Blog > Charge Cards vs. Credit Cards: Which is Right for Your Business?

Charge Cards vs. Credit Cards: Which is Right for Your Business?

Understanding the nuances of a business charge card versus a credit card is essential for any company looking to optimize its purchasing power and financial management.

Charge cards, often overshadowed by their credit card cousins, offer unique benefits for businesses. They typically require the balance to be paid in full monthly, which can instill disciplined spending habits. A corporate charge mechanism eliminates interest charges for companies that can afford to clear their dues regularly, thereby improving cash flow.

This article will explain the differences between charge cards and credit cards, use cases for each, and help you determine which cards are best for your business.

What is a charge card and how does it work?

Charge cards, provided by financial institutions, allow cardholders to make purchases and pay for them later, typically at the end of a billing cycle.

The key difference between charge cards and traditional credit cards is that charge cards require the user to pay off the entire balance each billing period. There is no option to carry over a balance from month to month with a charge card.

While charge cards don’t have a preset spending limit, this doesn’t mean unlimited spending. The charge card issuer will approve purchases based on various factors, such as the cardholder’s payment history, spending habits, and financial resources.

At the end of each billing cycle, the cardholder receives a statement listing all transactions. The total amount on this statement must be paid by the due date to avoid penalties. Failure to pay in full may result in late payment fees, restrictions on card usage, or cancellation of the charge card.

Charge cards can help build a credit score because issuers report activity to credit bureaus. However, because there is no preset limit, they do not factor into the credit utilization ratio, a component used to calculate credit scores. Charge cards often cater to individuals with excellent credit scores and are commonly used for business expenses.

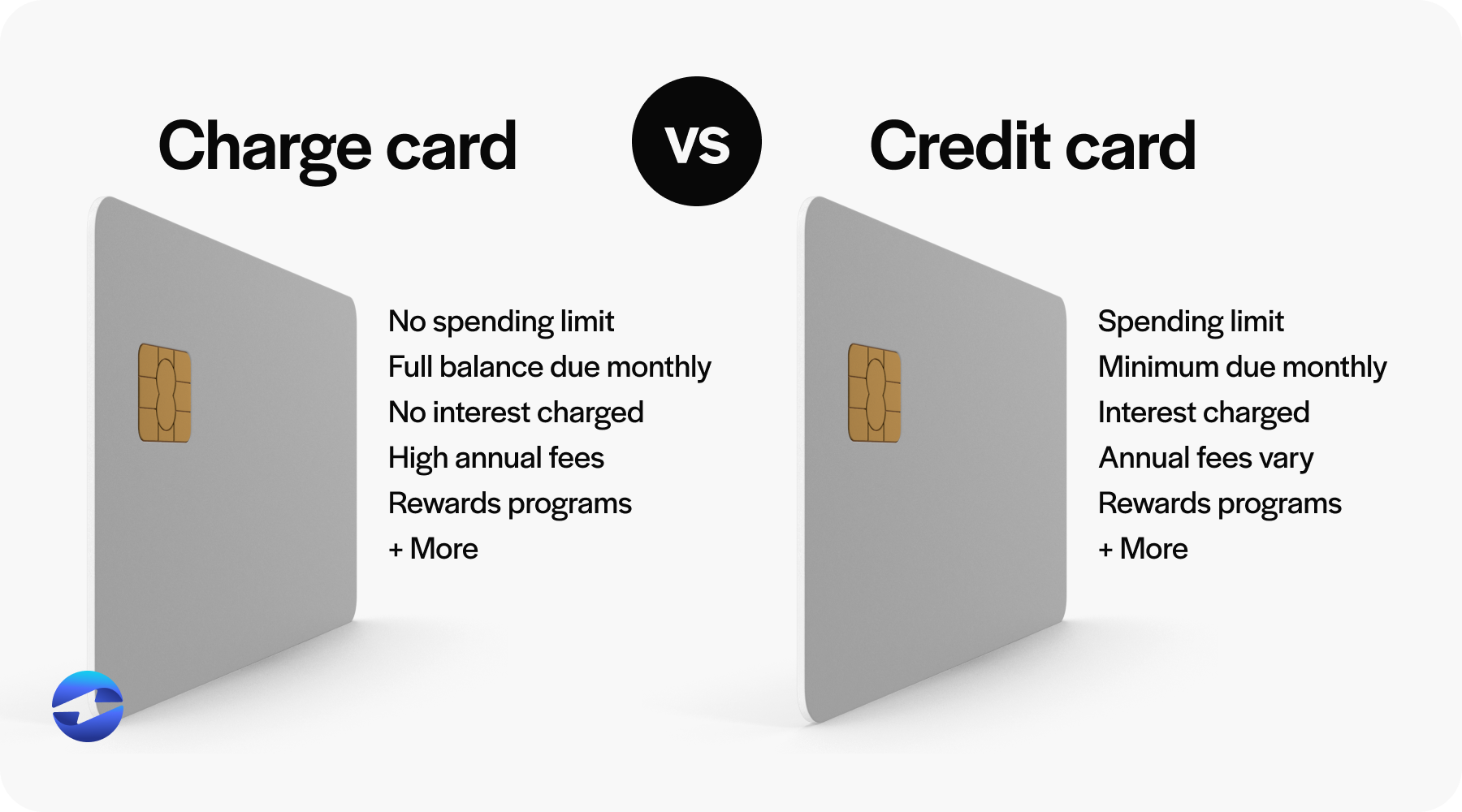

Charge cards vs. credit cards

Understanding the differences between charge cards and credit cards is essential for determining whether they are the best option for your business.

Here’s a full breakdown of charge cards vs. credit cards:NP

| Features | Charge Cards | Credit Cards |

|---|---|---|

| Spending limit | No pre-set spending limit | Pre-set spending limit |

| Payment due | Full balance due each month | Minimum payment due each month |

| Interest charges | No interest charges (if paid on time) | Interest charged on carried balance |

| Annual fees | Often higher | Varies depending on the type of card |

| Rewards programs | Usually has rewards programs | Has rewards programs |

| Credit impact | Requires high credit score and does not impact credit utilization ratio | Credit score requirements vary depending on the card and impacts credit utilization ratio |

| Building credit | Beneficial for building credit history | Helps build credit if used responsibly |

| Payment flexibility | Offers good flexibility, can pay whenever but needs to still be responsible | Less flexible because card needs to be paid in full each month |

| Suitability | Better for business who need to pay off balances over time rather than right away | Good for businesses that want rewards and can pay off within a month |

The main differences between charge and credit cards are their payment models and spending limits. Charge cards require the user to pay off the balance each billing period – there’s no option to carry over a balance from month to month. In contrast, credit cards can carry this balance month to month.

The following section will explore these differences in more detail to understand how each card type can impact your business’s financial management and spending habits.

Four differences between charge cards and credit cards

Understanding the distinct differences between charge cards and credit cards is critical when exploring options for business financial tools.

Four key differentiators between charge cards and credit cards are their eligibility requirements, spending limits and utilization, payment terms, and impact on credit scores.

1. Eligibility requirements

Eligibility requirements differ when considering a business charge card or credit card.

For business charge cards, approval often depends on a company’s financial health, revenue, and creditworthiness. A robust credit history and excellent credit score are crucial due to the higher risk the charge card issuer takes, given there’s no preset spending limit and the balance is to be paid in full each cycle.

On the other hand, business credit cards typically require a good to excellent credit score, and considerations may include the business’s revenue and credit history. However, the criteria can be more lenient than business charge cards, as credit cards tend to have a preset spending limit, which helps limit the issuer’s exposure.

2. Spending limits and utilization

When comparing business charge cards and credit cards, a central aspect is spending limits and utilization.

Despite business charge cards typically not having a preset spending limit, this doesn’t mean unlimited spending because purchases are approved based on payment history, credit record, and financial resources. This may benefit enterprises that experience fluctuating expenditures, allowing for greater flexibility during peak business periods.

Business credit cards have a defined credit limit, restricting the maximum balance that can be carried. Limits are set by the credit card issuer based on factors like credit history and business revenue. This cap also influences the credit utilization ratio, a critical component in credit scoring. A high ratio of outstanding balance to credit limit can negatively affect credit scores. Without preset limits, charge cards aren’t factored into this ratio similarly.

A business charge card may offer the necessary leeway for businesses to manage significant or unpredictable expenses without impacting credit utilization. However, staying within the bounds of a credit limit on a business credit card may aid in budget control and maintain a healthier credit utilization ratio, potentially boosting credit scores.

3. Payment terms

Payment terms are crucial when deciding between a business charge card and a credit card. The main distinction lies in how the balance is managed.

The balance for business charge cards must be paid off at the end of each billing cycle. There’s no option to carry over a balance from month to month. This can instill financial discipline, requiring the business to clear its debts regularly. Still, it may offer little flexibility during cash flow crunches.

In contrast, business credit cards allow minimum payments, with the remaining balance carried over to the next cycle, which can provide breathing room during tight financial periods. However, it can accrue interest, leading to higher costs if the balance isn’t appropriately managed.

4. Credit score impacts

The impact on credit scores between charge cards and credit cards is a critical operational factor to consider.

Charge cards don’t have a preset spending limit, meaning they typically don’t affect the credit utilization ratio, a significant factor in calculating credit scores. Unlike credit cards, where a high balance relative to the credit limit can lower scores, charge card balances don’t contribute to this ratio.

However, late payments are detrimental to both card types. Payment history is a substantial component of credit scores, and both late payments on charge cards and credit card issuances are reported to credit bureaus. Consistent on-time payments will favorably influence credit scores.

While business charge cards usually require the total balance paid off each month to ensure no balance is carried over, credit cards allow for minimum payments. However, carrying a balance from month to month on a credit card can accrue interest and potentially negatively affect credit scores if the outstanding balance becomes too high.

Who should use a charge card?

Identifying the most suitable financial tool can be pivotal to the success of your business operations. Charge cards can offer numerous benefits for various companies and industries.

Charge cards may be the best fit for an entity with the following characteristics:

- Consistent cash flow: Businesses with robust and reliable revenue streams can benefit from using a business charge card, as the entire balance must be paid each billing cycle.

- High spending and quick repayment: Charge cards can be helpful for companies with heavy spending habits that repay quickly due to the absence of preset spending limits.

- Credit building: A charge card can positively contribute to credit reports if the cardholder makes timely payments. This benefits businesses looking to build or maintain an excellent credit score.

- Organized accounting: Firms that want to simplify expense tracking may choose a corporate charge card since it allows for streamlined reconciliation of business expenses without the rollover of a balance from month to month.

- Avoiding debt accumulation: Charge card users avoid accumulating debt because, unlike business credit cards, they can’t make minimum payments.

Entities with controlled spending habits and the ability to clear their balances in full monthly are prime candidates for charge card usage.

Choosing the right card for your business

When selecting a card for your business, the decision hinges upon understanding the key differences between charge cards and credit cards.

Best charge cards for July 2024

When reviewing the best business charge cards available in July 2024, several standout options are designed to accommodate the diverse needs of businesses.

| Charge Card | EBizCharge Rating | Annual Fee | Rewards Rate | Intro Offer | Learn More |

|---|---|---|---|---|---|

| Ramp Corporate Card

|

4/5 Great if your company doesn’t want to pay annually for a card. 1.5% back on purchases is also great since you’re saving on the annual fee. |

$0 | 1.5% | N/A | APPLY |

|

Capital One Spark Cash Plus

|

5/5 Best card, best intro offer, best rewards. |

$150 | 2% – 5% | $1,200 | APPLY |

|

Ink Business Premier Credit Card |

4.5/5 While this card has very similar rewards to the Capital One Spark Cash Plus card, the annual fee is higher and the rewards are less flexible. |

$195 | 2% – 5% | $1,000 | APPLY |

Ramp Corporate Card

The Ramp Corporate card offers a variety of features that cater to business needs, providing both advantages and drawbacks.

The benefits of the Ramp Corporate card include no annual fees, advanced spend management tools to track and control expenses, and high credit limits for better purchasing power.

Disadvantages of the Ramp Corporate card include strict eligibility requirements for established businesses with solid financials, limited rewards, and no personal use, which might be limiting for entrepreneurs looking for personal and business expenses on one card.

Overall, the Ramp Corporate Card is an excellent choice for established businesses looking for robust expense management and straightforward cashback rewards. Still, it may not be ideal for some business types.

Capital One Spark Cash Plus

The Capital One Spark Cash Plus card is a popular choice among business credit cards. It offers a blend of valuable rewards and practical features designed to support businesses’ financial needs.

The Capital One Spark Cash Plus card offers unlimited 2% cashback on every purchase, no preset spending limit, a $1,000 cash bonus, no foreign transaction fees, free employee cards, and more.

Disadvantages of the Capital One Spark Cash Plus card include high spending requirements for bonuses, annual fees after the first year, no introductory APR offer, and excellent credit approval only.

The Capital One Spark Cash Plus stands out for its generous cashback rewards and flexible spending limits. Still, businesses should consider the high bonus spending requirement and the annual fee when evaluating whether if it meets their needs.

Ink Business Premier Credit Card

The Ink Business Premier Credit Card by Chase is tailored for businesses seeking robust rewards and premium features. While this card offers various benefits that enhance business spending, it also has some drawbacks.

The pros of the Ink Business Premier Credit Card by Chase include high reward rates, no foreign transaction fees, comprehensive travel and purchase protection, and free employee cards.

Disadvantages of the Ink Business Premier Credit Card by Chase include annual fees, annual fees after the first year, high spending requirements, limited APR offerings, and reward caps on high-ticket purchases.

The Ink Business Premier Credit Card is an excellent choice for businesses with substantial spending and a need for high rewards and premium features. However, its annual fee and high spending requirements for the welcome bonus may not suit all businesses, specifically smaller or cost-conscious ones.

Determining your financial needs to find the best card for your business

Deciding between a charge card and a credit card for your business depends on your specific financial needs and spending habits.

Charge cards offer flexibility with no preset spending limits but require full payment each month, making them suitable for businesses with predictable cash flow. On the other hand, credit cards allow you to carry a balance with interest, offering more flexibility for managing short-term expenses.

Assess your business’s cash flow, spending patterns, and financial management preferences to choose the best option that aligns with your operational needs.