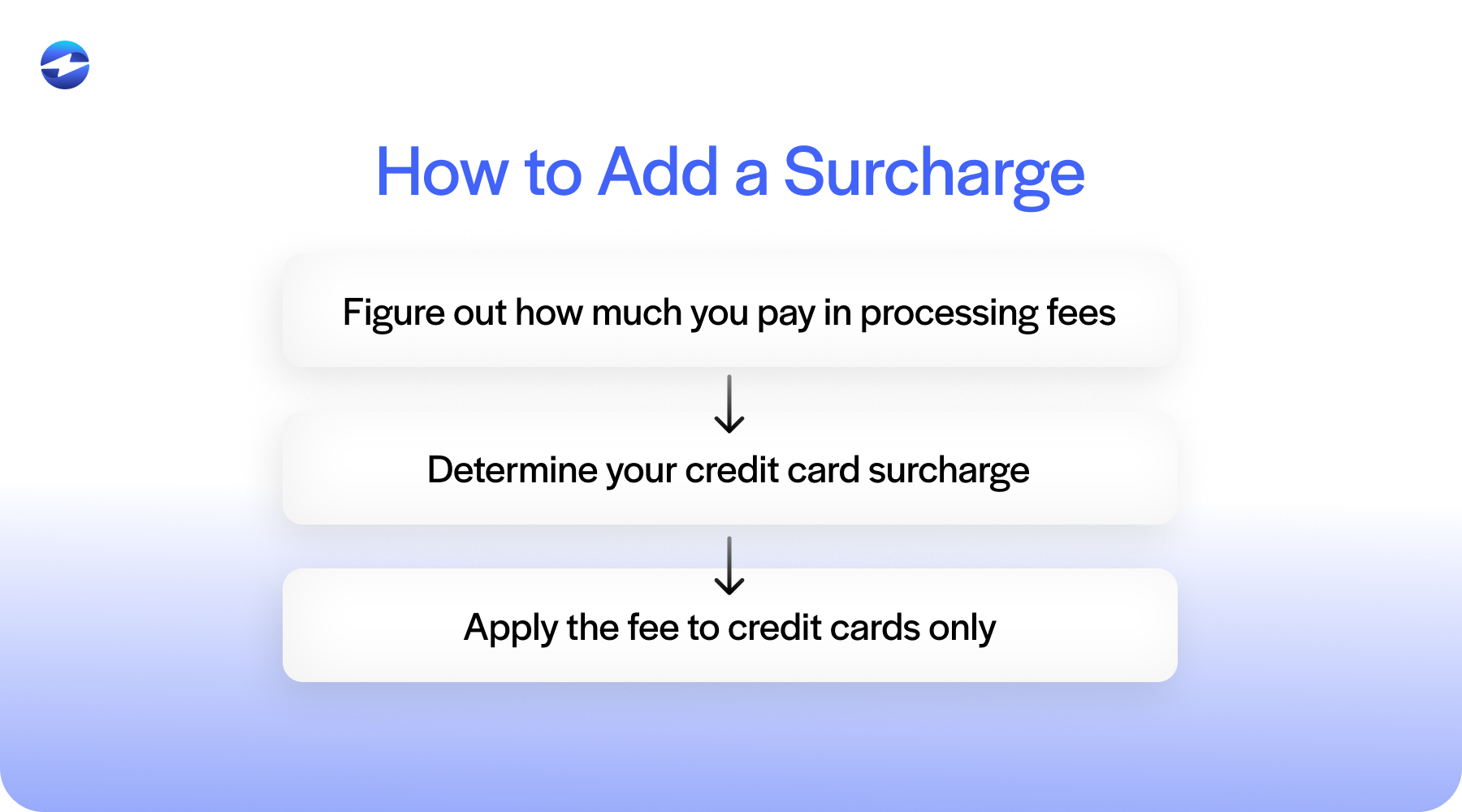

How to Add a Surcharge to Credit Card Transactions

Once you understand the rules and decide that surcharging makes sense for your business, the next step is setting it up correctly. This part isn’t complicated, but it does require a bit of coordination with your systems and service providers to ensure everything runs smoothly and legally.

Step one: figure out how much you’re paying in credit card processing fees. Your payment processor should be able to provide you with your effective rate.

Step two: determine your credit card surcharge—usually no more than 3%. The surcharge can’t exceed what you pay to process the transaction.

Step three: configure your system to apply the fee only to credit cards (never to debit or prepaid cards). Then add required signage at your business entrance, register, and/or online checkout.

If you’re stuck, ask your payment processor for help setting up your POS or online platform. They often provide templates and support.

Best Practices for Communicating with Customers

Being upfront with your customers makes a big difference. Post clear, easy-to-read signs that explain what the surcharge is and why it’s there. For example: “A 3% surcharge is applied to credit card purchases to help offset credit card processing costs.”

Train your employees to answer questions calmly and clearly. Most customers will understand if it’s explained honestly. Have a simple FAQ ready at the counter or on your website.

And if you’re weighing credit card surcharge vs. cash discount, remember: the former adds a fee for using credit, while the latter offers a lower price for using cash. Each has its own rules and presentation, so be sure to choose the one that aligns with your goals and compliance needs.

Tools and Services That Can Help

Many modern payment processing platforms offer built-in surcharging features. These include tools to:

- Automatically calculate and apply the correct credit card surcharge

- Block surcharges on debit and prepaid cards

- Provide receipt and signage templates

- Help you stay compliant with state and card network rules

Some providers even offer calculators that help you determine how much to surcharge or answer questions like “Is a credit card surcharge taxable?”

If you’re ever unsure, it’s worth consulting a compliance advisor or accountant familiar with your industry.

EBizCharge: Making surcharging work for your business

A small business credit card surcharge can be a practical way to handle rising credit card processing fees, but only if it’s implemented thoughtfully. You still need to navigate card brand rules, legal requirements, and customer expectations with care.

This is where EBizCharge can help simplify the process. With tools designed to automate surcharge calculation, block fees on ineligible cards, and generate compliant signage and receipts, EBizCharge takes the guesswork out of setup and compliance. It integrates with your existing systems and provides ongoing support so you can focus more on running your business and less on interpreting surcharge fine print.

Surcharging, when done right, can help your small business stay competitive without sacrificing transparency. And with a platform like EBizCharge handling the technical side, it’s easier to do things by the book while keeping your checkout process smooth and professional.

Yes, but you’ll need to structure and present it differently. Again, check the rules and understand the distinction between credit card surcharge vs. cash discount.

FAQs

FAQs

- Understanding Surcharges vs. Convenience Fees

- Is Surcharging Legal in Your State?

- Pros and Cons of Credit Card Surcharging

- Getting Started: What Small Businesses Need to Know

- How to Add a Surcharge to Credit Card Transactions

- Best Practices for Communicating with Customers

- Tools and Services That Can Help

- EBizCharge: Making surcharging work for your business

- FAQs