Blog > The Ultimate 2021 Guide for Every CFO | 9 Expert Opinions

The Ultimate 2021 Guide for Every CFO | 9 Expert Opinions

As businesses prepare to head into a new year, it’s no secret that each industry experienced dramatic changes in 2020. As Chief Financial Officers adjust their strategies and finances to meet new trends, we brought in nine finance experts to highlight the top focuses of 2021.

With the valuable input of these experts, this comprehensive guide will serve as great reference to assist CFOs during the planning process. These insights also emphasize the ever-changing role of the CFO and what this position can expect moving forward.

Originally, the role of a CFO focused on the technical side of company finances — investor relations, management reporting, and controllership and compliance. Today, the modern CFO goes beyond numbers to be a leader and business partner who aids in decision-making, growth initiatives, finance-focused strategy, internal and external controls, and more.

With new responsibilities and a new year in sight, CFOs can build comprehensive plans to align brand needs with the needs of consumers, stakeholders, teams, and industries. To help assist with this planning, our experts narrowed down 10 strategies for your business to implement.

Here are 10 essential strategies industry experts believe will drive success in 2021:

- Invest in customer value

- Mitigating risk for increased reward

- Capitalize during COVID-19

- Utilize software automation for greater ROI

- Allocate Capital to High-Priority Projects

- Improve project management to execute goals

- Preserve business strategies to increase cash flow

- Defend spending for growth opportunities and competitive advantage

- Implement company-wide cost-saving procedures

- Provide diverse resources to meet diverse budgets

Let’s get into it!

Invest in customer value

“The availability and adoption of technology, and its impact on improvements in efficiency and competitive advantage, mean your time will be spent working on how technology can improve your organization’s overall performance, rather than handling the administrative details.”

Daniel Penzing

Co-Founder of Maze of Our Lives

Providing value to your customers and improving brand perception is key to increasing profitability in the long run. As a CFO, it’s your responsibility to ensure your business implements effective strategies to appeal to targeted consumers. Building a reputation of trust, transparency, and credibility is crucial for your business, especially during times of economic downturn.

According to SuperOffice, customer experience will be the top priority for businesses for the next 5 years, as 86% of buyers say they will pay more for a better experience. CFOs can improve customer value by using three creative, cost-effective tactics:

- Digital transformation

- Consumer privacy and business protection

- Product and service adjustments

Digital transformation

According to Gartner, post-pandemic recovery will be focused on rapid digital transformation, with an emphasis on reallocating resources rather than the conventional method of cost-cutting.

Digitalization offers a cost-friendly solution to connect with and appeal to target customers through marketing tactics like social media, email, online ads, and content for SEO. CFOs can use this approach to increase brand value and sales at a low cost.

SEO is an increasingly important aspect of businesses budgets

Website optimization is also essential to ensure your page is user-friendly, easy to navigate, and visually appealing. A professional site represents a professional business presence.

CFOs should allocate funds for digital transformation to provide a valuable experience and informative content to targeted consumers, which in turn can yield higher profit and longevity.

Consumer privacy and business protection

Consumers will naturally be drawn to brands they trust to provide both valuable products or services and protective measures for sensitive information.

As more businesses transition online, it’s especially important for businesses to update their technology to ensure maximum defense against fraud and other threats. CFOs can meet customer and company needs by investing in necessary safety tools and resources.

With the pandemic pushing many businesses to remote work, phishing attempts are on the rise, leading 83% of CFOs to become more conscious of cybersecurity. Many CFOs now play an active role in defining protective measures for sensitive data and collaborate with CISOs to analyze the performance and productivity of their systems to determine their effectiveness and spending needs.

Investing in cybersecurity has become mandatory to protect customers, assets, and private information, and these security measures will add to both customer value and a positive reputation.

Product and service adjustments

CFOs who encourage adjustments to products and services to meet current trends, spending habits, behavior, and more, can improve customer value by relating more to consumer needs.

According to Deloitte’s 2020 Q3 survey, 28% of CFOs include investing in new products and services or expanding into new markets as one of their top priorities in the next 12 months. Customers appreciate businesses that listen to their needs, and this appreciation can result in new sales, return customers, future visitors, and improved brand reputation.

Nearly 62% of CFOs don’t expect demand to recover to pre-pandemic levels until Q2 2021. During economic downturns such as this, businesses can actually benefit from lowering prices because it shows customers their commitment to bringing value to them even during difficult times.

Mitigating risk for increased reward

“My favorite tool to grow revenue and EBITDA while mitigating risk is scenario planning. Any plans requiring an investment of more than $250,000 require two or three execution options with a budget for best case, worst case, and most likely case. Discussing the alternatives brings tremendous value in really understanding growth opportunity vs. risks, so we never have more than three initiatives at once and only the very best ones get our approval.”

Rob Hagen

CFO of United Scope LLC

It’s the CFO’s job to compile and evaluate financial data to forecast which growth opportunities will yield the most reward with minimal risk. Risk management is vital to determine how to increase profitability, ROI, and sales for your business.

When evaluating risks, it’s important to consider both financial- and performance-related components. The CFO should act as a steward of company assets, especially during a health crisis. The current pandemic serves as a good reminder to take every possible risk into consideration and plan accordingly for all scenarios.

An effective risk management program spans across all departments and ensures regular company-wide processes remain cohesive. CFOs should also evaluate insurance and finances to implement the best strategic, financial, and operational response to any loss.

To prevent this loss, businesses can try to address risks early on by analyzing current trends, future forecasts, and company insights.

To mitigate as much risk as possible, CFOs can revisit previous forecasts to evaluate past risk levels and make informed decisions for the future. Businesses can then address any threats such as loss of profit, data security, product malfunctions, resource deficiencies, and more.

In order to address threats, it’s important for businesses to know which concerns are the greatest. PwC’s Pulse survey displays CFOs’ top risk concerns for 2021 and beyond:

- Policy/regulatory risks: 67%

- Environmental: 46%

- Compliance: 44%

- Macroeconomic: 43%

- Cybersecurity: 36%

Additional concerns include skills shortage, workplace safety, liquidity and solvency, third-party disruption, brand/reputational damage, and fraud.

By building risk mitigation plans to address all threats, CFOs can position their company for better recovery, profitability, and increased rewards after the pandemic.

Capitalize during COVID-19

“With the pandemic’s unknown end date and impact on future revenues, it will be critical to react quickly to any downward trends in revenue by controlling and/or cutting overhead costs.”

Kevin Irwin

Director of Finance Century Business Solutions

With the pandemic creating stress for companies on a global scale, CFOs have had to continuously adapt their business initiatives to a rapidly changing economic climate. Businesses have reassessed how they operate, spend, and strategize, and CFOs have developed future contingency plans.

CFOs can continue to capitalize during the COVID-19 crisis using several strategies:

- Team communication and collaboration

- Operational and product improvements

- Increase outsourcing and automation

- Leverage liquidity

- Nurture stakeholder and investor relations

Team communication and collaboration

With remote work reaching unprecedented levels, CFOs should listen to and provide for the needs of their staff. In doing so, they can ensure protocols, procedures, and strategic planning remain cohesive despite uncontrollable factors.

Remote work does not seem to be going anywhere. Gartner suggests that 74% of surveyed CFOs intend to move at least 5% of their employees permanently remote.

With teams missing out on in-person communication, it’s crucial for leaders to boost company morale and maintain a strong sense of culture. By fostering a positive community, CFOs can improve overall productivity, which can impact product and service profitability in the long run.

CFOs can succeed with virtual communication and collaboration by incorporating goal-driven meetings, regular individual check-ins, team projects, support networks, and more. Remember, the goal is to retain talent — don’t micromanage, respect boundaries, and focus on well-being.

In addition to increased productivity, all of these tactics can contribute to increased sales, innovation, and growth in 2021.

Operational and product improvements

As the pandemic continues to require adjustments to business models for 2021, CFOs can adapt by tailoring operations and products for various scenarios.

Instead of forecasting based on financial data, CFOs can implement scenario planning. This approach still focuses on revenue and cash flow initiatives but also includes various situational courses of action. It may be beneficial to implement a multi-department team to take on scenario planning to address any obstacles that may arise in different areas of your business.

Businesses can also use capital expenditure models to evaluate investments to improve sales and gain an advantage over competitors.

Even during times of crisis and recession, high-performing companies produce new products and take advantage of growth opportunities. To target relevant products to meet current needs, CFOs should evaluate costs, pricing, and supply chain structure.

Being selective in which products and services you sell, develop, and market for the foreseeable future will determine how much or little your business will grow — research and development will help you analyze benefits, spending, and potential profitability to decide which to choose.

Increase outsourcing and automation

During times of economic uncertainty, it’s normal for CFOs to reduce costs, streamline functions, and increase savings to capitalize on future opportunities. Using both outsourced and automated processes can help.

Virtual data centers, cloud-based interfaces, and third-party financial services can all be useful for businesses seeking to increase outsourcing and automation.

Although CFOs continue to tap into virtual employment and automation, these options still haven’t reached their full potential. Only 27% of surveyed executives say at least 1 in 5 members of their finance teams are virtual, while 52% say automating manual processes is a high priority. These figures indicate the large margin of growth businesses can capitalize on to save time and money using automation.

Leverage liquidity

To ensure a business has the means to support operations, CFOs must prioritize liquidity during economic declines. Managing liquidity helps cut costs and maximize profits. Businesses can optimize assets and yield profitability by balancing short-term credit, cash, and performance needs.

Despite fluctuating finances and stock markets, CFOs can secure liquidity by leveraging tax planning, diversifying or securing new lines of credit, modeling cash flow, and more.

Nurture stakeholder and investor relations

Retaining stakeholder and investor relations during times of uncertainty is crucial — these connections can help businesses allocate more resources to new business ventures in 2021. To achieve this goal, CFOs should communicate on a weekly or even daily basis with executive leaders, board members, banks, private equity investors, and employees.

An EY Parthenon survey suggests that CFOs should shift their strategy to focus on all stakeholders, not just shareholders — 78% of executives say regulatory stakeholders are as important or more important than shareholders in financial services.

After identifying key stakeholders and investors, CFOs should provide them with information about the steps they’re taking to address the crisis. This information will not only serve the stakeholders’ needs but will demonstrate how the CFO is working to improve financial performance.SEC and PCAOB regulators have adjusted guidelines regarding financial reporting and disclosures to provide relief for issuers, investment advisers, and funds that may have been affected by the pandemic. Businesses should stay up to date on all policies and regularly communicate with these regulators for guidance. SEC deadlines could also affect registrants’ financial reporting. CFOs must be transparent about financial reporting, as it can affect business development, legal issues, and risk factors.

Utilize software automation for greater ROI

“The availability and adoption of technology, and its impact on improvements in efficiency and competitive advantage, mean your time will be spent working on how technology can improve your organization’s overall performance, rather than handling the administrative details.”

Brooke Lively

Founder & President of Cathedral Capital

As technology continues to expand its reach, software automation has become nearly essential for growing businesses. Tedious back-office duties can now be automated through ERP systems, allowing your team to improve time management. Streamlining operations can help CFOs and finance teams be more efficient, productive, and accurate.

COVID-19 exposed deficiencies in many business models, especially digital processes regarding accounting and finances. According to a 2020 Deloitte survey, roughly 60% of CFOs say their investments in information technology for virtual and automated business operations will increase over the next 12 months. Luckily, the current trend of remote work and online shopping has presented the perfect climate for implementing new digital systems.

CFOs and finance teams can greatly benefit from automating a variety of tasks:

- Financial planning/analysis

- Invoicing

- Document management

- Bookkeeping

- Procurement

- Monthly close

- Bank relationships

- Tax/treasury management

- Employee expenses

- Stock administration

- Billing and subscription management

It’s important to choose the right automation for your business. Choosing efficient solutions can yield a variety of benefits for CFOs and their organizations, including cost savings and high return on investment. To achieve these benefits, your business should start by implementing a small-scale automation solution that incorporates a consistently-updated ROI model and self-service financial dashboard to compare automation and exception percentages.

CFOs can start automating processes using integrations like:

- EBizCharge: A highly efficient, all-in-one integrated payment solution for accounting software

- Vena: A full-spectrum solution to automate financial planning and analysis

- Conduent: A document management system that offers document imaging, data extraction, and Enterprise Content Management (ECM)

The graphic above shows how automating simple tasks can save money, thus increasing long-term ROI.

Allocate Capital to High-Priority Projects

“At You Move Me, the whole team plays a role in the development of new products and/or services, since we all know what it’s like to move and can contribute to how we make our customers’ lives easier. However, as the Head of Finance, I have a specific role to ensure we balance meeting customer needs with long-term growth. I consider the profitability of any new products and also our ability to implement the product/services in a cost-effective, sustainable way.”

Melanie Pump

CFO of You Move Me

As 2020 comes to an end, businesses are learning the importance of allocating time, focus, and resources to high-priority projects. Adjusting balance sheets to reallocate funds to rewarding opportunities can be a driving factor for profitability in the new year and beyond. Despite the economic downturn that’s still taking place for many, 85% of CFOs believe new opportunities will surface.

CFOs should use real-time data and scenario planning to identify potentially high-priority projects in 2021, such as:

- Rewarding partnerships

- Cost-saving technology

- Current investments and new opportunities

- In-house functionality and performance

- Top-grossing products and services

It’s crucial for CFOs to weigh possible risks and find a balance between funding short-term, mid-term, and long-term investments to generate the most capital and ROI.

Rewarding partnerships

Internal stakeholders — project managers, finance team members, executive leaders, and investors — play an important role in determining which projects to prioritize and should be included throughout the decision process.

CFOs should also consider outside stakeholders like customers, partnerships, regulators, and others, as their needs can contribute to which projects are funded over others.

Capitalizing on mergers and acquisitions can also allow CFOs to leverage more funding to high-priority business ventures for both parties involved.

Cost-saving technologies

As discussed above, automation is essential for companies wanting to cut down on labor, errors, and allocate costs more efficiently. Although automation alone is helpful, CFOs would be wise to incorporate integrations into their systems to provide an all-in-one solution for maximum reward.

Integrating your allocation process with billing systems, document management software, and computer networks can allow your organization to save costs by reducing resources and cutting down on laborious, time-consuming operations.

Cloud computing is an efficient way for business to save on data storage

Current investments and new opportunities

When prioritizing ongoing and new investment opportunities, it’s important for CFOs to ensure investments are aligned with their brand’s strategic objectives for 2021. Before CFOs allocate capital, they should firmly understand the financial profile of each potential investment and develop a risk-resilient strategy.

Capital investments should be evaluated based on relevant KPIs, potential value drivers, return on investment, etc. Businesses can leverage competitive advantage and rebound by focusing on the timing and size of investments, and evaluating how certain cost reductions might affect competitive positioning.

Investors play a vital role in capitalizing and identifying high-priority projects since they provide funding — CFOs must keep a clear line of communication with them throughout this process. Since COVID-19 has presented many challenges for businesses, investors may be less inclined to back riskier, long-term investments compared with short-term projects with fewer threats. Still, businesses should develop plans to pursue strategic opportunities that can lead to growth.

In-house functionality and performance

When reviewing in-house procedures and team performance, CFOs should use real-time data focused on costs, trade-offs, and completion of top-line goals rather than looking at budgets or variances. You want to ensure your business is functional, productive, and efficient.

The numbers will reveal which areas of your business are the top priorities in terms of ROI, revenue, profitability, production/operation costs, etc. — they can help determine which projects are yielding the best results and should continue, which should be given more capital, and which should be reduced or eliminated completely.

Top-grossing products and services

Due to the impact of the pandemic, 63% of surveyed CFOs indicate they’ll be making adjustments to product or service offers. Allocating the necessary funds to top-grossing products and services over underperforming products can be highly beneficial and allow excess capital to go toward top sellers and new projects for the coming year.

If costs are too tight, delaying or canceling product and service launches can be beneficial for small to mid-size businesses. However, if CFOs determine these potential projects will trigger growth and competitive gain, it can be helpful to follow through with them.

Using the stage-gate approach, mentioned above, will help you determine how to prioritize projects

Improve project management to execute goals

“In 2021, leaders in business will be placing more importance into the hands of their finance department than ever before. This is due to the increasing focus on not only the bottom line, but also additional responsibility that will be placed on supporting the C-suite with the accountability of the growth and transparency of the company’s performance. Companies have less wiggle room, and tight financial leadership is key to survival for my businesses.”

Joseph Meyer

Co-Founder of The Dollar Soldier

CFOs are no longer solely concerned with the financial side of their organization — they are now delegating tasks across departments and leading by example through consistent communication with other C-suite executives and key stakeholders. This new leadership will depend on effective project management to execute goals.

Project management can include several facets of the business:

- Team management

- Cost, supply, and operations

- C-suite strategy

- Data management

Team management

CFOs and companies that finance and protect talent in 2021 will set themselves up for more success in the coming year. Performance evaluations are the determining factor for most businesses to decide which individuals or teams are top performers and will bring long-term success.

Motivating remote workforces will pose another challenge for CFOs in 2021.

Participating in weekly check-ins and collaborative projects can improve communication and boost morale, while also keeping employees actively engaged. To increase productivity, CFOs and leadership teams can use incentives to reward employees for hitting milestones and team goals.

The close-looped accountability approach can also help employees stay on task by using teamwork to clearly distribute tasks, so that everyone knows what needs to get done, by whom, when, and why.

CFOs must also address COVID-19 health and safety procedures to reassure employees that the organization cares and is taking the necessary precautions.

Cost, supply, and operations

Cost, supply, and operational tasks all play an integral part in each project. CFOs can work to implement effective management techniques to execute on their 2021 goals and business initiatives.

The costs that go into each project will determine how they’re planned, built, and executed. CFOs should avoid four common cost management mistakes:

- Blanket cuts with no realistic targets

- Failing to sustain behavior change

- Slowing down organizational growth

- Hindering innovation

To avoid making these mistakes, CFOs can implement cost optimization efforts in 2021 to manage projects more efficiently and factor in capital costs, hidden cost planning, and payment terms.

Supply chain operations and procedures also play a big role in how CFOs will plan to manage each task to execute on 2021 goals for their brand. An astounding 100% of executives had production/distribution problems in 2020 and 91% had issues with suppliers.

It’s important for leadership to understand their supply chain, as it can affect how warehouse operations run. CFOs should carefully analyze demand metrics and plan accordingly to provide an adequate amount of stock to meet consumer demand, while being careful to avoid overstocking and creating an excessive amount of inventory that will reduce profits.

Depending on the size of your business and volume of sales, there are many strategies CFOs can use to improve supply chain operations to meet demand, save costs, and improve their overall projects to achieve their business’s goals in 2021.

C-suite strategy

During times of economic crisis, executive leadership must remain strong and present a united front for their teams, stakeholders, and consumers. The CFO can encourage management to collaborate and develop strategic scenario-based plans for the upcoming year.

Flexibility and adaptability will be crucial in 2021, as this year has taught us that unpredictable situations can and will arise. CFOs should work with C-suite execs on a weekly basis to evaluate business models and make the necessary modifications to meet consumer needs depending on the economic climate, pandemic updates, purchase behavior, and more.

Data management

Automatic data collection and analysis will be major assets for project management in 2021. Automated processes, software, and digital tools will allow CFOs to quickly and easily report on finances, reduce human error, and strategize to drive profit, all while staying on task and executing goals.

CFOs can use digital tools to manage data and projects more efficiently in areas like:

- Financial planning — cloud planning systems, analytics-based models

- Finance operations — streamline workflows, advanced analytics using machine learning

- Decision support — cloud-based data for accessible insights, create interactive reports

CFOs can use a variety of data management technologies depending on the needs of their business, to lower operating costs, risks, and improve the overall management of each project.

One effective way to execute project management is shifting to blockchain technology to better secure your supply chain.

Preserve business strategies to increase cash flow

According to Deloitte’s Q3 2020 survey, 48% of CFOs said increasing cash flow is their second top priority for 2021 behind cutting costs. Increased cash flow will give businesses the freedom to support strategic business initiatives, despite external economic pressure.

In general, CFOs should follow three fundamental steps for cash flow management: assess, engage, and act.

When assessing, there are four main areas of focus: working capital, capital expenditures, operating expenditures, and the balance sheet. Businesses should regularly evaluate and update situation-based cash flow forecasts, working capital to meet needs, non-trading contracts, and liquidity.

After assessing, businesses should actively engage affected stakeholders to allocate funding for products, address shortcomings early on, form a strategic plan, and take action.

CFOs can increase cash flow using several actionable strategies:

- Inventory and supplier partnerships

- Payment term revisions

- Expense prioritization

- Asset liquidity

- Relief programs

To implement these strategies, financial planning and analysis and cash flow projections will be great tools for CFOs to monitor performance, working capital, revenue, profitability, etc.

Inventory and supplier partnerships

CFOs should strategically balance stock to maximize profit while minimizing excess inventory. Businesses can take procurement actions to achieve this balance, which includes regular auditing, demand planning, end-to-end supply chain, and more.

Encouraging partnerships with suppliers can be a beneficial tactic for CFOs to nurture lasting relationships for long-term success and resilience. Forging these lasting partnerships can help your brand improve internal and external transparency of business operations, gain access to more resources for lower costs, and promote higher standards of inventory and supply handling. All of these benefits can lead to less risk for your supply chain, clear terms and conditions, and regularly compiled performance metrics to evaluate and leverage cash flow for maximum profit.

Payment term revisions

CFOs can increase cash flow by revising payment terms to optimize accounts receivable.

Efficient customer onboarding can allow customers to opt in to standard payments, prevent scope creep, enhance scalability through streamlined processes, and more — all of which can increase long-term cash flow.

CFOs can also utilize standard, regularly occurring payments to reduce errors and late payments, and improve credit ratings and customer relations. Improving these areas allows businesses to increase long- and short-term cash flow by avoiding late fees, leveraging credit for better resources, and driving more sales through increased brand trust.

Expense prioritization

Accounts payable can be leveraged to increase cash flow by optimizing variable expenses to meet current trends and demands. CFOs should actively look at reports and forecasts to determine which costs can be cut based on the volume of sales.

Prioritizing these expenses based on data and strategic business initiatives can allow CFOs and their organizations to allocate capital to maintain operations and generate revenue.

Asset liquidity

CFOs can liquidate available assets that are unnecessary to business success during economic declines. Like prioritizing high- and low-priority projects, businesses can evaluate which products or services are not selling and liquidate them by offering discounts, bundles with top sellers, or resale options. Businesses can use this tactic to sell or move products to cover other costs.

Relief programs

In worst-case scenarios, CFOs can consider borrowing options such as loans, financing, and grants that alleviate funding issues to keep businesses afloat. There are different options available depending on your industry, location, and size of your business.

Companies would also be wise to take advantage of any available COVID-19 government relief.

Above is an example of a KPI dashboard. They can be used to adjust monthly expenses to meet business goals.

Defend spending for growth opportunities and competitive advantage

“Businesses can defend spending once they’ve identified that differentiation in a product line will set them apart from their competition. This would result in a higher cost product with different or added features. So, you’re going to spend more on product costing, but your defense is that you can charge a premium price for your higher-end product. The key metrics would be: What is my return on investment in higher production costs compared to increased expected revenues? Is this product going to prove a consistent difference in the market to influence buying decisions?”

Christopher Campbell

Owner of Christopher B. Campbell Bookkeeping

As businesses struggle to adapt to the new economic landscape, it can be tempting to put up financial barriers to protect assets. However, this practice can result in decreased revenue, consumer loss, stalled growth, and competitive disadvantage. Despite outside pressure, CFOs must defend spending that promotes business improvements and growth opportunities.

As businesses move forward with cautious optimism, capitalizing on growth initiatives and competitive opportunities is of the utmost importance. Deployment of the COVID-19 vaccine has shifted CFOs’ outlook, as 59% now expect better conditions in 2021, a 43% uptick from Q3 responses. These opportunities can make all the difference in recovery during the new year, and funds should be reserved for long-term growth efforts.

CFOs can implement several growth strategies to overtake competitors:

- Leverage spending for competitive differentiation

- Protect long-term investments

- Streamline products and services

- Build innovation-focused teams

Leverage spending for competitive differentiation

Gaining a competitive advantage over others in your industry will be huge in 2021, as most companies race to recover lost revenue and costs. Instead of copying current industry trends, CFOs can spearhead efforts to differentiate their business from others.

To leverage spending to overtake competitors, businesses can run reports involving competitor analyses, consumer performance reviews, sustainability measures, sales metrics, ROIC, and more. Gartner recommends skeptical CFOs use high-level metrics to differentiate growth efforts:

- Ratio of market share to defined constraints

- Pricing elasticity

- Customer acquisition costs

- Production costs

Businesses should consistently measure these factors to ensure spending limits are not exceeded and adequate resources are used.

Protect long-term investments

The pandemic has shifted most companies’ focus on short-term investments, as CFOs allocate funding and resources for remote work, necessary technology, and health and safety protocols. Despite these uncontrollable changes, businesses should still invest in long-term initiatives that promote growth and competitive advantage. The most effective CFOs will evolve long-term investment and growth bets as part of their COVID-19 cost management response, rather than eliminating them.

To manage costs, organizations should use real-time data to update or replace outdated long-term investments with newer ones. CFOs can lead innovation efforts by evaluating customer needs through personal interaction to gain insights and collect surveys that can be used to determine which investments will yield better results.

Instead of spending on a wide range of long-term investments, CFOs should use a targeted approach to create specific initiatives with tangible goals. Businesses can also evaluate their business portfolios to determine which costs are not yielding growth to distribute resources elsewhere.

Streamline products and services

According to Gartner, efficient growth companies differentiate themselves from competitors by structuring product and service lines into 24% fewer segments and by creating simple, strong portfolios that leverage growth and restructure spending.

By thoroughly analyzing products and services, CFOs can determine which generate revenue and which hinder growth. C-suite executives should not oversaturate the market with products that waste costs and don’t generate demand.

After streamlining their products and services, CFOs can increase spending margins to focus on differentiating top-grossing products from competitors, to yield short- and long-term growth. This spending should be defended to bring value to the market and profit to your business.

Build innovation-focused teams

By building innovation-focused teams, organizations can monitor profitability metrics to adjusts products and/or services, pricing, or operations early on. CFOs can train teams to recognize KPIs, emerging competitive opportunities, market shifts, and risk indicators — all of which can allow businesses to mitigate financial burden and generate more growth.

Challenging teams to produce innovative proposals can also keep morale and company engagement high for remote workers. By promoting this collaboration, CFOs can encourage their teams to develop strong initiatives within necessary budget limits.

It’s important to know what your competitive advantage is before investing money into it. Learn how to do that with the video above.

Implement company-wide cost-saving procedures

“There has been a tech explosion this year, as companies are forced to adapt to remote working. This generates huge opportunities for companies to review and upgrade their software. Many companies are still using older, more expensive platforms because that was all that was available on the market, and why change what works? Additionally, implementing new technology can help identify areas for growth, and, of course, free up time to pursue those growth opportunities.”

Lisa McGarry

Managing Partner of Proficient Financial Management

With coronavirus cases rising again and strict health restrictions being put in place as we transition into 2021, it’s likely that most businesses will continue to cut costs wherever they can, both internally and externally. Due to this unpredictable climate, CFOs will need to regularly assess the short- and long-term needs of their business to determine what brings value and what must be eliminated.

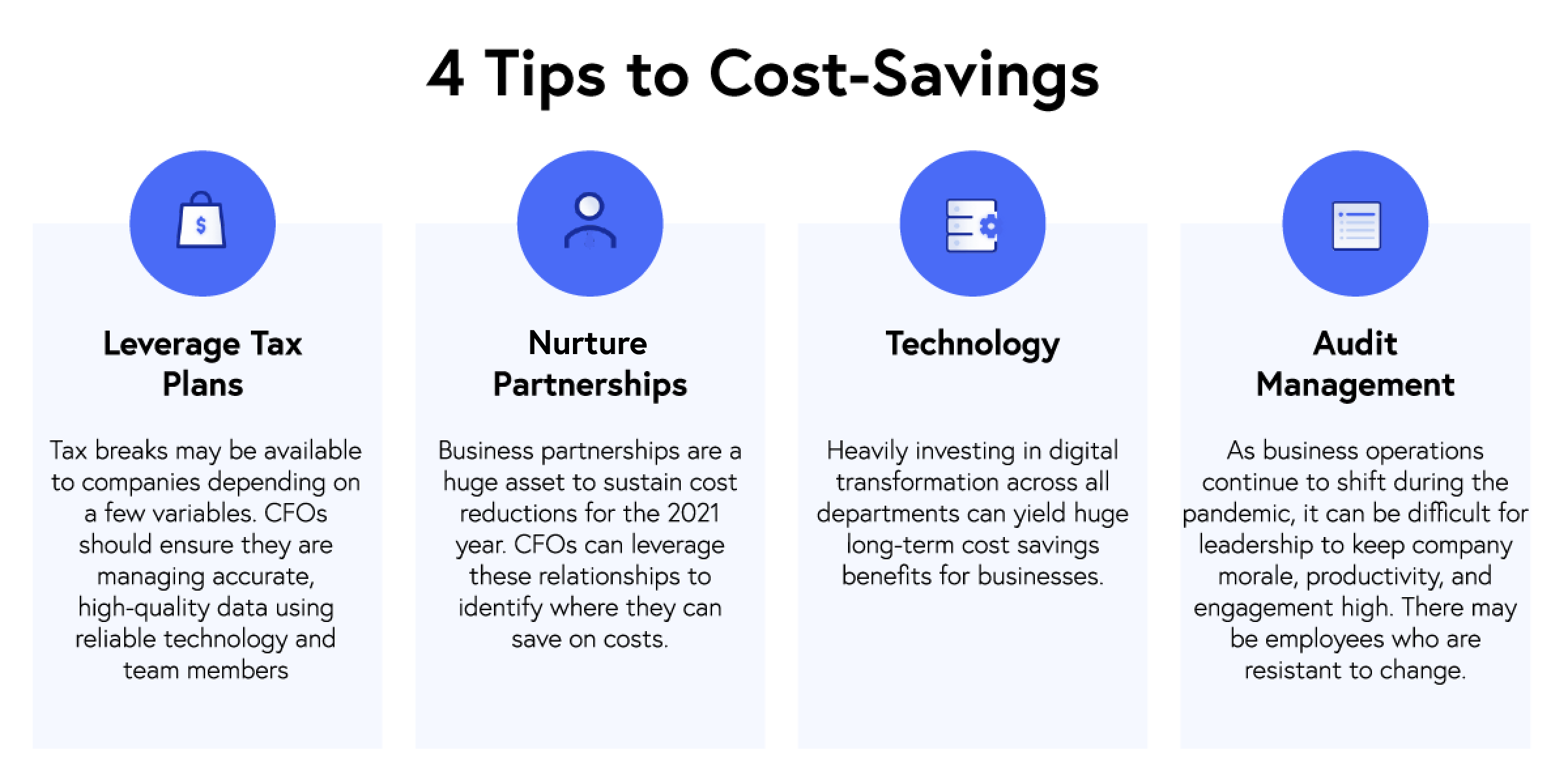

CFOs can use several strategies to implement cost savings:

- Technology is key to savings

- Leverage tax plans

- Nurture business partnerships

- Change management to improve internal transitions

Technology is key to savings

Technology will be huge for all businesses in 2021. Investing in digital transformation across all departments can yield significant cost savings for businesses. Cloud-based ERP technologies, automation, integrations, and RPAs can all be highly beneficial to CFOs and their businesses, depending on various needs.

CFOs can use technology for real-time procurement, expense tracking, invoices, accounting, cash management, restructuring, inventory, and more. Each department can save time and money by streamlining certain processes to allow them to focus on top-priority tasks.

Leverage tax plans

Despite all the negatives that have come along with COVID-19, tax relief can help CFOs keep their companies liquid and conserve money for other operational needs.

Tax breaks may be available to companies depending on a few variables. Regardless, CFOs should ensure they’re compiling financial data using reliable technology and well-trained teams — providing accurate reports can help businesses take advantage of the best possible relief.

Nurture business partnerships

Business partnerships will play a huge role in achieving cost reductions in 2021. CFOs can leverage these relationships to identify cost-saving opportunities.

CFOs can tap into cost win-back programs to return a fraction of investment costs back to partners to redirect to growth initiatives. These benefits serve as incentives for partnerships to identify unnecessary costs and allocate them to more valuable business ventures.

Change management to improve internal transitions

As business operations continue to shift during the pandemic, it can be difficult for leadership to maintain company morale, productivity, and engagement. There may be employees who are resistant to change or skeptical of technology taking their job.

CFOs can work with C-suite executives to fund training programs that coach teams through this transition. Change management strategies allow leadership to confront issues involving accountability, outdated or inefficient processes, performance, and motivation across departments. Creating a long-term incentive program can also help teams adjust and welcome changing business models. Incorporating LTI into change management processes can improve internal compensation gaps, behavioral issues, and talent retention. These areas can allow businesses to save on costs by creating a cohesive team unit dedicated to identifying and capitalizing on growth and cost-reduction efforts.

Provide diverse resources to meet diverse budgets

“It’s really hard to pinpoint where businesses should be allocating their budgets for 2021 because so many businesses face different challenges as a result of the pandemic. I would recommend identifying your key business drivers first. That’ll give you an idea of some of the most important places to focus your budget. If you can identify what drives your business, and you’re still trying to recover from the effects of 2020, then this will help you manage your budget more effectively.”

George Birrell

Founder and CPA of Taxhub

As CFOs compile diverse budgets to meet different business initiatives and goals, resource allocation may be difficult for companies that experienced the worst blowback in 2020. After crunching the numbers and assessing long- and short-term goals, C-suite executives must determine which resources will be used to meet each.

CFOs should consider building strategies around zero-based and driver-based budgets, both of which allow CFOs to plan for contingencies.

Zero-based budgeting

Zero-based budgeting allows businesses to review expenses and resources at the beginning of each budget cycle to determine which are necessary for each new period — every operation is evaluated based on the needs and costs.

This form of budgeting is more complex and must be done every few years for leadership to review certain functions each time. This approach helps businesses confirm each expense and resource is justified based on industry changes.

Driver-based budgeting

Driver-based budgeting allows teams to link demand with the resources necessary to fill it by identifying business drivers that influence financial performance. Common drivers include:

- Sales units

- Change in cost of raw materials

- Full-time equivalents

- Number of customers

After deciding which budgets will meet your business goals, CFOs will need to assess and determine proper resources, and address any other budgeting concerns.

As businesses head into a time of unpredictability, CFOs and finance teams should continuously evaluate their balance sheets and cash flow to address any budgeting concerns. VCFO, a company specializing in helping other businesses with finances, recruiting, and human resources, suggests monitoring leading indicators like:

- Sales lead volume and pipeline health

- Inventory levels and integrity of supply chain

- Average order value

- Average contract/agreement length

It can also be helpful for CFOs to leave room in their budgets for innovation and transformation initiatives.

CFOs can also build a controlled resource pool ranging from 10-15% of company spending to be used when new triggers show growth opportunities to meet demand and industry needs. This strategy can help businesses allocate the proper resources to meet growth-focused budgets.

Above features a resource availability heat map. This is an excellent way for CFOs to keep track of budget needs and identify resources for each task.

Conclusion

As businesses look to 2021 with optimism for new spending and growth opportunities, CFOs can use this guide to develop strategic plans that will help them adapt and evolve for whatever economic challenges may arise. Whether it’s providing customer value, allocating capital, or improving your software — your business can use this guide to predict the unpredictable and increase your cash flow in the new year.

Summary

- Here are 10 essential strategies industry experts believe will drive success in 2021:

- Invest in customer value

- Mitigating risk for increased reward

- Capitalize during COVID-19

- Utilize software automation for greater ROI

- Allocate Capital to High-Priority Projects

- Improve project management to execute goals

- Preserve business strategies to increase cash flow

- Defend spending for growth opportunities and competitive advantage

- Implement company-wide cost-saving procedures

- Provide diverse resources to meet diverse budgets

- Conclusion