Blog > How to Read a Statement of Cash Flows

How to Read a Statement of Cash Flows

Staying on top of your company’s finances, particularly the amount of cash going in and out, is an integral part of running an organization and essential for the longevity of your firm. Having enough cash on hand allows you to pay off necessary expenses, such as taxes and payroll, without having to use debt to finance vital assets.

Luckily, accounting tools like cash flow statements give businesses a clearer picture of incoming and outgoing money to maintain better financial stability.

A cash flow statement (CFS) is a financial statement that reveals how much cash inflow and outflow your company currently has. Cash flow statements are useful tools that will help your company identify financial opportunities or problems that should be addressed for the health of your organization.

This article will highlight the key features of a cash flow statement and what it looks like in action. You’ll also learn how to read a cash flow statement and how to interpret the statement of cash flows by discussing each category in detail.

What is a cash flow statement?

The statement of cash flows encapsulates the movement of cash flowing into and out of your company. This financial tool also outlines how much money you had during a specific period of time such as monthly, quarterly, or annually.

At its core, the statement of cash flows allows you to understand where money is coming in and out of your company and can provide valuable insights to enhance your finances. Cash flow statements account for every purchase within your company, regardless of how much they amount to. For example, if you purchased new chairs for your office, this expense would be shown in your statement of cash flows.

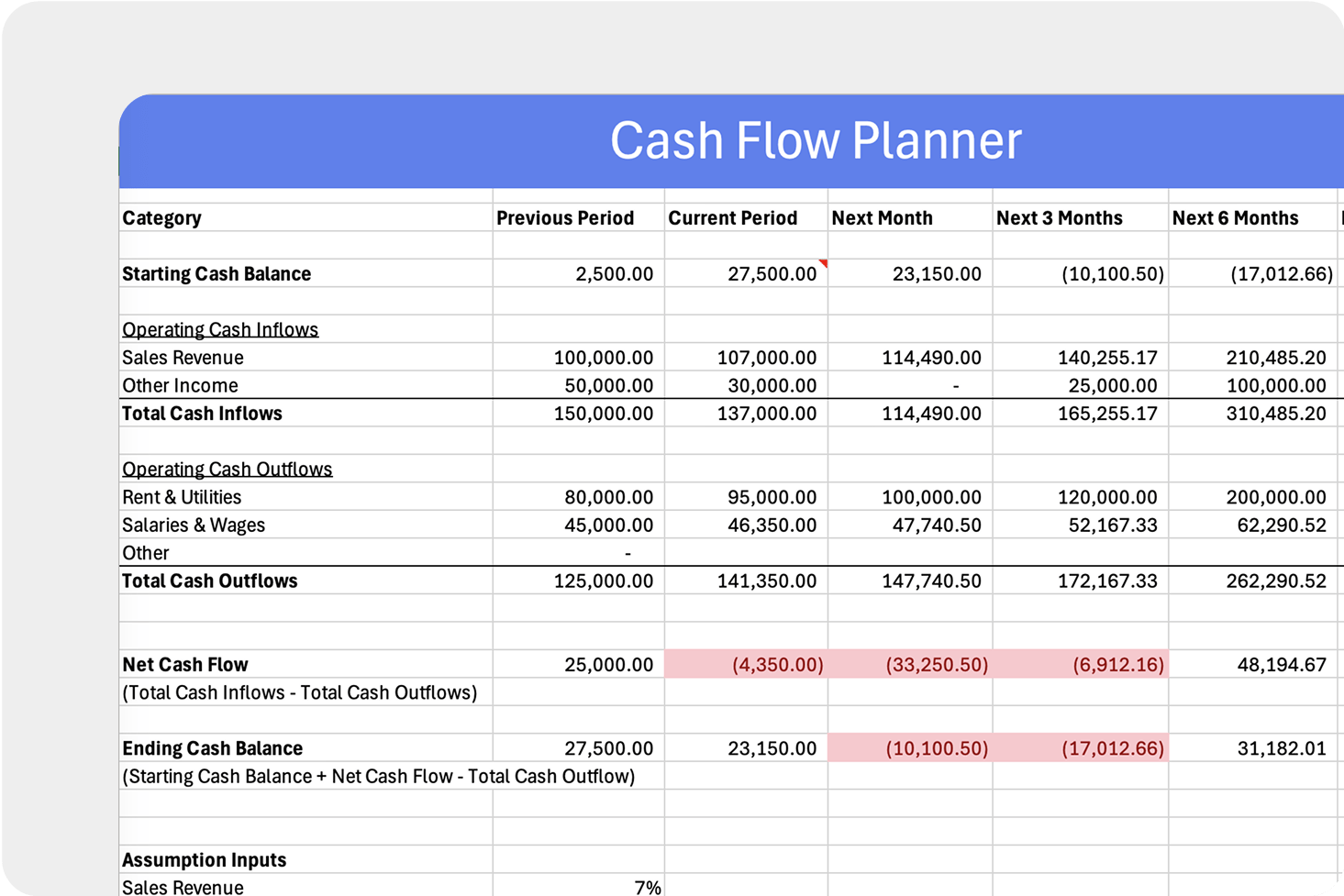

To help you better understand cash flow statements, we’ll refer to the below example throughout this article and highlight specific sections to explain how they all work together:

Understanding the statement of cash flows

It’s crucial that your company knows what direction its finances are headed to make calculated financial decisions for the future and longevity of your firm.

Cash flow statements organize and explain how companies receive and spend their cash on business expenses to offer more insights into which investments are profitable and which are unsuccessful.

If your company notices certain investments consistently operating at a loss over several statements of cash flow reports, you may need to reconsider and adjust current business strategies and investments for the following financial periods of time.

Using cash flow statements, your business can highlight specific areas or operations where it’s failing to appropriately distribute cash. After analyzing these cash flow faults, you can correct these mistakes and develop strategies to ensure you don’t repeat them moving forward.

Cash flow statements are also a critical tool to help investors or shareholders determine the financial strength of your business. After analyzing a company’s statement of cash flows, investors can gauge the performance of its products and services based on its customers’ purchases and spending habits. Whether customers pay upfront in cash or your company struggles to collect these payments, the statement of cash flows will offer more clarity to help you and your investors address these issues.

Now that you have a better understanding of what cash flow statements are, you can learn how to read these financial statements and gain more insight into each statement category.

How to read a cash flow statement

Statements of cash flows are typically organized into three different categories which include your company’s operating activities, investing activities, and financing activities. Within each section, every line item will either highlight the category or the specific activity within that category and show you how much money was generated or lost.

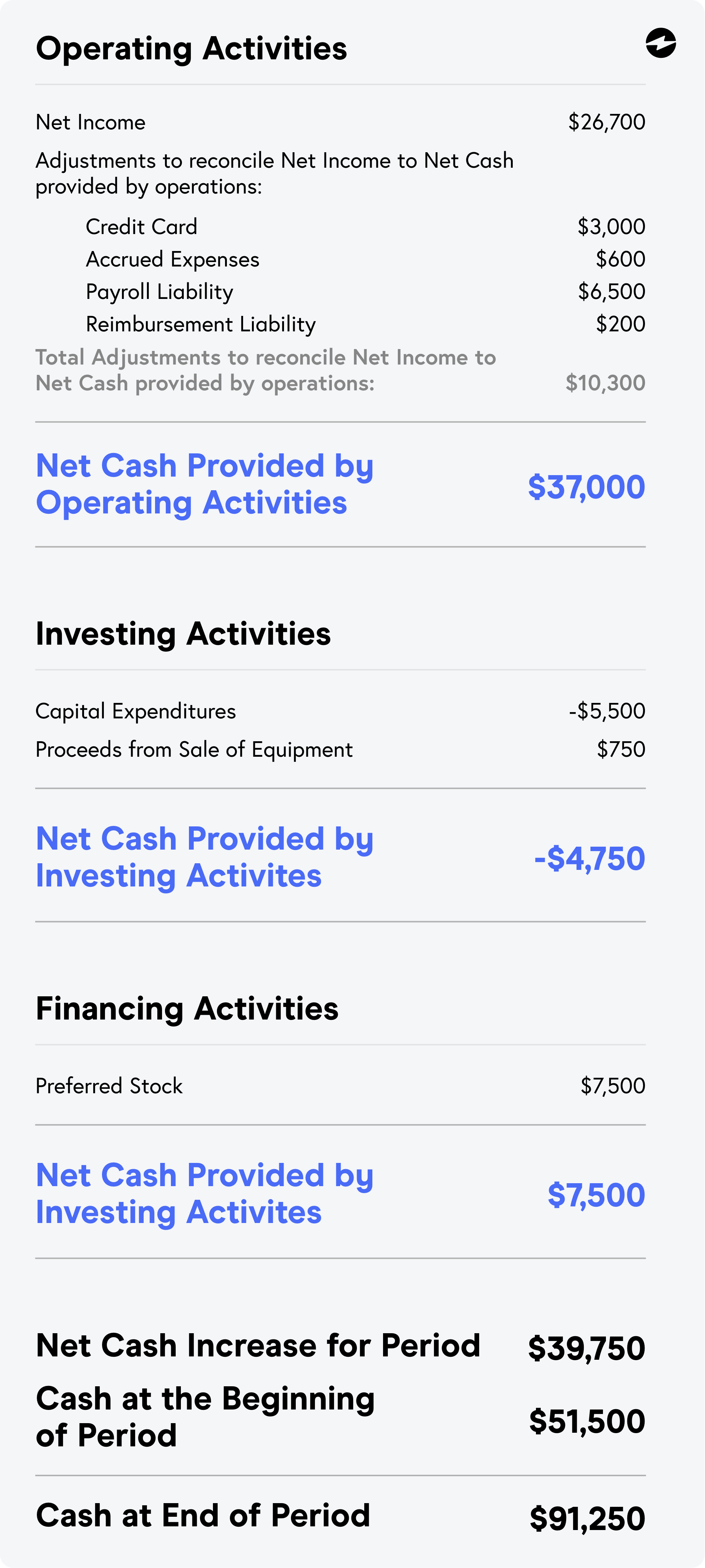

The first section in every cash flow statement is the operating activities category which shows how your company’s everyday operating activities impact the amount of cash going in and out.

Operating activities

In the operating activities section of your statement of cash flows, you’ll see Net Income listed first. Net income can be retrieved from your company’s income statement for a specific period of time. The example above shows a net income of $26,700.

You’ll then see the Adjustments to reconcile net income to net cash provided by operations section lists any non-cash expenses or revenue that aren’t already accounted for in your bank account.

After adding up this section, the sum of net income and adjustments to reconcile net income to net cash provided by operations equates to the net cash provided by operating activities. For this example, the net cash provided by operating activities is $37,000.

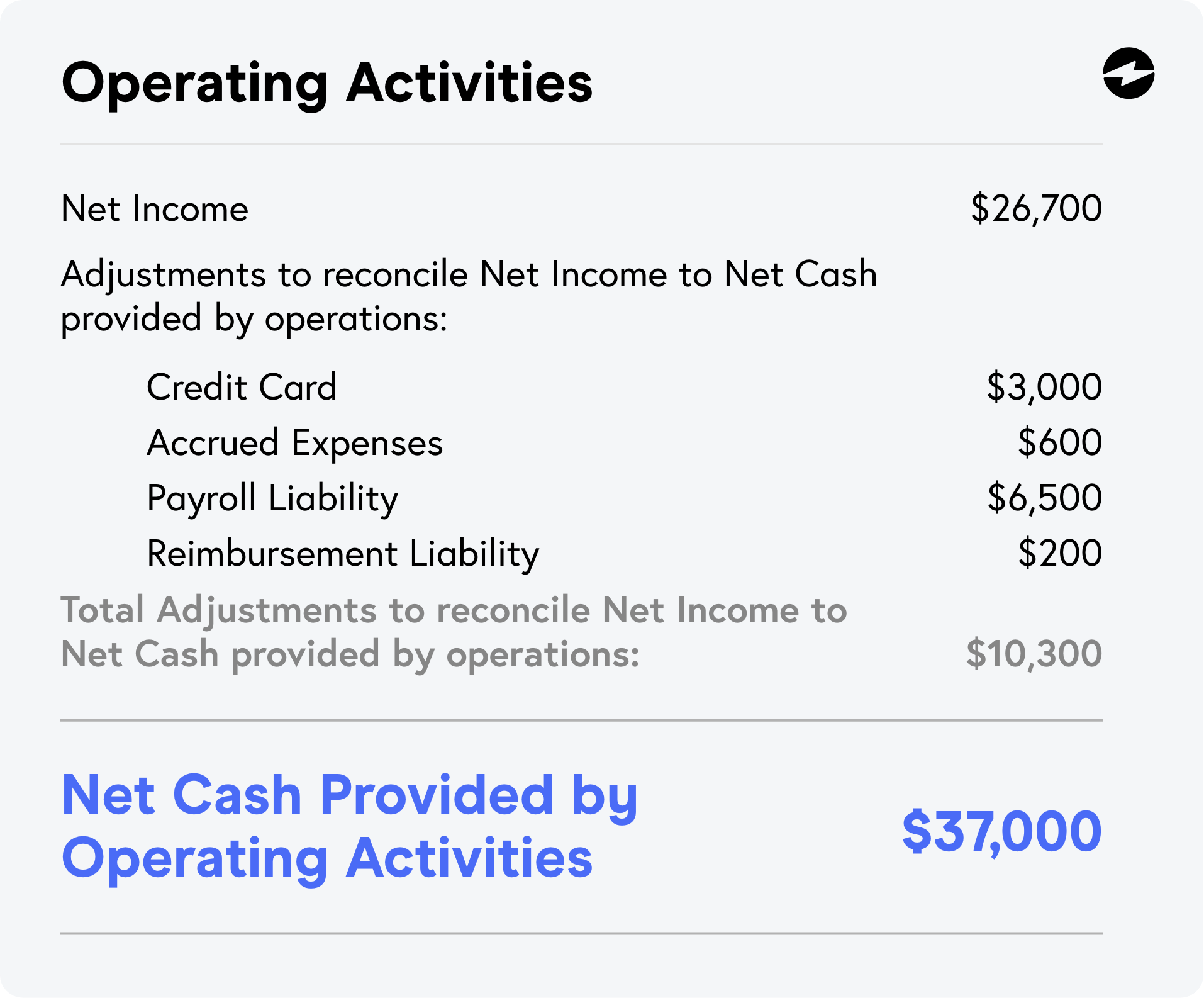

Investing activities

The investing activities section in your cash flow statement displays all the costs of the investments your business made during a specific time period that resulted in cash flowing in or out of your company. Reviewing these expenses can help you determine the overall impact of your investments during this time.

Examples of investing activities that would be represented on the statement of cash flows include:

- The buying or selling of physical assets such as office equipment or office spaces

- An acquirement or merger of another company

- The buying or selling of securities in other companies

Once all your company’s investing activities are added to the statement of cash flows, these investments represent your net cash provided by investing activities.

From the example above, we see that the company spent $4,750 on investing activities.

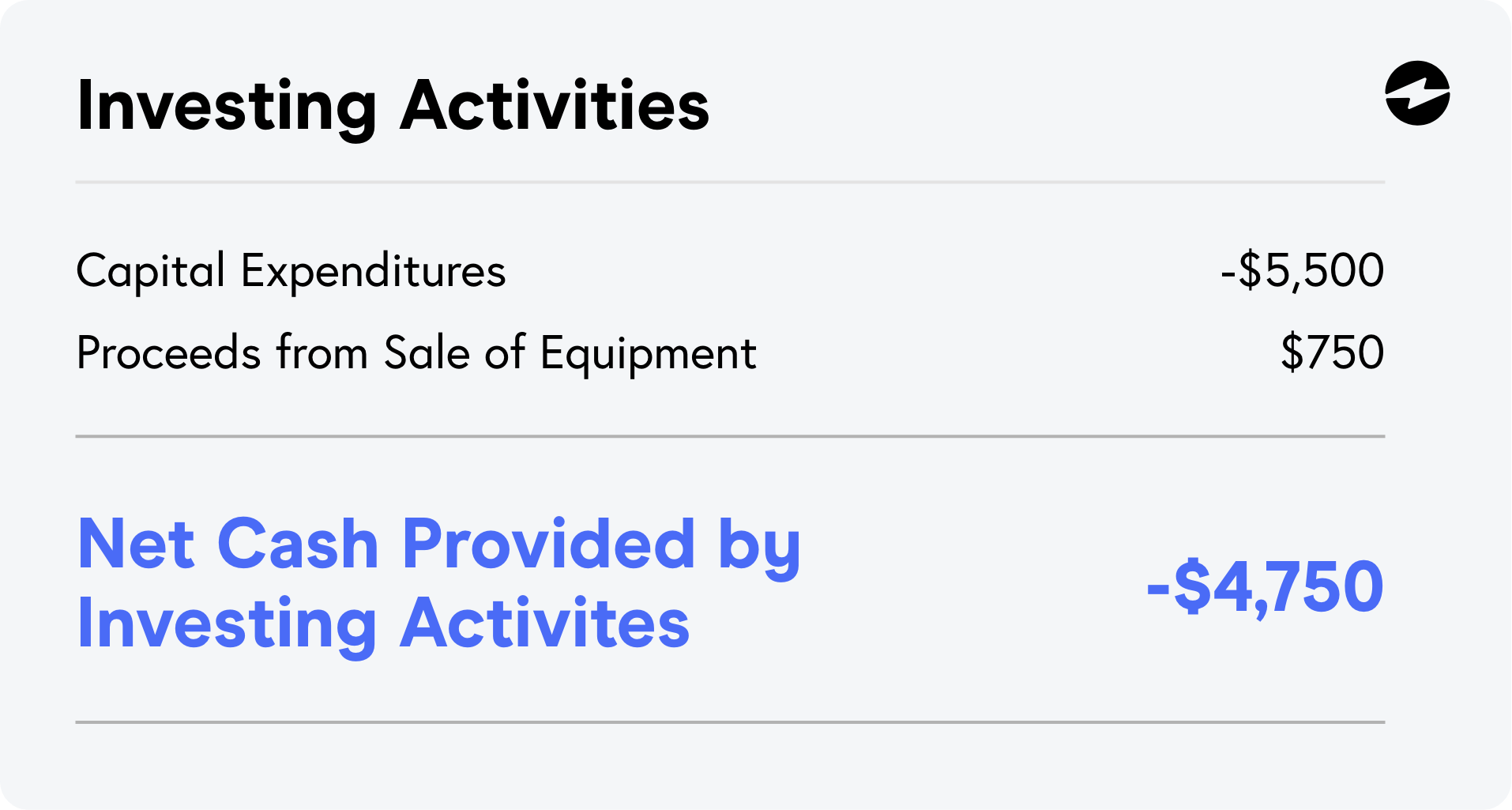

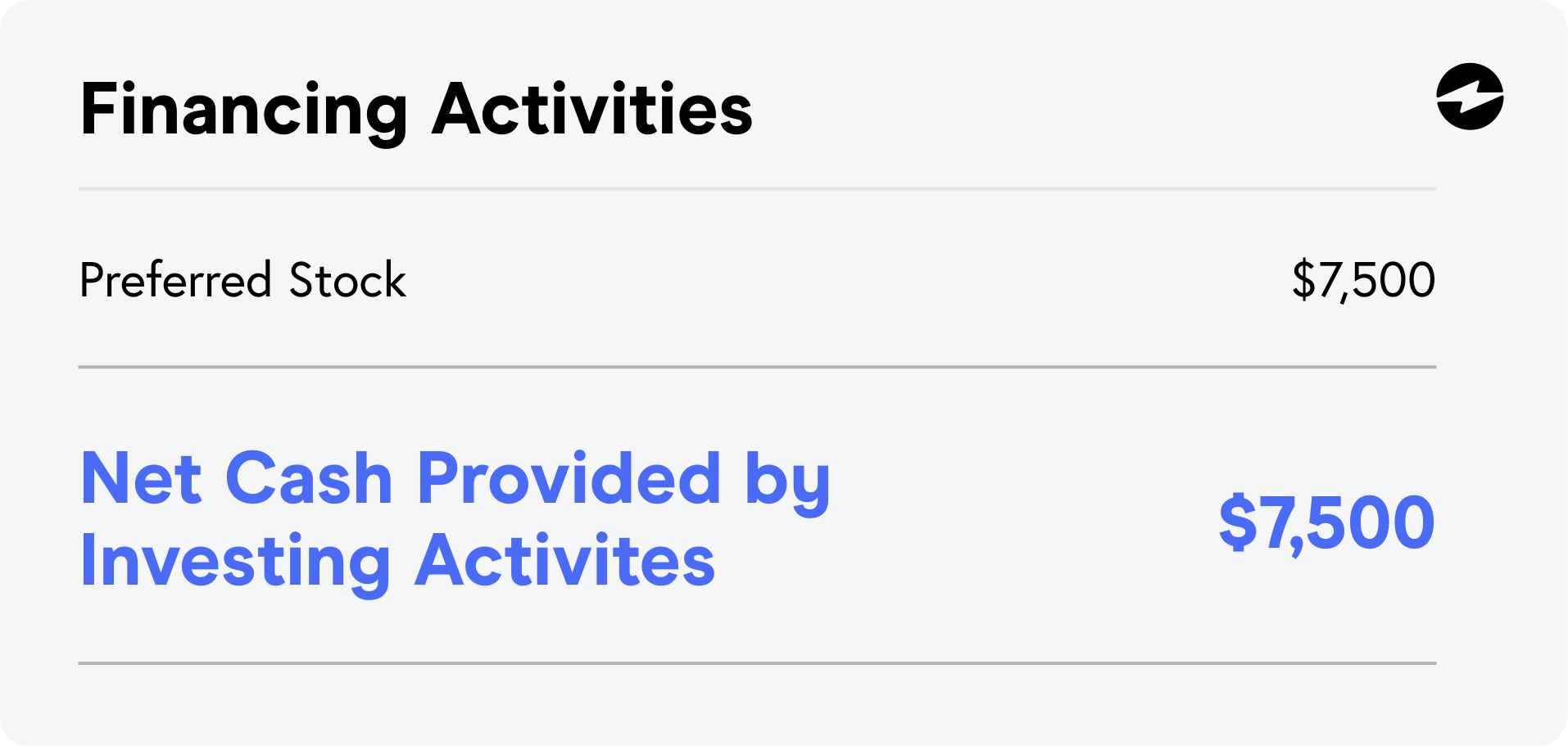

Financing activities

The final section of the statement of cash flows is the financing activities section which deals with the cash inflow and outflow associated with borrowing money, managing debt, or building capital.

The financing activities section records transactions or investments that other people make in your business. These include:

- Gaining more debt or repaying debt

- Paying for or receiving loans from a bank

- Paying out dividends to your shareholders

After adding all your financing activities, the total amount will be displayed as your net cash provided by financing activities.

The financing activities section of your statement of cash flows allows your business and its investors to evaluate your financial health. By reviewing your financing activities, your company can determine if its current financial model is working or needs to be restructured.

The example above shows that the company raised $7,500 in cash by selling its preferred stock.

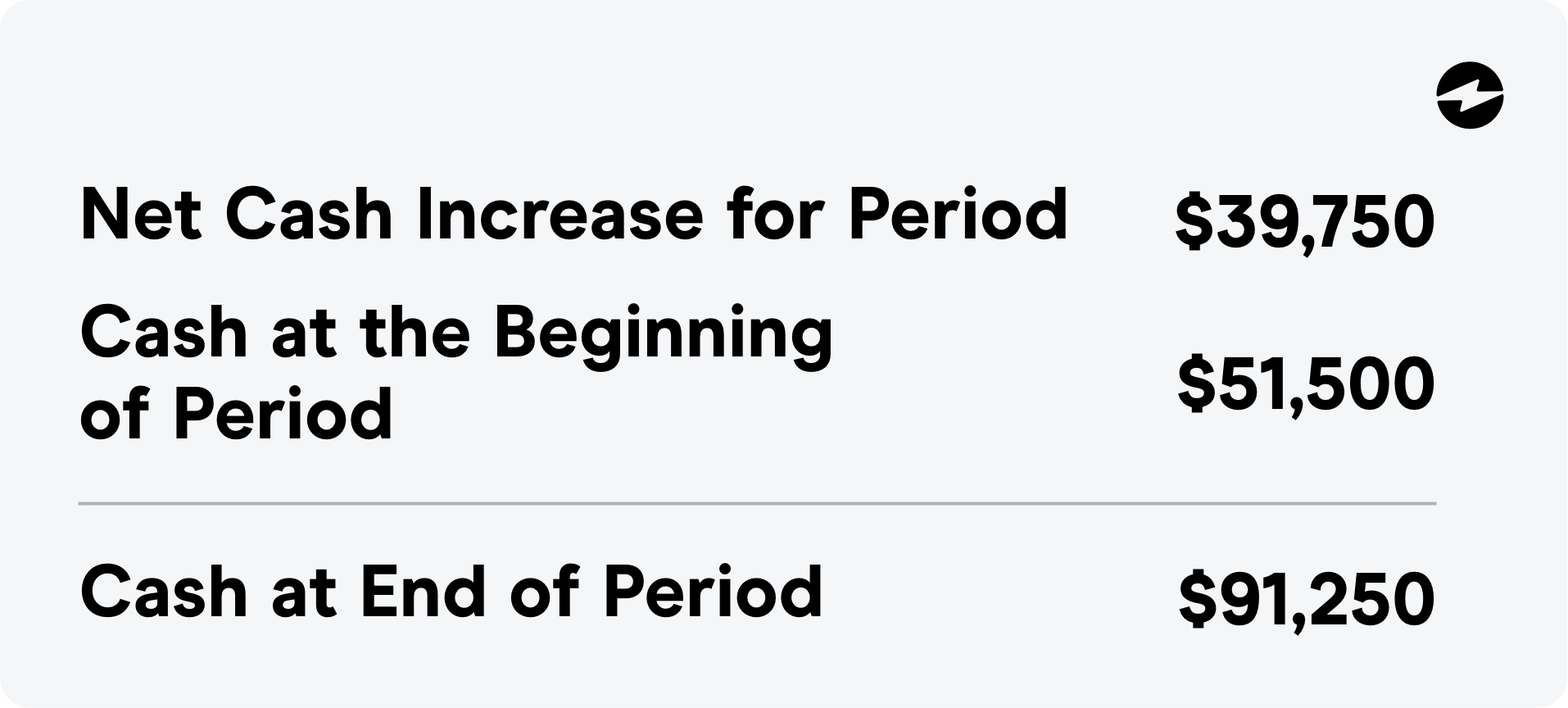

Once you’ve finished calculating your cash flows for the three previously mentioned categories, you’ll be able to calculate the cash your company had on hand at the end of the financial period of time:

The net cash increase for period category is the sum of all of the categories in the statement of cash flows. The cash at the beginning of period category will be obtained from your company’s previous cash flow statement.

Finally, the cash at the end of period total is the sum of the net cash increase for period and the cash at the beginning of period.

Interpreting the statement of cash flows to improve your company’s cash flow

Consistently tracking and reviewing your company’s incoming and outgoing cash flow will help your business focus on finding growth opportunities and gain better insights to develop valuable strategies to improve your overall financial status in the future.