Blog > What’s The Difference Between Manual and Automated Accounting Systems?

What’s The Difference Between Manual and Automated Accounting Systems?

The choice between manual and automated accounting systems can significantly impact organizational efficiency. As companies strive to keep pace with evolving transactions, understanding the nuances of these accounting methods becomes essential.

This article will explore the key differences between manual and automated accounting systems, exploring various aspects such as process, accuracy, cost, and scalability.

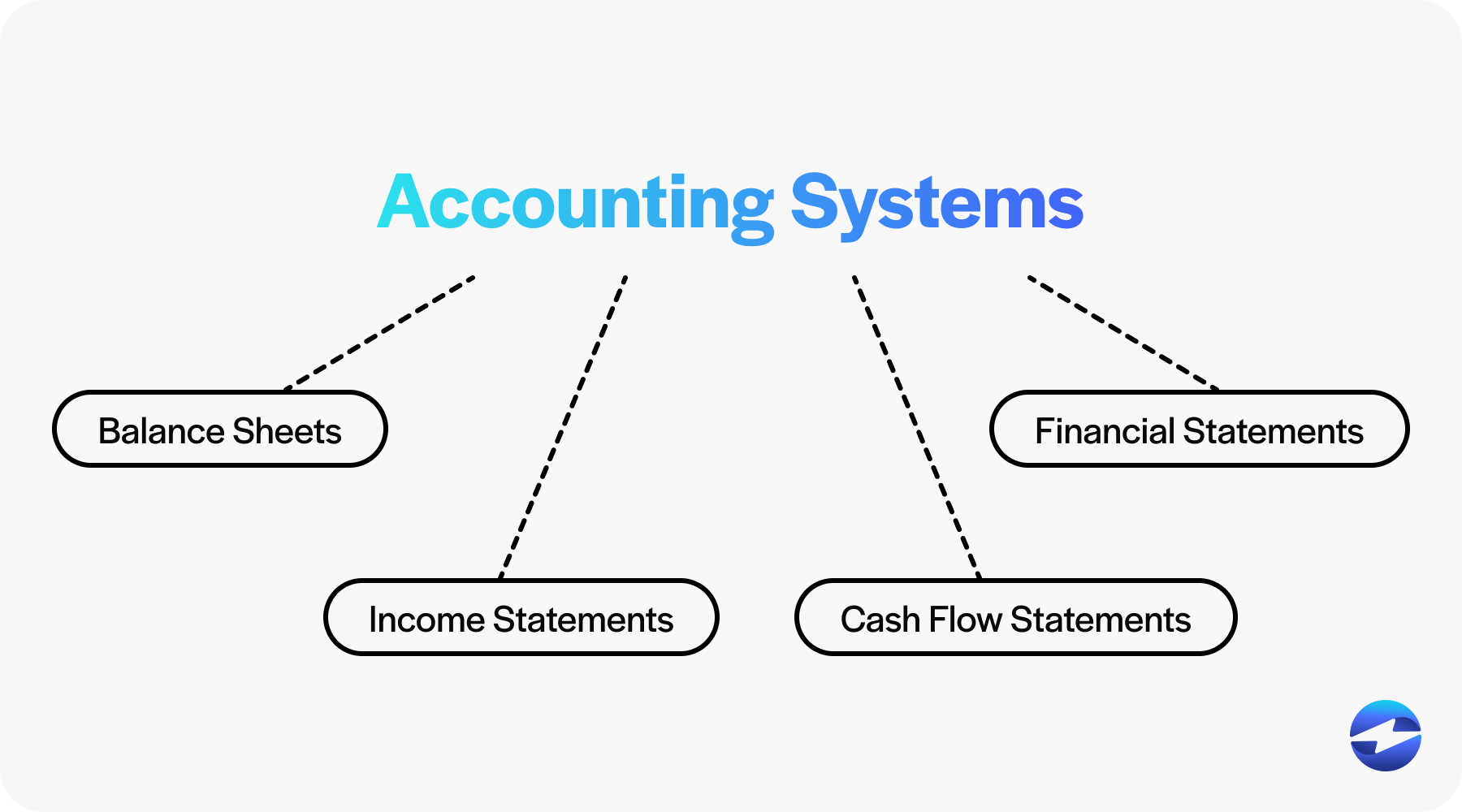

What are accounting systems?

Accounting systems are the methods and processes used to capture, record, classify, and report financial transactions. They serve the fundamental purpose of tracking all financial activities within a business or organization and provide the necessary data to prepare financial statements, such as the balance sheet, income statement, and cash flow statement. Effective accounting systems help businesses manage their finances by monitoring revenue and expenses, ensuring statutory compliance, and providing data-driven insights for business strategy and decision-making.

Manual accounting systems

Manual accounting systems are traditional methods where all accounting tasks are performed by hand. A manual bookkeeping system requires the use of paper journals and ledgers to record financial transactions. Each entry is made individually, often transcribed from physical documents such as receipts, invoices, or bank statements.

Automated accounting systems

Automated accounting systems use computerized accounting software to manage and process financial transactions with minimal human intervention. In this digital form of accounting, transactions are entered into the software, and the system automatically updates the books.

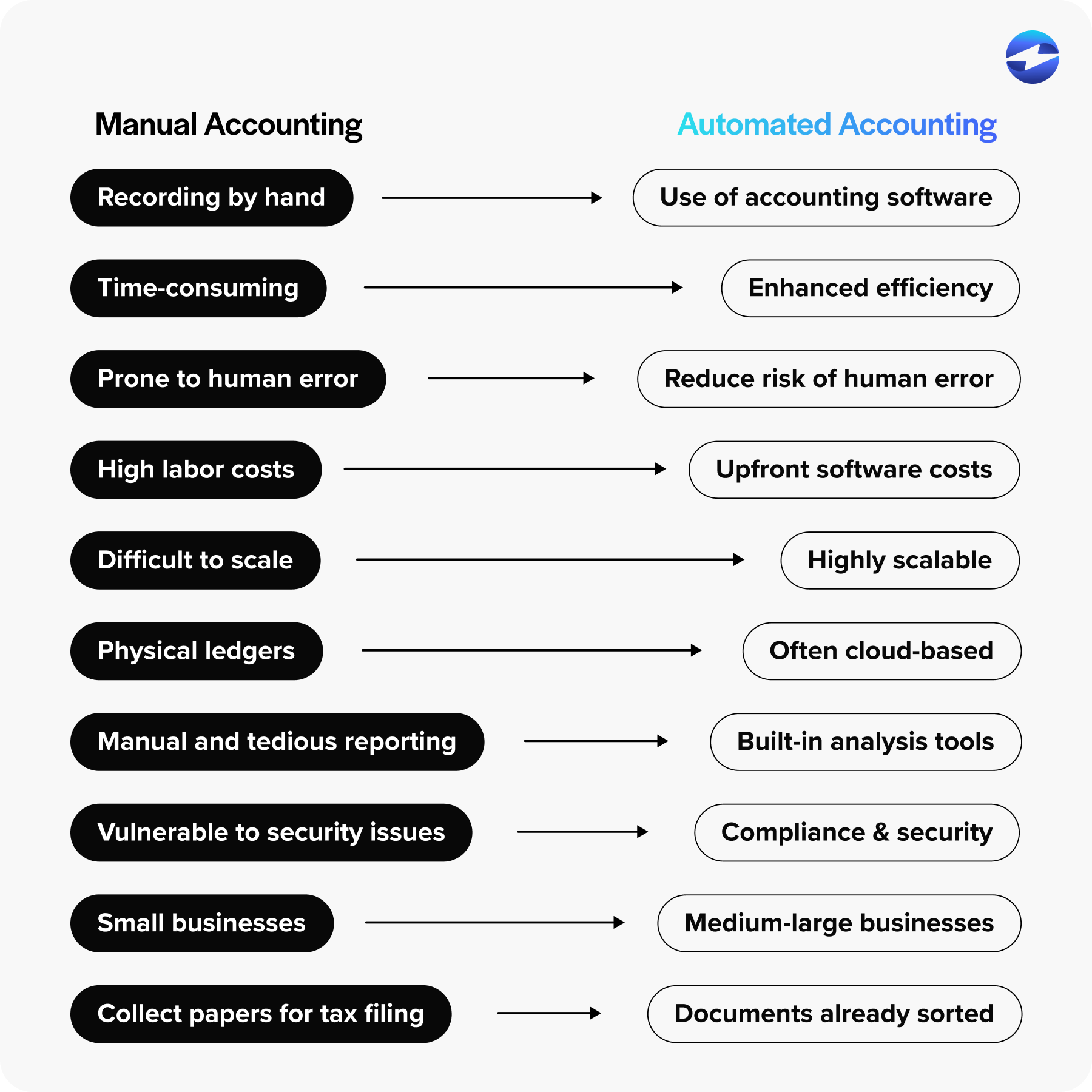

Manual vs Automated accounting: What’s the difference?

Manual and automated accounting systems represent two fundamentally different approaches to handling financial transactions and maintaining financial records. The main distinction lies in the implementation of processes and technology, but there are many distinctions:

1. Process

- Manual accounting: Involves recording transactions by hand, usually in physical ledgers or spreadsheets. Every transaction is manually entered, calculated, and categorized by an accountant or bookkeeper.

- Automated accounting: Uses accounting software to automatically record, categorize, and calculate financial transactions. The software can connect to bank accounts, payment systems, and other data sources to automate data entry and processing.

2. Speed and efficiency

- Manual accounting: Time-consuming, as every transaction must be recorded individually. This can slow down the accounting process, especially for businesses with a high volume of transactions.

- Automated accounting: Much faster and more efficient. Transactions are recorded in real-time, reducing the time spent on data entry and allowing accountants to focus on analysis and strategic tasks.

3. Accuracy

- Manual accounting: Prone to human error. Mistakes in data entry, calculations, or categorization can lead to inaccurate financial records, which may require additional time for corrections and audit.

- Automated accounting: Reduces the risk of human error by automating calculations and data entry. While software errors are still possible, the overall risk of inaccuracies is lower than manual accounting.

4. Cost

- Manual accounting: Typically involves lower upfront costs since it doesn’t require specialized software. However, it can become costly in terms of labor, requiring more time and effort from accountants or bookkeepers.

- Automated accounting: Involves upfront costs for purchasing and implementing accounting software. However, it can save money in the long run by reducing labor costs and improving efficiency.

5. Scalability

- Manual accounting: Difficult to scale as a business grows. Managing an increasing number of transactions manually can become overwhelming and inefficient, leading to delays and errors.

- Automated accounting: Highly scalable. Accounting software can handle large volumes of transactions with minimal additional effort, making it easier for businesses to grow without being bogged down by accounting tasks.

6. Accessibility

- Manual accounting: Typically stored in physical ledgers or offline spreadsheets, making it less accessible. Sharing information with other team members or stakeholders can be cumbersome.

- Often cloud-based, allowing for easy access to financial data from anywhere. Multiple users can access and update the data simultaneously, which enhances collaboration and real-time decision-making.

7. Reporting and analytics

- Manual accounting: Generating reports requires manual complication and calculations, which can be time-consuming and less detailed. Analyzing data manually is more challenging and less efficient.

- Automated accounting: Allows for quick and detailed reporting with built-in analysis tools. Financial data can be easily compiled into reports, charts, and graphs, providing valuable insights in real-time.

8. Security

- Manual accounting: Physical records can be vulnerable to loss, theft, or damage. Securing sensitive financial information can be more challenging without digital safeguards.

- Automated accounting: Offers enhanced security features such as data encryption, backups, and controlled access. Cloud-based solutions also protect against physical damage and allow for quick data recovery.

9. Business type

- Manual accounting: Often used by smaller businesses, sole proprietors, or those with limited transaction volume. These businesses may not have the budget for accounting software or may prefer the simplicity of handling their own records without relying on technology. Manual accounting is common in traditional industries, small retail shops, local service providers, and startups with minimal transactions.

- Automated accounting: Typically used by medium to large businesses or any business with a higher volume of transactions and more complex financial needs. Companies in industries such as e-commerce, manufacturing, real estate, and professional services often rely on automated accounting to handle the scale and complexity of their finances. Even small businesses focusing on growth and efficiency may opt for automated solutions.

10. Tax time

- Manual accounting: Businesses using manual accounting must gather and organize all financial records by hand, which can involve sifting through physical receipts, invoices, and ledger entries. The manual nature of the process increases the risk of errors, such as missing deductions, inaccurate calculations, or overlooked expenses. Preparing tax returns may require additional help from an accountant to ensure compliance and accuracy, adding to the time and cost. Meeting deadlines may also be a challenge if records are incomplete or disorganized.

- Automated accounting: Automated accounting software allows businesses to quickly generate financial reports and summaries necessary for tax filing. Tax-related data, such as expenses, income, and deductions, are already organized and categorized within the system. This reduces the time spent on gathering and preparing documents and minimizes the risk of errors. Many automated accounting solutions also offer integration with tax software, making it easier to file taxes electronically.

Now that you know the primary differences between these accounting systems, you should understand why many companies are switching to automated systems.

The power of automation

The shift from manual to automated accounting systems has been significant, primarily driven by the desire for efficiency and accuracy. Automated accounting software appeals to businesses because it can streamline repetitive tasks and reduce the risk of human error.

With the added convenience of integrating bank accounts, simplifying bank statement reconciliation, and improving accuracy in tax return preparation, businesses recognize the extensive advantages of automated systems. Moreover, digital accounting solutions are well-suited to handle a wide range of financial transactions efficiently, making a compelling case for their adoption over manual processes.

Businesses often integrate with third-party payment processors to facilitate these automated systems. This integration provides numerous advantages, including tools and features aimed at simplifying payment transactions.

Automating accounting processes with EBizCharges

EBizCharge plays a pivotal role in facilitating automated accounting processes. By integrating with existing accounting systems, EBizCharge automates tedious tasks such as data entry, reconciliation, and reporting, significantly reducing the margin for human error. This not only enhances the accuracy and efficiency of financial management but also frees up valuable time for businesses to focus on growth and strategic planning.

With its automation capabilities, EBizCharge ensures businesses can scale efficiently while maintaining precise, up-to-date financial records.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.