Blog > Maximum Credit Card Surcharge Limits Explained

Maximum Credit Card Surcharge Limits Explained

If you’re a business owner who accepts credit card payments, you’ve probably wondered whether you can pass the processing fee on to your customers. After all, those fees add up fast. One option on the table is adding a credit card surcharge—a small extra fee to help cover your costs.

But here’s the catch: surcharge rules are a patchwork of federal guidelines, state laws, and card network rules. Some states don’t allow them at all. Others place strict limits. And the card networks like Visa and Mastercard have their own rulebooks. Not knowing the rules can result in fines, lawsuits, or worse.

This guide lays out the basics and digs into the details so you can understand exactly what’s allowed, what’s not, and how to do it right if you choose to add a surcharge. We’ll also answer common questions like “how much is a credit card surcharge?” and “is it legal to add a credit card surcharge?” while showing how surcharging fits into a broader payment processing strategy.

What is a Credit Card Surcharge?

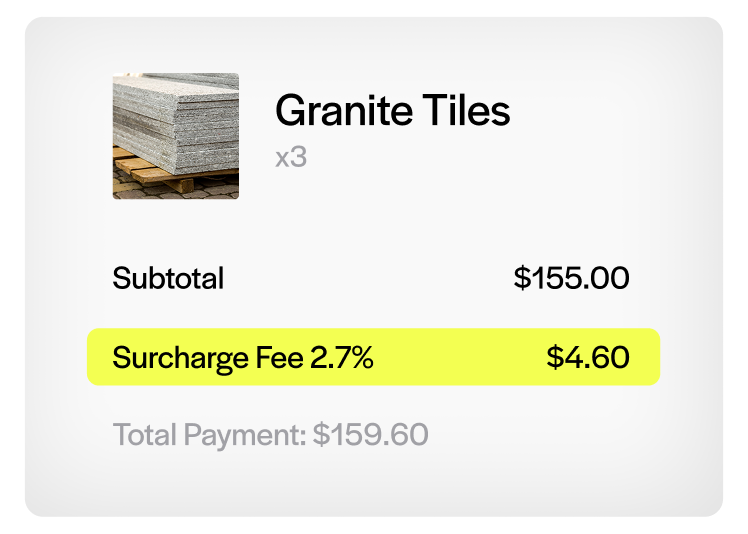

A credit card surcharge is an extra fee that a business adds to a customer’s bill when they pay with a credit card. The idea is to help offset the cost of credit card processing, which typically ranges from 1% to 4% of the transaction amount.

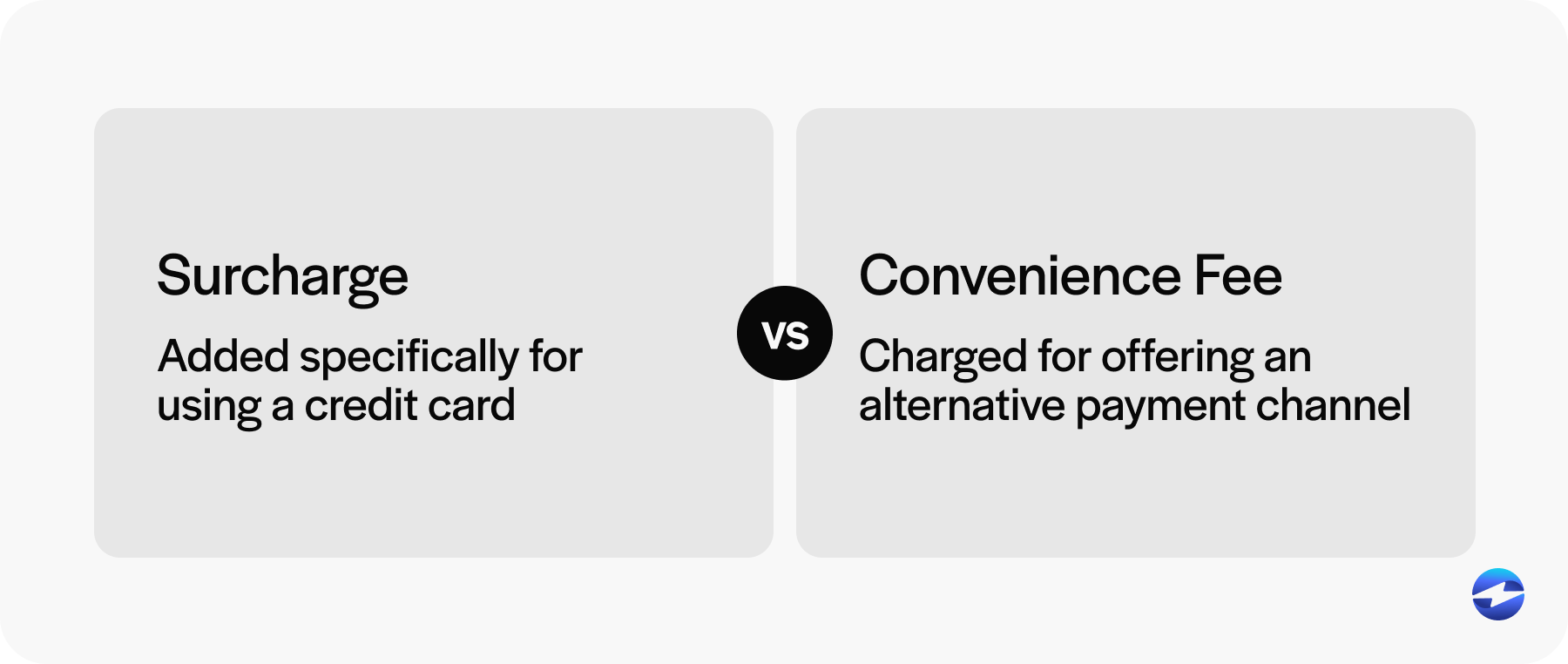

Surcharges and convenience fees often get mixed up, but it’s important to understand the distinction between the two. A convenience fee is charged when a customer uses an alternative payment channel, like paying online or over the phone instead of in person. It’s not based on the type of card used but rather on how the payment is made. A surcharge, on the other hand, is an extra fee added specifically when a customer pays with a credit card. That distinction is important because surcharges are more tightly regulated by both card networks and state laws. Getting the rules wrong can expose your business to legal penalties and fines from your payment processor.

Merchants tend to use surcharges in industries where margins are tight or where credit card usage is high—like utilities, tuition payments, or professional services. You’ll also see it more in B2B settings, where invoice sizes are larger and the cost of processing is more painful. If you’ve been asking, “is it legal to add a credit card surcharge?” the following sections will help clarify the boundaries.

Legal Background of Credit Card Surcharges

For years, surcharges were banned outright in many places. The dominant card networks—Visa, Mastercard, American Express, and Discover—had long prohibited merchants from adding extra fees for credit card usage. The justification was largely consumer protection; card companies didn’t want customers to feel penalized for using credit.

However, things started shifting after a series of legal battles between merchants and card networks, with merchants arguing that these rules unfairly burdened them with the cost of card acceptance.

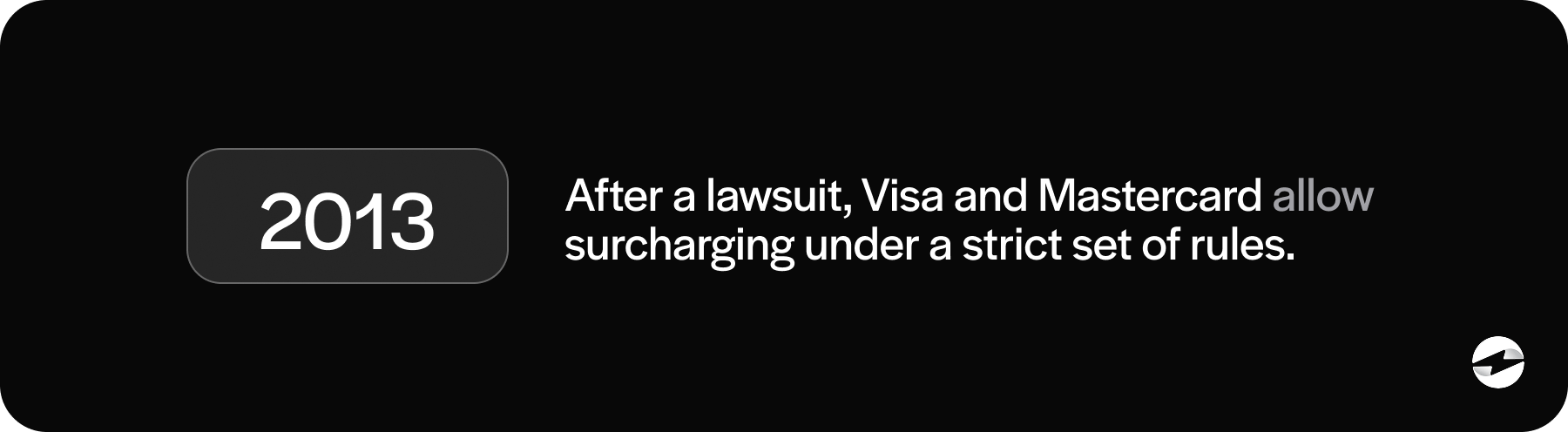

A major turning point came in 2013 when Visa and Mastercard settled a class-action lawsuit with a group of merchants. As part of that settlement, they agreed to permit credit card surcharges, provided that merchants followed a strict set of rules around limits and disclosures. This federal-level shift opened the door for surcharging in theory, but the practical reality still hinged on local legislation. State laws continued to regulate—or outright ban—surcharging, meaning merchants had to navigate both sets of rules before moving forward.

Today, surcharge rules are shaped by a mix of card brand requirements and state-level laws. The card networks generally allow surcharges, but they require strict disclosures and cap the fee you can charge. And while some states have lifted their bans, others still hold firm. Understanding the maximum credit card surcharge allowed is key before making changes to your pricing.

Federal and State Surcharge Laws

At the federal level, there’s no law preventing credit card surcharges. The courts have generally sided with merchants who argue they should be able to recoup processing costs. But the picture gets messier at the state level.

- States that prohibit surcharges include Connecticut, Massachusetts, and Puerto Rico. In these places, surcharging is not allowed—period.

- States that allow surcharges with restrictions—like California and New York—have seen legal challenges and revisions. While the outright bans have been overturned, merchants must be careful to follow consumer protection laws, especially regarding transparency.

- States with no specific laws defer to the card network rules, which means surcharging is generally allowed as long as merchants follow the network requirements.

It’s essential to check the latest laws in your state before implementing a surcharge. These rules are evolving, and what’s legal today might not be tomorrow. Your payment solution or payment processor should be able to help you stay updated.

Card Network Rules and Maximum Limits

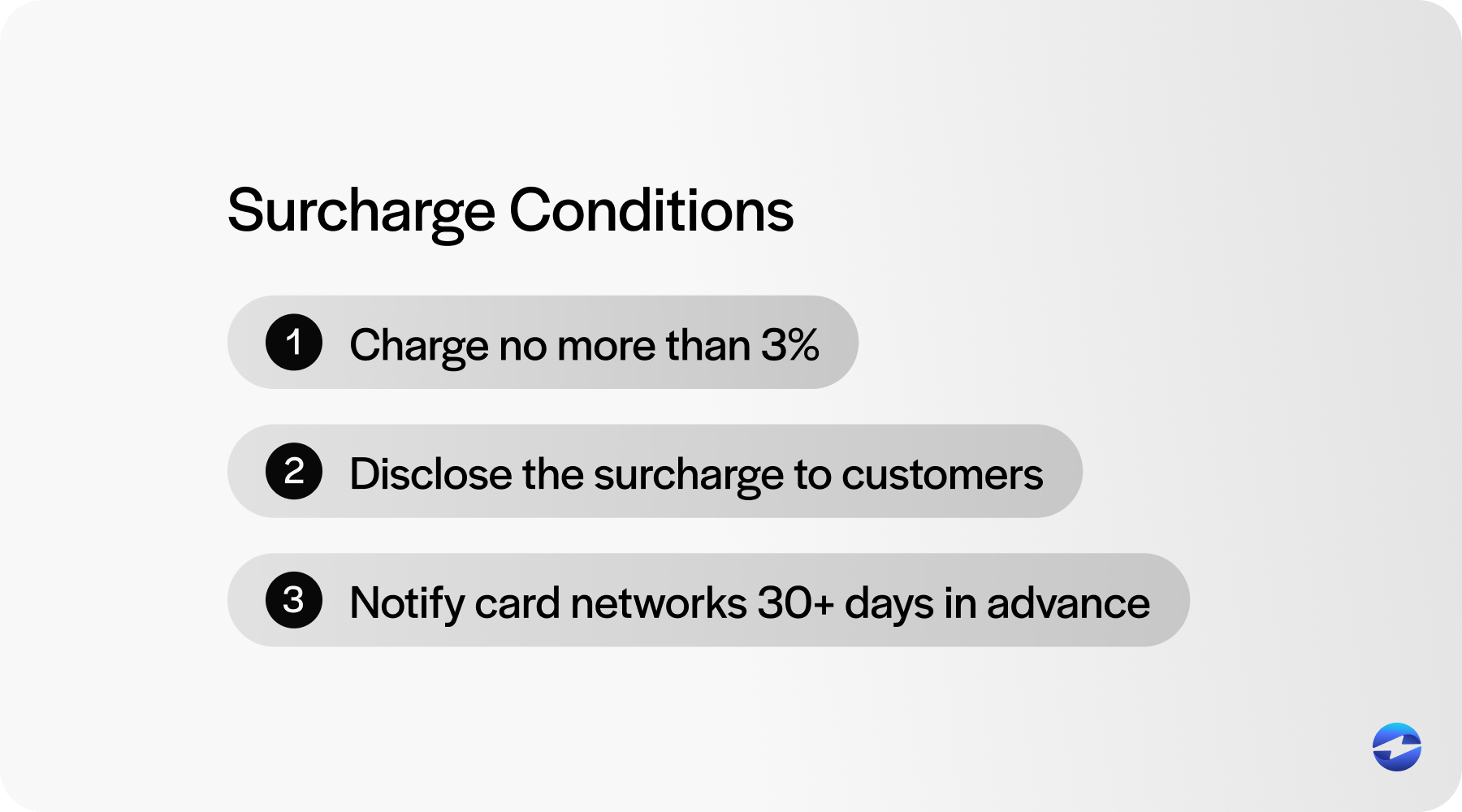

Visa and Mastercard allow merchants to add a surcharge, but only under certain conditions:

- You can’t charge more than 3% or your actual cost of credit card acceptance, whichever is lower. That’s your maximum credit card surcharge.

- You must disclose the surcharge to customers clearly and prominently, both at the point of entry (like a storefront or website) and at the point of sale (like on a receipt).

- You must notify Visa and Mastercard at least 30 days prior to implementing surcharging.

American Express and Discover also allow surcharges but with a caveat: you can’t treat their cards less favorably than others. If you’re going to surcharge, you need to do it across all brands equally.

Disclosure and Transparency Requirements

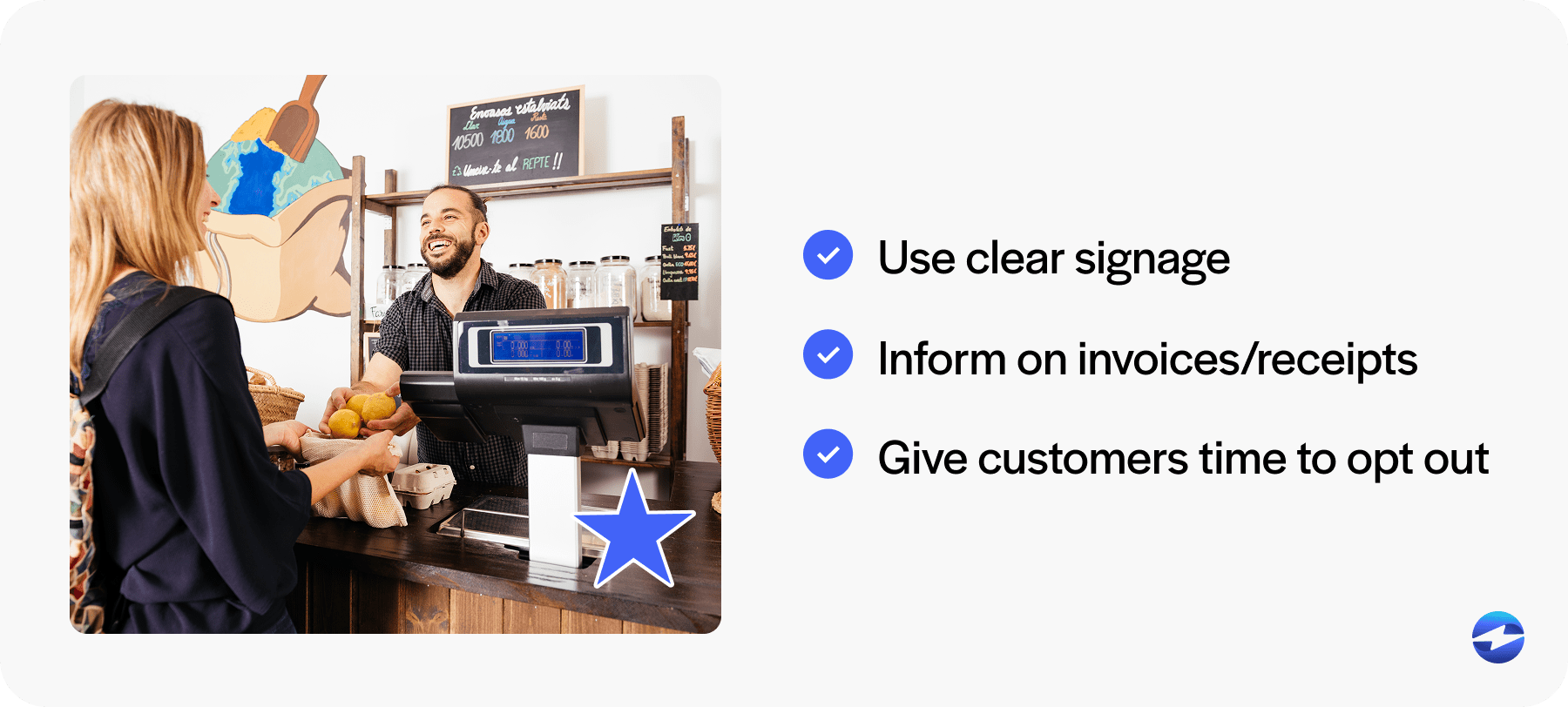

Disclosure and transparency are crucial. If you’re going to add a surcharge, your customers need to know upfront before they hand over their card.

- Signage: You’ll need clear signage at your physical location or notices on your website.

- Invoices and receipts: The surcharge must be listed as a separate line item.

- Timing: You must give customers the opportunity to opt out before the transaction is processed.

It’s not just about compliance—it’s about trust. Surprises at checkout can frustrate customers, even if the fee is small. Using a trusted payment solution can help you configure these steps correctly.

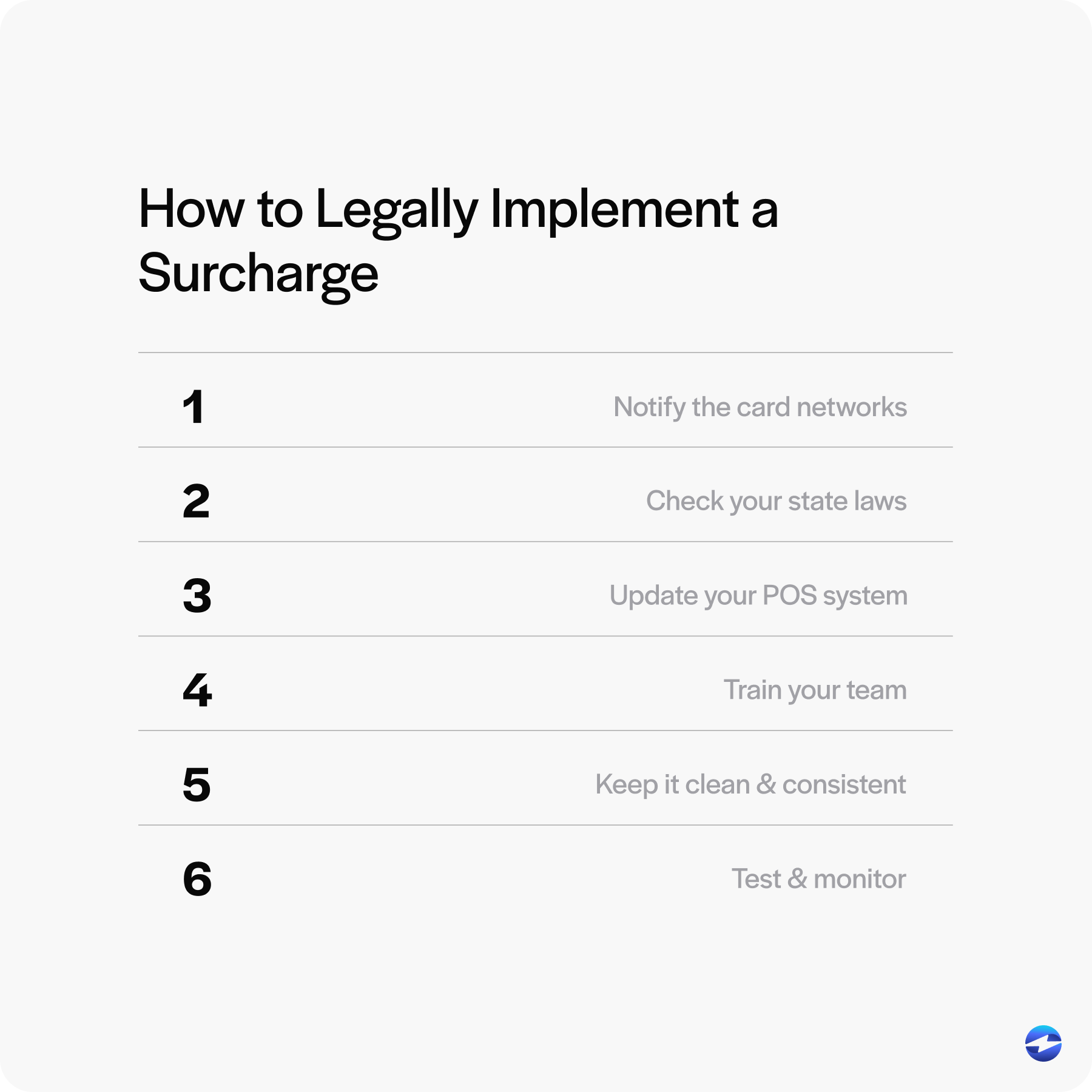

How to Legally Implement a Surcharge

Implementing a credit card surcharge isn’t just a matter of flipping a switch. There’s a detailed, multi-step process that ensures you’re not only compliant but also providing a smooth experience for your customers. Following this process helps avoid costly errors and builds trust with both customers and payment partners.

If you decide to move forward, here’s how to do it right:

- Notify the card networks. Visa and Mastercard require merchants to submit a formal notification at least 30 days before you start surcharging. This registration process includes providing details about your business, how the surcharge will be applied, and verifying that your fees won’t exceed the maximum allowed.

- Check your state laws. Surcharging is not legal in every state, and some have unique disclosure requirements or technical restrictions. Even if card networks permit it, you must comply with state consumer protection rules. Consulting legal guidance or a knowledgeable payment processor can help you interpret these state-specific nuances.

- Update your point-of-sale (POS) system. Your point-of-sale (POS)or eCommerce platform needs to support surcharges properly. That means the system should:

- Apply the fee only to credit card transactions (not debit cards).

- Display the surcharge as a separate line item on receipts.

- Include surcharge information during the checkout process (both in-person and online).

- Train your team. Your staff should know how to explain the surcharge to customers and handle any questions or concerns. This step is especially important in retail environments where transparency and customer service go hand in hand.

- Keep it clean and consistent. Never hide the surcharge or inflate prices to disguise it. Transparency is not just a best practice—it’s mandatory. Ensure consistent messaging across your signage, website, receipts, and customer service interactions.

- Test and monitor. Once implemented, regularly audit your system to ensure the surcharge is being applied correctly and legally. Watch for changes in state legislation or card brand rules that might require adjustments to your approach.

Done properly, a surcharge program can help you recover costs without alienating your customers. Skipping steps or rushing through implementation can expose you to compliance issues or reputational damage. Take your time, follow the rules, and don’t be afraid to ask your payment processor or technology provider for guidance. A well-executed surcharge policy should feel seamless to your business and your buyers alike.

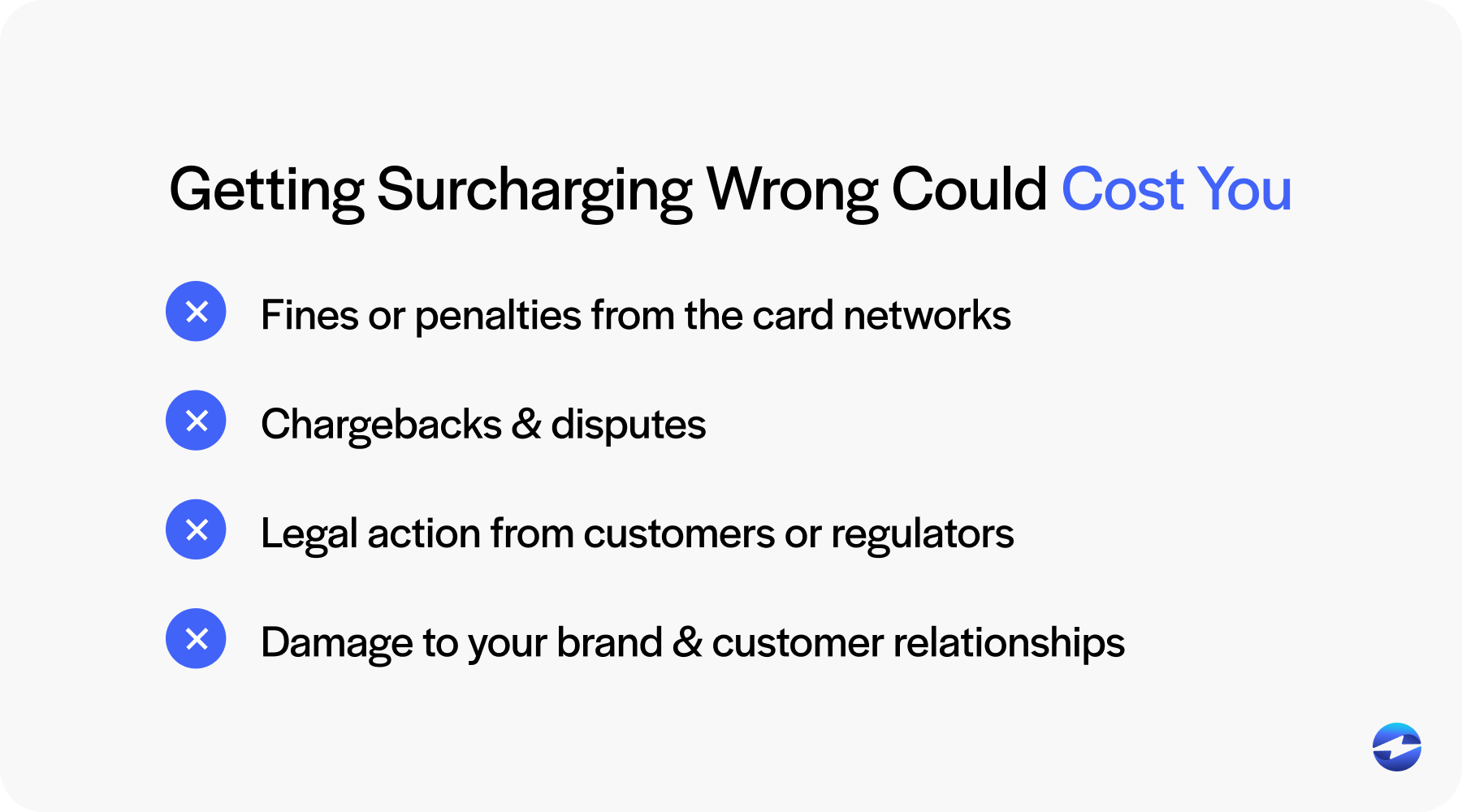

Risks and Penalties for Non-Compliance

Surcharging is legal in many cases, but only if you follow the rules precisely. One misstep—even something as simple as missing a required disclosure—can have serious consequences for your business. Card networks are strict, and regulators in some states are even stricter.

Getting this wrong can cost you. If you exceed the cap, fail to notify card networks, or forget proper disclosures, you could face:

- Fines or penalties from the card networks

- Chargebacks and disputes

- Legal action from customers or regulators

- Damage to your brand and customer relationships

These aren’t just theoretical risks—they happen, especially when businesses rush to implement a surcharge program without doing their due diligence.

So, take your time. Read the rules. Ensure your POS system is set up correctly. And if you’re unsure, ask questions. It’s worth double-checking everything before you flip the switch.

A good payment solution will help you manage surcharging rules and stay in compliance.

Simplifying surcharging practices with EBizCharge

Between shifting state laws, card network requirements, and strict disclosure rules, merchants face considerable complexity when trying to stay compliant. Knowing the maximum credit card surcharge you can apply—and how to do so without alienating customers—is critical.

That’s where EBizCharge comes in. This top-rated platform is built to simplify surcharging from start to finish for businesses in the U.S. and Canada. We help merchants determine eligibility, handle the required card brand notifications, and configure surcharges to ensure compliance with legal and network limits. Our system is designed to automate the hard parts—like displaying surcharge line items, ensuring customer transparency, and avoiding overcharges—so you don’t have to worry about compliance slipping through the cracks.

With EBizCharge, you get more than a payment processor—you get a full-service payment solution that removes the guesswork from surcharging. If you’re ready to recover fees without the regulatory headache, we’ll help you implement a surcharging strategy that’s effective, compliant, and hassle-free.

- What is a Credit Card Surcharge?

- Legal Background of Credit Card Surcharges

- Federal and State Surcharge Laws

- Card Network Rules and Maximum Limits

- Disclosure and Transparency Requirements

- How to Legally Implement a Surcharge

- Risks and Penalties for Non-Compliance

- Simplifying surcharging practices with EBizCharge