Blog > Credit Card Decline Codes Explained

Credit Card Decline Codes Explained

As consumers increasingly rely on digital transactions, they may face the frustrating experience of a declined credit cards. These declines often come with cryptic codes that offer little understanding to the average person.

Familiarizing oneself with decline codes can empower users with the knowledge needed to navigate payment issues.

What are credit card decline codes?

Credit card decline codes are specific error messages issued by a card issuer or bank when a credit card transaction can’t be processed. These codes communicate the reason for the decline, helping the merchant and cardholder understand whether the issue is with the card itself, the account, or the processing system.

Common reasons for declines include insufficient funds, an expired card, or surpassing a credit limit.

Decline codes can typically be categorized as soft declines or hard declines. Soft declines often result from temporary issues like communication errors, whereas hard declines may indicate a more severe issue, such as an invalid card number or a particular condition set on the card.

Card decline codes often vary by payment processor and card company, such as American Express or Visa.

It’s essential to be aware of various credit card decline codes since they can dictate whether to resubmit a transaction or an alternative payment method is necessary.

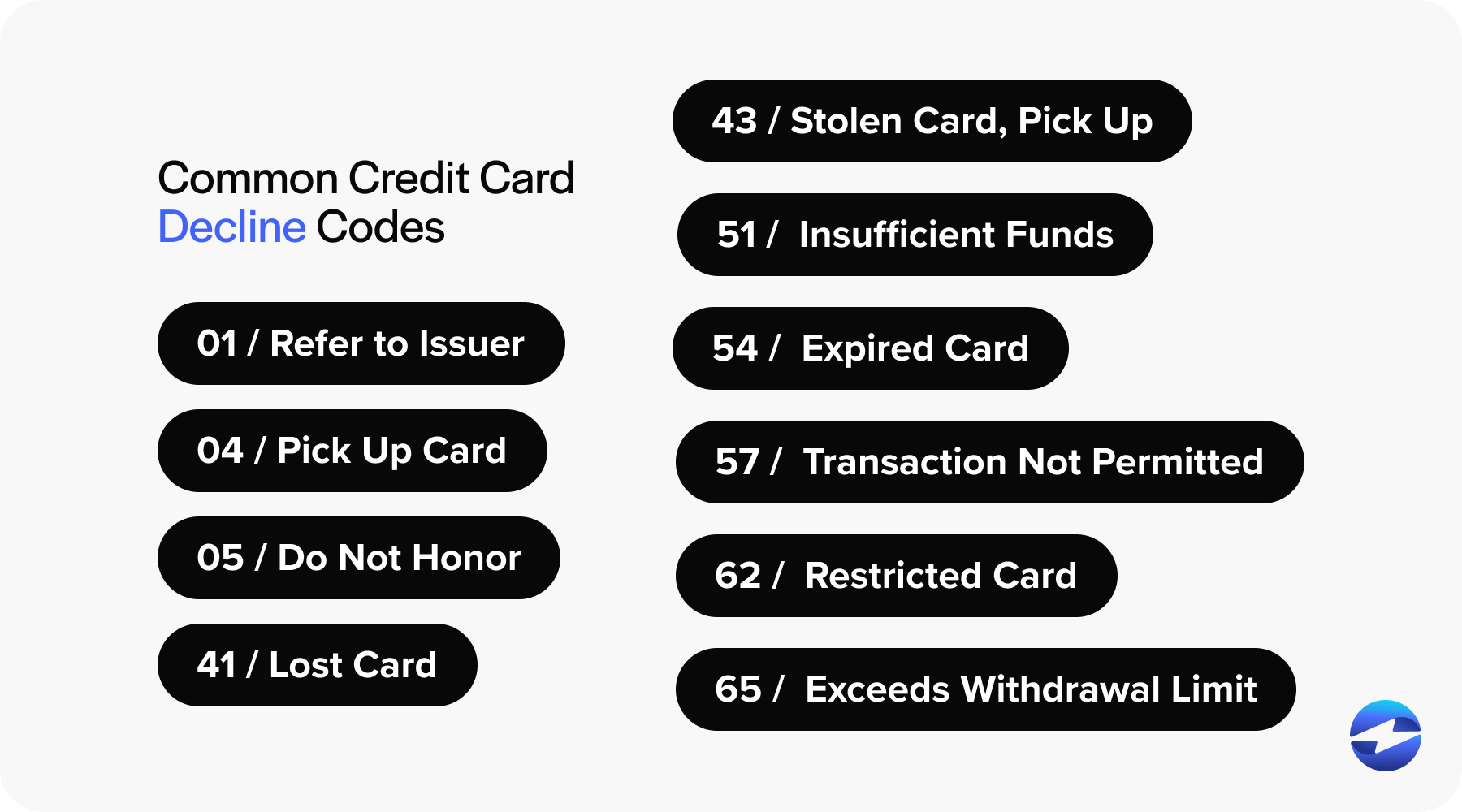

Common credit card decline codes

With a proper understanding of the various credit card decline codes, businesses can pinpoint the issue to minimize confusion and improve the user payment experience.

Here are 10 common credit card decline codes along with their definitions:

| Code # | Description | Definition |

|---|---|---|

| 01 | Refer to Issuer | The card-issuing bank requests a call to authorize the transaction. |

| 04 | Pick Up Card | The merchant should retain the card, and the issuing bank should be contacted. |

| 05 | Do Not Honor | The card issuer has declined the transaction for an unspecified reason. |

| 41 | Lost Card | A lost card has been reported, and the merchant should retain the card. |

| 43 | Stolen Card, Pick Up | A card has been stolen, the merchant should retain the card. |

| 51 | Insufficient Funds | The cardholder doesn’t have enough funds to cover the transaction. |

| 54 | Expired Card | The card has surpassed its expiration date and is no longer valid. |

| 57 | Transaction Not Permitted | The card issuer has restricted the card for this type of transaction. |

| 62 | Restricted Card | The card has specific restrictions that prevent the transaction. |

| 65 | Exceeds Withdrawal Limit | The cardholder has exceeded his/her withdrawal or purchase limit. |

Credit card transactions can be denied for various reasons. Understanding the associated decline codes is essential for merchants and customers, as each code communicates a specific message from the card issuer regarding the transaction’s status.

Complete list of credit card decline codes

While there are many credit card decline codes, there are three main categories of credit card codes.

Credit card decline codes can be divided into three types: Call/Decline, Hold-Call, and Error Codes. While they all have the same declined card outcome, each code can stem from a different cause.

Call/Decline codes

Call/Decline codes often signal that the merchant must call the card’s issuing bank or that the transaction has been outright declined without a specific reason provided by the issuer.

Common Call/Decline code examples include:

| Code # | Description |

|---|---|

| 01 | Refer to issuer |

| 02 | Refer to issuer, special condition |

| 04 | Pick up card (no fraud) |

| 05 | Do not honor |

| 51 | Insufficient funds |

| 54 | Expired card |

| 57 | Transaction not permitted, card |

| 65 | Activity limit exceeded |

| 93 | Violation, cannot complete |

Merchants may encounter these codes in real time. They must know the steps to take, such as contacting the card issuer or refusing the transaction.

Hold-Call codes

Hold-Call codes are similar to Call/Decline codes but typically indicate a more urgent situation, such as potential fraud or a block on the card by the issuer.

Common Hold-Call code examples include:

| Code # | Description |

|---|---|

| 07 | Pick up card, special condition (fraud account) |

| 41 | Lost Card, Pick Up |

| 43 | Stolen Card, Pick Up |

When a Hold-Call code is received, the point-of-sale (POS) equipment may notify the merchant to confiscate the card and contact the issuer immediately.

Error codes

Error codes typically indicate problems with the transaction processing rather than issues related to the card’s status or the account’s standing.

Common Error code examples include:

| Code # | Description |

|---|---|

| 00 | Issuer system unavailable |

| 12 | Invalid transaction |

| 13 | Invalid amount |

| 14 | Invalid card number |

| 15 | No such issuer |

| 19 | Re-enter |

| 28 | File is temporarily unavailable |

| 58 | Transaction not permitted, terminal |

| 62 | Invalid service code, restricted |

| 63 | Security violation |

| 85 | Issuer system unavailable |

| 85 | No reason to decline |

| 91 | Issuer switch is unavailable |

| 96 | System error |

| 85 | No reason to decline |

| 91 | Issuer or switch is unavailable |

| 93 | Violation, cannot complete |

| 96 | System error |

| CV | Card type verification error |

| R0 or R1 | Customer requested stop of specific recurring payment |

For error codes, the merchant or the customer may need to re-enter the transaction details or use a different form of payment if the error persists.

Process payments with a reliable payment processor like EBizCharge

Understanding and interpreting credit card decline codes can benefit all involved parties involved by guiding their actions.

Merchants that manage and offer credit card payments to their customers should actively review all credit card decline codes to facilitate smoother transactions and resolve issues more effectively. By optimizing the user payment experience to mitigate and avoid declined credit cards, businesses can encourage more customer loyalty, growth, and long-term revenue.

EBizCharge can also enhance the user experience by optimizing credit card payment processing operations for merchants to help them avoid transaction issues and decline payments.