Blog > Next-Day Funding: Secrets Exposed

Next-Day Funding: Secrets Exposed

Everyone knows that merchant processing is a highly saturated industry. Every business in the country receives calls from about 10-15 different merchant service providers each week, all asking to see their statements. And every processing company those businesses speak with make the same promises time, and time again. Due to the desire to have your money in your account as soon as possible, the more common promise one will hear is, “Of course we do next-day funding!”

As relieving as this promise sounds, you can already guess that some of these processors are lying through their teeth. This isn’t to say that it is not possible – because it obviously is. However, next-day funding requires a merchant to meet specific criteria in order to acquire these benefits. Unfortunately, some merchants get suckered into a contract before they know the ground-rules they need to follow to benefit from this feature. Let’s shed some light on this topic by going over a few of these critical guidelines…

Next-Day Funding Necessities

You must close your batch out at or before a specific time.

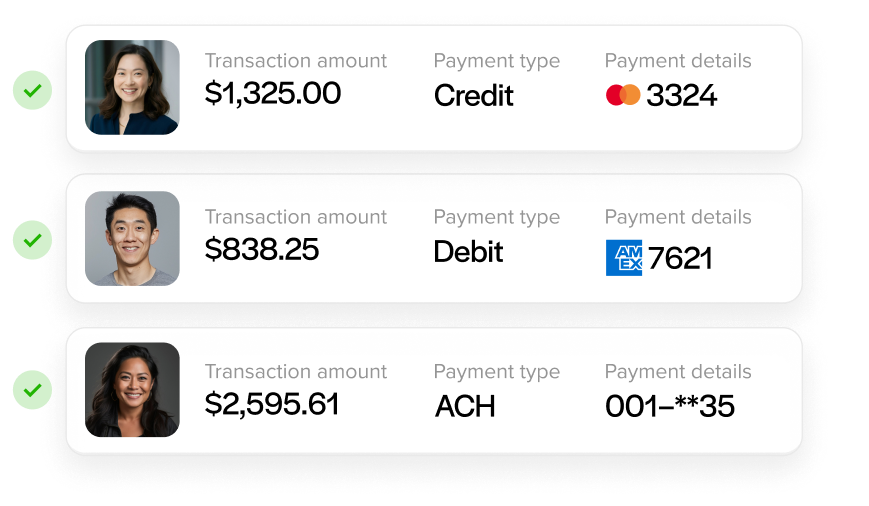

Here’s why: RISK. Getting you your money faster means that there is a much shorter time window for the ACH network to review your batches for accuracy and prevent fraud. This means that processors have to allow more time in order to meet the ACH time requirements. When the network sees something fishy, they will hold your funds for investigation (meaning: you don’t get your money yet!).

You will see cut-off times for next-day funding anywhere from 12 PM (EST) to as late as 7 PM (EST). If you are on the west coast, unfortunately you will need to close your batch pretty early in the work day to have your credit card receivables hit your account the next morning (which usually doesn’t work out so nicely for most businesses).

Only specific networks provide next-day funding.

In order to get your funds next-day, your merchant processor must be under provision of an acquirer (First Data, Bank of America, NOVA, etc.) that has acquired the rights to run on a credit card network (Cardnet, Omaha, Nashville, etc.) that provides that service. First Data is the largest acquirer in the world ($842 B) and has purchased the rights to run on all of the networks that offer next-day funding.

If you want next-day funding and your merchant processor operates under the TransFirst acquirer, tough luck. They don’t offer that service to anyone.

In order to qualify for next-day funding with an Elavon merchant account, you must have a bank account with US Bank attached to your merchant account. This is the only way they will allow next-day funding.

Only specific gateways are capable of next-day funding.

There is a short and exclusive list of gateways that have the capability to choose your batch close-out time. For example, some institutions will promise you next-day funding and set you up with a Pay Flow Pro gateway. The problem with this is that Pay Flow Pro only allows you to close out your batch at 8 PM PST. This means means that you would have to manually go in and close your batch before the required time by your network (assuming they have acquired the rights to process on one of the few networks that offers next-day funding).

Some of these gateways include, EBizCharge, Authorize.net, Orbital – just to name a few.

Issues with using next-day funding through your bank:

By now you might be thinking, “Okay so I’ll just go through my bank. I have all of my money there anyway. It should be safe and easy.”

Well that is halfway true, and halfway naive. Banks have the power to issue next-day funding because they don’t have to go through the ACH system. In other words, they are “fronting” you the money.

Your bank has total control of ALL of your money. They can see every change to your account balance. So there is a lot less risk on their part because if your bank sees a reason for it, they have the right to “mitigate risk at any time” by holding your hard-earned dollars hostage. Still seem safe? Even better still, they don’t have to tell you when they are going to “mitigate” that risk. Fun times for you when you need to make payroll (you can research the popular chain restaurant that this happened to – out of respect for the restaurant, they will remain unnamed in this article).

Okay, now, relax your shoulders, take a deep breath, loosen your grip on that sharpened pencil – there are some good guys out there. Your job is to do your best to research the companies before making any sort of commitment, or work with a company that doesn’t sign you to a contract or long-term obligation. It’s a bit tough, but the research pays off in the end when you find a merchant processing company with whom you can develop a trustworthy relationship. Alternatively, give us a call or request a quote and let us demonstrate how we can handle all your processing needs.