Apply for a Merchant Account

Enterprise merchant services that scale with your business

Enterprise merchant services that scale with your business

Processing enterprise-level transactions requires a payment partner who understands complex business needs. It affects your cash flow, operational efficiency, and customer experience. Our system is built specifically for enterprise businesses because we understand your sophisticated requirements.

Join thousands of companies using EBizCharge

Overview

What are enterprise merchant services?

What are enterprise merchant services?

It’s a comprehensive payment processing solution for large corporations, multi-location

businesses, and complex organizations. Standard merchant services often can’t

handle the scale, integrations, or custom requirements these businesses need.

It’s a comprehensive payment processing solution for large corporations, multi-location businesses, and complex organizations. Standard merchant services often can’t handle the scale, integrations, or custom requirements these businesses need.

Why are enterprise businesses different?

Large organizations need custom pricing, advanced reporting, multi-entity support, and dedicated account management. Generic merchant services lack the infrastructure and expertise for enterprise-level operations.

Why choose a specialist?

Standard payment processors use one-size-fits-all solutions that don’t scale with enterprise complexity. We specialize in enterprise merchant services and provide corporate-grade processing with custom solutions.

Our services are built for enterprise merchants

Our services are built for enterprise merchants

Payment processing should accelerate business growth, not create operational bottlenecks. That’s

why we created solutions specifically for enterprises and large organizations.

Payment processing should accelerate business growth, not create operational bottlenecks. That’s why we created solutions specifically for enterprises and large organizations.

Users love us

Why enterprise businesses choose EBizCharge

Why enterprise businesses choose EBizCharge

Why EBizCharge?

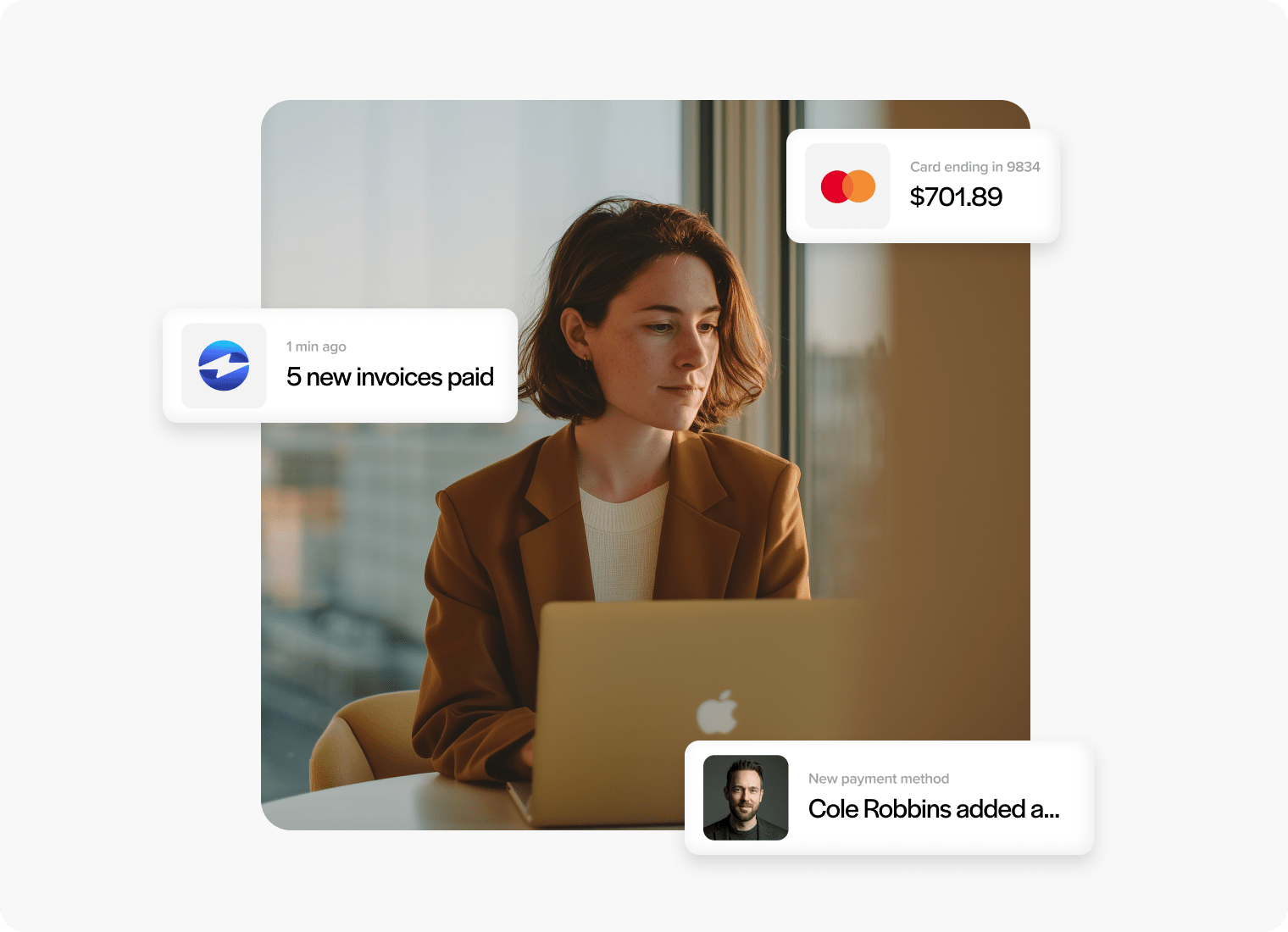

A payments experience unlike the rest

A payments experience unlike the rest

Other Providers

EBizCharge

With EBizCharge

Our Product

Specialized features for enterprise merchant services

Specialized features for enterprise merchant services

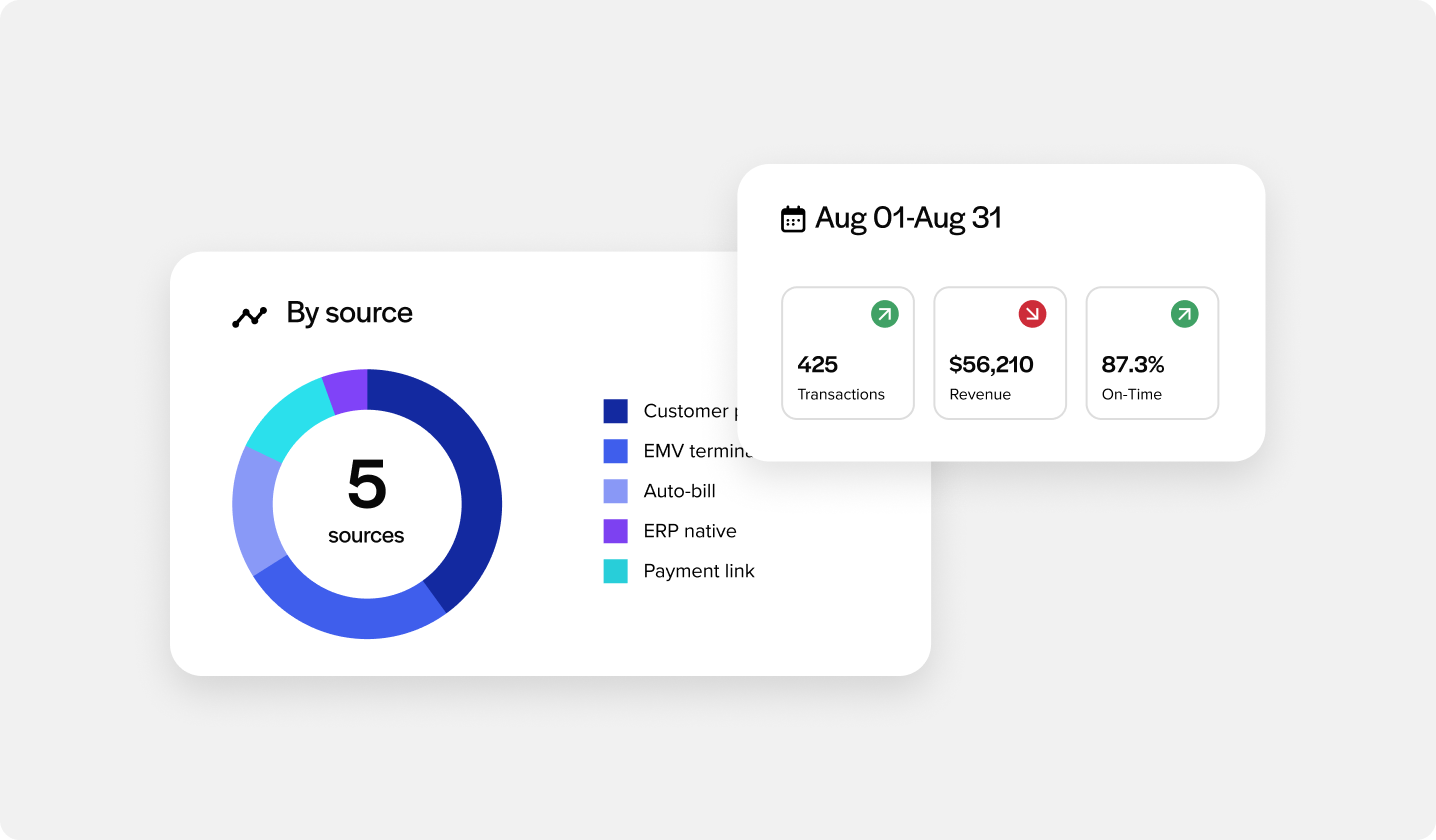

Advanced reporting and analytics

Get real-time dashboards, custom reports, and detailed analytics. Track performance across locations, channels, and time periods with enterprise-grade business intelligence tools.

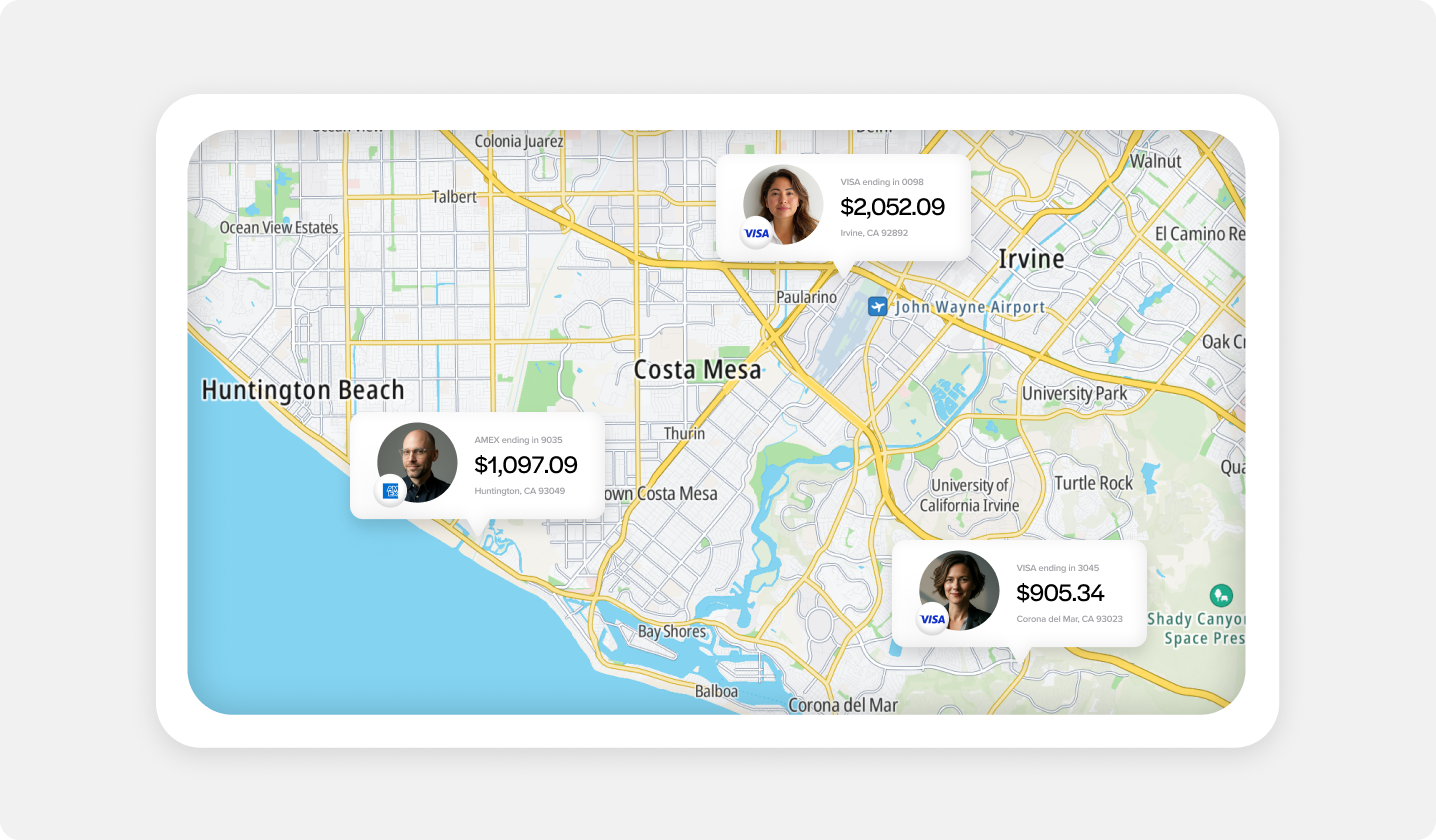

Multi-location and multi-entity management

Manage hundreds of locations from one platform. Centralized reporting with location-specific tracking, custom hierarchy views, and consolidated settlement options.

API and developer tools

Robust APIs for custom integrations and automated workflows. Build payment processing directly into your existing systems with comprehensive developer documentation and support.

Advanced security and compliance

Enterprise-level security with tokenization, encryption, and fraud prevention. Meet compliance requirements for PCI DSS, SOX, and industry-specific regulations.

Features

Payment processing options for

enterprise operations

Payment processing options for enterprise operations

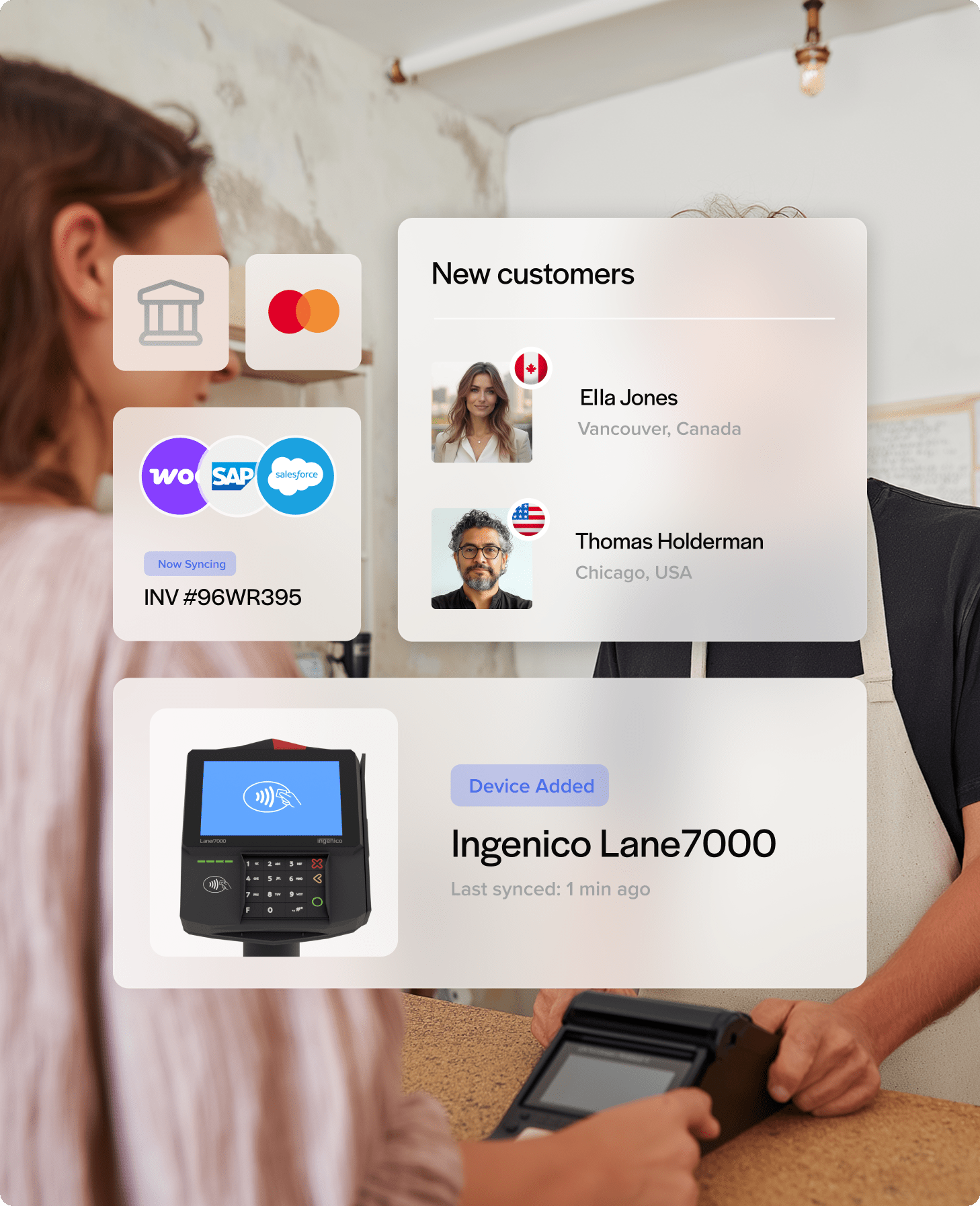

Omnichannel enterprise processing

Omnichannel enterprise processing

Accept payments in-store, online, mobile, and phone orders through one integrated platform. Unified reporting across all channels with consistent customer experience.

Unified financial workflows

Unified financial workflows

Eliminate manual data entry and reconciliation headaches. Payments automatically flow into your ERP system with proper coding, customer matching, and real-time updates to accounts receivable and cash flow reporting.

B2B enterprise payment solutions

B2B enterprise payment solutions

Handle large B2B transactions with ACH processing, wire transfers, and extended payment terms. Support complex invoicing and automated accounts receivable workflows.

International payment processing

International payment processing

Accept global payments with multi-currency support and international card processing. Expand globally while maintaining centralized payment management.

Steps to get started

Enterprise merchant services setup is streamlined

Enterprise merchant services setup is streamlined

Opening a merchant account is an essential step for any business that wants to accept payments from customers. Whether you run an online store, a physical location, or offer services, a merchant account makes it easy and secure to process credit card and electronic payments.

Opening a merchant account is an essential step for any business that wants to accept payments from customers. Whether you run an online store, a physical location, or offer services, a merchant account makes it easy and secure to process credit card and electronic payments.

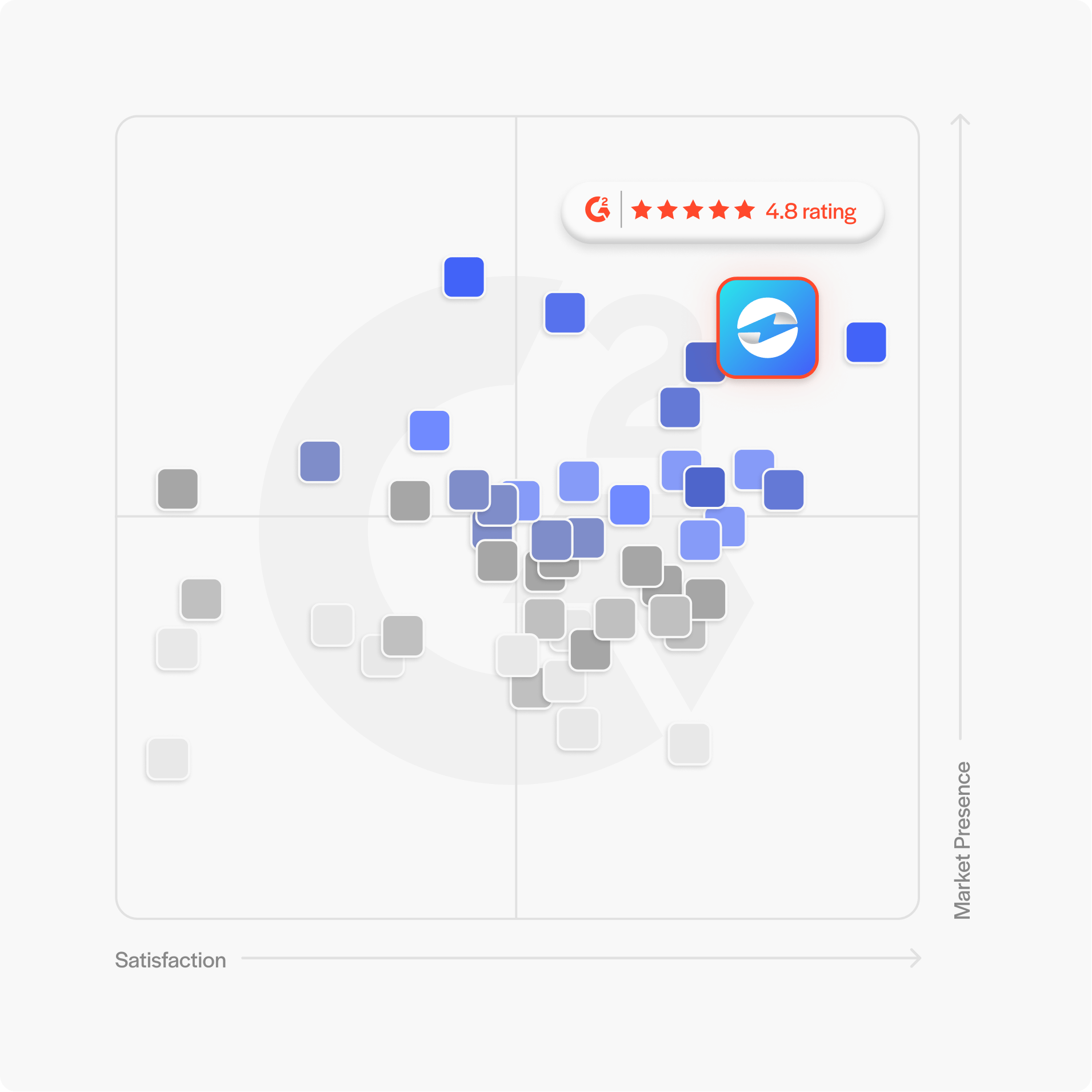

Displayed is the Momentum Grid from G2

Displayed is the Momentum Grid from G2

Ready to optimize your enterprise payment processing?

Ready to optimize your enterprise payment processing?

Don’t let inadequate payment processing limit your enterprise growth. Get the corporate-grade enterprise merchant services your organization deserves.

Don’t let inadequate payment processing complicate your B2B relationships. Get the specialized B2B merchant services and B2B payment processing your business deserves.

$0 Starting Costs | $0 Cancellation Fees | Unlimited Support