What is a times interest earned ratio (TIE)?

The times interest earned (TIE) ratio is a financial metric that shows how easily a company can cover its interest expenses with its earnings. Think of it as a stress test for a business—how many times over can it afford to pay the interest on its debt using its operating income?

Imagine you run a coffee shop that has been doing extremely well. You’ve decided to expand, so you take out a loan and now have monthly interest payments. If your shop’s profits are strong, those payments are just a small dent in your earnings. If business slows down, covering that interest could become a struggle. That’s what the TIE ratio helps measure—whether a company is comfortably managing its debt or skating on thin ice.

Key Points

- The TIE ratio shows how many times a company can cover its interest payments using its earnings.

- It’s calculated by dividing EBIT (Earnings Before Interest and Taxes) by interest expense.

- A TIE ratio of 3 or higher is considered safe, while anything below 2 indicates financial risk.

How to calculate the times interest earned ratio

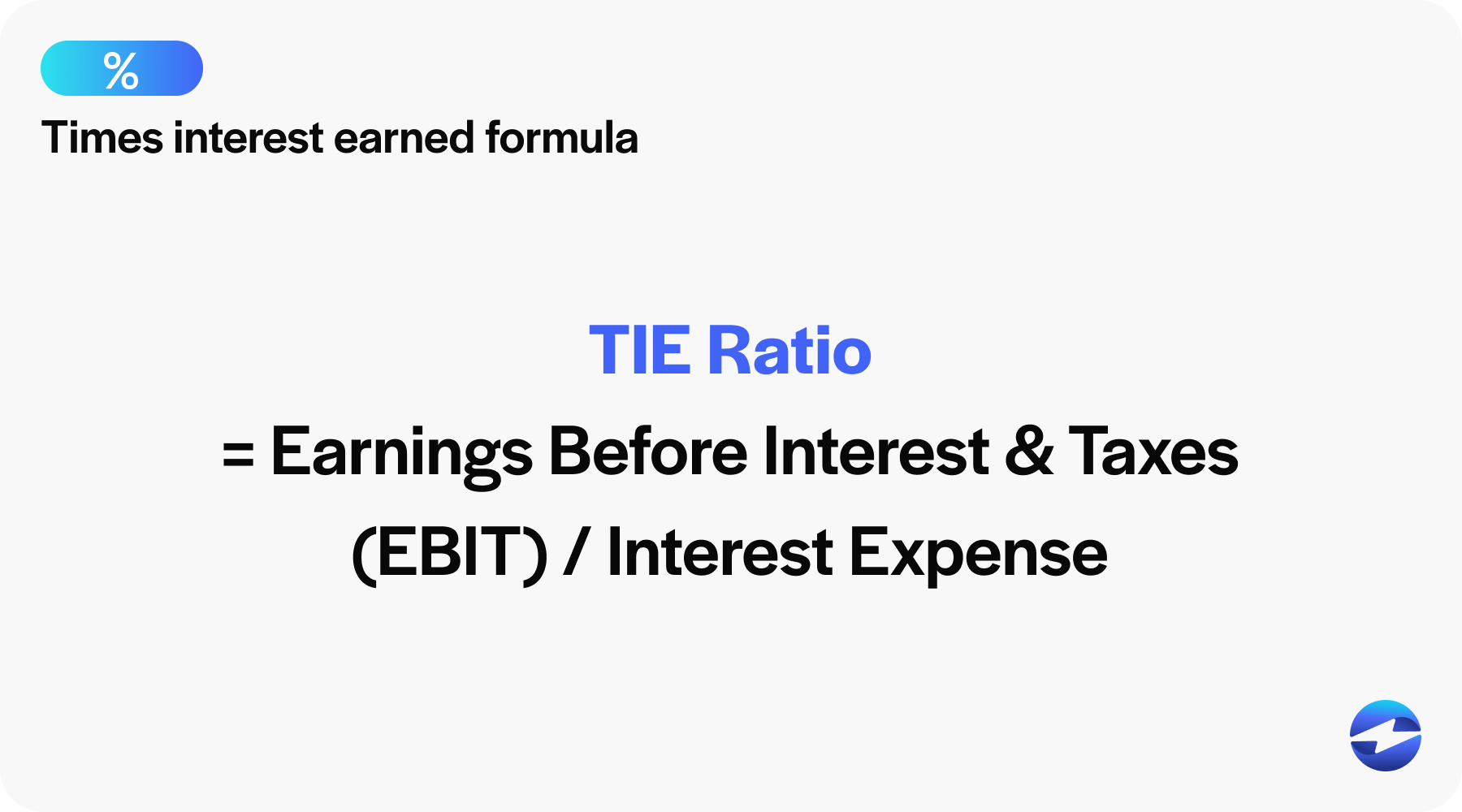

The formula for the times interest earned ratio is:

TIE Ratio=Earnings Before Interest and Taxes (EBIT) / Interest Expense

Let’s break it down:

- EBIT (Earnings Before Interest and Taxes) is your company’s profit before deducting interest and taxes.

- Interest Expense is how much you owe on borrowed money.

If your business has an EBIT of $500,000 and interest expenses of $100,000, the TIE ratio would be:

500,000/100,000 = 5

This means your company earns five times the amount needed to cover its interest payments—generally a comfortable spot to be in.

What is a good times interest earned ratio?

A higher TIE ratio means a company has a strong cushion to cover interest payments, while a lower ratio signals risk.

- A TIE ratio of 3 or higher is usually considered safe. This suggests the company earns at least three times its interest expenses, making it unlikely to default on its loans.

- A TIE ratio below 2 can be concerning, as it indicates that a downturn in earnings could make debt payments difficult.

- A TIE ratio under 1 is a red flag—this means the company isn’t generating enough profit to cover its interest, putting it in danger of financial trouble.

Of course, context matters. A startup might have a low TIE ratio while reinvesting heavily in growth, whereas an established corporation should ideally maintain a strong buffer.

Times interest earned ratio example

Let’s say Lisa owns a chain of restaurants. Her business generates $1.2 million in EBIT annually, but she pays $400,000 in interest on loans.

Her TIE ratio is:

1,200,000/400,000 = 3

This tells Lisa that her company earns three times what’s needed to cover its interest expenses. She’s in a relatively stable position. If she takes on more debt, she should ensure her earnings grow accordingly.

Imagine her competitor, Mike has the same interest expenses but only earns $500,000 in EBIT. His TIE ratio would be:

500,000/400,000 = 1.25

Mike is cutting it close—if business slows even slightly, he could struggle to meet his debt obligations. This could make it harder for him to secure future loans or expand his business.

The times interest earned ratio is a simple but powerful way to gauge financial health. Whether you’re a business owner, investor, or someone trying to understand financial statements better, keeping an eye on this number can tell you a lot about a company’s ability to manage debt.

You May Also Like

Payment Processing for Industrial Equipment Manufacturers on Epicor

Read More

Read More

Read More