Blog > ACH vs. Credit Cards: Comparing Payment Methods

ACH vs. Credit Cards: Comparing Payment Methods

As transactions evolve, merchants often find themselves torn between Automated Clearing House (ACH) payments and credit card processing.

Understanding how these payment methods operate and the benefits and disadvantages of each can help you determine which is best for your business to significantly enhance your bottom line.

ACH vs. credit card payments: A comprehensive comparison

ACH and credit cards are two popular options for electronic payments. Each comes with unique features that suit different business needs.

ACH transfers involve direct bank-to-bank transactions, while credit card payments typically rely on third-party processors and incur higher transaction fees. Therefore, it’s essential to thoroughly grasp each before implementing them into your infrastructure.

| Feature | ACH Payments | Credit Card Payments |

|---|---|---|

| Processing Speed | 1-3 business days | Real-time to next day |

| Avg. Transaction Fees | $0.20 – $1.50 per transaction | 2.9% + $0.30 per transaction |

| How It Works | Direct bank-to-bank transfer | Through card networks (Visa, Mastercard, etc.) |

| Fraud Risk | Lower risk | Higher risk |

| Transaction Limits | Higher limits possible | Varies by card/issuer |

| Reversibility | Difficult to reverse | Easy chargebacks/disputes |

| Customer Requirements | Bank account and routing number | Credit/debit card |

| Best For | Recurring payments, large amounts | One-time purchases, immediate needs |

| Cash Flow | Delayed (1-3 days) | Faster (same/next day) |

| Failed Payment Costs | Lower fees for returns | Chargeback fees ($15-25) |

How do ACH payments work?

Automated Clearing House (ACH) is a network tailored for moving funds directly between bank accounts. This payment system is predominantly used for payroll, direct deposits, and bill payments.

An ACH payment operates through a batching method. Here, transactions are accumulated and processed within one to three business days.

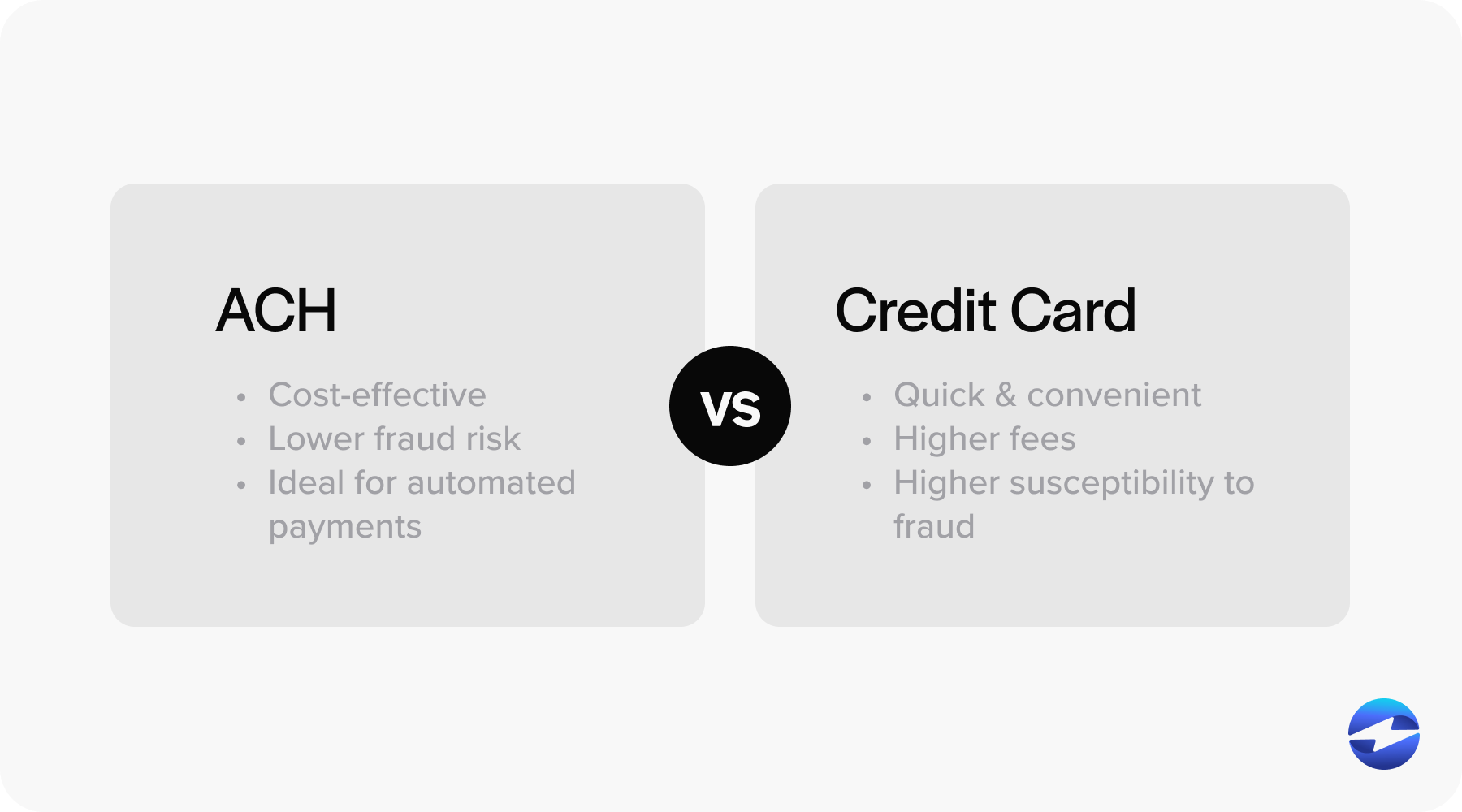

Key characteristics of ACH payments include:

- Cost-effectiveness: Generally lower processing fees compared to credit card fees.

- Security: Lower fraud risk due to direct bank account transactions.

- Automated payments: Ideal for recurring payments or regular billing cycles.

The ACH payment process plays a vital role in modern banking and commerce, offering a seamless and efficient way to transfer funds between accounts.

How do credit card payments work?

Credit card payments rely on a robust network connecting customers, merchants, and financial institutions. Unlike ACH, credit card transactions are processed through this network, allowing for rapid funds transfer. Typically, credit card payments are completed in real-time or by the next business day.

The credit card payment process includes:

- Speed and convenience: Swift transactions are suitable for quick, one-time payments.

- Higher fees: Generally higher processing and transaction fees than ACH payments.

- Fraud risk awareness: Higher susceptibility to fraud due to credit card network protocols.

Understanding these processes helps businesses make informed decisions. Whether opting for ACH or credit cards, evaluating your specific needs is essential in selecting the right payment solution.

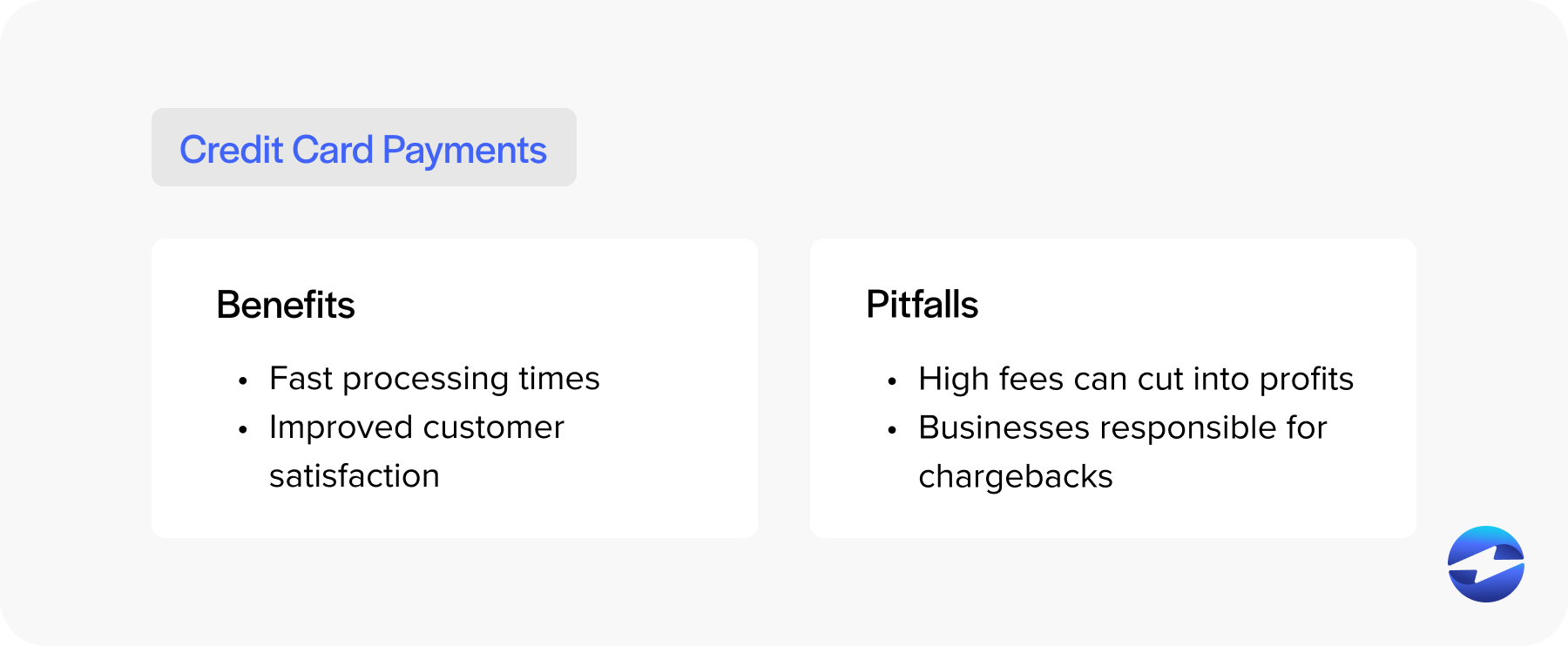

Benefits and pitfalls of ACH and credit card payments

When deciding between ACH and credit card payments, merchants should weigh the benefits and pitfalls of each method.

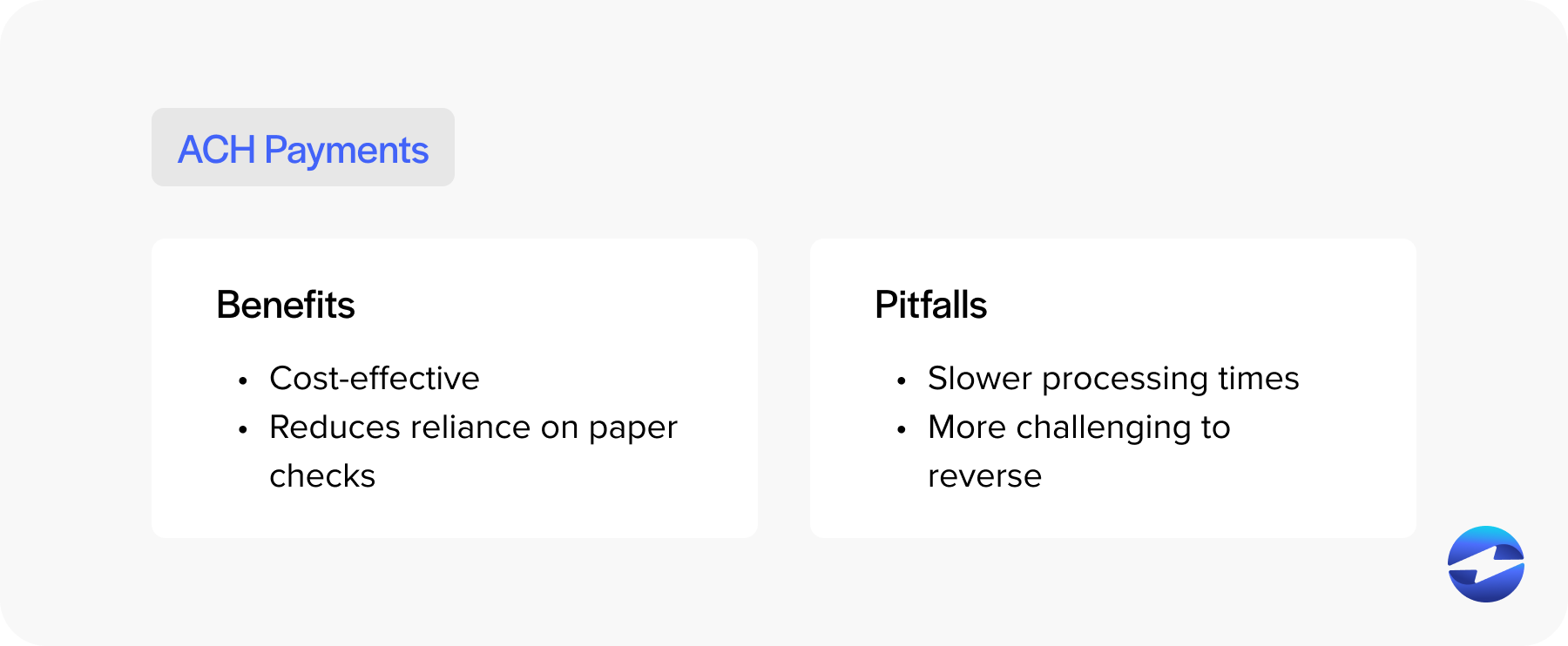

Benefits:

- ACH payments: These are cost-effective, with lower processing fees compared to credit cards, making them ideal for recurring payments or large transactions. They also reduce reliance on paper checks, streamlining cash flow.

- Credit card payments: Credit cards provide fast payment processing and allow customers to pay conveniently, which can increase sales and improve customer satisfaction.

Pitfalls:

- ACH payments: Processing times can be slower, sometimes taking several days, which may delay cash flow. ACH transactions are also more challenging to reverse in cases of errors or disputes.

- Credit card payments: High processing fees can cut into profits, especially for small businesses. Additionally, businesses are responsible for chargebacks, which can result from disputes or fraudulent transactions.

By understanding these trade-offs, businesses can choose the payment method that best aligns with their operational and financial goals.

Should your business accept ACH or credit cards?

Businesses should carefully evaluate their payment options to determine which solution best aligns with their operational needs and customer preferences.

ACH payments are a cost-effective choice for recurring or high-volume transactions, such as payroll or subscription services, as they typically involve lower processing fees.

On the other hand, credit cards provide faster processing, greater flexibility, and convenience for customers, which can enhance their overall payment experience.

The decision ultimately depends on factors like transaction type, volume, cost considerations, and the preferences of your target audience. Many businesses find value in offering both options to cater to diverse customer needs and maximize payment flexibility.

Automate both with EBizCharge

Automate ACH and credit card payments with EBizCharge to streamline your business transactions.

ACH is a reliable electronic payment method that allows funds to transfer directly from one bank account to another. This method is perfect for recurring payments and is often more cost-effective than credit card payments.

That said, EBizCharge can also automate credit card payments to further simplify the payment collection process. Whether handling one-time transactions or recurring billing cycles, EBizCharge ensures secure and timely credit card processing.

By automating ACH and credit card payments, EBizCharge empowers merchants to reduce the manual workload associated with payment collection while enhancing operational efficiency.

Whether you’re looking to save on transaction fees with ACH or streamline credit card payments, EBizCharge offers a comprehensive solution for your payment needs. Embrace a simplified and automated payment process with EBizCharge today.