Blog > Understanding EDI Payments: Key Differences from ACH and EFT Transactions

Understanding EDI Payments: Key Differences from ACH and EFT Transactions

Ideal for businesses globally, EDI payment systems are crucial for electronic data interchange, carving a niche in the financial transaction process.

Understanding an EDI payment and how it differs from Automated Clearing House (ACH) and Electronic Funds Transfer (EFT) is pivotal for efficient financial operations in an increasingly digital world.

What is an EDI payment?

An Electronic Data Interchange Payment, or EDI Payment, refers to a system where financial transactions are processed electronically in a standardized format. This method is often used in business-to-business (B2B), where companies exchange payment documents such as invoices and purchase orders electronically instead of as paper documents.

EDI payments streamline the payment process, reduce human error, minimize manual data entry, and facilitate faster funds transfers between banks.

The standardized format is critical, ensuring that payment information is compatible across different systems used by various business partners. This contributes to efficient electronic payments and can save costs by eliminating the need for paper checks and manual payment processes.

EDI payments are a direct way to facilitate electronic funds transfer specific to business transactions, ensuring that the flow of financial data is seamless and secure.

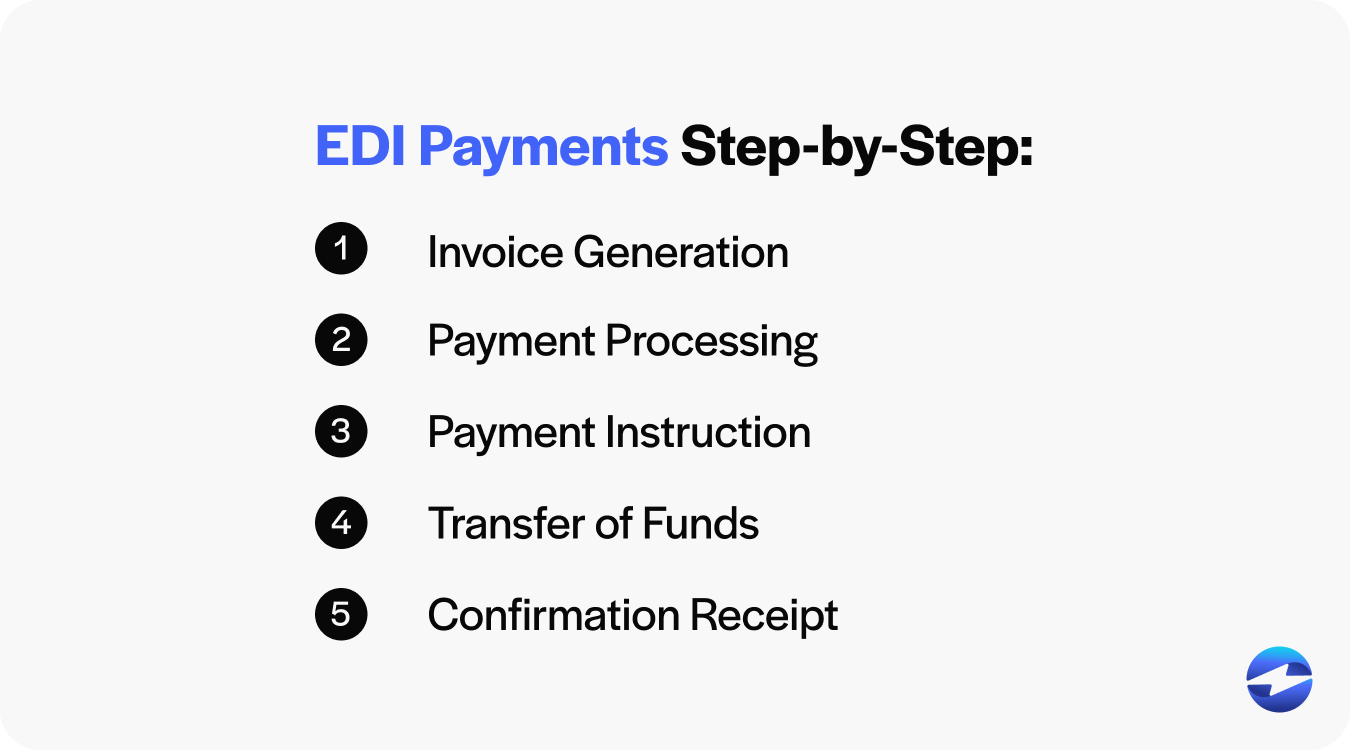

How do EDI payments work?

Understanding how EDI payments work involves a series of automated steps that enhance efficiency and accuracy in business transactions. These steps include generating and sending electronic invoices, processing payments, sending payment instructions electronically, transferring funds between banks, and confirming receipt of payment, all facilitated through EDI software.

Here’s how EDI Payments Work:

- Invoice Generation: A seller generates an electronic invoice and sends it to the buyer through EDI software.

- Payment Processing: The buyer processes the invoice and prepares the payment information, again using EDI.

- Payment Instruction: Payment instructions are sent electronically from the buyer to their bank, often as an EDI 820 transaction set.

- Transfer of Funds: The buyer’s bank transfers funds to the seller’s bank account.

- Confirmation Receipt: Confirmation of the payment is sent back to the buyer, completing the transaction loop.

With EDI, the entire payment transaction is carried out over secure networks with a high level of accuracy, resulting in reduced processing times and minimizing human error. Funds between banks are transferred efficiently, contributing to faster settlement and cost savings for both parties.

What are the differences between EDI, ACH, and EFT payments?

Electronic payments have evolved, making financial transactions more convenient and efficient. Understanding the differences between EDI payments, ACH, and EFT is crucial when considering the electronic transfer of funds. These payment methods have distinct characteristics, protocols, and uses.

While they may overlap in their goal to facilitate money transfers and reduce reliance on paper checks, each has a unique role in electronic transactions.

EDI vs ACH

EDI payments refer to the process and standards for exchanging business documents electronically, including the transfer of funds. Meanwhile, ACH is a specific network for moving funds between banks in the United States. ACH is widely known for processing large credit and debit transactions, including direct deposits and bill payments.

Key Differences:

- Data Exchange: EDI encompasses a broader range of information beyond payment details, such as invoices and purchase orders; ACH solely focuses on the financial side.

- Transaction Types: EDI is often used for transactions between companies, while ACH can be used for both business-to-business and individual transactions.

- Standards: EDI follows strict international standards for formatting electronic documents, whereas ACH transactions comply with the National Automated Clearing House Association (NACHA) rules.

Similarly, EFT involves the electronic movement of money between bank accounts but does differ in a few ways from EDI.

EDI vs EFT

EFT, Electronic Funds Transfer, is a broad term for any electronic payment method, including ACH transfers, credit card payments, and wire transfers. EDI is an EFT method that focuses on inter-company communication. It aids explicitly in exchanging all types of business documents and completes payment instructions in a standardized format.

Key Differences:

- Scope: EDI refers to the payment itself and the comprehensive exchange of transaction-related documents; EFT indicates any electronic transfer of funds.

- Standards: EDI demands a highly standardized format to facilitate the exchange of business information, whereas EFT could include various forms of electronic transfers without the need for standardized business documents.

ACH vs EFT

ACH is a form of EFT, but EFT is a broad category encompassing different electronic payment types, including ACH. All ACH transactions are forms of EFTs, but not all EFTs are ACH transactions.

Key Differences:

- Network: ACH operates under a specific network with its own rules and protocols, while EFT is an overarching term covering any electronic fund transfer.

- Variety of Transfers: EFT includes a broader array of transactions, such as wire transfers, electronic checks, ATM withdrawals, and ACH payments.

- Geographical Scope: ACH is primarily used for domestic transactions within the US, while EFTs can be used for domestic and international money transfers.

The table below can provide a quick glance at the difference.

| Key Factor | EDI | ACH | EFT |

|---|---|---|---|

| Focus | Business document exchange | Financial transactions | Broad term – all kinds of electronic transfers |

| Scope | International standards | Domestic US transfers, NACHA regulations | Includes all electronic payment types |

| Uses | B2B transactions | Business and individual transactions | Domestic and international transfers |

These electronic payment methods continue influencing how businesses and individuals manage financial transactions, driving a more efficient and paperless economy.

The 2 main types of EDI payments

Two primary types of EDI payments enable business partners to execute electronic transactions: Direct or Point-to-Point EDI and Web EDI. Each type adheres to standardized rules for the electronic transmission of financial data, which helps to reduce manual data entry, minimize human error, and enhance the speed of payment processing.

Direct or point-to-point EDI

Direct refers to the electronic exchange of business documents between organizations in a standardized format. EDI involves a direct connection between two business partners without the need for intermediary services.

Direct EDI relies on secure and private networks, such as a Value-Added Network (VAN) or protocols like FTP (File Transfer Protocol) and AS2 (Applicability Statement 2).

Businesses that use this electronic transfer type often have significant transactions justifying the setup and maintenance of dedicated EDI systems. Direct EDI is integral for companies seeking streamlined operations and enhanced collaboration with key business partners.

Web EDI

Web EDI, short for Web Electronic Data Interchange, offers a streamlined means for business partners to exchange critical documents over the internet using a web browser. This method removes the complexity and need for costly EDI software or extensive EDI knowledge, broadening accessibility to many businesses. It functions through a simplified interface that allows even smaller partners to comply with EDI requirements using standardized formats.

Web EDI supports various documents such as purchase orders, invoices, and advance ship notices, facilitating electronic transfers with speed and efficiency. It’s significant for businesses seeking to maintain competitive edges through cost-saving measures and reducing human error commonly associated with manual data entry. Often considered a stepping stone to more advanced EDI technology, Web EDI provides a solid foundation for companies stepping into electronic business documents and transactions.

6 key benefits of EDI payments

EDI payments offer a myriad of advantages for businesses engaged in financial transactions. Implementing this payment method streamlines the transfer of funds, improves communication between trade partners, and ensures secure and rapid transaction processing. It redefines the traditional financial exchange landscape by presenting numerous efficiencies and simplifications.

1. Strengthened business relationships

EDI payment methods foster greater collaboration and trust between business partners. By facilitating a reliable and consistent exchange of payment transactions, partners can enjoy a smoother, more predictable relationship. The standardized format of EDI payments means less ambiguity and fewer discrepancies, leading to a more robust, mutually beneficial connection.

2. Enhanced data security

The security protocols inherent in EDI payments are rigorous, ensuring that sensitive financial information is protected. Through secure networks and encryption, EDI payments minimize the possibility of data breaches and unauthorized access, giving businesses peace of mind and safeguarding their reputation with customers and partners.

3. Regulatory compliance

EDI payments help businesses adhere to industry standards and regulatory requirements by ensuring that all electronic transactions are formatted and transmitted according to established protocols. This compliance reduces the risk of legal issues and fines, as it guarantees that transactions meet the necessary data security and privacy standards. Moreover, using EDI facilitates accurate record-keeping and auditing processes, making it easier for companies to demonstrate compliance during inspections or reviews by regulatory bodies.

4. Cost-effective payments at scale

Switching EDI payments can lead to significant cost savings, especially for businesses that process many transactions. Eliminating paper documents reduces material and postage costs. It allows staff to focus on more strategic tasks instead of administrative overhead, thus providing economies of scale.

5. Increased productivity

Automating and streamlining payment transactions with EDI allows employees to reduce time spent on repetitive tasks. This newfound time can be redirected towards more productive activities that contribute to business growth, such as customer service or sales initiatives.

6. Improved efficiency and speed

EDI payments are faster and enhance overall operational efficiency. With EDI, funds and associated data are transferred seamlessly and swiftly, accelerating the cash flow cycle and allowing businesses to respond quickly to market demands and changes. This expeditiousness is a significant asset in today’s fast-paced business environment.

Challenges and considerations for EDI payments

While EDI payments streamline the transfer of funds between banks and reduce the reliance on manual payment processes, there are inherent challenges and considerations to keep in mind. Implementing an EDI payment system can be complex, requiring a clear understanding of both the technological and procedural aspects to ensure successful integration and continuous operation. Businesses must evaluate their own needs alongside the capabilities of EDI systems to find a suitable match. Additionally, consideration must be given to the impact on existing processes and the level of change management required to transition to an EDI-based approach.

Infrastructure and cybersecurity requirements

The infrastructure needed to support EDI payments must be robust and secure. Electronic transactions necessitate a reliable network, compatible software, and hardware capable of handling the EDI requirements. Cybersecurity is critical, as financial data is particularly sensitive and attractive to cybercriminals. Implementing stringent security protocols and encryption measures is vital in protecting against unauthorized access and data breaches. Regular updates and monitoring are required to maintain security standards and adapt to evolving threats.

Initial setup and maintenance costs

Deploying an EDI payment system necessitates initial setup costs. Businesses must budget for both the technical components, such as EDI software or service provider fees, and the costs associated with integrating the EDI system into existing financial and ERP systems. On top of that, ongoing maintenance costs must be considered, including software updates, system enhancements, and troubleshooting support. Over time, these costs can be offset by the efficiency gains and cost savings afforded by EDI payments, but initial capital investment can be a barrier for some businesses.

Staff training

Effective utilization of EDI payment systems requires knowledgeable and competent staff. This often means investing in comprehensive staff training programs to familiarize employees with the new processes and software. Training should cover using the EDI system, troubleshooting common issues, and maintaining data integrity and security. Investment in training is crucial in avoiding disruptions and errors during the transition to and use of EDI payments.

Data backups

Disruptions to the EDI payment system, whether due to technical malfunctions or cybersecurity incidents, can have severe consequences for a business. Therefore, a solid data backup strategy is essential to mitigate risks. Regular backups of transactional data and business documents ensure that operations can be restored quickly with minimal financial impact in the event of data loss. This includes having off-site or cloud-based backups that can be accessed in case of an on-site failure, ensuring continuity of payment transactions under all circumstances.

Best practices for implementing EDI payments

Implementing EDI payments into a business’s financial processes can streamline transactions and reduce human error. Below are the best practices for implementation:

- Assessment:

- Evaluate current payment processes to identify the scope and requirements of the EDI implementation.

- Determine the volume of transactions and types of documents that will be exchanged.

- Standards and Compliance:

- Select the appropriate EDI standards (like ANSI and EDIFACT) that align with your industry and partners.

- Ensure compliance with legal and regulatory requirements for electronic transactions.

- Partner Coordination:

- Collaborate with business partners to align on standards, formats, and schedules.

- Test EDI exchanges with partners to verify accurate and efficient processing.

- Technology and Security:

- Invest in reliable EDI software or partner with a trusted provider.

- Implement robust cybersecurity measures to protect sensitive financial data.

- Training and Support:

- Educate staff on EDI processes and software to ensure smooth adoption.

- Set up support channels for addressing technical issues or questions.

- Monitoring and Maintenance:

- Regularly review EDI transactions for accuracy and efficiency.

- Update protocols and systems as needed to accommodate changes in business or regulations.

Adhering to these guidelines can lead to cost savings, quicker processing times, and improved accuracy in electronic payment methods.

Future trends in EDI payments

The rise of mobile technologies means EDI systems will adapt to mobile access, allowing users to initiate and approve payments. Additionally, the need for enhanced security measures will drive innovation in EDI technologies, ensuring that electronic payment methods are protected against cyber threats. Real-time transaction processing is expected to become standard, providing immediate validation and acknowledgment of payments.

With advancements in machine learning and artificial intelligence, EDI payments will become more competent, learning from past transactions to predict and respond to future payment behaviors. Finally, increased global trade will necessitate the development of EDI payment systems that can easily manage international transactions, address different currencies, and comply with various regulations.

Are EDI payments right for your business?

EDI payments can be beneficial to a business’s financial operations, provided the business frequently engages in transactions with other companies where exchanging orders, invoices, and payments electronically is common and volumetric.

Businesses may optimize their payment processes by automating transactions with EDI, reducing manual data entry, mitigating human error, and potentially achieving cost savings. Additionally, the standardized format of EDI ensures consistency and streamlines communication across various business partners.

However, assessing whether EDI payments suit a company depends on several factors:

- Volume of Transactions: High transaction volumes can justify EDI systems’ setup costs and complexity.

- Partner Compatibility: If business partners are also set up for EDI, it promotes efficient interoperability.

- Nature of Transactions: Businesses with regular, structured ordering and invoicing can benefit more from EDI.

- Need for Speed: EDI can speed up transactions when quick processing times are crucial to operations.

Businesses contemplating EDI should consider the upfront costs, the staff learning curve, and integration with existing systems. If a business prioritizes electronic efficiency and quick financial transaction turnaround and already has partners capable of EDI, it’s positioned to benefit from adopting EDI payment methods.

Alternatives to EDI payments

Alternatives to EDI payments include several electronic payment methods that differ in operation and purpose, offering businesses flexibility.

Aside from ACH and EFT, credit card transactions are also prevalent. They allow the immediate transfer of funds from the cardholder’s credit line to the merchant’s account, incurring fees for this convenience.

Lastly, online payment services like EBizCharge facilitate electronic transactions between parties. These services are top-rated for online businesses and offer an easy interface for payment processing. Businesses that want to complement or move beyond EDI can also look at payment solutions that connect directly to their ERP. A NetSuite credit card integration lets finance teams accept and reconcile card payments within their existing workflows, while a Sage Intacct payment gateway automates payment collection for mid-market accounting teams. For manufacturers and distributors on Acumatica, an Acumatica payment processor keeps every transaction synced to your ERP in real time. These options give businesses the speed and automation of EDI without the complex setup and infrastructure requirements.

Each option presents an alternative to the standardized format of EDI payments, providing businesses with multiple payment choices to suit their needs.

Conclusion

Understanding various electronic payment methods is crucial for efficient business transactions in the digital age. EDI payments stand out as a specialized, highly structured form of electronic funds transfer specifically designed for business documents and financial transactions between business partners. Choosing the appropriate payment method can significantly impact how companies manage their finances and business relationships, making it essential to understand the implications of EDI payments.

Summary

- What is an EDI payment?

- How do EDI payments work?

- What are the differences between EDI, ACH, and EFT payments?

- The 2 main types of EDI payments

- 6 key benefits of EDI payments

- Challenges and considerations for EDI payments

- Best practices for implementing EDI payments

- Future trends in EDI payments

- Are EDI payments right for your business?

- Alternatives to EDI payments

- Conclusion