Blog > What Is Accounts Receivable Factoring?

What Is Accounts Receivable Factoring?

Accounts receivable (AR) refers to money owed to a company by its customers for goods or services that have been delivered but not yet paid. For many businesses, managing AR can be challenging, particularly when faced with cash flow constraints or delays in receiving payments from customers. In such cases, accounts receivable factoring emerges as a valuable financial tool.

This article will explore AR factoring, how it works, and the benefits of this ancient practice.

Understanding accounts receivable factoring

AR factoring, also known as invoice factoring or receivable financing, is a financial transaction in which a business sells its outstanding invoices to a third party called a factoring company.

This sale provides the business with immediate cash flow, allowing them to access funds without waiting for clients to pay their invoices within the standard credit terms.

How do factoring companies pay for invoices?

A factoring company specializes in purchasing outstanding invoices by assessing the credit risk associated with unpaid invoices and providing an advance rate, which is a percentage of the invoice’s value.

The factoring company then collects payment from the clients when the invoices are due, deducting a factoring fee for their service. Subsequently, the remainder of the collected amount is passed back to the business.

In addition to knowing what a factoring company is and how it operates, you can look at how the factoring process works.

How does factoring work?

AR factoring is a straightforward, strategic process that enables businesses to enhance their cash flow. It begins with businesses identifying invoices for services or products already delivered but not yet paid for.

Here’s an outline of the steps involved in the factoring process:

- A business submits a batch of its outstanding invoices to an AR factoring company.

- The AR factoring company evaluates these invoices by assessing the debtor’s creditworthiness.

- Once the factoring company approves the invoices, it offers an advance rate. The advance is a cash payment, typically representing about 70% to 90% of the total invoice value.

- The business receives this advance, providing the necessary liquidity for its operations.

- The factoring company then takes on the responsibility of collecting invoice payments from the business’s customers.

After the customers pay the invoices in full, the factoring company releases the remaining invoice value to the business minus the factoring fees.

In the eyes of factoring companies, not all invoices are worth buying. Factoring companies need to assess each invoice based on several details that determine the risk they impose.

How do factoring companies determine how much to pay for an invoice?

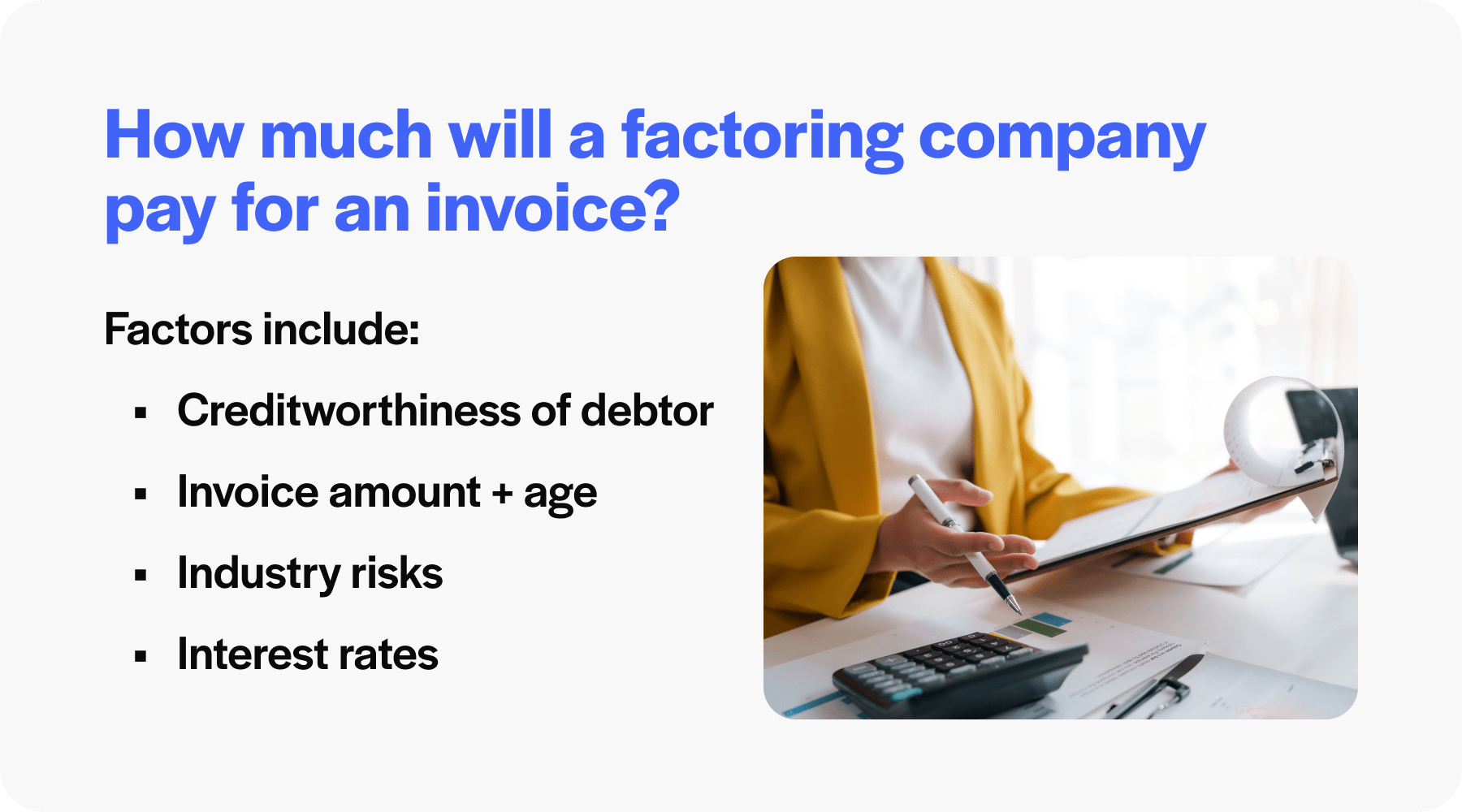

Determining the value of an invoice hinges on a combination of factors. These include the credit history of the business’s customers, the amount of the invoice, the age of the invoice, and industry-specific risks.

Here’s a deeper look into the process:

- Creditworthiness of debtor: The stronger the credit history of the customer responsible for the invoice, the higher the advance rate. This is because the risk of non-payment is lower.

- Invoice amount and age: Larger and newer invoices are often preferred, as they represent a higher value and a lower risk of going unpaid.

- Industry risks: Some industries may have longer standard payment terms, while others could have higher instances of bad debt, both of which influence the factoring proposal.

- Interest rates: While not traditional loans, factoring agreements are affected by prevailing interest rates, which can influence the cost of the factoring service.

Now that you know how the factoring process works, it’s important to understand the different types of factoring.

Understanding the different types of AR factoring

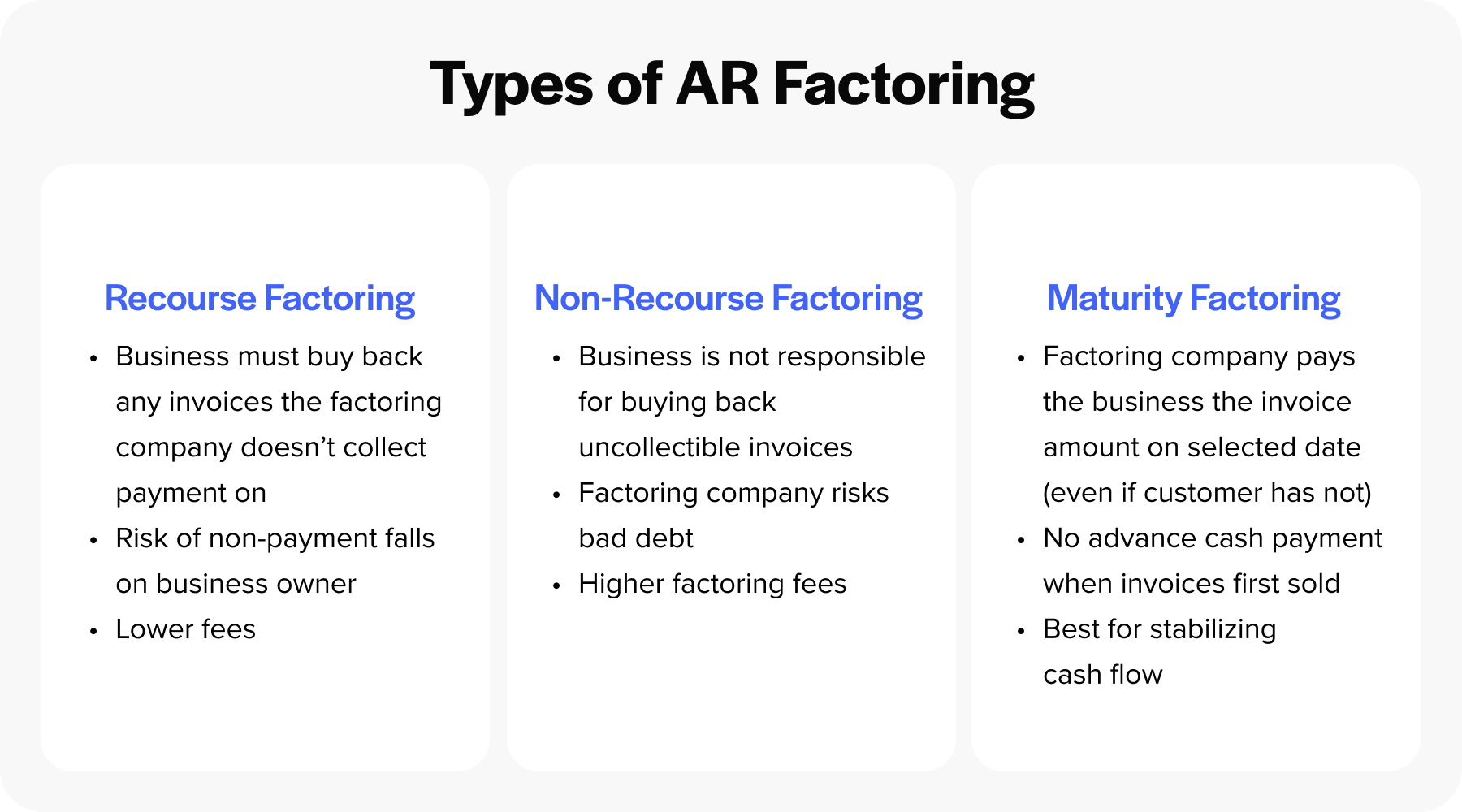

AR factoring takes various forms to accommodate business owners’ diverse needs and risk appetites. It can be classified as recourse factoring, non-recourse factoring, or maturity factoring.

Each type dictates different obligations and risk levels for the business and the factoring company. Therefore, selecting the right kind of factoring arrangement can significantly affect a company’s balance sheet, cash flow, and overall financial management.

Recourse factoring

Recourse factoring is a common form of AR financing in which a business sells its invoices to a factoring company with the understanding that it must buy back any invoices the factoring company can’t collect payment on.

With recourse factoring, the risk of non-payment falls back on the business owner instead of the factoring company. Therefore, the fees are typically lower because the business assumes more risk.

Non-recourse factoring

Non-recourse factoring allows a business to sell its outstanding invoices to a factoring company with the agreement that it isn’t responsible for buying back any uncollectible invoices.

The factoring company takes on the risk of bad debt, providing the business with a greater sense of financial security. However, this added protection comes at a cost, and businesses can expect higher factoring fees due to the factoring company assuming the credit risk.

Maturity factoring

Maturity factoring, also known as collection or service factoring, involves a factoring company paying the business the invoice amount on the maturity date of the invoice or a pre-agreed extended date, regardless of whether the customer has paid the invoice.

The factoring company is responsible for collecting payments from the customer, but there is no advance cash payment when the invoices are first sold.

Maturity factoring often suits companies that want to stabilize their cash flow but handle their customer payment terms and collections to an extent.

Understanding the nuances of each factoring type is crucial for businesses when selecting the factoring service that meets their unique cash flow and risk management requirements.

Now that you understand the different types of AR factoring, here is a quick look at how factoring is calculated.

How is AR factoring calculated?

The AR factoring calculation involves a series of steps designed to determine how much money a business will receive upfront from the factoring company and the final amounts that will be exchanged once the invoices are paid.

Businesses can follow the following steps to calculate accounts receivable factoring:

- Determine the total invoice value: The first step in calculating AR factoring is to compile all outstanding invoices intended for factoring and sum their total value. This establishes the basis for the amount the factoring company will advance.

- Assess the factor’s advance rate: After determining the total invoice value, the next step is to consider the factoring company’s advance rate. This rate is the percentage of the total invoice value the factoring company will provide to the business upfront. Advance rates typically range from 70% to 90%, depending on industry standards, customers’ creditworthiness, and the factor’s policies.

- Calculate the initial advance: Once the advance rate has been established, multiplying it by the total invoice value yields the initial cash amount the business will receive. For example, with a total invoice value of $100,000 and an 80% advance rate, the initial advance would be $80,000.

- Determine the factor’s fee: The factor’s fee or factoring fee is the cost a business pays for the factoring service. It’s usually a percentage of the total invoice value and can vary depending on the agreement length, receivable volume, and the payment history of the invoiced customers. Factoring fees may fluctuate during the time it takes for the account debtor to pay the invoice.

- Subtract the factor’s fee: Subtracting the factoring fee from the initial advance gives the net amount the business will ultimately receive. If the factor’s fee is 3% on a $100,000 invoice volume, the company would incur a $3,000 fee. Deducting this from the $80,000 initial advance, the business effectively gets $77,000 in hand after fees.

- Account for reserve amount: The reserve amount is the difference between the total invoice value and the initial cash advance. The factoring company holds it as security funds until the customer pays the invoice in full.

- Calculate the final payment: Once customers pay the invoices, the final payment represents the reserve amount minus the factoring fees and any other charges (processing fees, service charges, etc.), if applicable.

Now that you understand how to calculate factoring, it’s important to note why this process is so important.

Reasons to use AR factoring

By leveraging the power of AR factoring, companies can enjoy more predictable cash management, stronger credit positions, reduced administrative burdens, and more, all of which contribute to sustained business growth.

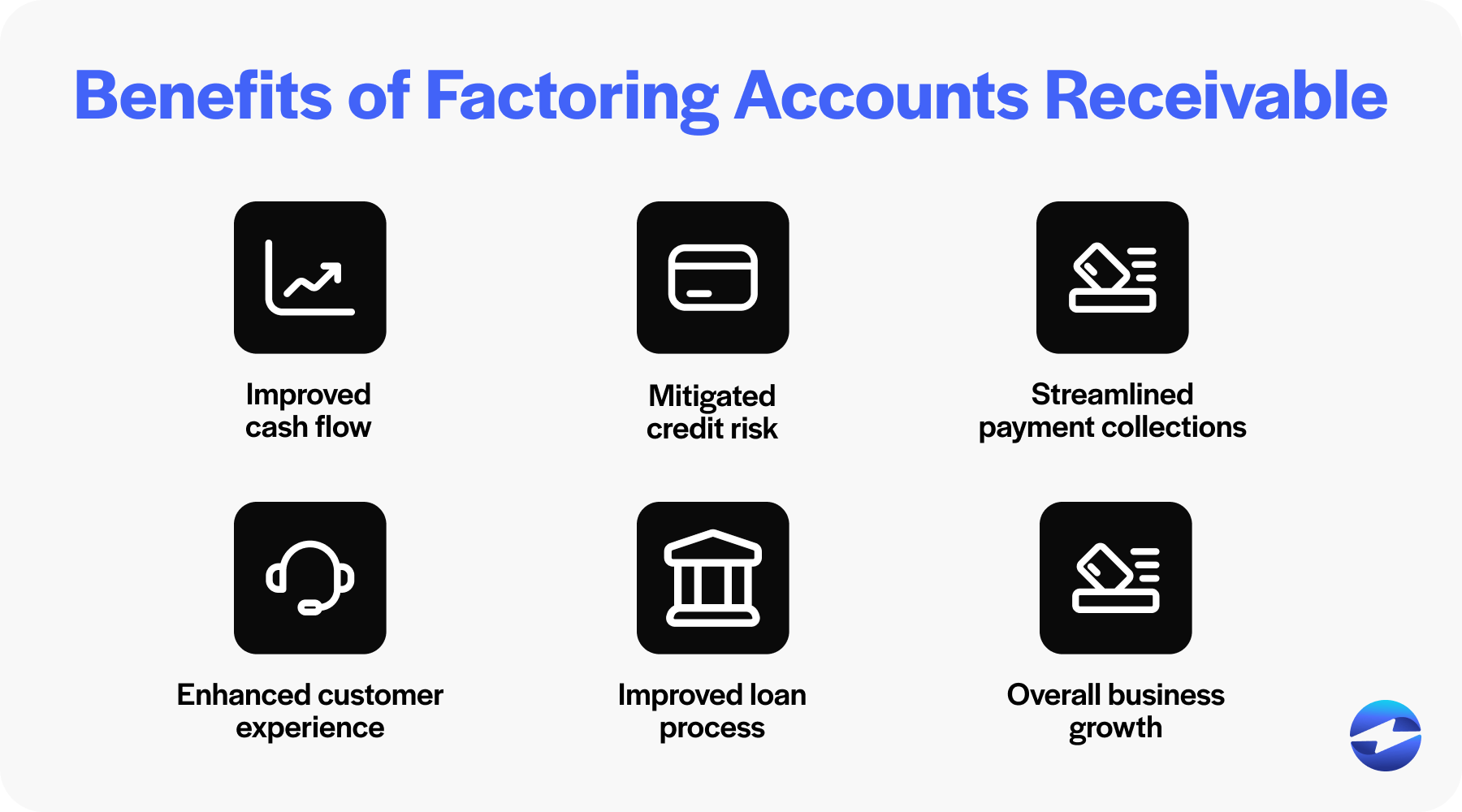

Six benefits of factoring accounts receivable include:

- Improved cash flow

- Mitigated credit risk

- Streamlined payment collections

- Enhanced customer service

- Improved loan process

- Overall business growth

1. Improved cash flow

Instead of waiting for clients to pay within their 30- to 90-day credit terms, businesses can access most of the invoice value within a few days.

This rapid infusion of cash can be a lifesaver for companies facing time-sensitive financial obligations or those looking to capitalize on immediate growth opportunities. By alleviating cash flow pressures, businesses can maintain a steady stream of working capital to meet ongoing expenses and invest in their companies without interruption.

2. Mitigated credit risk

AR factoring, specifically non-recourse factoring, transfers credit risk to the factoring company, offering businesses peace of mind and more financial stability.

This risk mitigation is especially valuable for businesses that lack the resources to absorb bad debts or that operate in industries with a high incidence of client defaults.

Since factoring companies evaluate and manage client credit risk, businesses can focus on their core operations without the anxiety of potential unpaid invoices.

3. Streamlined payment collections

Alongside the quick cash benefits, AR factoring also offers streamlined collection processes.

When businesses sell their invoices to factors, they often pass on the responsibility of collecting payments. This means factoring companies handle most of the legwork involved in chasing down customer payments, freeing the business’s resources and allowing them to refocus efforts on productive activities.

Collection can be time-consuming and stressful, so offloading it to a dedicated party helps improve operational efficiency and reduce businesses’ administrative burdens.

4. Enhanced customer service

Freed from the time-consuming tasks of invoice administration and collections, businesses can better allocate their efforts to activities that improve the customer experience.

Additionally, the careful credit analysis performed by factors before purchasing invoices ensures that businesses engage with financially sound and reliable clients. This gives your company more bandwidth to innovate, provide responsive support, and build stronger customer relationships.

5. Improved loan process

Invoice factoring can streamline access to capital in ways traditional loans can’t.

Businesses often find the approval process for a factoring arrangement quicker and more straightforward than securing a business loan from a bank. Since the primary qualification for AR factoring is the creditworthiness of the recipient instead of the business seeking funding, newer enterprises with a limited credit history can quickly obtain the cash they need.

This streamlined loan process saves time and eliminates the extensive documentation and stricter credit requirements typical of conventional bank loans.

6. Overall business growth

AR factoring can encourage more business growth by providing more reliable cash flow, reduced credit and collections risks, improved customer service, and accessible funding processes. These can all improve your company’s financial positioning to invest in development initiatives.

Factoring can finance inventory purchases, expansion into new markets, increased marketing efforts, and enhanced R&D — all vital elements for driving business expansion. Without debt burdens on the balance sheet, companies can also retain more flexibility and seize growth opportunities as they arise, fueling long-term prosperity.

What are the pros and cons of AR factoring?

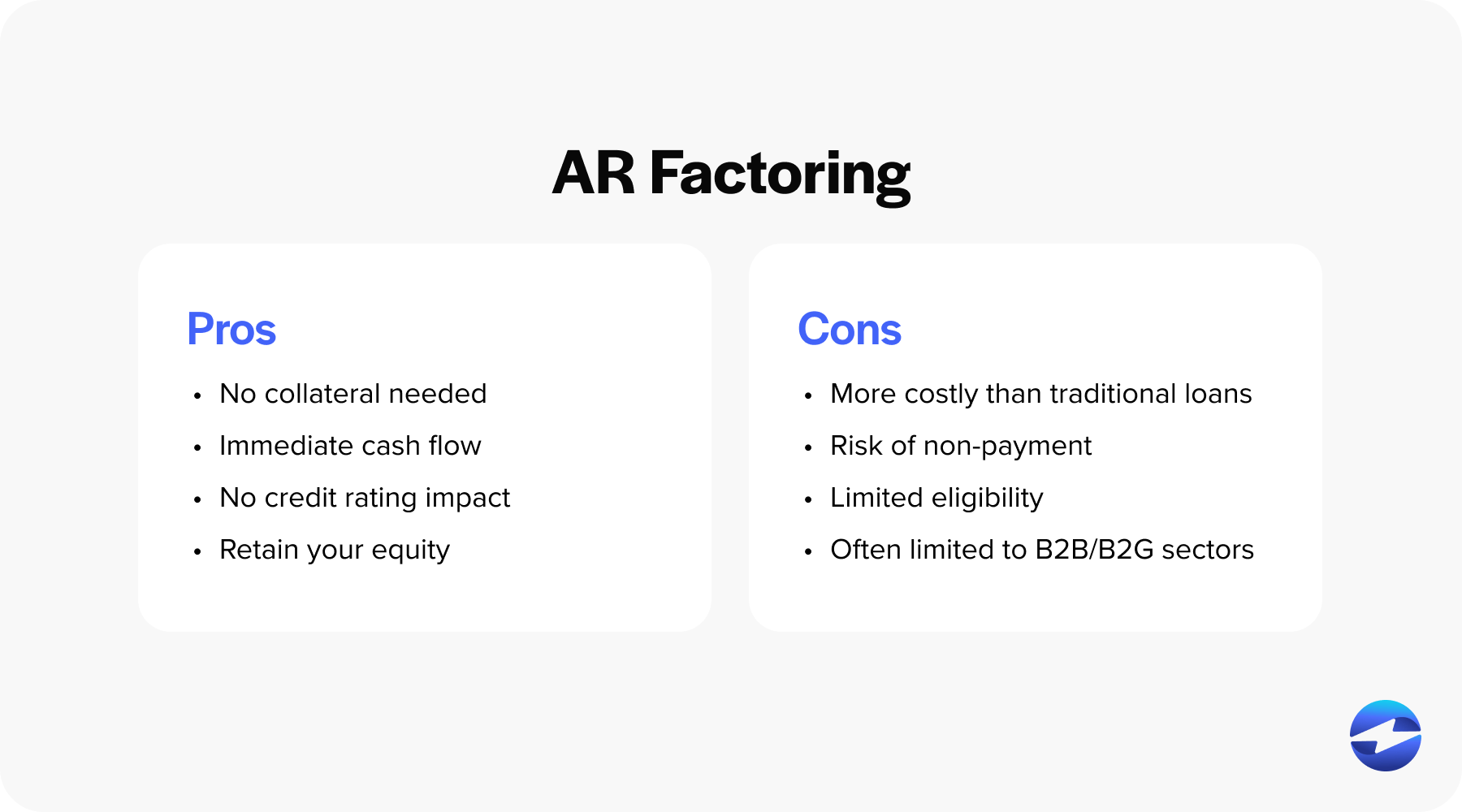

While there are many benefits to AR factoring, it does carry some cons as well. Here’s a quick look at the pros and cons associated with AR factoring:

Pros…

- No collateral needed: Unlike some traditional loans, factoring doesn’t require assets as collateral, easing the process for business owners.

- Immediate cash flow: Factoring provides companies with quick access to cash flow, which is vital for maintaining daily operations and taking advantage of growth opportunities.

- No credit rating impact: Since factoring isn’t a loan, it typically doesn’t affect a business’s credit score.

- Retain your equity: Businesses don’t have to give up equity to receive funding, enabling them to maintain complete control of their company.

Cons…

- Cost: Factoring can be costlier than conventional bank loans, reflected in higher factoring fees.

- Risk of non-payment: Depending on the factoring arrangement, the business may still be liable if the customer fails to pay.

- Limited eligibility: Not all receivables qualify for factoring. Factors may impose eligibility requirements based on the creditworthiness of the client’s customers, the age and size of the invoices, and the industry in which the client operates.

- B2B/B2G limitations: Factoring is often only applicable for companies operating in B2B (business-to-business) or B2G (business-to-government) sectors, limiting their reach to those markets.

Nonetheless, AR factoring can still be an excellent tool for businesses to streamline their revenue and financial operations.

How factoring can close the cash flow gap

Factoring accounts receivable can be a strategic move for businesses that struggle with the gap between delivering services or products and receiving payment.

Factoring can be leveraged as a source of funding to effectively turn unpaid invoices into immediate working capital, thus empowering businesses to maintain and grow their operations without being hindered by credit terms or the risk associated with credit.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.

EBizCharge is proven to help businesses collect customer payments 3X faster than average.