Blog > Cost of Goods Sold (COGS): What It Is and How to Record It

Cost of Goods Sold (COGS): What It Is and How to Record It

As a key component in determining gross profit, the cost of goods sold (COGS) directly influences merchants’ financial health, making it imperative to grasp how to calculate it properly. Therefore, a clear understanding of how to record COGS and its implications can aid in strategic planning, budgeting, and identifying potential areas for improvement.

Thankfully, this article will thoroughly explain COGS, its recording process, and best practices to maintain precise accounting.

What is cost of goods sold?

The cost of goods sold (COGS) refers to direct expenses a company accrues from producing the items it sells.

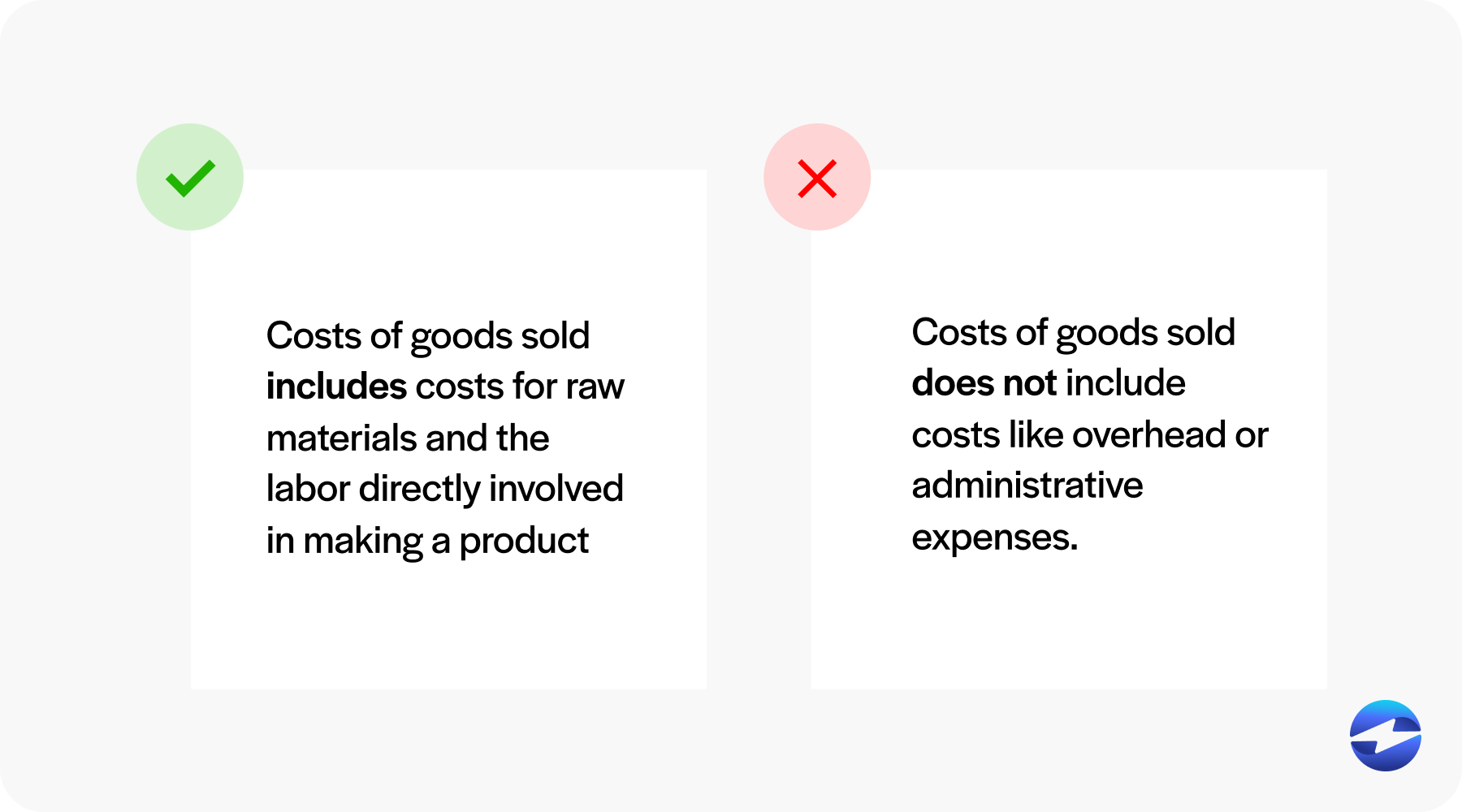

COGS includes costs for raw materials and the labor directly involved in making a product but doesn’t include indirect costs like overhead or administrative expenses.

Accurately calculating COGS is vital since it affects how profit margins are calculated and helps determine a product’s exact costs and a company’s overall financial health.

Understanding COGS is only the first step in managing it effectively. For the most reliable financial reporting and adherence to accounting principles, businesses must also record these costs correctly. This is where a COGS journal entry comes into play.

What is a COGS journal entry?

A COGS journal entry is the accounting record that reflects the direct costs associated with the production or acquisition of goods that a company sells during a specific period.

When a company sells inventory, the COGS journal entry ensures that the expense correctly matches with the revenue generated from the sale, adhering to the matching principle in accounting.

Typically, the entry involves debiting the COGS account to recognize the expense and crediting the inventory account to reduce the inventory value on hand. This process is essential for accurately determining gross profit, as COGS is subtracted from revenue on the income statement to calculate this figure.

The following section will explain how the COGS recording process works.

How to record COGS

Understanding how to record the COGS is essential for any business, as it provides valuable insights into its financial standing and capital.

Here’s a quick breakdown of how to record COGS:

- Define your reporting period: COGS is calculated and reported for a specific accounting period (monthly, quarterly, or annually) to match revenues with related expenses as per the matching principle in accounting.

- Gather the necessary data: By gathering and inputting relevant data, such as beginning inventory, purchases, direct costs, and ending inventory, your COGS calculation will reflect the actual expenses incurred during a period.

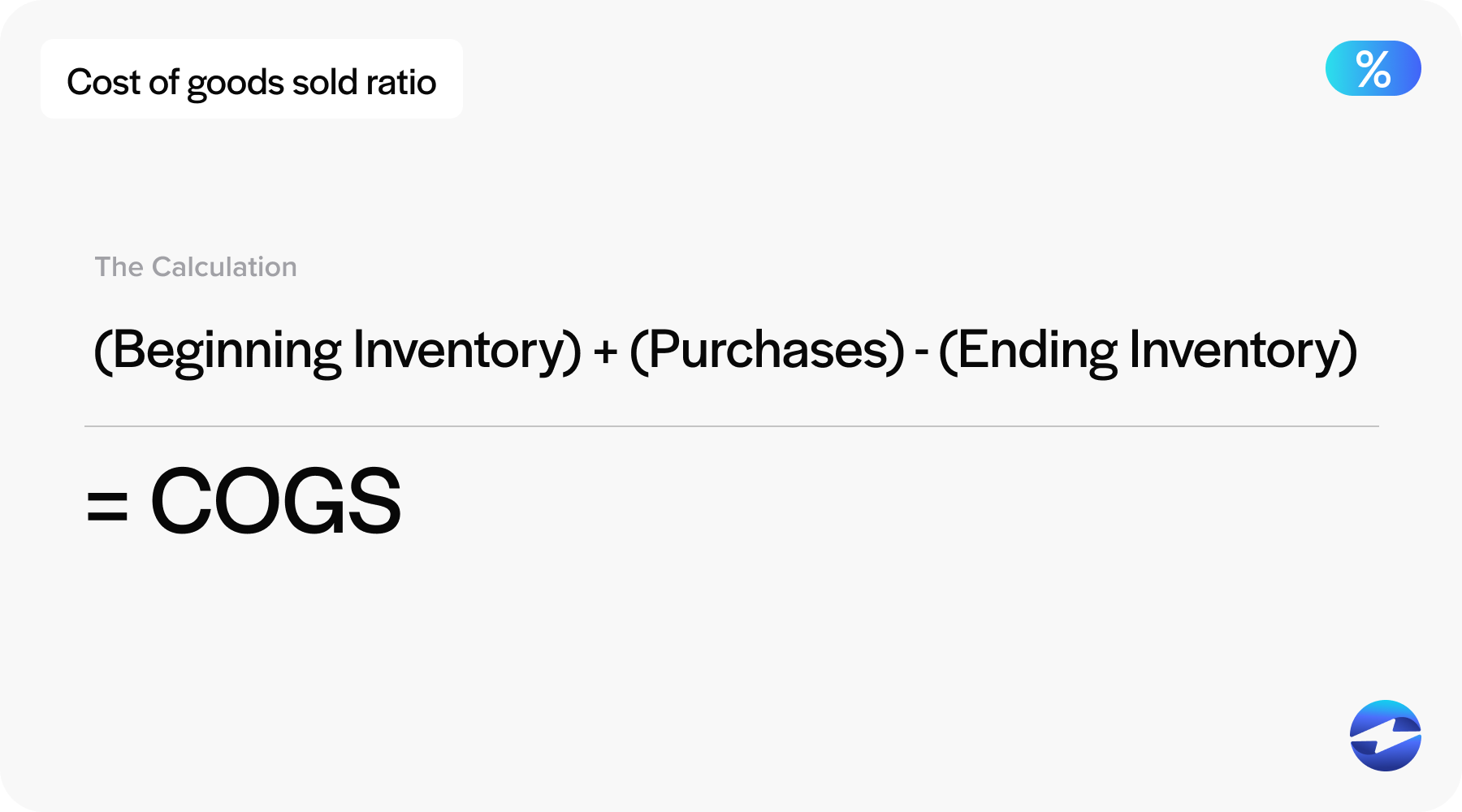

- Use the COGS formula to record all your expenses: COGS = (Beginning Inventory) + (Purchases) – (Ending Inventory)

- Record all purchases of inventory. Your business will need to record all inventory costs, including raw materials and any additional expenses incurred to prepare the goods for sale. It’s vital to keep accurate records of purchases to ensure the accuracy of your COGS calculation.

- Transfer costs to COGS. This transfer reflects the cost of goods sold during the period and involves a journal entry that debits COGS and credit inventory.

- Review inventory at the end of the accounting period. Your company will need to count its remaining stock and value it. Accurate inventory records are essential for calculating the correct ending inventory figure and directly affect the COGS calculation.

- Report COGS on your income statement. This is an essential component, as it will be deducted from sales revenue to determine gross profit. An accurate report of COGS provides insights into business expenses and profitability.

By understanding each step, you can ensure that the costs reflect the actual cost of goods sold.

See the example in the following section to better understand how the COGS recording process works.

Example of a COGS journal entry

For example, a manufacturing company sells goods for $10,000, and the cost of producing these goods is $6,000.

| Account Name | Debit | Credit |

|---|---|---|

| Cogs | $6,000 | |

| Inventory | $6,000 |

- Debit COGS: The $6,000 is debited from COGS. This entry reflects the cost of goods sold as a business expense on the income statement.

- Credit inventory: The $6,000 is credited to Inventory. This reduces the inventory account on the balance sheet since these goods have been sold.

This structured approach to recording COGS not only ensures accurate financial reporting but also enables business decision-making.

For more accuracy when recording COGS, businesses should follow several best practices.

4 best practices for recording COGS

Merchants would be wise to enforce reliable COGS recording protocols and tools to maintain clear financial records, determine profitability, and comply with accounting standards.

Following best practices for recording COGS can help businesses avoid errors, improve efficiency, and gain valuable insights into their operations.

Here are four best practices to improve your COGS recording process:

- Utilize technology and software: Using technology and software to record COGS simplifies and streamlines the process. Many accounting software options are available, offering tools to automate COGS calculations.

- Consistency in accounting methods: Using the same accounting methods across periods helps maintain clear and comparable records. This consistency ensures that changes in COGS are due to actual business performance, not accounting discrepancies. Pick a method that suits your business and stick to it, whether it’s First-In-First-Out (FIFO), Last-In-First-Out (LIFO), or another.

- Training staff: Routine training will ensure that employees involved in accounting are aware of current procedures and software and conduct the most accurate COGS recording, preventing costly mistakes and misstatements.

- Regular inventory management: Implement timely inventory audits and counts to align inventory levels with accounting records. Effective inventory management is essential for recording COGS, as it helps businesses properly assess their costs.

Proper monitoring and recording of COGS enable businesses to remain compliant with income tax regulations and financial reporting standards like Generally Accepted Accounting Principles ( GAAP) and implement strategic initiatives that drive growth and profitability.

How businesses can leverage COGS data to generate more growth

Beyond simply recording expenses, COGS is a foundation for making informed pricing, inventory management, and cost optimization decisions. Businesses can leverage COGS data to uncover patterns, identify inefficiencies, and implement targeted strategies to improve profitability.

As industries evolve and technology advances, the ability to record, analyze, and act on COGS data will continue to be a competitive advantage. Embracing these practices ensures businesses are compliant and well-positioned to adapt to changes, seize opportunities, and thrive in an ever-competitive market.

COGS is more than tracking costs — it’s about unlocking a roadmap to more innovative business growth.

Get a free cost-comparison of your current payment processing costs vs. EBizCharge

Get a free cost-comparison of your current payment processing costs vs. EBizCharge