Blog > What is a Surcharge? Everything Merchants Need to Know

What is a Surcharge? Everything Merchants Need to Know

Looking for a $0 cost payment processing solution?

Check out our surcharge tool.

What is a surcharge?

A surcharge, also known as a checkout fee, is an additional fee that merchants charge customers to defray the cost of processing credit card payments.

Each time a business accepts a credit card payment, they pay a small fee (either a percentage or a fixed rate) to various entities, including the card brand (Visa, Mastercard, American Express, etc.) and the credit card processor.

Small businesses may find this credit card processing fee a barrier to accepting credit cards from their customers. But with a surcharge, businesses are able to pass the costs of accepting credit cards onto customers allowing their business to have zero cost processing.

The major card brands have a negative view of surcharging, as it adds costs for customers and may discourage them from purchasing. However, when done thoughtfully, surcharging can be a benefit to both businesses and customers.

For example, some customers may want the added convenience of paying via credit card versus cash and would be happy to pay a small fee for the ease of use. Businesses that would otherwise not be able to afford credit card processing can leverage surcharging to offer additional payment methods to their customers.

However, surcharging is not legal in every state. Merchants who want to use surcharging should reference the laws in their state as well as the rules set forth by the various card brands. Once merchants do their due diligence and ensure they’re following the necessary laws and regulations, they can begin surcharging with confidence.

Key takeaways:

- A surcharge is defined as an additional fee, charge, or tax that a business will add to the cost of goods sold to combat the costs of processing credit card payments.

- Adding a surcharge to a payment allows small businesses to accept credit cards because it passes the costs of accepting credit cards to their customers.

- Surcharges are not legal in every state so merchants should do their research before adding a surcharge.

Is surcharging legal?

Surcharging is currently legal only on a state-by-state basis. Some states allow surcharging, while others don’t. Businesses in New York, California, Florida, and Texas have each brought the issue to court, demonstrating the strong feelings that surcharging elicits in both customers and businesses. When determining if surcharging is right for your business, first check the laws regulating surcharging in your state.

Common regulations include:

- Merchants can’t profit off of surcharging. Card brands enforce this rule by either requiring the surcharge to stay under 4% of the transaction or by requiring the surcharge to be lower than the merchant’s cost of accepting the credit card.

- Before beginning to surcharge, merchants must provide notice, typically 30 days in advance, to the card brands and other relevant parties.

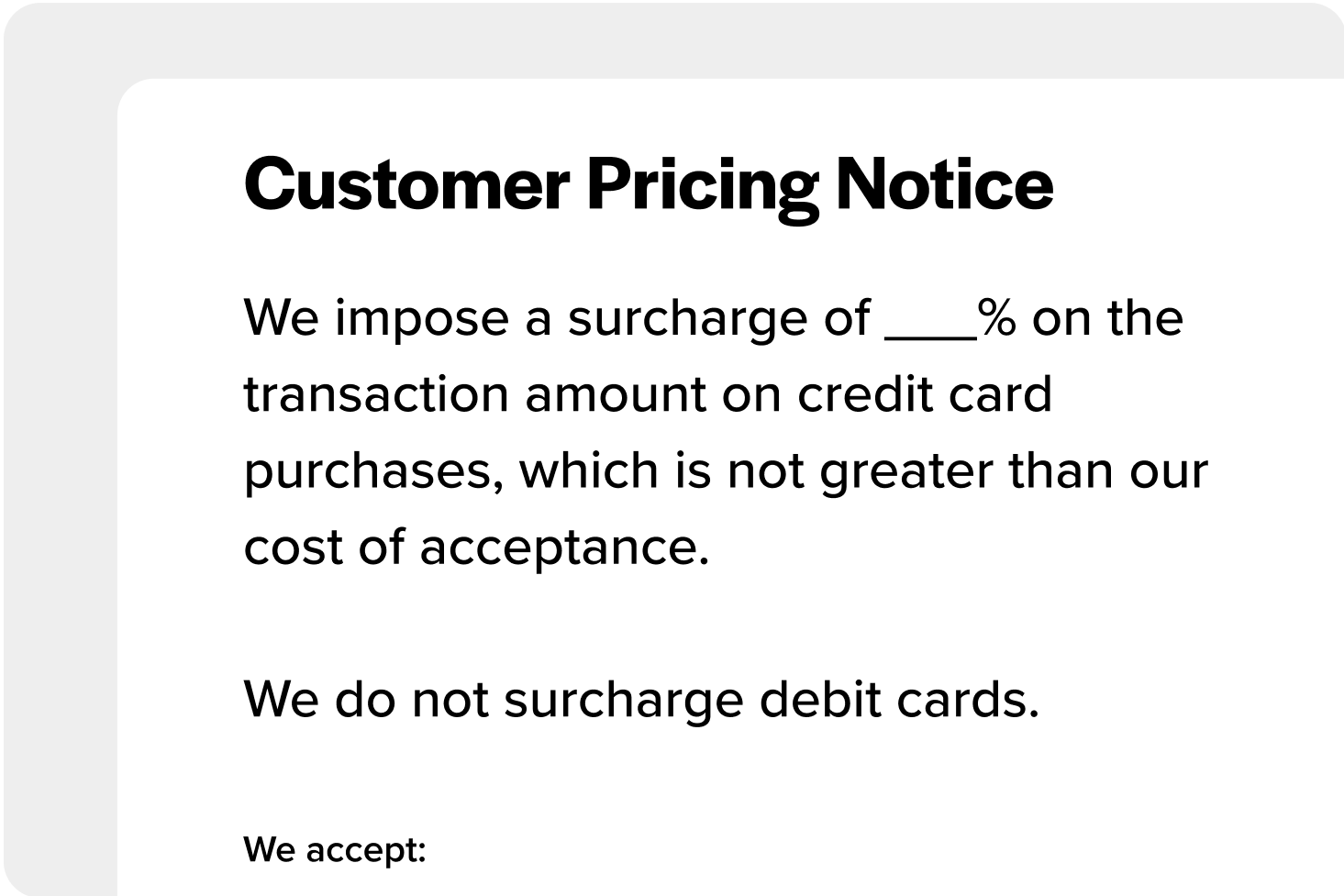

- Merchants must notify their customers about surcharges. In a physical store, this means clear signage at the cash register. On a website, this means a disclaimer on the checkout page.

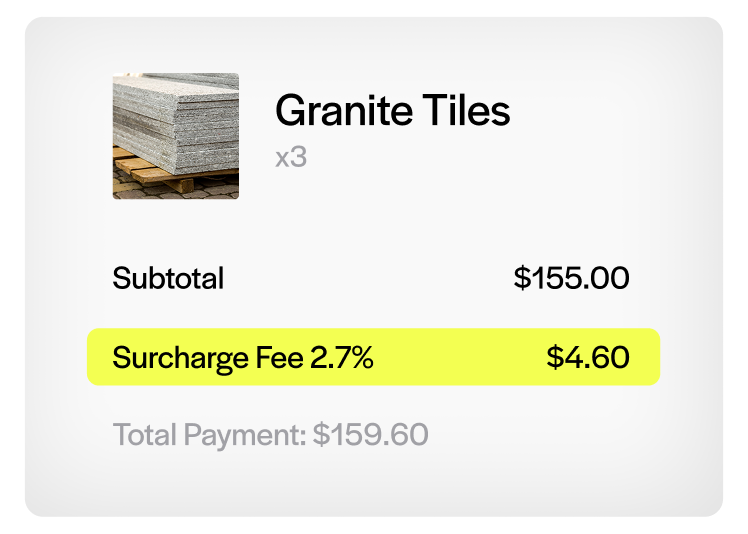

- Merchants must itemize the surcharge on receipts and invoices.

- Merchants can’t privilege certain card brands over others. For example, if they impose a 2% surcharge on American Express cards, then they must apply that same percentage to all other card brands.

Card brands may alter these regulations at any time, so be sure to research the most recent requirements for surcharging.

Pros and cons of surcharging

There are two main benefits to surcharging customers:

- Surcharging helps merchants recoup the cost of accepting credit card payments and may even allow them to accept credit card payments in the first place.

- Surcharging allows merchants to offer additional, more convenient payment methods to customers.

On the flip side, there are two main drawbacks:

- Customer opinion. If customers see that you’re imposing a surcharge and don’t like it, they may take their business elsewhere. The decision to surcharge could negatively affect your business’s reputation.

- Rules and regulations. The burden is on the merchant to do their research and stay compliant with all state laws and card brand regulations.

Each merchant must weigh these pros and cons before deciding if surcharging is the right decision for their business.

How to efficiently surcharge your customers

If your business decides to move forward with surcharging, you can use a payment integration like EBizCharge to automatically add surcharge to all your transactions. Using a payment integration means you won’t have to manually calculate surcharge with every transaction; you simply set up the surcharge as either a percentage or a dollar amount, and the integration automatically adds it to the transaction.

If surcharging isn’t an option…

If surcharging is illegal in your state or if your businesses has decided surcharging isn’t the way to go, but you’re still struggling with the cost of accepting credit card payments, it’s time to work on those fees.

Merchants can lower their credit card processing fees in a number of ways:

Change the pricing model. There are several different credit card processing pricing models. Each model has pros and cons and are better suited to different business types. If you’re using a pricing model that doesn’t make sense for your business, then switching to a different pricing model may cut costs.

Change the way you accept cards. There are a number of small actions merchants can take to mitigate risk and therefore lower the cost of accepting credit cards. For example, including AVS and preauthorizing and capturing for the same amount can help reduce processing fees.

Negotiate with your processor. Ultimately, if you’re unhappy with your credit card processing fees, it’s worth it to speak with your credit card processor and discuss options.

Get a quote from a different processor. If you think you’re paying too much for credit card processing, do some comparison shopping. The quotes you receive will help you assess if your fees are truly too high.

Use a payment integration to automatically lower costs. A payment integration allows you to accept credit card payments directly in your accounting software. In addition to using automation to simplify the accounting workflow, payment integrations also automatically lower your credit card processing costs. Solutions like EBizCharge offer QuickBooks credit card integration and payment processing for Epicor, so you can process transactions, apply surcharges, and reconcile payments all within the software you already use.

So, what is a surcharge? It’s up to the merchant

While surcharging may involve a lot of forethought, merchants can still do it in a responsible way that benefits their business. Ultimately, each merchant must consider the pros and cons of surcharging and decide what makes the most sense for their business.