Blog > ACH and ABA Routing Numbers: What’s the Difference?

ACH and ABA Routing Numbers: What’s the Difference?

ACH and ABA routing numbers are two critical pieces of information used in banking and financial transactions.

Therefore, it’s crucial to understand the differences between these two routing numbers to help you decide which is the best to use for your business.

What is an ACH routing number?

ACH stands for Automated Clearing House which is a system that facilitates electronic payments and direct deposits between financial institutions. Therefore, ACH routing numbers are unique nine-digit numbers that identify financial institutions participating in the ACH network.

ACH numbers were developed in the 1970s when there was a significantly large amount of checks which threatened to slow down the banking system. This started an even larger industry-wide shift toward electronic banking.

ACH routing numbers work by routing funds from one bank account to another through the ACH network. This system is used to process direct deposits, bill payments, and other types of electronic payments.

ACH routing numbers are different from ABA routing numbers since they’re used specifically for electronic transactions. The first two digits of ACH routing numbers typically range from 61 to 72, whereas the first two digits of ABA routing numbers range between 00 and 12.

The purpose of ACH routing numbers is to ensure funds are accurately and efficiently transferred between financial institutions. ACH routing numbers are used for various transactions such as direct deposit of payroll, government benefits, and tax refunds.

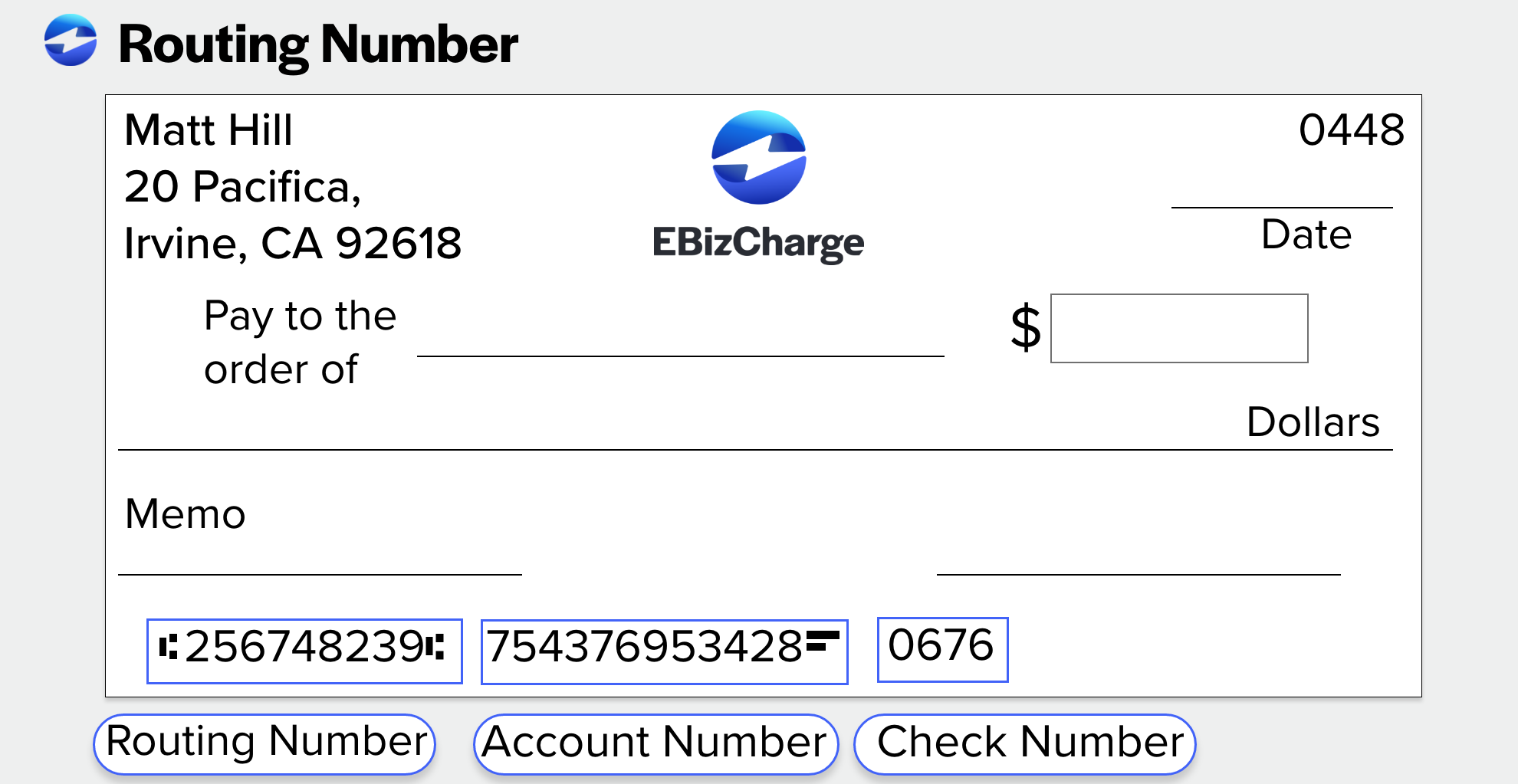

ACH routing numbers can be found on personal checks, bank statements, or by contacting your financial institution. Some financial institutions provide this information on their websites.

What is an ABA routing number?

ABA stands for American Bankers Association which is a trade organization that represents banks in the United States. Bank ABA routing numbers are unique nine-digit numbers that identify financial institutions participating in the ABA system.

ABA routing numbers work by routing funds from one bank account to another through the ABA network. This system is used for traditional check processing, wire transfers, and other transactions. Unlike ACH routing numbers, ABA routing numbers are used for both electronic and paper transactions.

Similar to ACH routing numbers, the purpose of ABA routing numbers is to ensure funds are accurately and efficiently transferred between financial institutions. ABA routing numbers are used for various transactions such as check processing, wire transfers, etc.

ABA routing numbers can also be found on personal checks, bank statements, or by contacting your financial institution. Some financial institutions provide this information on their websites.

Is an ABA number the same as a routing number?

Yes, an ABA number and a routing number are essentially the same thing. The term “ABA number” comes from the American Bankers Association, which originally developed this 9-digit identification system for banks. Today, most people call it a “routing number,” but both terms refer to the same code that identifies your specific financial institution for processing transactions like checks, direct deposits, and electronic transfers.

However, there’s an important distinction about ACH routing numbers. While people often use “ACH number” and “routing number” interchangeably, an ACH routing number is technically a specific routing number designated exclusively for electronic ACH transactions. Many banks use the same 9-digit number for all transaction types, but some larger financial institutions assign different routing numbers for different purposes. One is for ACH transfers, another is for wire transfers, and sometimes a separate one is for check processing. This is why it’s always best to confirm which routing number to use for specific transaction types with your bank.

Differences between ACH and ABA routing numbers

While there are several similarities between ACH and ABA routing numbers, there are also key differences when comparing the two.

Quick Reference: When to Use Each Number

| Use ACH Routing Numbers For: | Use ABA Routing Numbers For: |

|---|---|

| Direct deposit setup | Writing or depositing checks |

| Automatic bill payments | Wire transfers (domestic and international) |

| Electronic fund transfers | Setting up new bank accounts |

| Online banking transfers | General banking transactions |

| Payroll processing | When unsure which type is needed |

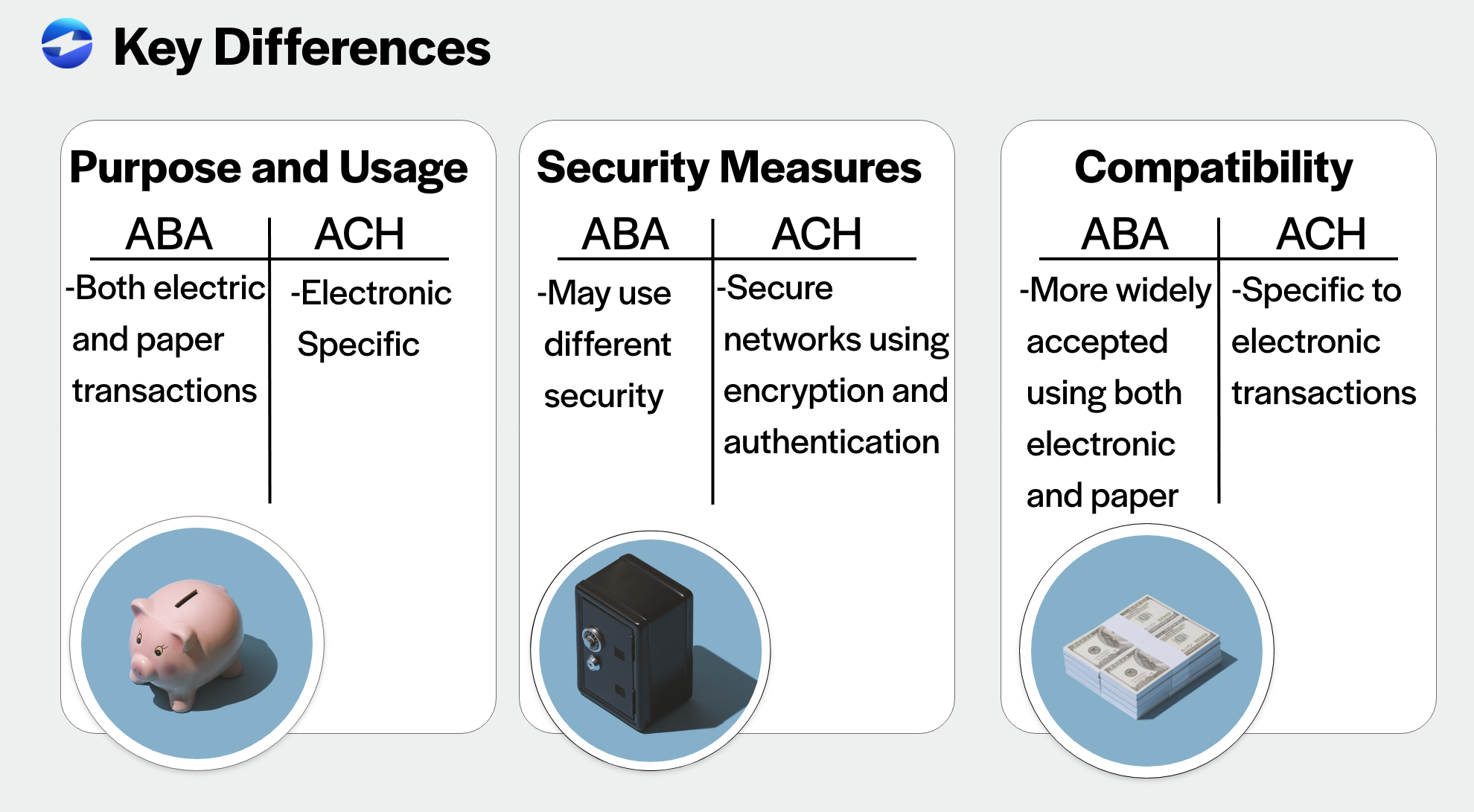

The main differences between ACH and ABA routing numbers are:

-

Purpose and usage:

ACH routing numbers are used specifically for electronic transactions, whereas ABA routing numbers are used for both electronic and paper transactions.

-

Security measures:

ACH transactions are typically processed through secure networks and subject to security measures such as encryption and authentication, while ABA transactions may be subject to different security measures depending on the financial institution and type of transaction.

-

Compatibility with different payment systems:

ACH routing numbers are used specifically for electronic transactions, so they may not be compatible with all payment systems. On the other hand, ABA routing numbers are used for both electronic and paper transactions and are more widely accepted.

ACH number vs routing number

While both ACH and ABA routing numbers are 9-digit codes that identify financial institutions, they serve different purposes in banking transactions.

ACH routing numbers are designed specifically for electronic transactions through the Automated Clearing House network, such as direct deposits and automatic bill payments, and typically begin with digits 61-72.

ABA routing numbers, developed by the American Bankers Association, handle a broader range of transactions including both electronic and paper-based transfers like checks and wire transfers, with numbers typically starting with digits 00-12. The key distinction is that ACH numbers work exclusively within electronic payment systems and often include enhanced security measures like encryption, while ABA numbers are more universally accepted across different payment methods but may have varying security protocols depending on the transaction type. Many banks use the same 9-digit number for both purposes, but larger institutions often assign separate routing numbers for different transaction types to optimize processing efficiency.

What are other types of routing numbers?

ABA and ACH are not the only types of routing numbers you may encounter. There are different types of routing numbers, each serving a specific purpose. Here are the main types of routing numbers, including the previously discussed ABA and ACH numbers:

ABA Routing Numbers:

These are 9-digit codes assigned by the American Bankers Association (ABA) to identify banks in the United States. They are used for various transactions, including paper or check transfers, direct deposits, and wire transfers.

ACH Routing Numbers:

These are routing numbers used specifically for electronic transfers through the Automated Clearing House network. They are used for electronic transactions such as direct deposits, electronic bill payments, and other automated transfers.

Wire Transfer Routing Numbers:

Financial institutions may have separate routing numbers specifically designated for wire transfers, which are used for sending and receiving funds electronically between banks domestically or internationally. These routing numbers are distinct from ABA routing numbers and are typically used for high-value or time-sensitive transactions.

International Routing Numbers:

For international transactions, banks use different codes, such as SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes or IBANs (International Bank Account Numbers) instead of traditional routing numbers. These codes help identify specific banks and branches internationally to facilitate cross-border transactions.

Fedwire Routing Numbers:

These are used specifically for processing large-value, time-critical payments and transfers between financial institutions within the country. Fedwire is a real-time gross settlement system operated by the Federal Reserve Banks in the United States.

These are the main types of routing numbers that are essential for the smooth movement of funds between financial institutions, both domestically and internationally.

Utilizing the benefits of ACH and ABA routing numbers

ACH and ABA routing numbers serve distinct purposes in the world of banking and finance, whether it be electronic transfers such as direct deposits and bill payments or traditional paper transactions such as check processing.

Understanding how these routing numbers work helps businesses process payments more efficiently. Solutions like EBizCharge simplify ACH transactions by automating the entire process. With NetSuite payment processing and Sage Intacct credit card integration, every ACH payment posts directly to your accounting software so your records stay accurate without manual entry.

Frequently Asked Questions

Is ABA and routing number the same?

Yes, an ABA number and a routing number are essentially the same. The term “ABA number” refers to a routing number assigned by the American Bankers Association (ABA) used for various types of financial transactions, including checks, ACH transfers, and wire transfers.

What is a routing number vs. account number?

A routing number and an account number are both essential for processing financial transactions, but they serve different purposes.

- What is a Routing Number? This 9-digit number identifies the specific financial institution where your account is held. It is used to direct the transaction to the correct bank or credit union.

- What is an Account Number? This is a unique number assigned to your individual account within the financial institution. It specifies your personal account where funds should be withdrawn or deposited.

What is an ABA number vs. routing number?

An ABA number and a routing number are often used interchangeably. Here’s a more detailed breakdown:

- ABA Number: The term “ABA number” comes from the American Bankers Association, which originally developed the system to identify banks in the United States. These numbers are used for processing checks and other transactions.

- Routing Number: This is the more commonly used term today. A routing number is a 9-digit code that identifies a specific financial institution. It directs the transaction to the correct bank or credit union. Routing numbers are used for various types of financial transactions, including electronic funds transfers (EFTs), direct deposits, and wire transfers.