Blog > What Is Revenue Recognition: Methods and Best Practices

What Is Revenue Recognition: Methods and Best Practices

How a company recognizes its revenue can significantly impact its financial health and reporting. Understanding this fundamental aspect is crucial for stakeholders, from investors to management, as it directly influences profitability and valuation.

This article will outline the different methods of revenue recognition and best practices for ensuring compliance and accuracy.

What is revenue recognition?

Revenue recognition is a generally accepted accounting principle (GAAP) that determines the conditions under which revenue is recognized and accounted for. It dictates when an entity can record its sales or services income in its financial statements.

The core concept behind revenue recognition is to reflect income when it’s earned, which may not necessarily coincide with when the payment is received. This means the business shows the income in its books when the service is provided, or the product is delivered, even if the customer hasn’t paid yet. The process behind revenue recognition is relatively simple, containing 5 steps.

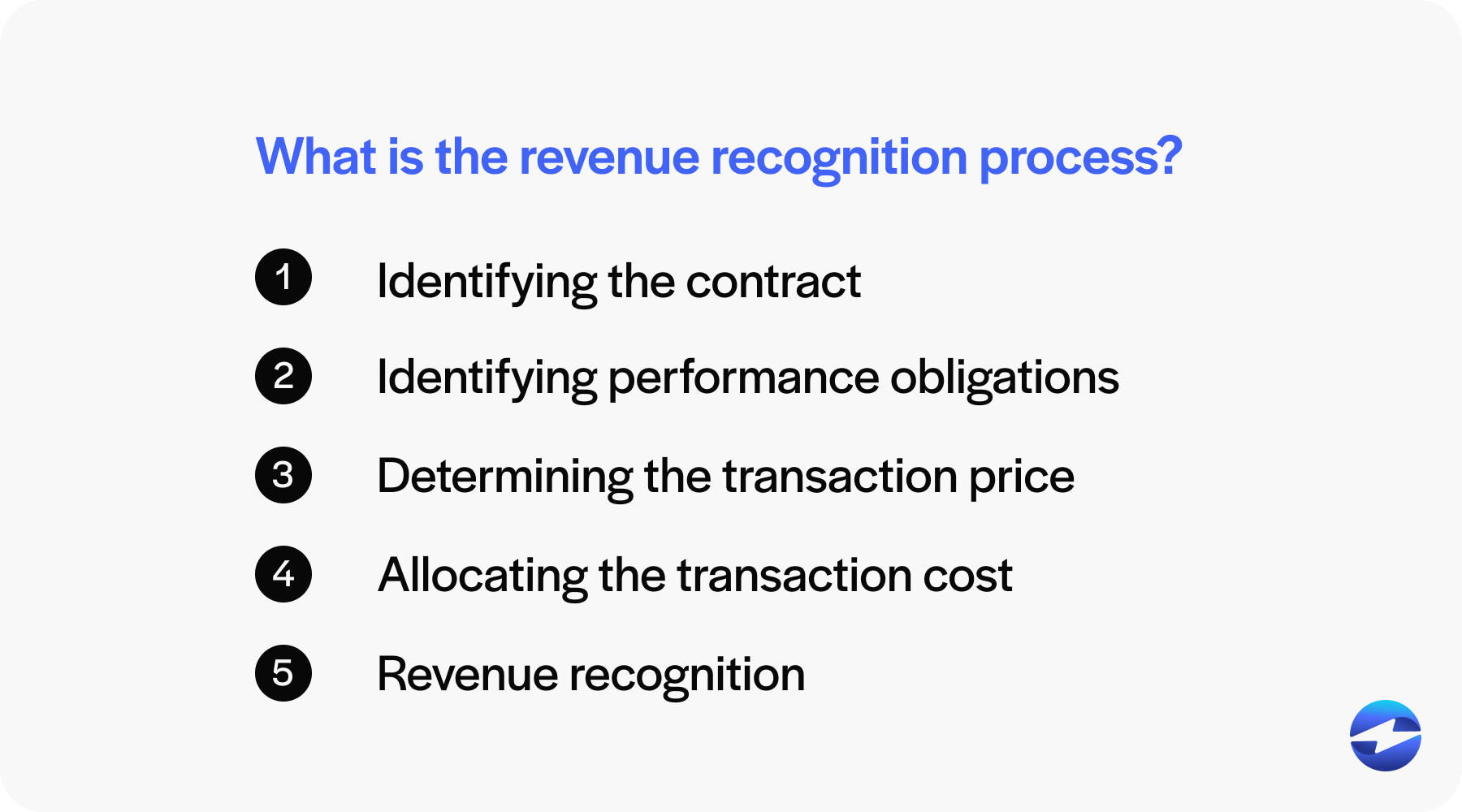

What is the revenue recognition process?

Understanding the revenue recognition process is essential for offering transparency and a consistent framework for financial reporting across diverse business models and industries.

- Identifying the contract: The first step in the revenue recognition process is identifying the contract with a customer, which sets the foundation for the next steps.

- Identifying performance obligations: Once the contract is established, the second step involves identifying the performance obligations within the contract. A performance obligation is a promise to transfer goods or services to the customer.

- Determining the transaction price: The transaction price is the amount the entity expects to be owed in exchange for transferring promised goods or services to a customer. This can include fixed amounts, variable costs, and any non-cash amounts. Factors such as discounts, rebates, refunds, credits, incentives, and penalties can affect the transaction price, and the entity must consider the effects of each on the amount it will be owed.

- Allocating the transaction cost: The fourth step involves allocating the transaction price to the performance obligations identified in the contract. If a contract has multiple performance obligations, the entity must allocate the transaction price to each obligation based on their standalone selling prices. This allocation reflects the amount of revenue to be recognized upon the payment of each obligation.

- Revenue recognition: Revenue is recognized when the entity satisfies a performance obligation by transferring control of a promised good or service to the customer, which can occur over time. Factors such as the transfer of legal title, physical possession, risk and rewards of ownership, and customer acceptance can influence the timing of recognition.

With this process, businesses can ensure accurate revenue reporting, which is fundamental to an organization’s financial reporting and a vital indicator of its financial performance. It’s important to note that there are numerous revenue recognition models, each serving as a solution for different circumstances.

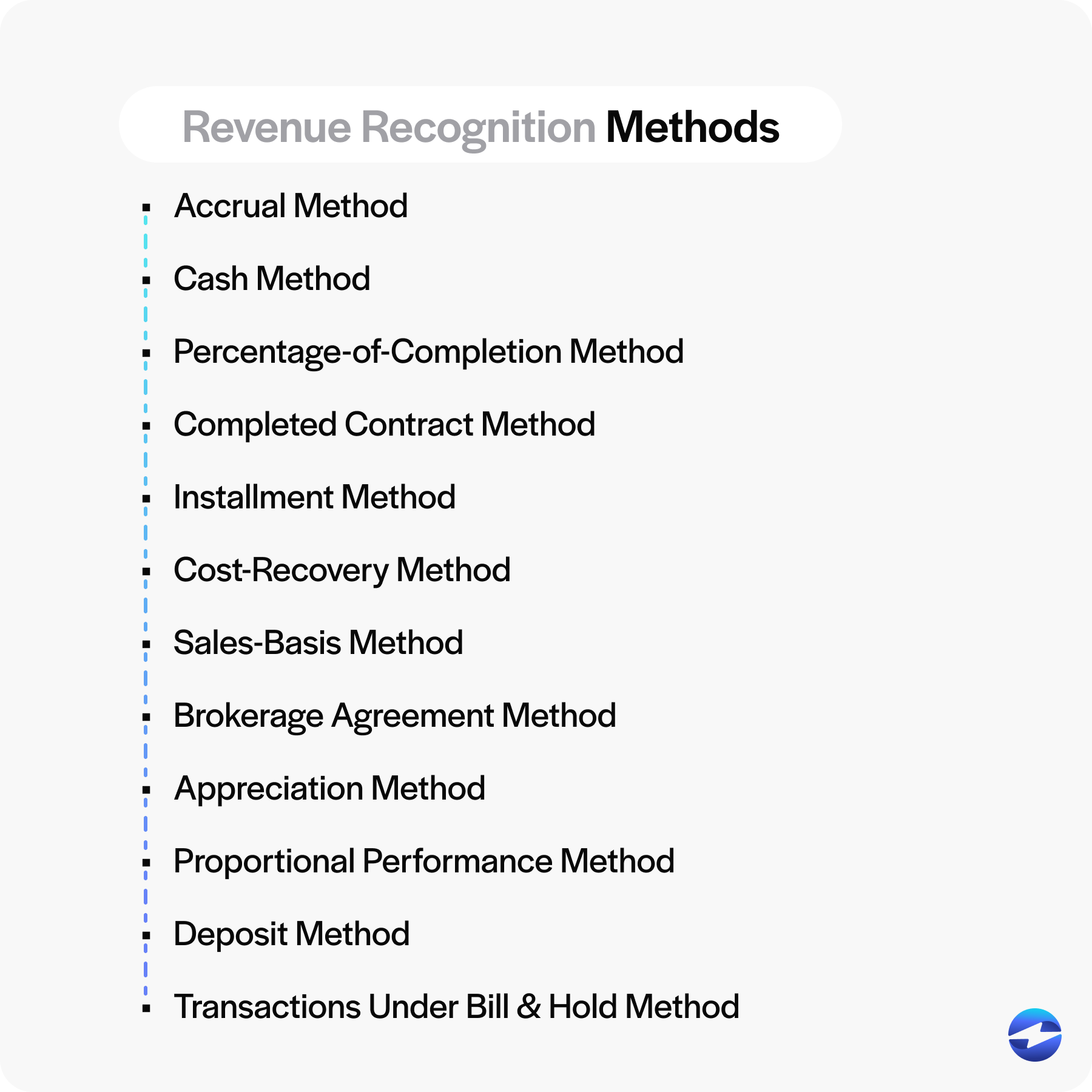

What are some revenue recognition methods?

Revenue recognition isn’t a one-size-fits-all process; instead, it involves a selection from multiple revenue recognition methods that vary based on the type of business, industry standards, or the nature of the transaction. Here are a few revenue recognition models to keep in mind:

Accrual method

The accrual method is a key revenue recognition technique where income is recorded when it’s earned, regardless of when the payment is received. This method adheres to the matching principle, ensuring that revenues and expenses are recorded in the period they occur. The accrual method provides a more accurate reflection of a company’s financial position over time, making it the preferred approach for revenue recognition in accordance with many accounting standards, including Generally Accepted Accounting Principles (GAAP) and International Financing Reporting Standards (IFRS).

Cash method

The cash method of revenue recognition records revenue only when cash is received from customers, not when it’s earned. Expenses, similarly, are recognized when they’re paid. Although this method is simpler and offers a clear picture of cash flow, it doesn’t always accurately depict the economic reality of a company’s financial performance, as it disregards the actual timing of revenue recognition and matching of incurred expenses.

Percentage-of-completion method

The percentage-of-completion method is primarily used in long-term projects where revenue and expenses are recognized as the project progresses. It allocates revenue based on the percentage of work completed during the accounting period, providing a timely reflection of work done and the financial reality of ongoing projects.

Completed contract method

The completed contract method delays revenue recognition until a contract is fully completed. While this method is straightforward and minimizes revenue recognition based on estimates, it can result in fluctuating income statements, particularly for long-term contracts. It’s usually applicable in instances where project outcomes are uncertain or when it’s difficult to estimate the project’s degree of completion.

Installment method

The installment method is used when revenue is recognized proportionally as cash payments are received from customers. Commonly applied in real estate or high-ticket item sales, this method provides a basis for recognition corresponding to the pattern of cash inflows and can be particularly useful when collections on sales are uncertain.

Cost-recovery method

Under the cost-recovery method, no profit is recognized until all the costs incurred in the sales transaction have been recovered. After recovery, all subsequent payments are recorded as profits. This conservative method safeguards against recognizing revenue prematurely when the collectability of a sale’s price is in doubt.

Sales-basis method

The sales-basis method recognizes revenue at the point of sale, typically when the title and risks of ownership have transferred to the buyer. This method is widely applicable to retail and many other businesses where transactions are clear-cut, and the transfer of control is immediate.

Brokerage agreement method

In the brokerage agreement method, revenue is recognized when a broker’s services are complete, leading to a transaction between two parties. The commission or fee earned by the broker is recorded as revenue only after the deal is finalized, ensuring that recognition aligns with the broker’s contractual obligation fulfillment.

Appreciation method

The appreciation method, though rare, focuses on recognizing revenue as assets (typically investments) increase in value over time. Any gains arising from the appreciation of asset values are considered revenue. Due to its reliance on market conditions, this method isn’t frequently used to recognize operational revenues.

Proportional performance method

The proportional performance method splits each distinct service within a contract and recognizes revenue as each element is fulfilled. This method demands an evaluation of multiple performance obligations, matching revenue with services rendered throughtout a contract.

Deposit method

When using the deposit method, revenue recognition is deferred until the certainty of a sale increases, even if cash has been received. Payments are recorded as liabilities on the balance sheet (as customer deposits), not as revenue until the full scale is completed or the services are performed, reflecting ongoing obligations.

Transactions under bill & hold method

In the transaction under the bill & hold method, revenue is recognized even though the goods remain at the seller’s premises at the customer’s request. Prerequisites for this method include a confirmed sale with an established price, the customer’s explicit request for delayed delivery, goods ready for shipment, and inventory segmentation from the seller’s goods. This method tends to be more complex due to the need for objective evidence that a sale has occurred.

Understanding the various methods of revenue recognition is crucial as they determine when and how a company reports its income, impacting the financial statements and, by extension, the interpretation of financial health.

Best practices for revenue recognition

Understanding and implementing best practices for revenue recognition is crucial for any business to ensure its financial statements accurately represent its financial performance and position.

- Understand the applicable standards: Understanding the applicable revenue recognition standards is crucial as these provide the framework for recognizing revenue. The revenue recognition models put forth by the FASB and IASB offer comprehensive guidelines that must be followed.

- Implement a robust contract review process: A robust contract review process is imperative for revenue recognition. Since revenue is recognized when certain criteria are met, usually detailed in contracts, understanding each contract’s terms is imperative. The review process should be designed to identify all performance obligations and assess the terms of the transfer of control of goods or services.

- Use clear and consistent policies: Clear and consistent revenue recognition policies are fundamental for accurate financial reporting. These policies should reflect the relevant revenue recognition standards and be communicated effectively throughout the organization.

- Maintain accurate and detailed records: Maintaining accurate and detailed records is imperative in revenue recognition. Detailed records support the accuracy of recognition by providing a clear trail of evidence for each transaction. This includes maintaining supporting documentation such as contracts, invoices, and work orders.

- Automate when possible: When feasible, automating the revenue recognition process can significantly improve accuracy and efficiency. Automation reduces the likelihood of human error and can streamline complex calculations and workflows associated with recognizing revenue over time or in complicated transaction situations.

By adopting these best practices, businesses can avoid common pitfalls such as premature revenue recognition, which can lead to a distorted picture of financial health and potentially serious consequences in the form of regulatory penalties or loss of investor trust. As mentioned, automation is a great way to simplify revenue recognition. Comprehensive payment processing solutions that can facilitate this automation serve as an invaluable tool.

Simplifying revenue recognition with a comprehensive payment processing solution

A payment processing solution capable of automating the revenue recognition process ensures financial statements reflect the economic reality of business transactions accurately and promptly. Automated systems reduce errors associated with manual data entry and make adhering to various revenue recognition standards easier, including recognizing revenue as performance obligations are fulfilled. This leads to an accurate reflection of a company’s financial performance.

Software solutions such as EBizCharge can facilitate this automation, integrating into existing accounting systems to provide seamless and accurate revenue recognition. EBizCharge includes features such as automated invoicing, real-time reporting, and compliance checks that align with the latest revenue recognition standards. Through automation, the revenue recognition process becomes more manageable and less prone to error, contributing to the overall reliability of financial reporting.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.