Blog > Credit Card Surcharge Rules by Network: Visa, Mastercard, and More

Credit Card Surcharge Rules by Network: Visa, Mastercard, and More

If you’re thinking about passing your credit card processing costs onto customers, it’s important to understand how the major card networks—like Visa, Mastercard, Amex, and Discover—handle surcharges. While it might sound simple, credit card surcharge rules can vary depending on who issued the card. And getting them wrong can lead to penalties, chargebacks, or unhappy customers.

This guide breaks down the differences between networks and outlines the necessary steps to ensure compliance. Whether you’re just getting started with credit card surcharging or reviewing your current setup, this article will give you a clearer picture of how to do it right.

What Is a Credit Card Surcharge?

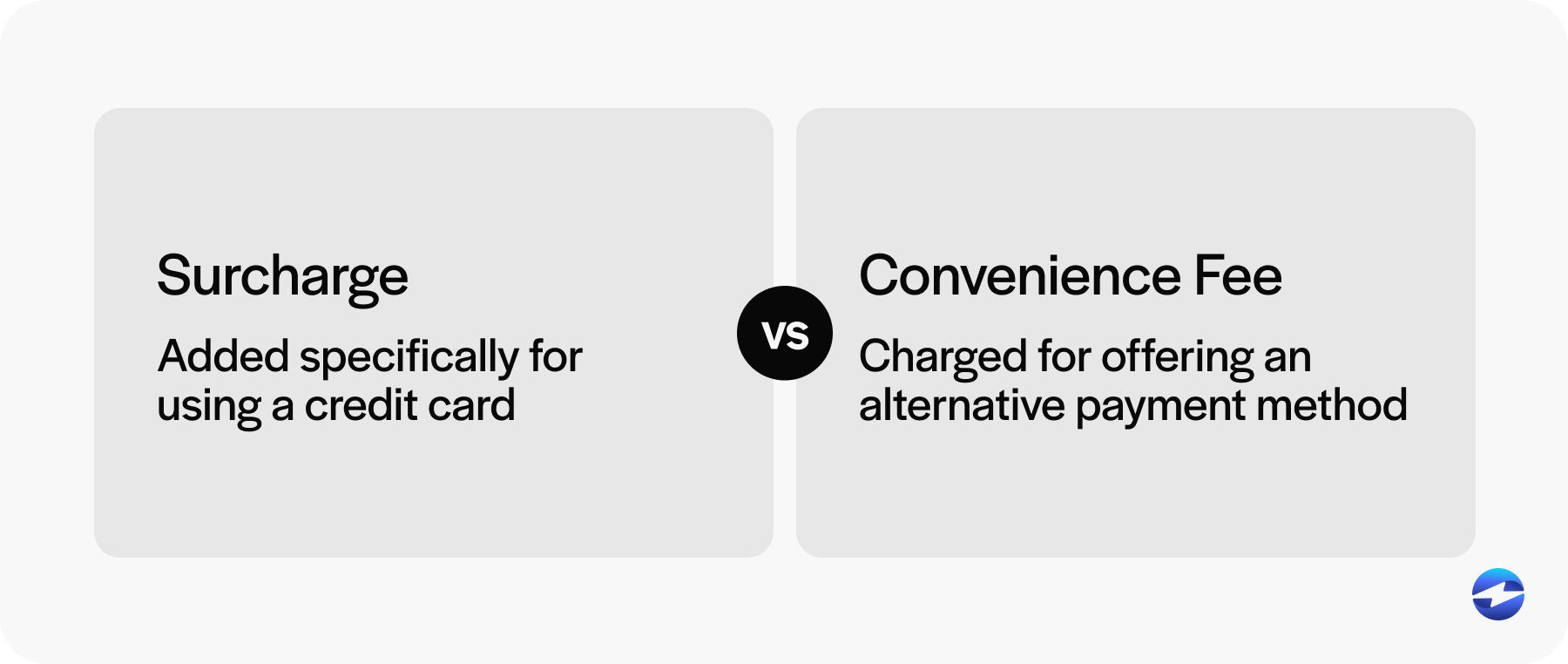

Before diving in, it’s important to distinguish between a surcharge and a convenience fee. The two are often confused, but they’re not the same. A credit card surcharge vs. convenience fee comes down to when and why the fee is applied. A surcharge is added specifically for using a credit card, while a convenience fee is charged for offering an alternative payment method, like paying online instead of in person. Understanding the difference between a credit card convenience fee vs. surcharge is key to applying the correct policy for your business.

A credit card surcharge is an extra fee added to a sale when a customer chooses to pay with a credit card. It’s designed to help merchants cover the cost of payment processing, which can eat into profits if left unchecked.

Surcharges are only applicable to credit cards, meaning they can’t legally be applied to debit or prepaid card transactions. Being compliant not only protects your business from penalties but also helps you stay transparent with your customers.

Why Card Network Rules Matter

Each card brand has its own set of credit card surcharge rules. If you accept cards from multiple networks (which most businesses do), you have to follow the rules for each one. Some requirements overlap, but others are unique.

Non-compliance can result in fines or even losing your ability to accept certain cards. On top of that, inconsistent or unclear surcharge practices can erode customer trust. If you’re going to apply a credit card surcharge fee, make sure the process is consistent, clearly communicated, and backed by a solid understanding of network policies.

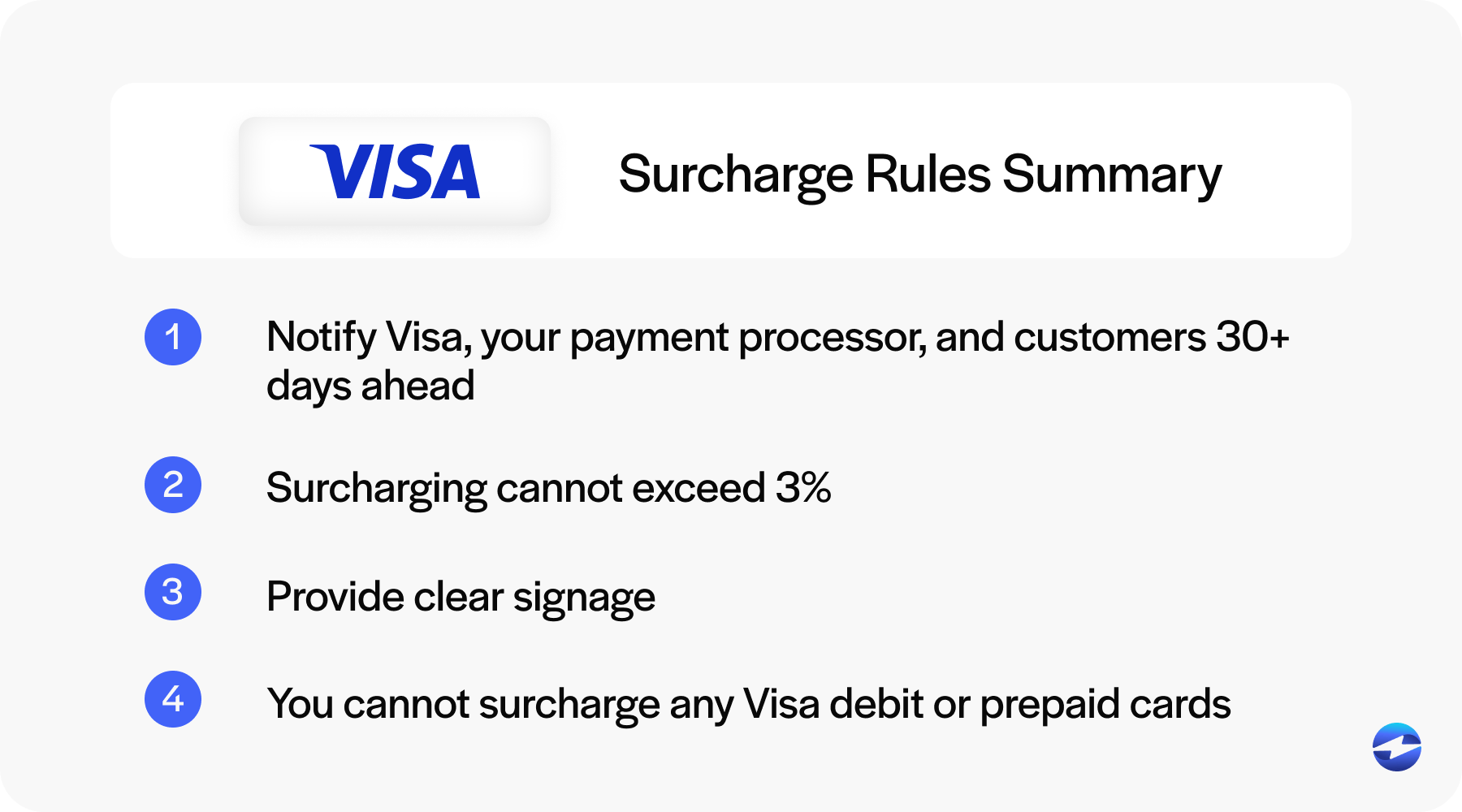

Visa Surcharge Rules

Visa has some of the strictest and clearest requirements, and for good reason. They want merchants to be upfront, fair, and consistent when it comes to surcharges. If you’re planning to apply a fee to Visa transactions, here’s what you need to know about Visa credit card surcharge rules:

Notification Requirements

Before you do anything, you’re required to notify both Visa and your payment processor at least 30 days before you begin surcharging. This isn’t just a formality—it’s your formal credit card surcharge notice to customers and the card network that a fee will be added to credit card purchases. Visa even provides a portal for this notification.

Fee Limits and Cap

Visa allows you to pass on the cost of acceptance, but the surcharge must not exceed what you’re paying to accept the card—and in any case, it can’t go over 3%. This cap is in place to protect customers from being overcharged and to maintain consistency across merchants.

Disclosure Requirements

You must provide clear signage—both at the point of entry and at the point of sale—stating that a surcharge will be added to credit card purchases. This credit card surcharge notice must be clearly visible and easily understandable. Additionally, the surcharge must be displayed as a separate line item on all receipts, allowing customers to see exactly what they’re paying and why.

Visa also recommends using consistent and transparent credit card surcharge fee wording to prevent customer confusion and disputes.

Prohibited Card Types

You are not allowed to apply a surcharge to Visa-branded debit or prepaid card transactions—no exceptions. Even if a debit card is run as ‘credit’, surcharging it still violates the rules. Ensure your system can distinguish between card types to prevent accidental non-compliance.

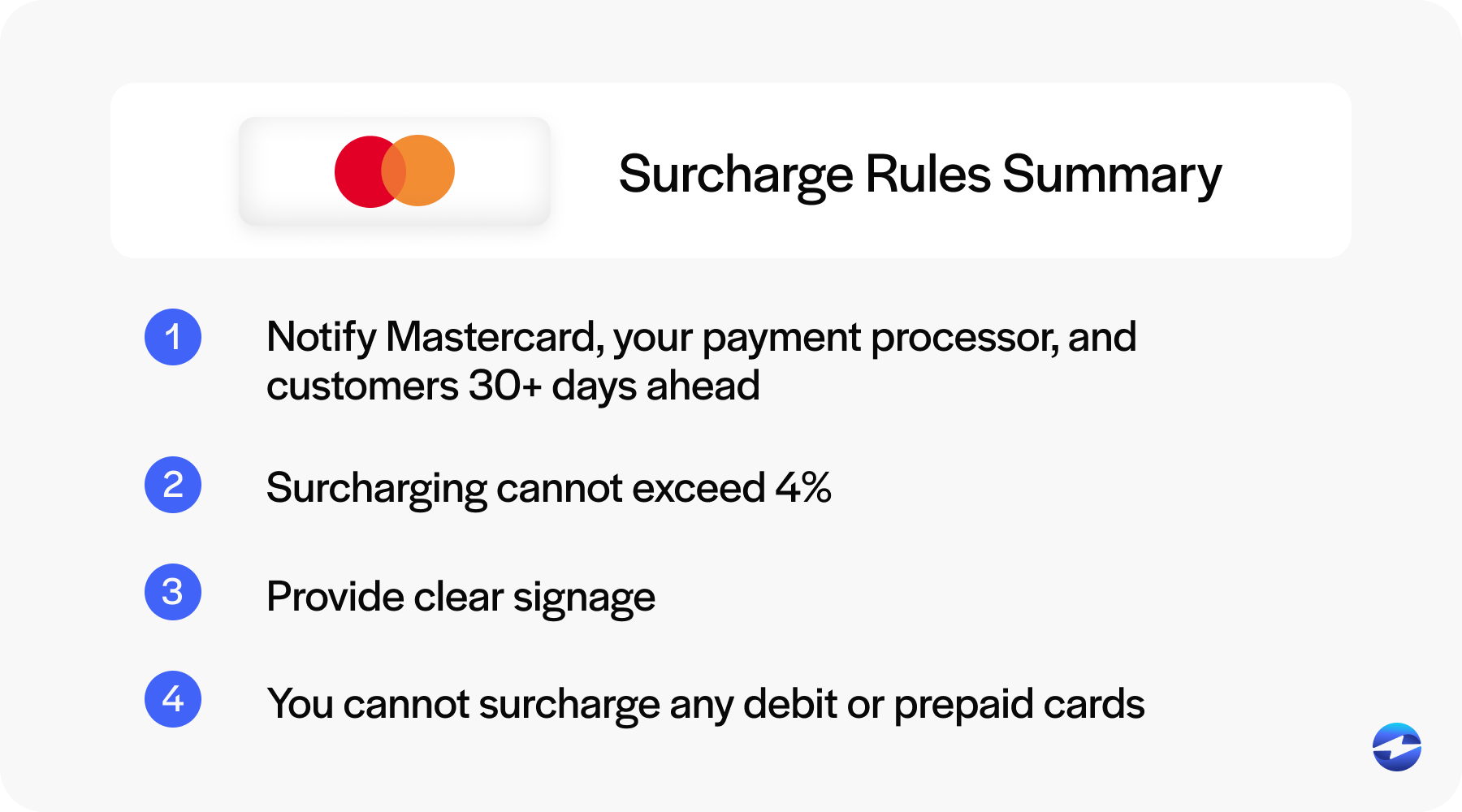

Mastercard Surcharge Rules

Mastercard’s policies are similar to Visa’s in many ways, but it’s still important to understand the unique details that apply to this network. Mastercard emphasizes transparency and fairness to cardholders and expects merchants to uphold these standards when implementing surcharges.

Notification Requirements

Just like with Visa, Mastercard requires that you provide a formal notification to both the card network and your payment processor at least 30 days before you begin surcharging. This notice serves as your official credit card surcharge notice to customers and stakeholders that a fee will be added to credit card payments.

Fee Caps

The surcharge you apply must not exceed your actual cost of accepting the card, and it can never be higher than 4%. This rule helps ensure that fees are not excessive and that the surcharge remains a cost-recovery mechanism rather than a revenue stream.

Signage and Disclosure

You’re required to post clear and visible credit card surcharge notices to customers at your business entry points, at checkout, and online if you accept payments digitally. Additionally, the surcharge must be listed as a separate line item on customer receipts, both printed and electronic. Mastercard also recommends using standardized and consistent credit card surcharge fee wording to reduce misunderstandings.

Prohibited Card Types

Just like Visa, Mastercard does not permit surcharges on debit or prepaid cards under any circumstance. Even if the transaction is routed as a ‘credit’ payment, it’s still classified as a debit card, and surcharging it would violate Mastercard’s rules. Ensure your payment system can accurately distinguish between card types to avoid accidental non-compliance.

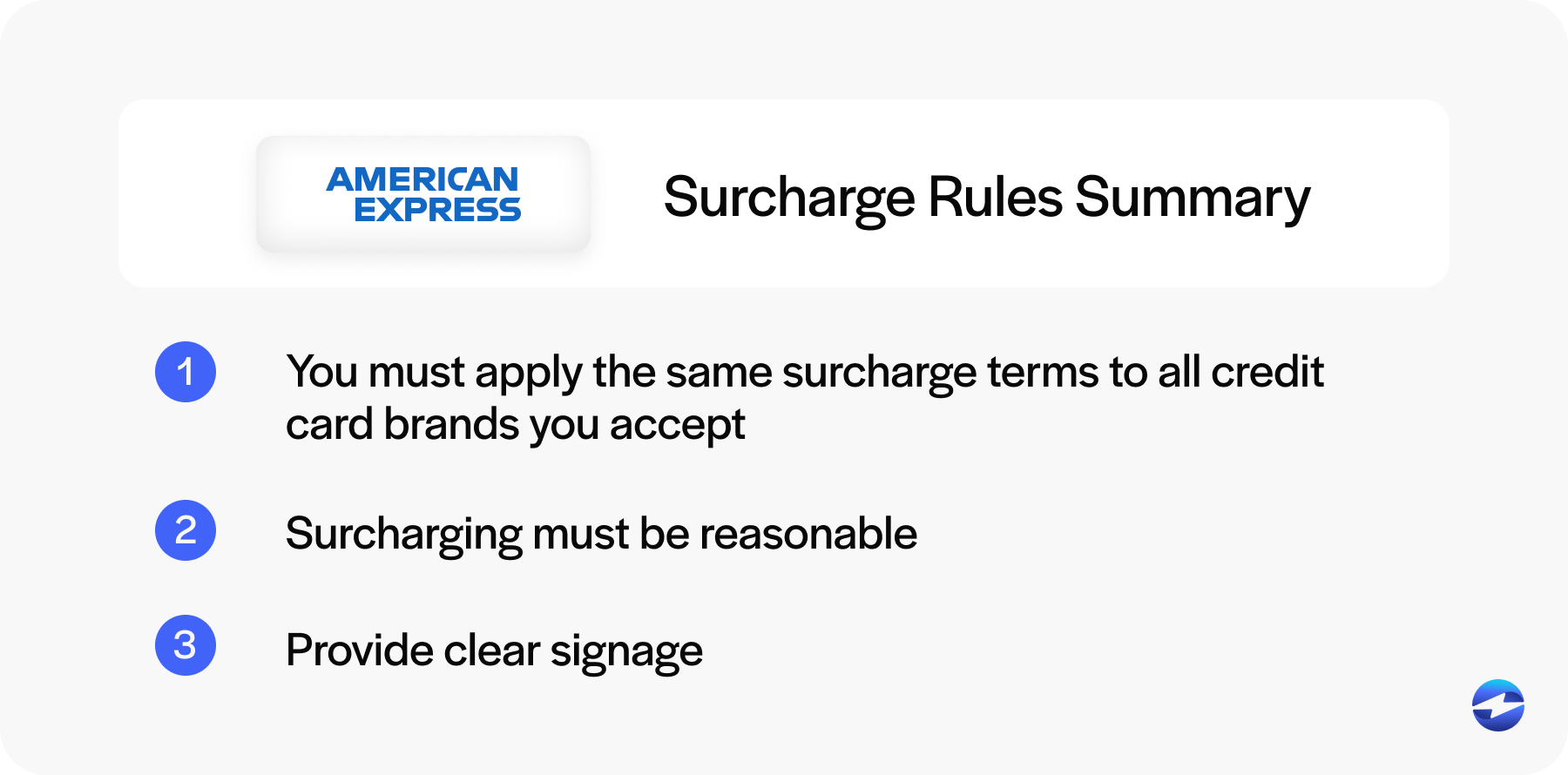

American Express Surcharge Rules

Policy Overview

Amex takes a slightly different approach when it comes to surcharging. While they do permit it, there’s an important condition: you must apply the same surcharge terms to all credit card brands you accept. In other words, you can’t apply a surcharge to Amex cards unless you’re doing the same for Visa, Mastercard, and Discover. This “equal treatment” rule helps maintain a level playing field and prevents merchants from targeting Amex with higher fees.

Fee Guidelines

Unlike Visa and Mastercard, Amex doesn’t set a firm cap on the surcharge amount. However, they still expect merchants to keep it reasonable. That means the fee should reflect your actual payment processing costs and remain in line with what you’re charging for other card brands. Charging more for Amex would go against their equal treatment policy.

Notice and Display Requirements

Amex requires the same general standards for signage and receipt transparency. You’ll need a clear and visible credit card surcharge notice to customers, whether they’re shopping in person or online. It’s important that your credit card surcharge fee wording is simple, accurate, and not misleading—customers should understand what they’re paying and why. Make sure you also include the surcharge as a separate line item on receipts, just as you would for other networks.

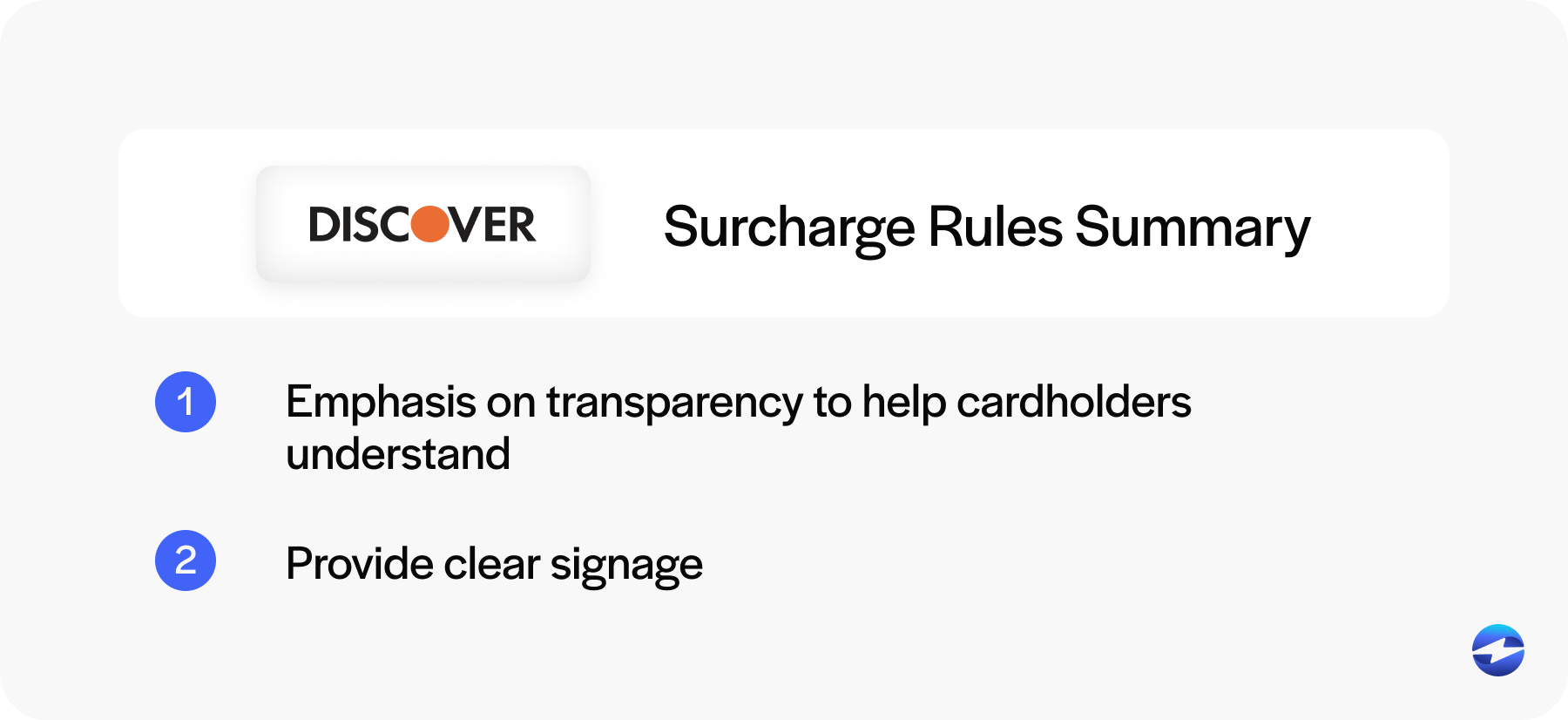

Discover Surcharge Rules

General Approach

Discover allows surcharges under similar conditions as the other major card brands. However, they also expect merchants to ensure clarity and fairness when applying any fees. While Discover tends to align its policies with other networks, it’s still important to review their latest guidance and match your practices accordingly.

Disclosure and Compliance

As with Visa, Mastercard, and Amex, you must notify Discover in advance of implementing a surcharge. In addition to filing the appropriate notices, you’ll need to comply with state-specific surcharge laws and make sure all signage and communication meet visibility and accuracy standards. Like the others, you’ll need a credit card surcharge notice at checkout and must clearly show the surcharge as a separate line item on the receipt. Discover emphasizes transparency to help cardholders understand any added costs tied to credit card use.

Summary Comparison Table

| Network | Notice Period | Max Fee | Debit Cards | Signage Required | Receipt Disclosure |

|---|---|---|---|---|---|

| Visa | 30 days | Up to 3% | Not allowed | Yes | Yes |

| Mastercard | 30 days | Up to 3% | Not allowed | Yes | Yes |

| Amex | 30 days | Must be equal | Not allowed | Yes | Yes |

| Discover | 30 days | Reasonable Fee | Not allowed | Yes | Yes |

You’ll also want to be clear on the difference between a credit card surcharge vs. a convenience fee, especially when setting policies and signage.

Mislabeling a fee could confuse customers or result in a compliance issue. When comparing a credit card convenience fee vs. surcharge, remember that a surcharge is tied directly to credit card usage, while a convenience fee is about the method or channel of payment.

Key Takeaways for Merchants

- Always notify the card networks and your payment processor before applying a surcharge.

- Keep your credit card surcharge fee wording clear and consistent across your receipts and signage.

- Use a well-designed credit card surcharge notice template to meet signage requirements.

- Never apply surcharges to debit or prepaid card transactions.

- When in doubt, follow the most conservative policy across networks to stay safe.

How EBizCharge Helps

Managing credit card surcharging on your own can be complicated, especially if you’re juggling multiple systems or store locations. EBizCharge takes the guesswork out of compliance. It automatically calculates and applies surcharges where allowed, helps generate compliant signage, and ensures your receipts reflect the correct surcharge details.

Plus, the system stays updated with the latest credit card surcharge rules, so you don’t have to constantly check back with each card brand. If you’re looking for a more reliable way to manage payment processing and stay compliant, EBizCharge can help simplify the process.