Blog > How to Read a P&L Statement

How to Read a P&L Statement

Understanding the different financial statements for your business is essential for understanding the movement of money in your company. They give you the information needed for making appropriate financial projections about your business’s future and health. This article will dive into one type of financial statement specifically, the Profit and Loss (P&L) statement, sometimes described as an income statement. Then, the article will dive into how to read a profit and loss statement.

What is a Profit & Loss Statement?

At its core, a P&L statement is a type of financial statement that summarizes a company’s revenues, costs, and expenses during a specific period of time, generally monthly, quarterly, or fiscal year. The revenue section of the P&L statement displays how much money you brought in from your products or services after subtracting the cost of creating those products or services. The value displayed after subtracting the cost of goods sold from the revenue is your company’s gross profit. The expenses section shows how much money you spent throughout a specified period of time. The next value on the P&L statement is the net operating income which is the gross profit minus the total expenses. If this value is positive, then your company made a profit, if negative, then your company endured a loss.

P&L Statement vs. Balance Sheet

The P&L statement and balance sheet are two similar types of financial statements that both give you information about money flowing in and out of your company. The key difference between the two financial statements is focused on time.

The Balance Sheet

The balance sheet displays your company’s assets and liabilities during an exact period of time. For example, the first day in the previous month or the last day in January of the previous year. Reading a balance sheet shows your company how much you own on a certain date. It covers your assets, liabilities, and equity.

The Profit and Loss Statement

The P&L statement displays your revenue and expenses over the period determined by your company (monthly, quarterly, yearly, etc.). Rather than showing how much is in your bank on a specified date, the P&L statement will show you a much more detailed view of your company’s financial position.

What’s the purpose of a P&L statement?

The Profit and Loss statement is utilized for identifying trends in your business, and understanding whether your business is turning a profit or at a loss. The P&L statement identifies the following trends in your business:

- Is your company making a gross profit (revenue minus the cost of goods sold by your company)?’

- How are your revenue streams performing against each other?

- Where are most of your company’s expenses coming from?

- Of your company’s expenses, are there any categories that you might be able to reduce?

The P&L statement is an excellent financial tool to answer these questions and identify the weaknesses in your company’s finances.

Aside from identifying potential issues with your company’s finances, the P&L statement can also spot areas of growth and opportunity. If a particular department or aspect of your company is bringing in more revenue than the others, you can strategize to exploit this and continue to grow in the following months or years. On the other side, if there are struggling areas of your business, you can dig deeper and try to identify the reasons why those areas are struggling or remove them completely from your business model.

The next section will discuss how to read a P&L report to benefit your company.

Understanding how to read a P&L statement

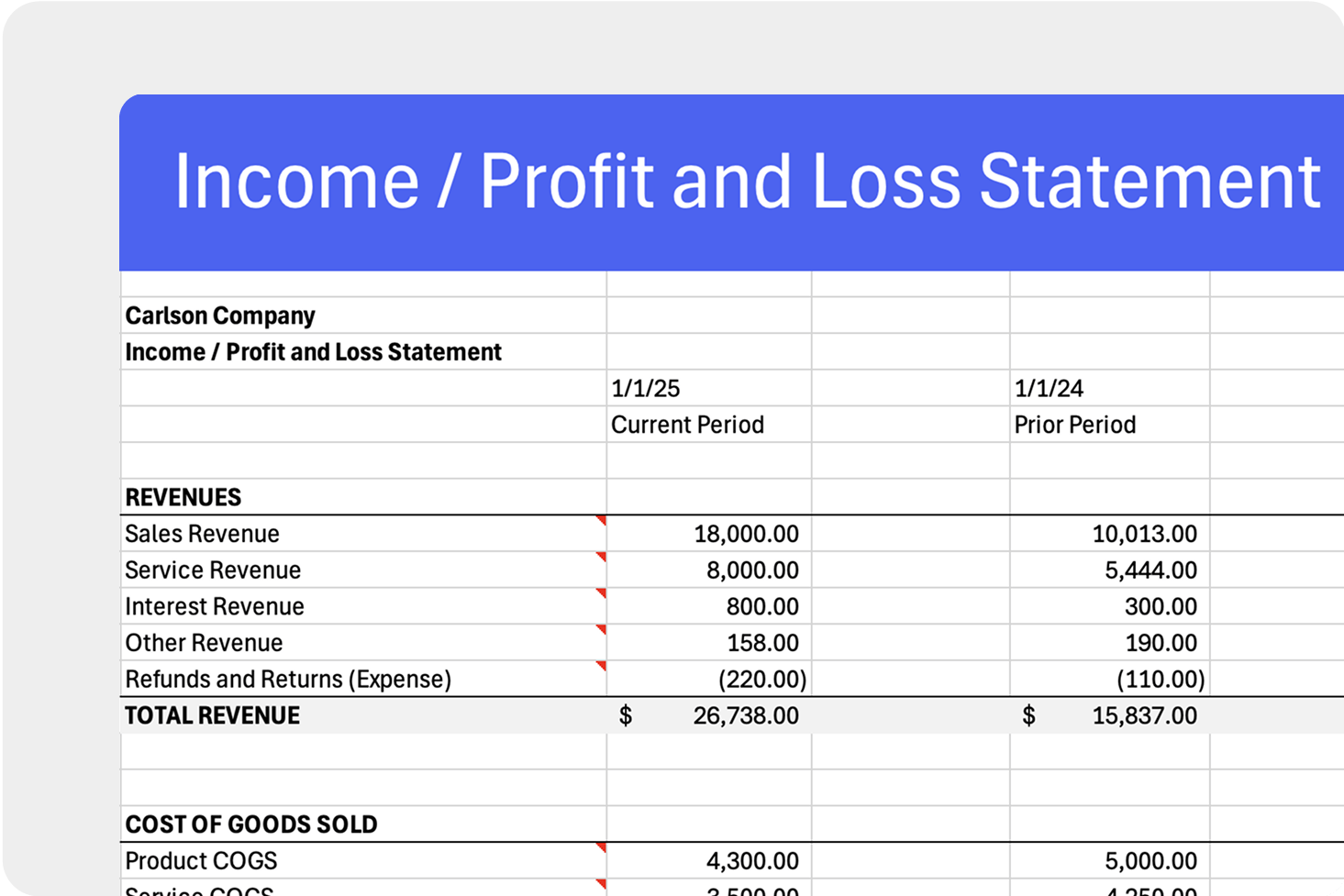

The P&L statement includes your business name, business address, date, income, COGS, gross profit, expenses, net operating income, and total net income. The following example will break all of these financial factors into detail and show you everything that goes into the P&L statement and how to read a P&L.

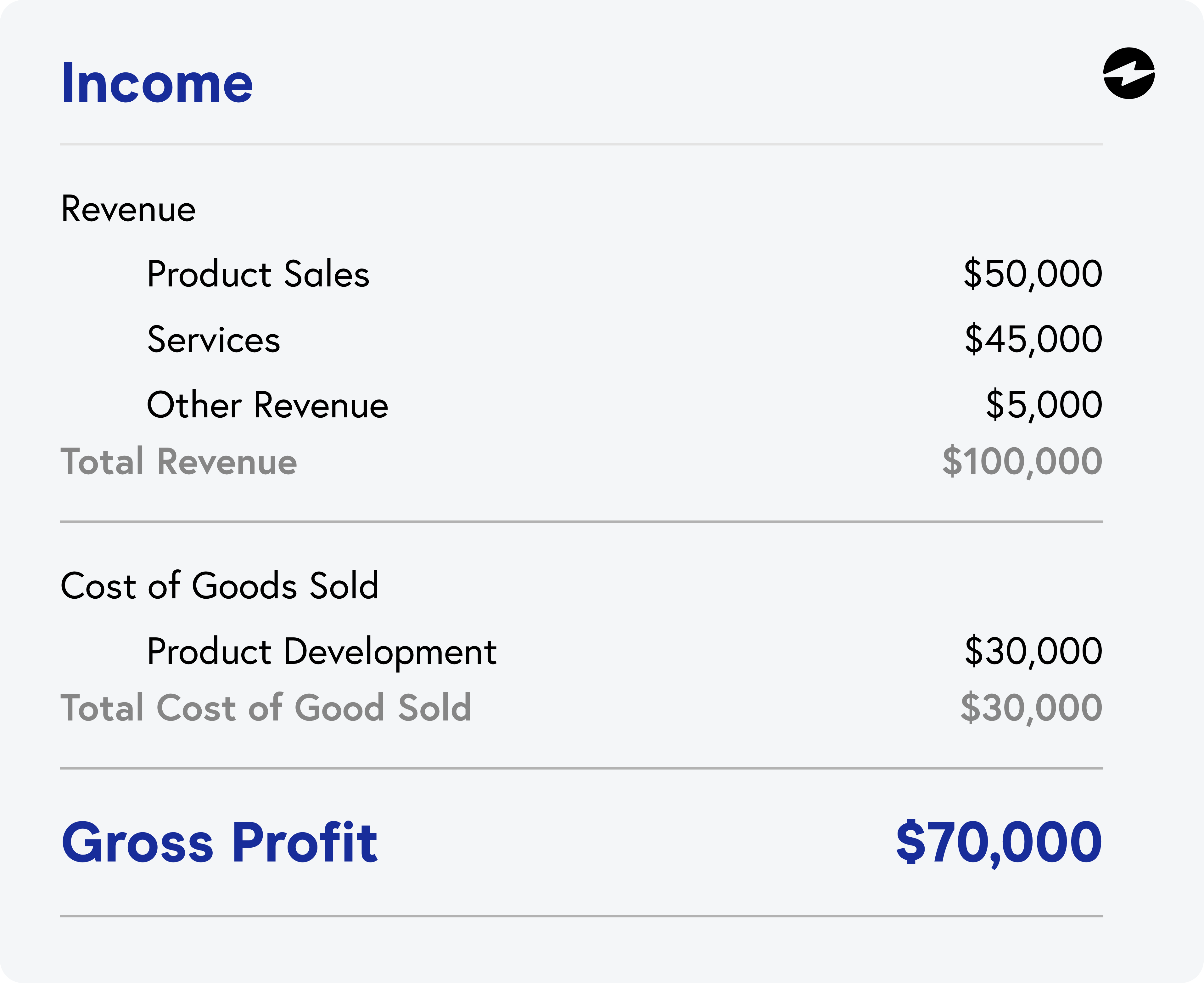

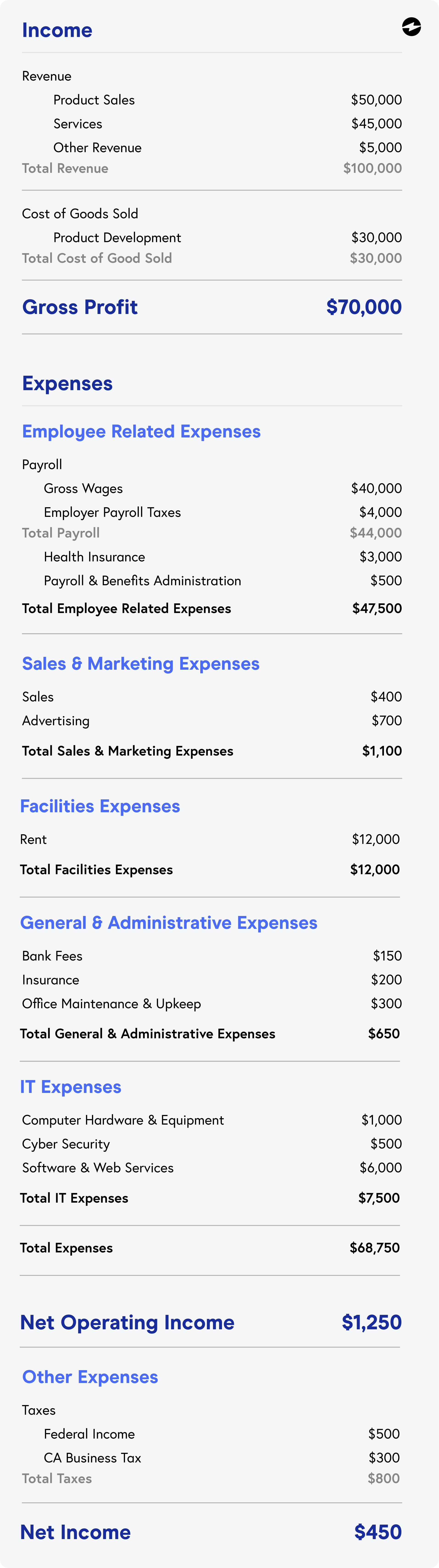

We’ll first take a look at income in the P&L statement:

The first part of the P&L statement mentions income, COGS, and gross profit. As displayed in the example above, the company had a total revenue of $100,000 and the cost to make those products was $30,000, thus resulting in a gross profit of $70,000 (Total Revenue – COGS = Gross Profit). The revenue is all of the money you made from sales or by other means. For each new revenue stream, there needs to be a new category on your P&L statement.

Underneath revenue on the P&L statement, the Cost of Goods Sold (COGS) is listed. This is how much the company spends to make the products and/or services they sell. In the above example, there’s a total of $30,000 COGS.

The end of the income section of the P&L statement states the gross profit. The gross profit is the total revenue minus the COGS. The gross profit is your company’s profit before the expenses are calculated. In the above example, the gross profit is $70,000.

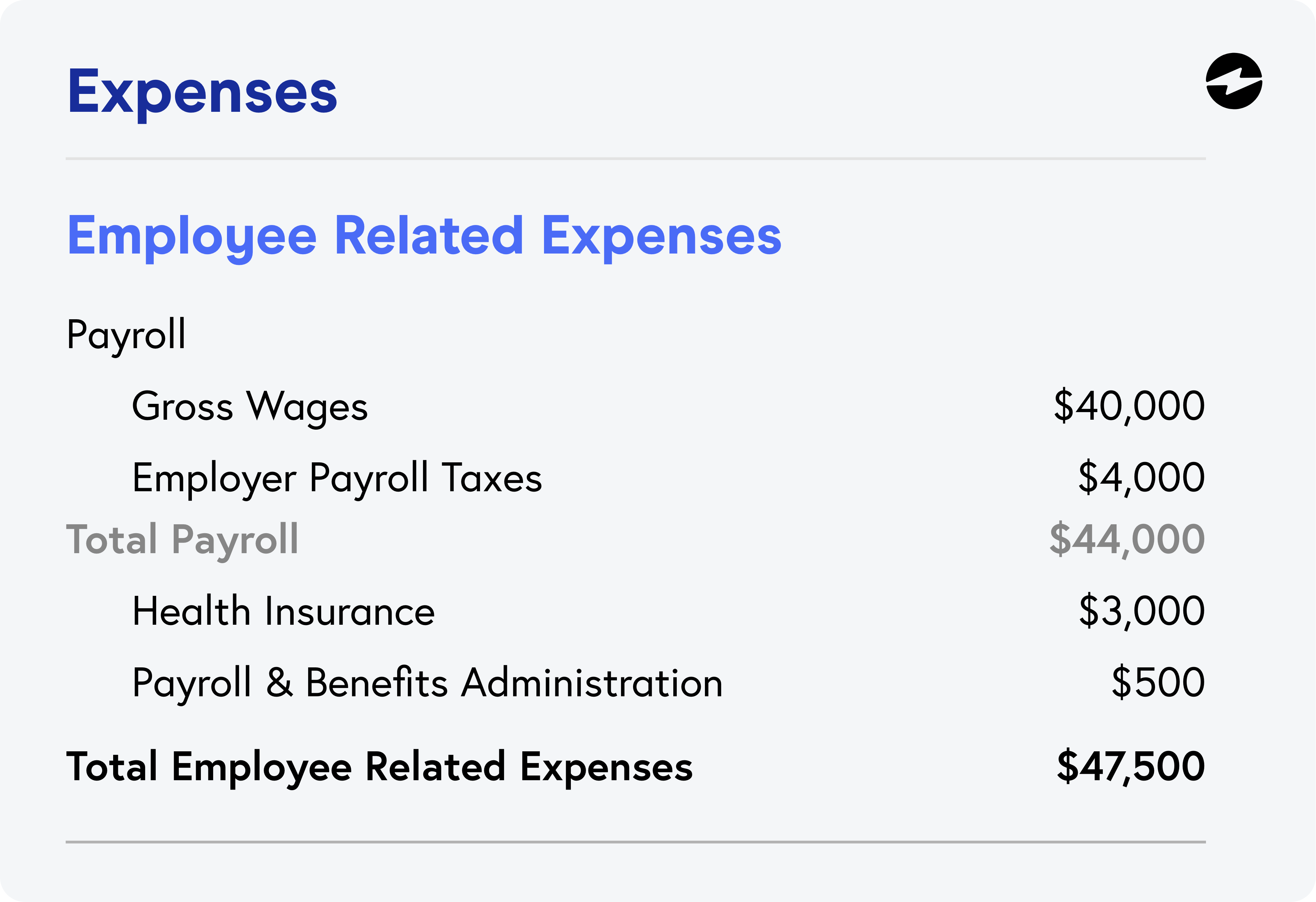

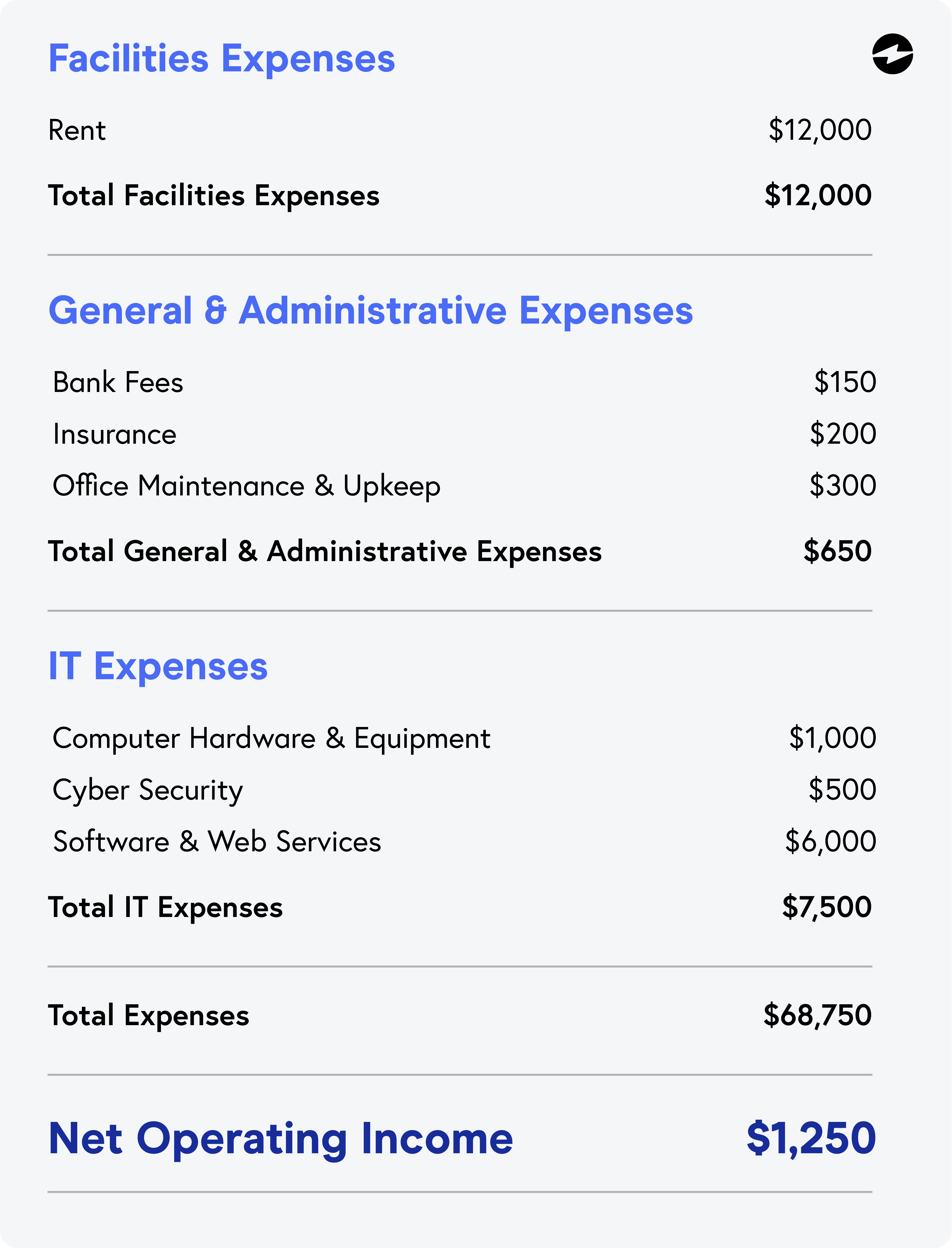

Following the revenue section of the P&L statement are the expenses of the company. These are divided into different categories and subcategories, which gives you a specified look at what your company is spending money on. In the above example, we notice that the total payroll expense is $44,000 with one category of gross wages at $40,000 and one subcategory of employer payroll taxes at $4,000. The next category, total payroll, shows a health insurance expense of $3,000 and a payroll & benefits administration expense of $500, coming to a total employee related expense of $47,500.

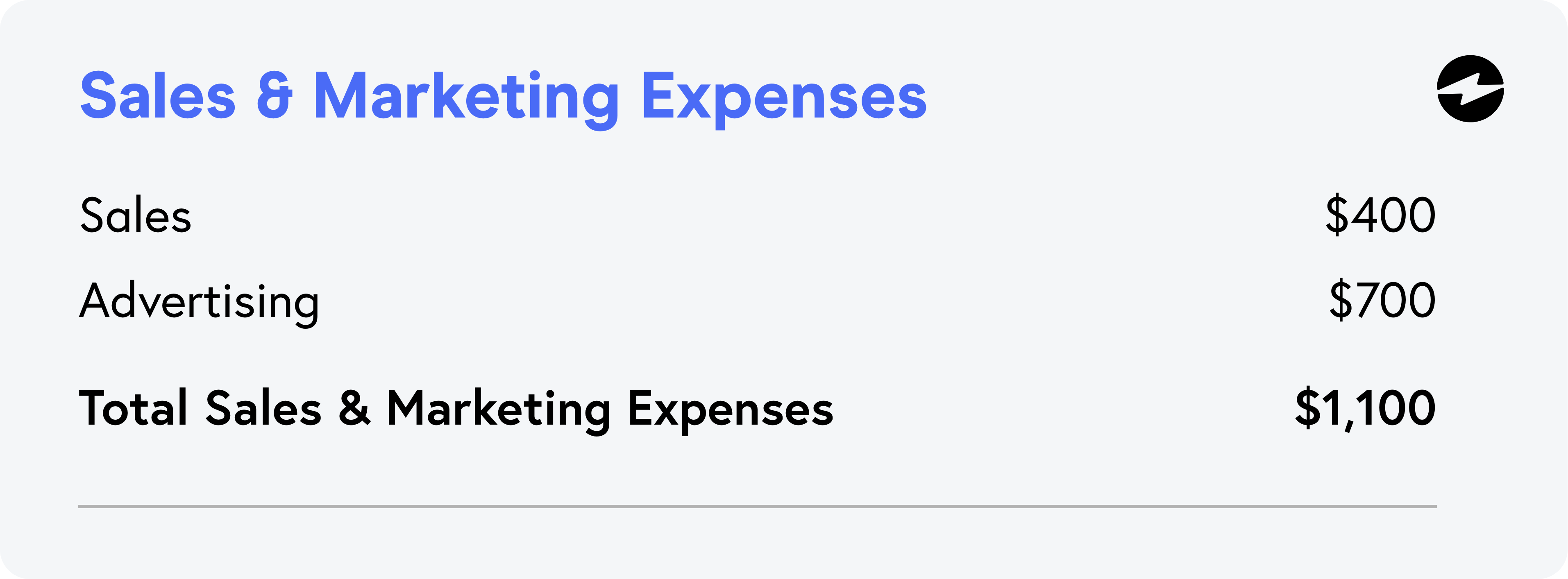

While some categories and subcategories can be broken down into significantly more detail, the standard format for the P&L statement is as shown above. It starts with a broad expense category like “Sales & Marketing expenses” and then it breaks it down into other categories that share the main category’s theme.

Net operating income is a crucial aspect of the P&L statement because it is what is leftover after all the expenses have been subtracted from the gross profit. If the net operating income value is negative, then it means that your business is at a loss. When your company is at a loss, it suggests that you’re spending a lot on expenses just to stay afloat. If the value is positive, then it means that your business is profitable.

The net operating income in the P&L statement is the gross profit ($70,000) minus the total expenses before taxes ($68,750). For this example the net operating income is $1,250 which means the company had a gain of $1,250. While it’s a positive that this company did not attain a loss, a profit of $1,250 is still low and the company should look to cut down on any insignificant expenses.

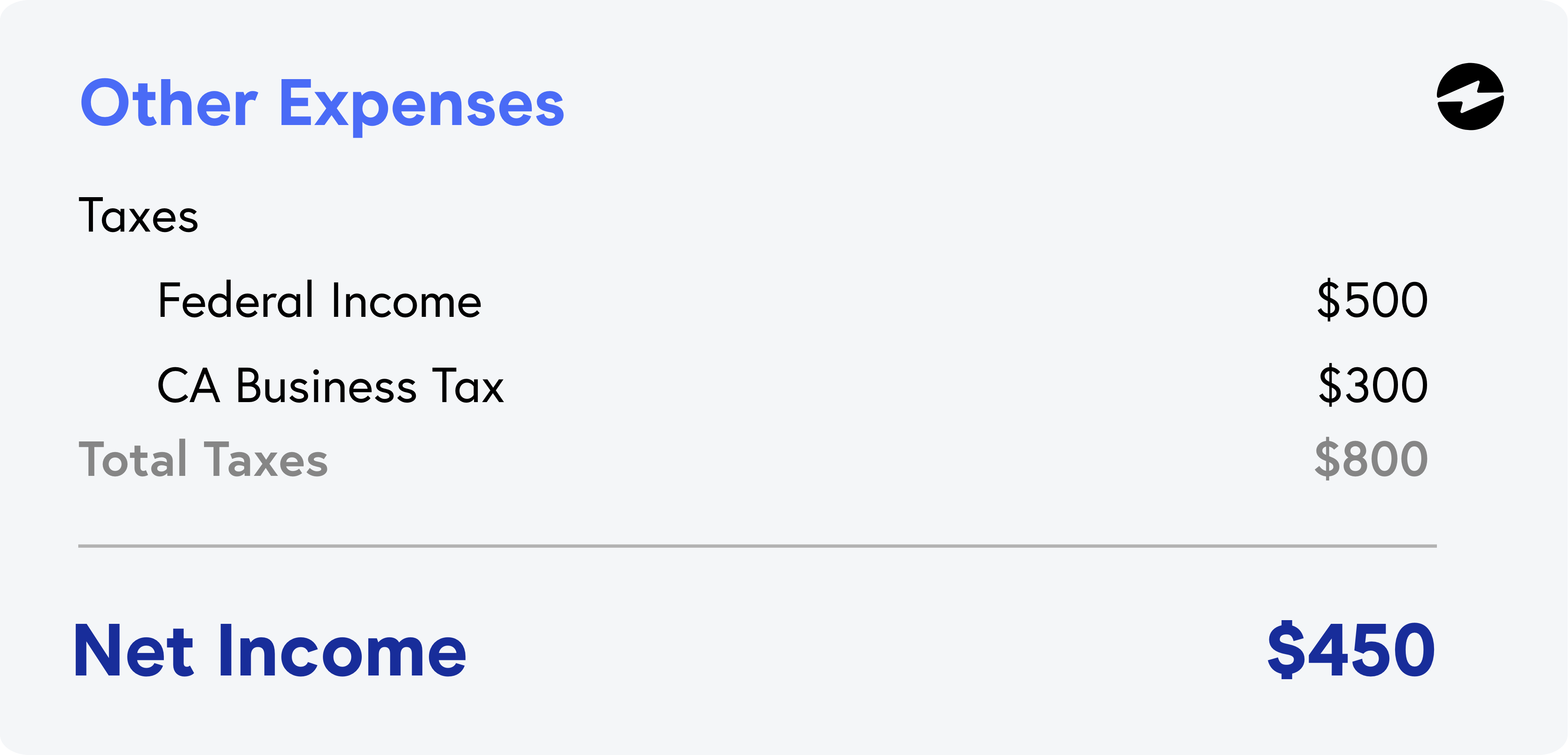

Finally, the non-operating expenses are provided. These generally include taxes that are not related to the daily operations of running a business. The company in this example paid $800 in total taxes with $500 from the federal income tax and $300 from the CA business tax. When this amount is subtracted from the net operating income, the final net income is $450. Even after the other expenses are added, the example company is still profitable.

Below is how the P&L statement looks when everything is put together:

Being able to manage the profit and loss statement is an integral part of financial statements and a critical tool in understanding your business’s money and knowing how to make changes after examining the P&L statement. Mastering the P&L statement will give your company the knowledge to adapt to the constant shift in finances and boost your company’s profits for the following time periods.