Blog > Transform Your Sales Team and Increase Sales with Salesforce Payment Processing

Transform Your Sales Team and Increase Sales with Salesforce Payment Processing

Sales teams are the lifeblood of any business. Their success—or failure—plays a pivotal role in the future of the business. But hidden inefficiencies can slow sales teams down and stunt company growth.

Salesforce payment processing transforms your sales team and boosts sales by streamlining the sales pipeline, empowering your team to take payments on the fly, and reducing friction between sales and accounting.

What is Salesforce payment processing?

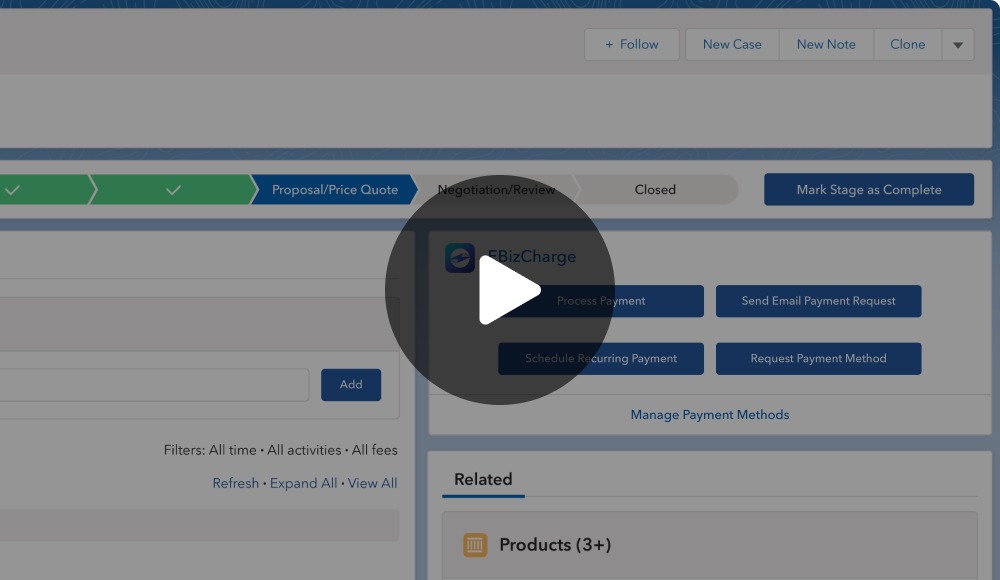

Salesforce payment processing allows your sales team to accept credit card payments directly in Salesforce. Instead of having to exit Salesforce and use a different program to process the payment, your sales team can run the payment right from the CRM.

How does it work? You simply install a third-party application that seamlessly integrates with Salesforce. There’s no development needed, and installation is easy. You can even customize your team’s workflow by enabling payment on any Salesforce object. Using a Salesforce payment application is a quick and effective way to transform the way your sales team makes and closes sales.

Benefits of Salesforce payment processing

A typical sales process looks something like this:

- The salesperson is speaking with the customer on the phone. The customer would like to move forward with a sale.

- The salesperson has to get all the customer’s details and get in touch with the accounting department. Then, the salesperson has to wait for accounting to run the payment and send over confirmation. Oftentimes, this process can take a few hours or even multiple days as the accounting department juggles many responsibilities.

- Finally, the salesperson has to go back into Salesforce to manually update the CRM with the sale information.

This process can be very frustrating for both salespeople and the accounting department. It’s a lot of back and forth, with plenty of opportunities for mistakes or miscommunication. And for the customer, the wait time can be annoying and even raise doubts about the legitimacy or efficacy of the business.

Salesforce payment processing streamlines this entire process, reduces friction between sales and accounting, and empowers your sales team to sell like never before.

When your sales team has the ability to run payments directly in Salesforce, there’s no need to contact the accounting department. They don’t have to interrupt the flow of their conversation with the customer and don’t have to wait on accounting to run the payment. They have the power to speed up the sales process and make sales on the fly.

Your team will spend less time on manual accounting processes and data entry and more time making and closing sales. By eliminating unnecessary steps in the payment process, you speed up the sales pipeline and help your sales team close more sales more quickly.

In addition to simply accepting credit card payments, a Salesforce payment application gives you added features to better manage your payments, such as:

Email payment links

Send email payment links directly to customers. Instead of taking payments over the phone, your sales team has the option to send secure email payment links to customers. The customer clicks on the link to make a quick payment that automatically syncs back to Salesforce.

Recurring billing

If your customers need to make recurring payments, you can quickly set up recurring schedules directly in Salesforce. When the payment date rolls around, your customer is automatically charged and the payment information syncs back to Salesforce.

How to choose the best Salesforce payment processing application

Not all Salesforce payment applications are created equal.

To get the most out of your Salesforce credit card processing, look for a payment application that also connects with your accounting software. The application will automatically push and pull all payment data between Salesforce and your accounting software, reducing manual data entry and the back and forth between different programs and different teams.

For example, if your business uses both Salesforce and QuickBooks, you’ll be able to run a payment in Salesforce and see it reflected back in QuickBooks with no additional work on your part. This type of automation reduces the chance of human error and frees your team from tedious data entry tasks.

In addition, look for the ability to payment enable any object in Salesforce. Most salespeople will simply accept payments on sales orders and invoices in Salesforce, but the ability to customize your payment workflow to your team’s unique needs is a definite plus.

Finally, ensure that your Salesforce payment application provider offers additional benefits, such as robust security features, reliable support, and Level III payment processing.

Security

These days, data security is paramount. Data breaches are rampant and have serious consequences for businesses of all sizes. Because credit card data is so sensitive, you need a Salesforce payment application provider that takes data security seriously.

Make sure your chosen payment application is PCI compliant and uses both tokenization and encryption to protect card data. Bonus points if card data is stored off-site, as this reduces your business’ liability.

Support

A reliable support team is crucial for credit card processing. If something goes wrong, you need to address the problem ASAP. When choosing a Salesforce payment application, make sure you’ll get the support you need when you need it.

Level III payment processing

What if you could experience all the benefits of Salesforce payment processing and lower your payment processing costs at the same time? With Level III payment processing, you can.

Level III payment processing is a service offered by your Salesforce payment application provider that automatically secures lower credit card processing costs for your business. With no extra work on your part, the payment application qualifies credit cards at lower rates and ultimately reduces the overall costs of accepting credit card payments for your business.

Conclusion

When salespeople don’t need to rely on the accounting department to run a payment, they can be more agile and more responsive to customers’ needs. They’ll have the freedom to make sales on the spot and improve customer relationships.

The accounting team will love the change, too—they’ll do less manual data entry, won’t need to worry about special requests from the sales team, and can concentrate on their core work.

Transform your sales team, increase sales, and optimize the sales pipeline with Salesforce payment processing.