Templates | Pro Forma Statement

Pro Forma Income Statement

Pro Forma Income Statement

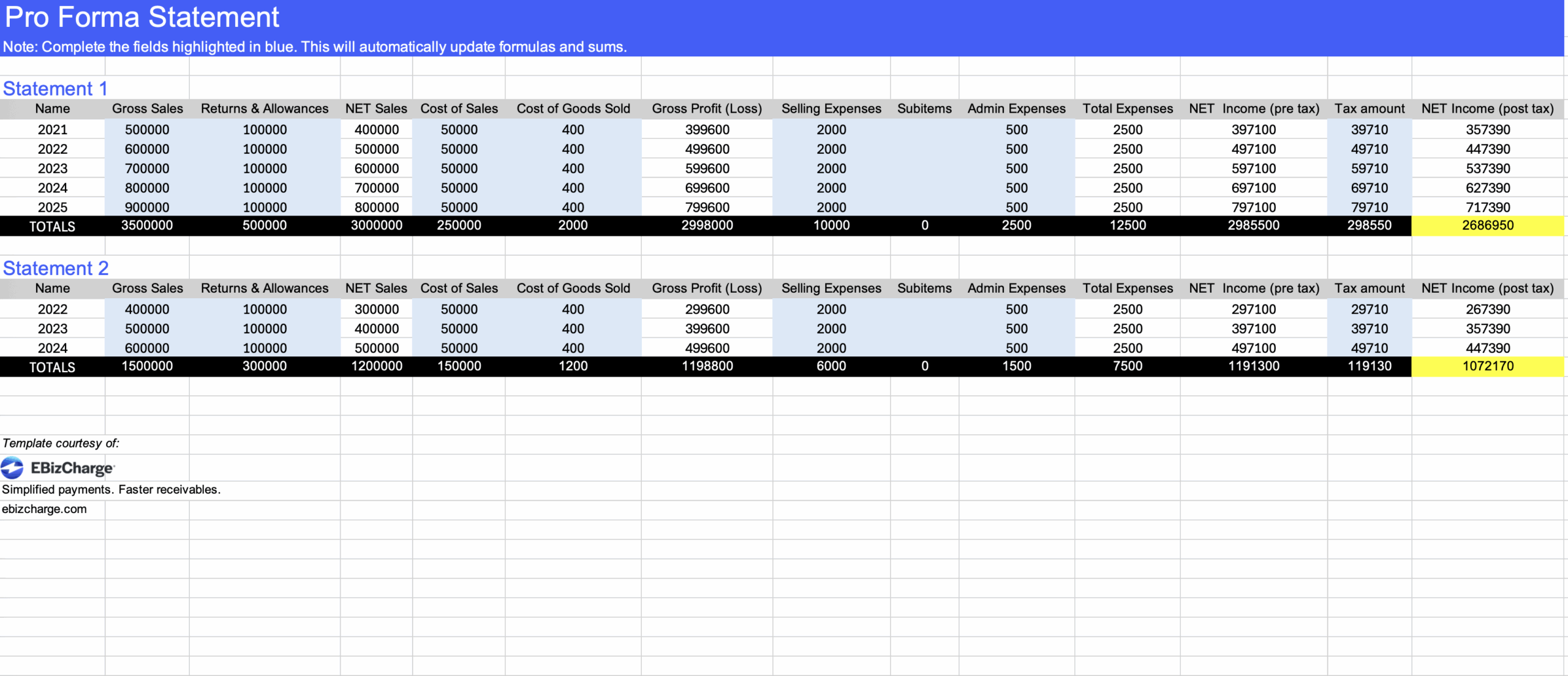

Get a free pro forma income statement template to estimate future profits and plan your business finances with confidence.

Get a free pro forma income statement template to estimate future profits and plan your business finances with confidence.

Download our free excel template today.

A business proforma template shows expected income and expenses, helping you plan ahead or present to investors.

Our printable pro forma income statement template lets you map out expected earnings and costs, giving you a clear view of your business’s financial future.

What is a pro forma income statement?

A pro forma income statement is essentially a financial forecast. It’s a way to estimate how much revenue your business might bring in and what your expenses might look like over a specific period of time. Think of it like a preview of your income statement—only instead of showing what already happened, it shows what you expect to happen.

If you’re planning to launch a new product, enter a new market, or secure funding, a pro forma income statement helps you get a grip on the financial impact before making any big moves. It’s not just for startups, either. Many established businesses use them when preparing for internal planning or trying to get a loan.

In short, it gives you a tool to ask “what if” questions about your business—then model those answers with real numbers.

How to create a pro forma income statement

- Start with what you know: your historical financial data, if you have it. That includes past income statements, sales figures, and expense records. If you’re a startup without a financial history, you’ll have to rely more on research and assumptions—industry averages, market size, projected pricing, and so on.

- From there, list your projected revenue first. Be realistic—optimism is great, but lenders and investors will spot overly rosy assumptions a mile away.

- Next, subtract your expected costs. That includes things like cost of goods sold (COGS), operating expenses (like salaries and rent), and any other anticipated outflows.

The result is your projected net income. This gives you a bottom-line estimate of profitability based on your assumptions. If you want to get more detailed, you can build out different versions of the statement based on best-case, worst-case, and moderate scenarios.

How are expenses forecasted on a pro forma income statement?

Forecasting expenses is part art, part math. The goal is to make educated guesses based on what you already know and what you can reasonably expect.

Fixed expenses like rent or insurance are easy to plug in since they don’t change much. Variable expenses—things like utilities, materials, or shipping—depend on how much you plan to sell, so those are typically calculated as a percentage of revenue or unit sales.

If you’re growing, factor in hiring costs, marketing campaigns, and higher utility bills. If you’re cutting back, adjust downward. Always include a buffer—unexpected costs happen more often than not.

The more accurate and detailed your expense assumptions, the more reliable your entire pro forma income statement becomes.

What is the difference between a pro forma income statement and a regular income statement?

A regular income statement looks backward. It shows what already happened—how much money your business made, what it spent, and what the profit or loss was over a set period. It’s based on actual, recorded numbers.

A pro forma income statement, on the other hand, looks ahead. It’s built on projections and assumptions to model potential outcomes. The structure is similar—revenue at the top, expenses subtracted, profit at the bottom—but the numbers come from your expectations, not your books.

Both are useful, but for different reasons. One tells your financial story. The other helps you plan your next chapter.